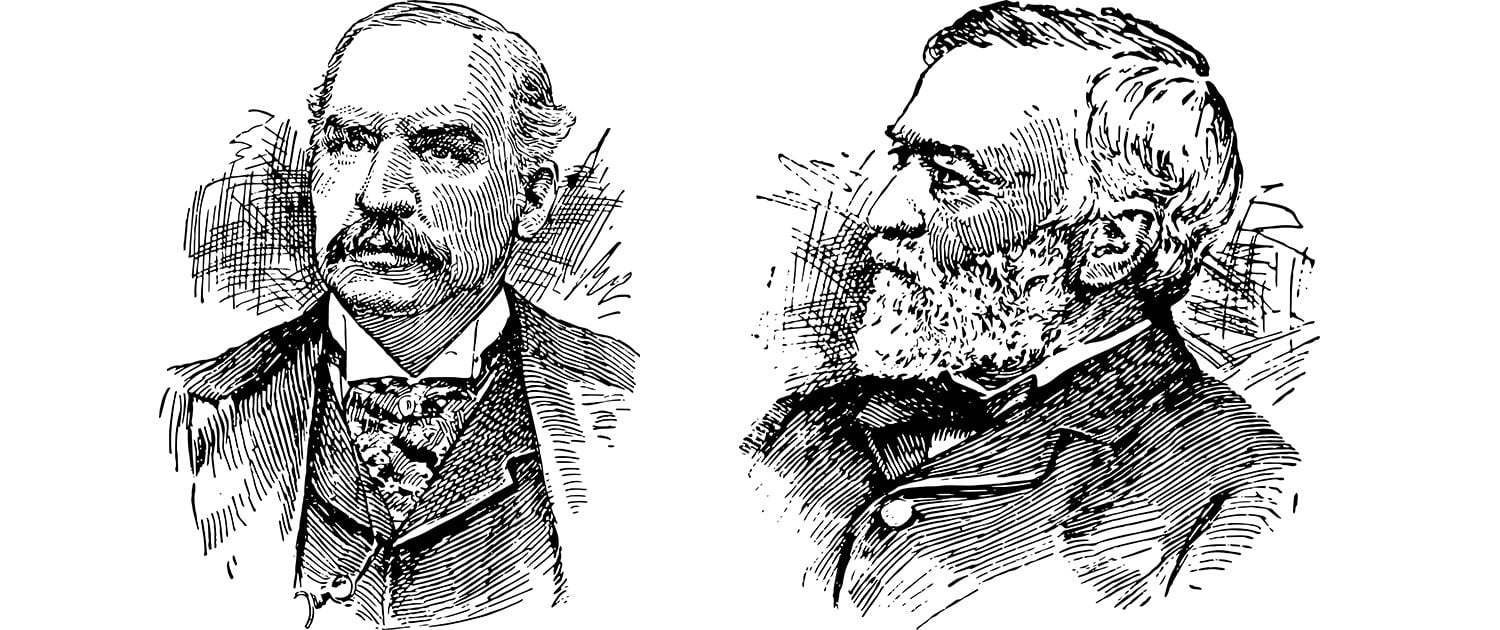

There’s a story about JP Morgan and Andrew Carnegie, from the Panic of 1873. Carnegie was a client of the Morgans, with $50,000 on deposit plus some stocks. After selling his $10,000 interest in a railroad, Carnegie supposedly came by the office to pick up a check for $60,000. To his surprise, JP Morgan handed over a check in the amount of $70,000, explaining that the bank had underestimated how much cash Carnegie had on deposit. Given what seemed like an obvious overpayment, Carnegie refused to take the extra funds at first. He said, “Will you please accept these ten thousand dollars with my best wishes?” But Morgan replied, “No, thank you. I cannot do it.”

A clue as to why JP Morgan would so magnanimously pay Carnegie more than he expected, is found in his famous 1912 testimony before Congress, when he brought up the subject of character:

Q: Is not commercial credit based primarily upon money or property?

JPM: No, sir. The first thing is character.

Q: Before money or property?

JPM: Before money, or anything else. Money cannot buy it.

In light of this exchange, it’s clear that JP Morgan acted the way he did with Carnegie because he wanted to preserve his reputation of high character. Character, after all, was in his mind crucial to creditworthiness.

Why is character so important? Because credit is all about trust. When a bank extends credit to a debtor, the bank is trusting that he will honor his word, and repay the debt on time. It doesn’t matter if the debtor is wealthy. If he is dishonest, he’ll have a hard time getting credit. It makes sense. As JP Morgan said later on in his testimony: “A man I do not trust could not get money from me on all the bonds in Christendom.”

JP Morgan’s words about credit in his 1912 testimony, however, are not nearly as famous as his words about money and gold:

Q: But the basis of banking is credit, is it not?

JPM: Not always. That is an evidence of the banking, but it is not the money itself. Money is gold, nothing else.

Interestingly, we see here that JP Morgan makes a clear distinction between money and credit. Gold, unlike credit, is not dependent on a third party “coming through”. Gold is a physical good, while credit is essentially a promise. Gold can never default, but credit is only as good as the character of the borrower.

That’s why Morgan added: “…and nothing else.” All other assets in the banking system at the time—including dollar bills—were forms of credit, whose value depended on the debtor paying it back. Gold is the only financial asset that bears zero counterparty risk.

Although JP Morgan spoke these words over a century ago, this essential difference between credit and money (gold) remains true today.

x

Want to earn interest on your gold & silver?

Set up your account today!

Or schedule a call with a Monetary Metals Relationship Manager to learn more.

:

:

Imo, silver is money also. Everything else though is currency.

Agreed. Silver technically is also a money. Though gold is a more marketable money.

Brilliant