Wizard’s First Rule, Report 4 Nov 2018

Terry Goodkind wrote an epic fantasy series. The first book in the series is entitled Wizard’s First Rule. We recommend the book highly, if you’re into that sort of thing. However, for purposes of this essay, the important part is the rule itself:

“Wizard’s First Rule: people are stupid.”

“People are stupid; given proper motivation, almost anyone will believe almost anything. Because people are stupid, they will believe a lie because they want to believe it’s true, or because they are afraid it might be true. People’s heads are full of knowledge, facts, and beliefs, and most of it is false, yet they think it all true. People are stupid; they can only rarely tell the difference between a lie and the truth, and yet they are confident they can, and so are all the easier to fool.”

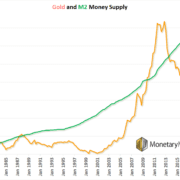

Does this not aptly describe the belief that the dollar will lose its reserve status, will collapse relative to other paper currencies, and is facing imminent hyperinflation with a skyrocketing gold price?

Both motivators apply here. The gold community wants to believe it, because that means that gold will go up. To $10,000 or as that speaker at FreedomFest 2017 confidently predicted: $65,000. Everyone with a few gold Eagles in his sock drawer will be rich. And those who put a few hundred thousand bucks into gold will be Seriously Rich. A real Fat Cat! Like with Ferraris, and chauffeur-driven Rolls Royces, and everything.

Never mind that if the dollar collapses, $65,000 won’t be worth much. This will be the dollar going down, not gold going up. Never mind that in a world where everyone is impoverished to that degree, you would not dare to drive your Ferrari even if you owned one. Tune in to the chaos going on in Caracas, Venezuela for a picture of this problem.

Never mind that the other currencies are dollar-derivatives and would not survive the collapse of the currency from which they derive, if they even last that long. Never mind that the quantity theory of money, used to predict this hyperinflation, is wrong and that we have the opposite of hyperinflation now. Never mind that the other central banks are abusing their currencies worse than the Fed abuses the dollar.

Many people’s heads are full of this stuff, yet they think it’s all true.

The other motivator is fear. Some of the people who want collapse to be true, also fear it. And many more fear it to be true. The fear gives reality to the idea.

Our view, at Monetary Metals, is that the dollar will collapse—last. And that there are several good kicks left in that can. There is no imminent threat of collapse of the dollar. The Swiss franc, as we have written about for several weeks, is much closer to collapse. And even that may not be imminent.

The world has not experienced this disease before. No one knows how long it takes to progress through the corpus economic. We are only studying the numerous pathologies one at a time so far. And we invite others to join the field of scientific inquiry. You need only some passion, some time, and a willingness to discard all that stuff which isn’t so, like quantity theory of money.

One might ask, “OK Keith, what’s your purpose in writing this?”

We write this because the world does face a grave problem. It is serious, but most people don’t take it seriously. In part because of “gold is going to $65,000!”

But they had better start taking it seriously, if we are to solve it while there is still some time. We need a transition to the gold standard, not to try to encourage another speculative bubble.

This Report was written from London. Also visiting Vienna, Madrid, Zurich, Hong Kong, Singapore, Sydney, and Auckland. If you would like to meet, please contact us.

Supply and Demand Fundamentals

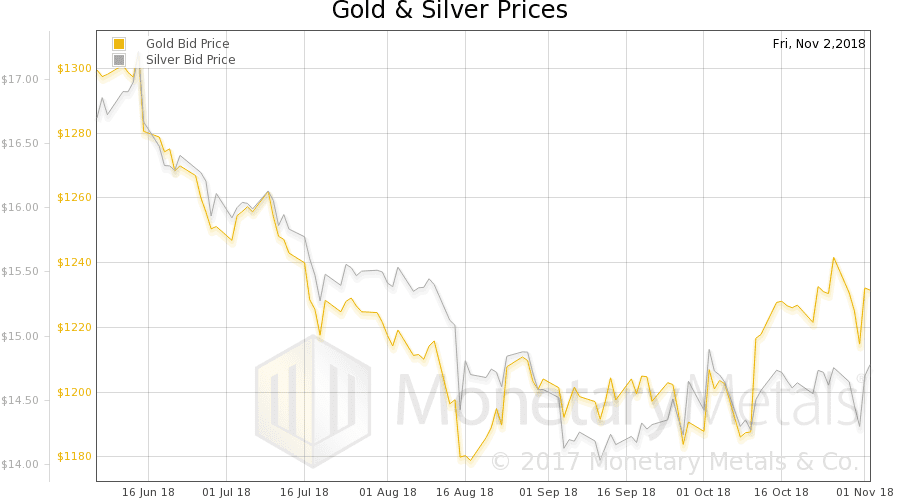

The price of gold was unchanged, while that of silver rose 8 cents. Of course that doesn’t tell the story of the price drop on Monday and Wednesday, with the 50-cent gain on Friday.

