Monetary Metals Supply and Demand Report: March 2, 2013

The Last Contango Basis Report

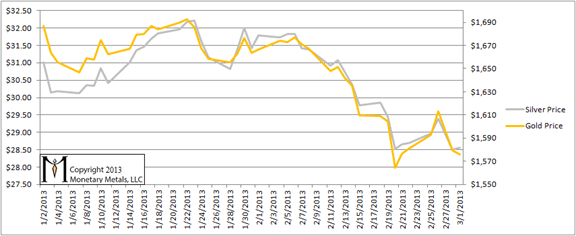

The dollar strengthened further this week, which is another way of saying that the price of the metals, measured in dollars, declined. Gold was -$6, and silver -$0.13. On Monday, we published What Drives the Price of Gold and Silver? We argued that the price of a metal could rise sharply on a Fed announcement, but sooner or later it would have to come down. The spikes in the gold and silver line in the graph below occur after Fed Chairman Bernanke’s testimony before the Senate on Tuesday. Prices finished reverting on Thursday.

Gold and Silver Price

The purpose of this Report is to shed some light onto market dynamics, focusing on the basis. To summarize, a rising basis tends to go along with a falling cobasis. This is not a bullish sign for the dollar price. A falling basis along with a rising cobasis is a bullish sign.

This week, there has been a lot of discussion on the Internet about the concept of the basis and backwardation in gold and silver, more than I can recall seeing ever in one week. Let’s look at the data so that you can form your own conclusions.

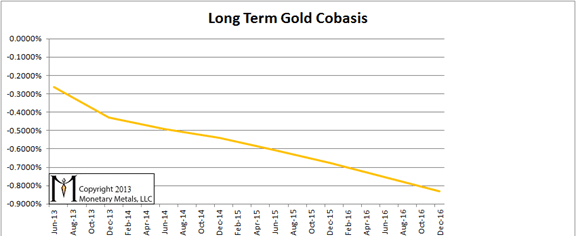

First, is the long-term cobasis in gold. Other than the front month (April) there is no backwardation. This is not a chart showing the history of particular data points as we normally show, but a current snapshot of the cobasis values from June 2013 through December 2016. As you can see, the cobasis is negative for every month. Also, it is falling; as we look farther out in time each succeeding value is lower. This is what we would expect to see in a normal contango market in gold.

Long-Term Gold Cobasis

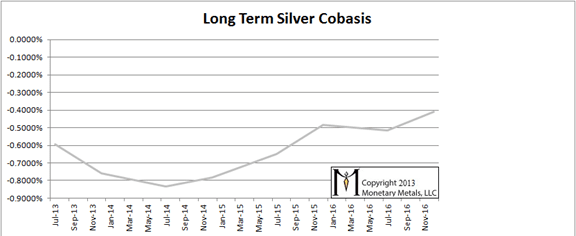

Likewise in silver, there is no backwardation either (other than March which a case of Temporary Backwardation). But we see something very different from the gold picture. After July 2014, the cobasis is rising as we look at farther months. It is still not above -0.4% in Dec 2016, but the rising slope is a remnant yet of the long-term backwardation that did exist in silver from 2010 through 2011. It has been subsiding very slowly.

Long-Term Silver Cobasis

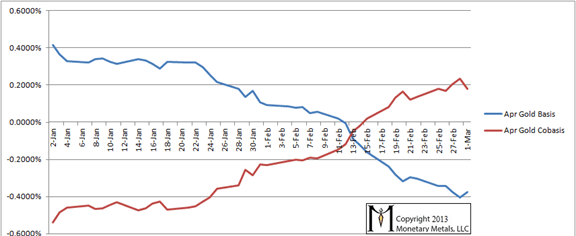

In gold, we see April stubbornly clinging to backwardation and perhaps still in a rising trend.

Gold Basis and Cobasis

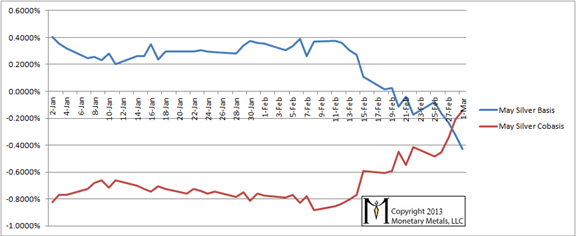

In silver, we see a sharp rise in the cobasis, though it’s still below -0.1%.

Silver Basis and Cobasis

Needless to say, it would be premature to declare either metal to be in permanent backwardation, just as it would be incorrect to declare that the front month for both metals is in contango. If one thinks of the financial system as a tree, we can see some rot occuring within but not yet threatening to topple it.

Leave a Reply

You must be logged in to post a comment.

Want to join the discussion?

Feel free to contribute!