Frequently Asked Questions

Why Earn Interest on Gold and Silver?

Before we dive into our frequently asked questions, an introduction to why you should even consider earning interest on gold silver might be helpful. The videos below feature presentations from our CEO Keith Weiner and Vice President of Marketing Dickson Buchanan. In talks given around the world, from Australia to New Orleans, we lay out the reasons why earning interest on gold silver is so important today. The videos will also provide an overview of our Gold Fixed Income product and show how the process works for earning interest on gold and silver.

A Yield on Gold, Paid in Gold®

How is Monetary Metals able to pay interest on gold and silver?

Our ability to pay interest on gold and silver deposits comes from connecting investors with businesses that use gold productively. We provide them Gold Financing, Simplified™.

What kind of businesses? Jewelers, mints, precious metals dealers, refiners, recyclers, mining companies. Basically any company that has physical gold or silver as inventory or work-in-progress.

They happily pay a fee to lease the gold & silver inventory required in their business. Our lease financing eliminates the price risk present in traditional bank financing, and protects their margins (since they no longer have to hedge).

What interest rate can I expect to earn?

Historically, Monetary Metals’ leases have paid between 2.0 – 5% net annual to investors. The weighted average rate of return in our lease program currently hovers around 3%. In other words, 100oz earning 3% every year, will generate 3oz in gold income, annually. Gold bonds, which are securities, offer higher yields (such as 19% on our recent offering). Gold bonds are available to accredited investors only.

Does Monetary Metals also pay interest on silver?

Yes. We offer silver leases in addition to gold leases. Clients can open an account, hold a silver balance, and earn interest in silver in that account, in addition to holding and earning on gold.

Some clients have gold as an investment and silver as an investment. Take a look at a client statement showing both (with growing ounces!) here.

Does Monetary Metals offer compound interest?

Yes. The power of compounding interest comes from redeploying or reinvesting the interest earned.

Monetary Metals’ leasing program lets you do this with ounces of physical gold and silver. The interest you earn is paid to you in additional ounces of gold and silver which you can reinvest in another lease opportunity. This enables you to compound your gold and silver over time.

To see an actual client statement reflecting such growth, go here.