That old idea that a country can just declare its heretofore-irredeemable currency to be gold backed lives on. Alasdair Macleod posted this article on Friday. We won’t reiterate our comments about the impossibility of such a price-fixing scheme, which is what it would be, as we covered it last week.

We do want to comment on a few additional ideas presented in the article.

“Assuming China has significant undeclared gold reserves, this could be done very simply through the issuance of a perpetual jumbo bond, paying coupons in gold or yuan at the holder’s option.”

To see the issue here, think of yourself, borrowing money, let’s say for a house. Now frame it the way China gold bonds are framed above. You can take out a mortgage, assuming you have significant dollar reserves…

But no one borrows in order that he might drain his cash reserves. One borrows to buy an asset. And one pays the loan, not by cash in inventory—stocks—but by income earned during the life of the loan—flows.

To get a mortgage you need a salary, not a pallet full of twenty dollar bills in the basement.

Next:

“For China, a gold-exchange yuan standard is now the only way out. She will also need to firmly deny what Western universities have been teaching her brightest students.”

A proper gold standard is the only way out for the world! China included!

But the problem here is that few deny what they learned in school, and usually the brightest are the least willing. Paying interest on gold is Monetary Metals’ business. We are in a position better than anyone in the world to know what prospective gold bond issuers are thinking.

Keith has met with many legislators, treasurers, controllers, and others both at the state and federal level in the US, at the policy think tanks, and in a number of countries abroad. We wish to be wrong in saying this, but no one wants the gold standard. If they are interested in issuing gold bonds, it is not for reasons of solving any kind of global monetary problem.

One may as well say that Philippines will legalize drugs, as to say any government in the world today wants the gold standard. They don’t, full stop. And they have no incentive to do so.

Again, we fervently wish it were otherwise.

Next, there is this:

“…fiat currencies losing their purchasing power at an accelerating pace.”

Everyone—central banking friend and foe alike—thinks this way. This formulation lets the central banks and their irredeemable currencies off the hook! Even with the relentless rise of non-monetary factors pushing up costs and prices (e.g. taxes, regulations, labor law, environmental controls, zoning, permitting, litigation, etc.) prices are not skyrocketing.

At best, this presumes what we must prove. That, one day, prices will hyperinflate. But at the moment, very few people would agree that hyperinflation is a concern. Especially in governments and central banks.

And finally, the cash value of this argument is spelled out:

“…assuming a gold price of Y15,000 ($2,150 at current exchange rates)…”

Gold is going up! That number, once again, is 1-800-BUY-GOLD!

On a serious note, we would not put our worthless fiat irredeemable printing press paper dollars in harm’s way betting on this price or a Chinese gold backed currency.

Now let’s look at the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver.

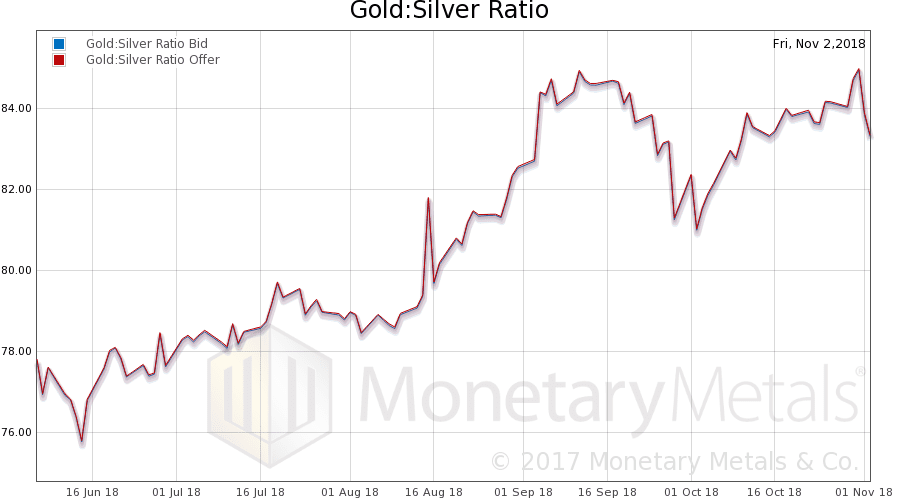

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It fell slightly this week.

