A Golden Renaissance, Report 25 Nov 2018

A major theme of Keith’s work—and raison d’etre of Monetary Metals—is fighting to prevent collapse. Civilization is under assault on all fronts.

The Battles for Civilization

There is the freedom of speech battle, with the forces of darkness advancing all over. For example, in Pakistan, there are killings of journalists. Saudi Arabia apparently had journalist Khashoggi killed. New Zealand now can force travellers to provide the password to their phones so the government can go through all your data, presumably including your gmail, Onedrive, Evernote, and WhatsApp. China is now developing a “social credit” system, to centrally plan the economy and control citizen behavior. Canada has made it a crime to call someone by the wrong gender pronoun. Even in the US, whose First Amendment has (mostly) stood as a bulwark against censorship now has a president who threatens antitrust action against Amazon, because its CEO Jeff Bezos owns the Washington Post, which prints things he does not like. On college campuses, professors are harassed if they say one thing that the professional sensitives are sensitive to. If a controversial speaker is invited, he risks an angry mob coming to disrupt his talk (or worse).

Then, there is the nearly-over war against patients’ rights to purchase health care services from the provider of their own choosing, and health care professionals’ right to sell services to patients at a price they prefer. In the US, insurance companies are still forced (as under Obamacare) to provide insurance to anyone who applies, even those who have pre-existing conditions. This would be like forcing home insurance companies to issue policies to people whose houses are currently on fire. It is not insurance, but an unfunded welfare program.

The use of practical energy sources is in the battle for its life. Germany and Japan are de-nuclearizing. Other countries flirt with taxes designed, not to raise revenue, but to reduce the use of fossil fuels. While many may go along with this, thinking it’s OK to pay another 50 cents a gallon for gasoline, this will not be nearly enough to force large numbers of people to do without. Gasoline for driving to work and oil for heating homes has a highly inelastic demand. The price would have to rise enough to force people to change their lifestyles, abandoning their spacious houses in the suburbs to crowd into tiny urban apartments. In Europe this month, Keith saw petrol around $8 a gallon. And they use so much fossil fuels that more taxes are demanded to reduce carbon dioxide much further.

Few Want a Free Market in Money

And don’t even get us started on money. Even otherwise-free-market economists, and even wealthy entrepreneurs and business leaders, are for a properly managed irredeemable currency. One prominent person who is all of the above recently declared that if the Fed adopted GDP targeting (it currently does its central planning based on inflation and unemployment) it would end the business cycle! He did not want to hear anything about GDP being an invalid measure, about eating the seed corn, declining marginal productivity of debt, etc. If you break a window, it does add to GDP. This is not a recommendation to break windows. It is a damning indictment of GDP as a measure.

Where tyranny, socialism, and central planning (we repeat ourselves) are on the rise, not only liberty and human happiness wither, but so does the ability of people to coordinate their productive activities. A major theme of Keith’s dissertation is that government intervention promises improved outcomes, but always reduces coordination.

Others, especially Ayn Rand, have noted that socialism sets man against man. They can no longer cooperate to enrich each other. So they are forced to squabble to loot each other through the apparatus of the state.

This is a formula for misery even in a primitive agricultural economy. Wherever it has been adopted, it has been lethal not just to those who think independently, but even to millions of loyal supporters of the regime. The death toll of the socialist regimes of the 20th century—both international and national, i.e. communist and fascist—was in the hundreds of millions.

Trust is Delicate

It is also a formula to destroy trust between people. Trust is a necessary element for people to coordinate their activities, especially over time. There could be no mass produced food, much less computer chips, without both banking and equities markets.

In a world where no one trusts anyone else, everyone hoards their favorite commodity at home. They fear to give it to a fraudulent bank who will steal it. So, instead of financing business, production, inventory, trade, and entrepreneurialism, they simply accumulate salt or silver or gold.

This is a picture of a miserably poor society, composed of small farm villages where life is barely above subsistence. And businesses are nothing more than a one- or two-man workshop. Think of Medieval Europe prior to the Italian Renaissance.

What is now called the developing world is significantly better off than this. That’s because developed markets have produced goods that are so cheap that even laborers in India, even farmers squatting in a rice paddy can afford mobile phones (though not plumbing or toilets). Life all over the world will degrade back to the level of poverty that long prevailed—if the lights go out in the West.

Many in the gold community wish for everyone to dump their savings and investments, buy gold and silver metal, and take the metal home to put it under the mattress. It is true that, if even a small percentage of people did this, the prices of gold and silver would skyrocket. These gold owners focus on this, but not on what we describe above. We have said before that they should be careful what they wish for, so we will not dwell on that point further here. We have a different point to make today.

For the reasons of creeping central planning, socialism, government intervention in all markets, and artificial conflicts of interest between groups, there is a worldwide megatrend of declining trust. Keith describes a collapse in trust as one of the eight indicators of financial implosion in his dissertation: “(8) the willingness of people to trust one another falls to zero.”