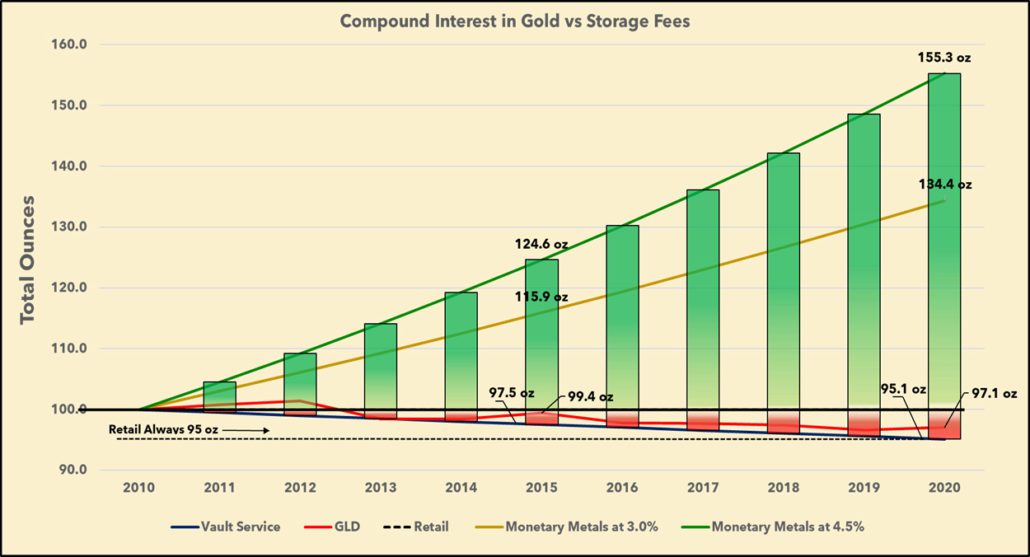

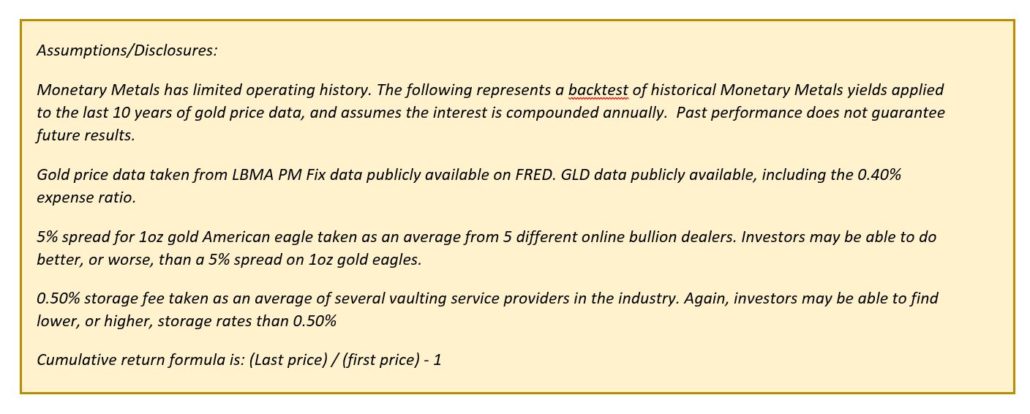

The chart below illustrates the power of compound interest on a Monetary Metals gold investment relative to other methods of holding gold. Earning interest while not paying storage fees can make a big difference!

When and how is the interest paid?

Most of our leases pay interest monthly, but some pay quarterly. This is disclosed to investors prior to committing to a deal.

Generally, interest is paid in kind (silver interest for silver leases, gold interest for gold leases) and is deposited directly into the client’s account.

Clients receive monthly statements showing how much gold or silver they have earned over the previous period, year to date, and since inception.

You can view an actual client statement, here.

ZERO fees for storage or insurance? Seriously?!

Yes. Seriously!

We do not charge any storage or insurance fees.

And while there absolutely is a cost to store and insure precious metals, Monetary Metals is in the business of Unlocking the Productivity of Gold™ so we have a different revenue center than other gold companies.

We make our money by putting metal to work so our clients can earn interest. In other words, we only make money when our clients make money. We find that this creates a healthier alignment of incentives between company and client.

As a result of covering the storage and insurance fees, we are incentivized to bring a flow of solid, attractive leases to our clients.

What is the cost to buy or sell gold and silver with Monetary Metals?

Monetary Metals sells or buys gold and silver at a spread to the London Fix price, or the spot price, depending on when the trade occurs. Below is a table of our spreads according to the volume of the transaction.

| Tier | Spread |

| Under $250k | 0.75% |

| $250k – $1 Million | 0.55% |

| $1 Million or more | 0.40% |

How does Monetary Metals stack up to other precious metals investments?

We’ve authored two publications addressing this question.

The New Way to Hold Gold explores the conventional methods of holding gold and silver, and illustrates how those methods compare with Monetary Metals’ offerings. Download your copy now.

The Case for Gold Yield in Investment Portfolios presents an in-depth analysis of the impact our Gold Fixed Income offerings can have on investment portfolios. Request it here.

What do Monetary Metals’ clients have to say?

We hear from our clients, often. They’re pleased to be free of storage fees, they like knowing that they’re making a difference in the world by putting their precious metals to work, and they especially enjoy earning interest on their gold and silver. Here are a few comments we’ve received recently:

“I love earning more gold and silver on my gold and silver holdings!” Stephen B, client since 2017

“I was pleasantly surprised to look at my MM account statement the other day and see that I had earned over 2 ounces of gold interest since I started out. It really works!” Chris G, client since 2018

“Monetary Metals has become an excellent financing solution for our company. We’re proud to participate in a program which is working globally to remonetize precious metals, and we’re also gratified to be paying lease fees to precious metals investors rather than paying interest to bankers!” Stefan Gleason, President, Money Metals Exchange

“My, how interesting to see the precious metals come into focus recently. I am so proud to be associated with you folks.” Georgia B, client since 2019

“With just a small amount of paperwork, we’re on our way to a much better diversified portfolio. We are excited about our gold earning additional ounces. As a result, we sleep much better at night.” Sandi S, client since 2020

“Monetary Metals provides GBI a cost effective and reliable source of inventory financing for our exciting line of luxury gold jewelry.” Marc Scher, President, Gold Bullion International

Are there any reviews of Monetary Metals?