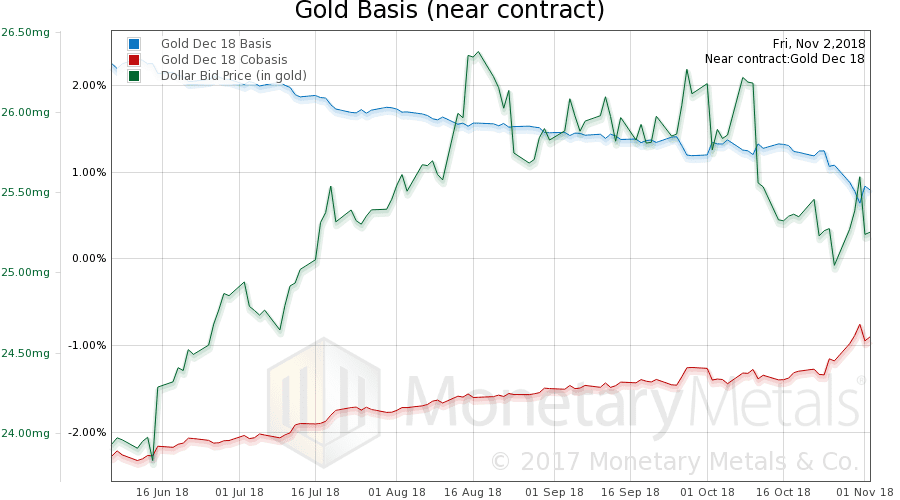

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

As we noted last week, there is a steady rise in the cobasis. Gold is becoming scarcer. Even as its price is firming up.

The Monetary Metals Gold Fundamental Price rose another $7, from $1,333 to $1,340.

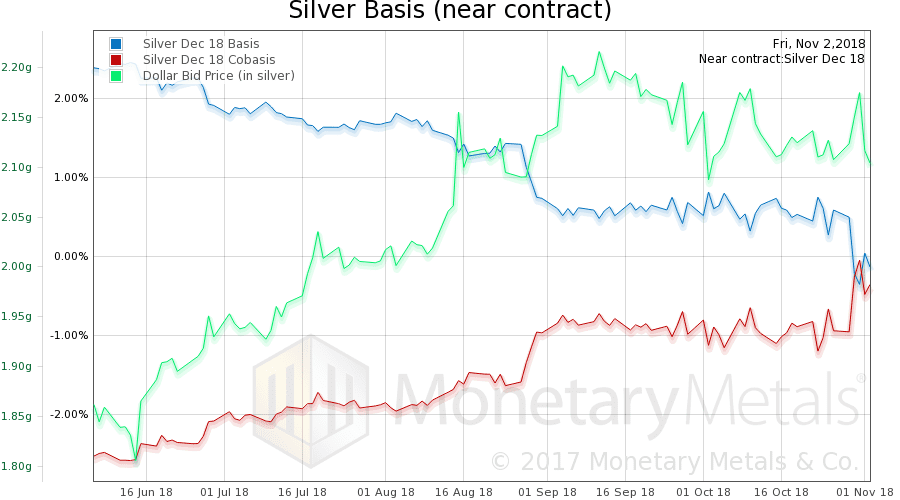

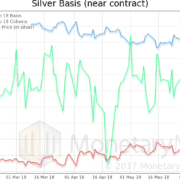

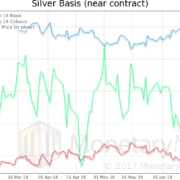

Now let’s look at silver.

Now this week, even with a rise in price, we see a rise in scarcity of this metal too.

The Monetary Metals Silver Fundamental Price rose 27 cents from $15.29 to $15.56.

© 2018 Monetary Metals

While Keith is out galavanting the globe, hopefully some of you have taken the time to buy a few interest bearing securities while they are still interest bearing. All of this talk of a strong economy and such… but they talk little if at all about a yield curve flatter than the previous 9 years. And given the debt load it seems reasonable that a full inversion won’t be necessary to slow things down.

Minutes ago the 3-year Treasury note auction rewarded hesitate buyers with yields of 2.978%, not a bad place to park cash while waiting for $65,000 gold. Of course with a flat curve you can get close to the same with 2 year notes or 1 year bills. The choice is yours. But if rates go back down — a frequent topic here at MM — you’d be well advised to consider locking in something — anything — while you can.

Thoughts?

The capital gain will be bigger on the 10-year.

I fail to see why a gold backed bond would be good for Nevada but bad for China. Both have a gold income and, in addition, China has substantial gold reserves l.

All the best and more power to your elbow.

Note the weaker futures price as the fundamental price strengthens–why inverted correlation?