This trend necessarily occurs so long as government interferes with production, and renders people less and less able to coordinate. Much has been written about how the banks privatize gains and socialize losses. Deposit insurance, not to mention central bank lenders-of-last-resort, provide a moral hazard to ignore risk and bet big with Other People’s Money. More recently, they are starting to enact policies that provide for bail-ins. This is when depositors lose their deposits and instead get (possibly worthless) shares in the bank.

Rational Response to Irrational Social System

Something makes our mission, to reverse the trend and save civilization, damnably frustrating. That is, it’s an entirely rational response of the individual to withdraw his trust when others demonstrate they are untrustworthy. It is entirely rational to withdraw his capital when counterparties demonstrate they are putting it at undue risk, or paying insufficient or negative real returns.

As an aside, by real return, we do not mean measuring the consumer price index and subtracting from the interest rate. Prices are measured in money. Money cannot be measured in prices. If you empty a bag of gummy bears, and line them up, you can measure the line with a steel meter stick, e.g. 500mm. You cannot invert this and say the meter stick is two bags-of-gummy-bears long.

We measure real returns in money terms—i.e. gold. If you have $1,200 and earn 3% interest on, then at the end of a year you have $1,236. However, if the gold price goes to $2,472 (we do not predict this, but for sake of easy math), then you have gone from 1oz of gold capital to 0.5oz. You have lost 50%. You would have been (far) better off, to have a gold Krugerrand under the mattress.

We won’t even talk about having gold vs. being an involuntary volunteer for a bail-in.

So how do you fix a problem caused by people rationally responding to the perverse incentives imposed by an irrational system? You must offer them different incentives. You must appeal to their rationality, to their self-interest to trust, to invest.

What is the Gold Standard, Really?

The gold standard is more than just sound money. If it is to serve the needs of people and support modern civilization, it must be based on honest credit. It is about honesty and moral rectitude.

We realize this is not sexy material. A headline screaming “gold to go to $5,000” with a subhead about people buying phyzz will grab everyone’s attention. A sermon containing the words “moral rectitude,” not so much.

But, in a way, this summarizes the two alternatives facing us. One is get-rich-quick speculation on Fed-induced asset price volatility, seeking to convert someone’s wealth to another’s income, and destruction of the capital that supports our way of life. The other is the boring old-school values of honesty, fair dealing, sound credit, and continuing the growth that began in Florence in the 14th century.

It may not be sexy, and it is a long and arduous road. Nevertheless, we hope you will join us in working to administer the gold cure to the dollar cancer.

This Report was written from Hong Kong. Keith is also visiting Singapore, Sydney, and Auckland. If you would like to meet, please contact us.

Supply and Demand Fundamentals

The price of gold moved up two bucks, and the price of silver fell 14 cents. But the precious metals is not where the action occurred, this week. The S&P 500 was down 113 points, or -4.1%. Crude oil was down over five bucks, or -9.1%. Bitcoin was down from around $5,500 to around $4,200 or -24%.

Welcome to deflation—a forcible contraction of credit. The cause may lie elsewhere in the unsustainable debts of the many borrowers who now face rising interest expense when they already were marginal at the recent lower rates. However, remember the word contagion from the last bust/crisis of 2008? Credit stress propagates, because debtors are forced to liquidate and creditors want to contract their balance sheets.

And, interesting (no pun intended) that the price of gold is not much affected too.

We called all of this. We were way early (and this may not be it yet in any case). But we have said many times credit is in danger of deflating. And it will impact stocks severely. And bitcoin is unsound and has no firm bid. And the prices of the metals may not be so much affected this time as surely no one owns gold or silver with much leverage after all these years of bear markets. And those who love leverage in their portfolios have long ago discarded gold, out of favour.

And now, maybe, here it is. Certainly something has happened. The S&P is just about testing its crash low from the start of the year. Oil hasn’t looked like this since second half of 2014. And—no doubt bitcoin proponents could quibble—bitcoin has never looked like this.

The euro fell a penny (remember this is the second biggest currency in the world). The pound was unchanged, as was the Chinese yuan. The Swiss franc was up slightly.

Speaking of the franc, we want to briefly address one argument against collapse.

“The franc will not collapse, because the SNB and the Swiss banks have liabilities in francs and assets in euros. So the more the franc were to drop, the more the liability is falling / asset is rising. Therefore, any decline will be self-correcting, because it adds capital to the Swiss banking system balance sheet.”

We find this argument interesting. Much more interesting than the plain ol’ “everyone loves the franc, worldwide, so that keeps its value up” argument. Clearly, people can stop loving something abruptly. But this argument is our kind of argument: not an appeal to speculators’ apparently permanent preference, but to the balance sheet.

And it’s true. A drop in the franc against other currencies (especially the euro) will add capital. As an aside, we just need to pause here to say two words.