Yes! You can check out our Monetary Metals Reviews page. Or you can find reviews of us on third-party sites like Bullion.Directory. We also have a BBB profile (Better Business Bureau) with an A+ rating.

Opening a Monetary Metals Account

What is the minimum amount to open an account?

The account minimum is 10 ounces of gold, or 1,000 ounces of silver.

How do I open an account?

You can begin the preliminary steps online, here.

If you prefer to talk to a Monetary Metals team member, just schedule a call that suits your schedule.

How long does it take to open an account?

Preliminary account setup takes just a few minutes online, and can be done here.

After that, there are a couple online documents to complete, which generally take less than 5 minutes. In most cases, the account is officially open within 24 hours, ready to fund.

There are no forms to print, scan, or mail in order to set up an account.

What is required to open an account?

To open an account, you’ll need to:

- provide a photo ID if you are a US citizen; for non-US citizens, two copies of ID may be required

- complete a W-9 (or a W8BEN or W8BEN-E for foreign account holders)

- complete an escrow account agreement for storage purposes

You can begin the preliminary steps online, here.

If you prefer to talk to a Monetary Metals team member, just schedule a call that suits your schedule.

How do I fund an account?

You can fund an account by wiring funds to purchase gold, or sending in gold bullion to one of the depositories we work with.

We accept all major bullion products when funding a Monetary Metals account.

We have clients across the globe, and can accept precious metals in many vaults around the world, not just in the US.

For metals being shipped from a residential address in the United States, we provide complimentary shipping and insurance via a pre-paid label from Fedex.

For metals being shipped from a vault, or outside the United States, please contact a Relationship Manager for more information.

You can begin the preliminary steps online, here.

If you prefer to speak with a Monetary Metals team member, just schedule a call that suits your timeframe.

What documents are provided to investors? And when?

Investors will receive a countersigned copy of their account agreement upon opening.

When an investor puts their metal into a lease, they will receive a countersigned copy of the lease agreement. A sample lease agreement is available upon request.

Additionally, Monetary Metals sends client statements on a monthly basis. The statement shows how much interest the investor has earned, per metal type, over the previous period, year to date, and since inception.

The statement also shows the total metal balance, how much of that metal is in a lease, and the dollar values of all balances. To see a client statement, go here.

How do I withdraw metal from my account?

Clients can initiate a partial or full withdrawal of any metal not on lease by request at any time by completing a one-page form. Metal can be sold for cash, redeemed for physical delivery, or shipped to a different storage account.

Metal that is being leased would need to wait for the lease termination before it can be withdrawn.

If the lease account is in the name of a trust, who needs to sign the documents?

That depends on the trust formation documents, which one of our team members can review for you.

You can begin the preliminary steps online, here.

If you prefer to talk to a Monetary Metals team member, just schedule a call that suits your timeframe.

What type of gold and silver do I own in a Monetary Metals account?

Monetary Metals uses allocated pool gold and silver for all leases and interest payments.

This is the most liquid, efficient, and marketable form of physical ownership, and it best suits the business purposes of putting gold and silver to work for you.

When clients want to withdraw, they can liquidate the metal for cash, or they can convert their metal into any globally recognized bullion product for delivery.

Do I have to be an accredited investor?

No. You do not need to be an accredited investor to open an account and participate in our leasing program. If you want to participate in our gold bond offerings, then yes, you must be an accredited investor. Accredited investors are defined based on wealth and income thresholds, as well as other measures of financial sophistication.

Financial Criteria

– Net worth over $1 million, excluding primary residence (individually or with spouse or partner)

– Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expect the same for the current year

Professional Criteria

– Investment professionals in good standing holding the general securities representative license (Series 7), the investment adviser representative license (Series 65), or the private securities offerings representative license (Series 82)

– Any “family client” of a “family office” that qualifies as an accredited investor

Investing in Gold and Silver Leases

How many leases has Monetary Metals completed?

We’ve funded over 55 leases since our start in 2016, with more on the way. You can view the entire list on this page.

All leases have successfully concluded or are actively paying interest. There have been no losses of client metal since opening our lease program. Additionally, nearly 90% of the leases have been renewed for a subsequent year.

If the price of gold goes up while my metal is in a lease, do I still get the gain?

Yes. You own the metal, whether it’s on lease or not.

If the dollar price of gold doubles, then the dollar value of your gold doubles as well. If the dollar price of gold falls, then the dollar value of your gold in the lease falls.