“On roosters and owls”

In the end of the second millennium, there were some fake predictions of the end times. So, in the down of the year 2000, people and news on radio, TV, newspapers were saying the Apocalypse was near. Many scenarios of world’s demise were backed by the authority of ancient writings, clairvoyants and heads of all sorts of religions and sects. Nothing happened. Later, they realized that the old millennium didn’t end in the last day of year 1999 but in the end of year 2000 (it was true). So the Apocalypse was yet to come, only the time was mistaken. When nothing happened again, those mouths were shut for good. This situation turned the historians to an old and long debated topic: the roosters and owls. Inside the extensive literature on this topic, a concise study is Richard Landes’ “On Owls, Roosters, and Apocalyptic Time: A Historical Method for Reading a Refractory Documentation”. Let me introduce these two animals in Landes’ words: “Roosters crow about the imminent dawn. Apocalyptic prophets, messianic pretenders, chronologists calculating an imminent doomsday—they all want to rouse the courtyard, stir the other animals into action, shatter the quiet complacency of a sleeping community. Owls are night-animals; they dislike both noise and light; they want to hush the roosters, insisting that it is still night, that the dawn is far away, that the roosters are not only incorrect, but dangerous—the foxes are still about and the master asleep. In some sense, the history of eschatology is the history of the conflict of these two birds; and the documentation naturally favors that one who has been and will be correct as long as history is written—the owls”. Different crowds of different beliefs in different places and time have had predicted by the roosters their own eschatology, that is the belief the world would come to an abrupt end. These roosters crowed in the first-century Palestine, in the fifth-century Mediterranean, in the seventeenth-century England, in the eighteenth-century America, in the nineteenth-century China and in the thirteenth-century Europe. For the western world, the year 1000 has been crucial, too. People closed inside their houses waiting for the celestial fire to consume their sinful lives. This fear had its impacts in the social lives and individual behaviors as well. It fostered the formations of the first cities, too: it changed the history. Opposite to the roosters’ cock-a-doodle-dew was the owls song, that is the few unheard voices of those who where saying nothing would happen and there was no end in sight. However, there is such little record of the roosters’ cock-a-doodle-dew, to the point that the historians frequently have wondered if there was any literature on eschatology at all. Unveiling those records has been a tough job to the historians…

There is a symmetry between the past roosters and owls of the Apocalypse and the nowadays roosters and owls of the markets, with the difference that there are much more roosters and much less owls in the latter. In a few words: the roosters say the price is going up when it is going down and that the price is going down when it is going up. They prefer say buy when it is very high and sell when it is very low. For example, in a meeting for the gold in September 2018, an important participant among the mining representatives said with the current (low) prices at around 1180USD they could come through easily, but they were yearning for the price to go up like 1350USD so one could say “Wow: it’s time to invest in gold”. In other words he was saying: “Don’t buy it now that is at 1180USD, buy it when it is at 1350USD!” I know that there will come a time when 1350USD will seem too low, but that time may not be the next time gold reaches 1350USD. Moreover, now is now: why buy it at 1350USD when you can buy it much lower? There is a great amount of articles of the roosters, they abound when the price of a commodity (or another product) is very low or very high. You can find crucial examples from early November 2015 to early January 2016, when the gold price went under 1100USD. The mainstream analysts were predicting the price to go under 1000USD, preferably around 890USD. On the contrary, in 6 months it went past 1370USD. There are other crucial examples in July 2016, when silver price skyrocketed at 21.200USD. The mainstream analysts were predicting the price was going 50, 60, 100, 150USD and even 650USD. These analysts said silver price was taking a breath after a long manipulation and that it was time to buy, before it was too late. Indeed, it ended the other way around. To make a profit of these articles, note the names of the most enthusiast roosters and you will know for sure each time they crow it is the other way around it is going to happen. Opposite to this are the owls’ articles, as those of Mr. Keith Weiner. To make a point, based on his analyses he was predicting from early November 2015 to early January 2016 the price of gold was going up, and it did. Boris Mikanikrezai analyzing trading volumes said “Bulls will come back with a vengeance” and he proved right. Based on his technical analyses, Avi Gilburt said the gold had bottomed. Anyways, Mr. Keith’s analyses have proved to be more accurate over time, for example, recently when he was saying gold had bottomed, because market price was much lower than the fundamental price. (He takes into account also other variables as basis, cobasis, dollar price measured in silver grams, premium, open interests in future markets etc.). To make a point also with the historical spike of silver price in July 2016 that lasted some time, I recall his article “The great silver bubble” posted at silverseek.com on August the 8th and at Silver Doctors on August the 9th. He accurately predicted the price was going much south and it did in a bit more than two months since he wrote the article.

There is one last analogy between the past roosters and owls of Apocalypse and the nowadays roosters and owls of the markets: the former destroy their records. I try so hard to find those articles predicting on purpose the opposite of what was going to happen. I simply can’t. When I talked of examples of roosters’ articles back in 2015-2016, I was saying: “Call to mind!”, because it’s hard to find those articles now. But don’t panic! You can find the roosters’ cock-a-doodle-dos in the comments of the owls’ rare articles. Those are mainly, market pigs that have invested the opposite of what they should according to the article. There are also people in a position of conflict of interest with the articles’ content. Finally, there are some rooster analysts too, in disguise under false names.