Monetary Metals is focused on one thing – enabling investors to grow their total ounces of gold. This provides a unique way for investors to express a long gold investment thesis, while earning income on that position for the duration of the investment.

What happens to my gold when a lease is over?

In most cases, you have the option to continue leasing your metal for another year, or have it returned to your account.

If the Lessee chooses not to roll the lease for another year, your metal would be returned to your account and any remaining interest would be paid.

Monetary Metals has a near 100% roll rate with lessees. This means that lessees who decide to lease metal from us for one year are highly likely to continue to lease it year after year.

Lessors in an existing lease have priority to roll their metal into the same lease for another year.

Is there a lockup on my metal?

When metal is idle in your account, there is no lockup and it can be withdrawn at any time.

When metal is in a lease, then it is subject to the term of that lease. Typically, our lease term is one year.

Does Monetary Metals carry insurance on my metal?

We require the depositories where we store the metals to have insurance, and also of each lessee who leases the metals.

As part of our due diligence process, we require the lessee to have Monetary Metals listed as loss payee on the insurance certificate.

We also have an additional policy through a leading global insurer based out of the UK that is used to cover some, but not all, of our leases, as deemed necessary.

Can you provide details on future leases?

We are always working on bringing new lease deals to our marketplace. The best place for current info is on our Lease Opportunities page.

Out of fairness to our lessees and to all of our investors, we do not discuss prospective lease deals until they are ready to be offered.

If you are interested in our program and serious about participating, we invite you to schedule a call with one of our relationship managers. They will be able to discuss previous leases with you in greater detail as well as where the where the market is currently.

To receive notifications as new opportunities are announced, sign up here.

What if I need my metal back before the end of a lease?

If you choose to pull your metal out of a lease, Monetary Metals will work to find another investor to cover your ounces. Because liquidity is built into our business, replacing your ounces can usually occur quickly.

For every lease we’ve done, it has been anywhere from 2 to 4 times oversubscribed. Which is another way of saying that for every 1 oz of metal in the lease, there are 2 to 4 ounces available to take its place, assuming similar market conditions. To see examples of oversubscription, visit our funded leases page.

To learn more about this concept, check out 5 Ways Oversubscription Can Benefit Investors.

Can a lessee sell my leased gold or silver?

No.

The lease is to finance their inventory. And although inventory is purchased and sold, the lessee must buy the replacement gold first, to ensure that the full amount of gold on a Monetary Metals lease is present & secure at all times.

For example, there is a 1,000 oz gold lease and the dealer has 1,000 oz of coins in his inventory. His customer orders 50 oz of coins. The dealer buys 50 gold Eagles first, bringing total inventory up to 1,050 oz. Then he can fill the customer order and sell the coins. The balance of gold in inventory never falls below 1,000 oz.

What kind of companies do you lease to?

We lease to businesses that use gold and silver productively, as work-in-progress inventory. For example, jewelers, mints, precious metals dealers, refiners, recyclers, or mining companies.

They happily pay a fee to lease the gold & silver inventory required in their business. Our lease financing eliminates the price risk present in traditional bank financing, and protects their margins (since they no longer have to hedge).

Miscellaneous

How does Monetary Metals make money?

Monetary Metals earns revenue by charging a market-making fee to bring the lessee and lessors together in a lease.

This fee comes from the interest rate on the lease and is disclosed to investors prior to committing to a lease. The fee is typically 2%, unless stated otherwise.

For example, let’s say Monetary Metals brings “Acme Lease A” to its investors, and the lease rate closes at 3%. That means Acme would pay 5% total to lease the metal: 3% to investors, and 2% to Monetary Metals as their fee.

Where does Monetary Metals store my gold & silver?

Monetary Metals works with a number of different depositories and vaulting institutions throughout the world.

However, Monetary Metals is not a storage company. Nor are we the company for deep, cold, off-the-grid storage for your precious metals.

We use our network of storage providers to facilitate our leases, which is all about putting your metal to work and growing your total ounces of gold and silver over time.

Can I buy gold and silver for delivery from Monetary Metals?

No. Monetary Metals is not a bullion dealer. We rely on professional institutions in the bullion dealing industry to support our Gold Fixed Income suite of products. Clients may redeem metal from their account in the form of bullion which is shipped to them but we are not a bullion dealer.