HOW PERVERSE. In an honest gold standard, there is no way a bank can profit from the decline in its liabilities. If its bond—or worse yet its note!—is being discounted by the market then it is in deep trouble. It cannot get out of trouble by a drop in its liabilities. By that point, it has already lost its equity capital. And if its notes are impaired, it’s also lost its bondholders’ capital. By contrast, in irredeemable currencies, commercial and central banks have a perverse reason to want their currency to drop a little (sorry, that was more than two words).

Anyways, with that off our chest, we agree it does work. However, if the collapse is self-limiting due to capital gains when the currency falls, this mechanism also has a built-in limit. It only staves off banking system insolvency when the currency goes down. That is, if SNB assets < liabilities, and people sell off the franc as a result, then liabilities fall and the SNB is solvent again. But only so long as the franc doesn’t rise.

This strikes us, not as a guarantee that the currency won’t collapse. But as a mechanism to slow it. With each tick down, the currency is temporarily saved.

There is a more inexorable force that opposes collapse. The negative interest rate, about which we have written so much, is reducing the banking system’s liabilities. While the yield of their asset, euro denominated bonds, is not as negative as the corresponding bond in Switzerland. And the yield of their dollar assets is positive.

We plan to revisit the topic in the near future.

Ultimately, all irredeemable currencies fail. They rack up debt at an exponentially accelerating rate. And eventually they reach the point when it all must be defaulted. To hold the currency is to be a creditor, and it’s bad to be a creditor when there is a cascading systemic default of all debtors.

There is no mechanism that can prevent this, though the mechanisms described above provide some color to Adam Smith’s “There is a great deal of ruin in a nation.”

Now let’s look at the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It rose a point this week.

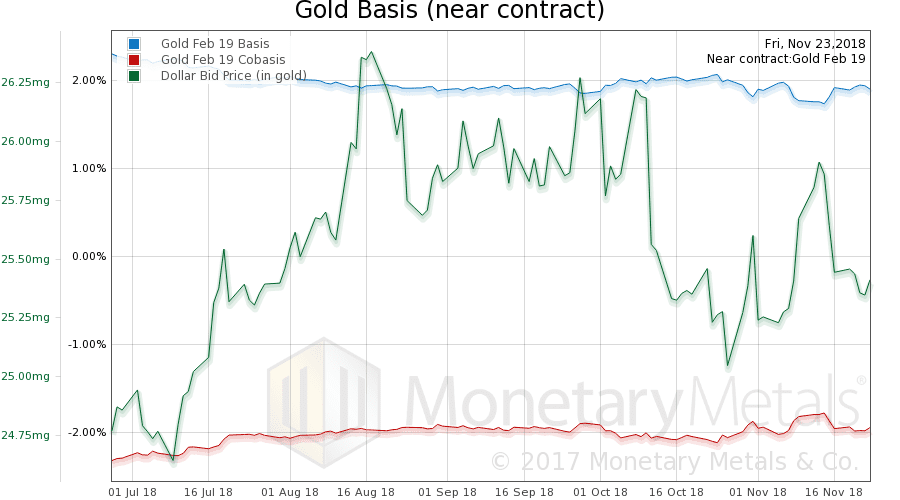

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

Note that we switched over from the December contract in both gold and silver.

This week, there was not much change in the price, and not much change in the scarcity, of gold.

The Monetary Metals Gold Fundamental Price rose $9 last week, and feel $7 this week to $1,316.

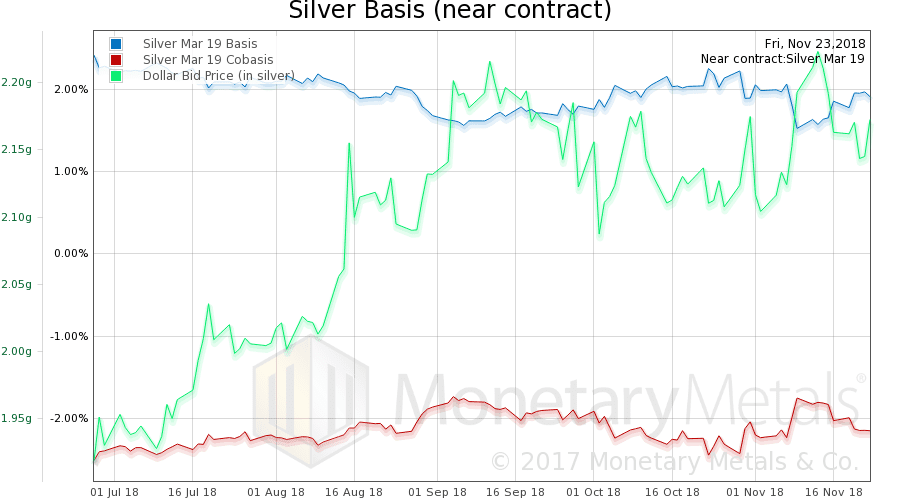

Now let’s look at silver.

In silver, while the dollar rose (i.e. price of silver fell), the abundance of the metal (i.e. basis, the blue line) rose slightly. The change is more pronounced when we look at the silver basis continuous. There was some selling of physical metal this week.

The Monetary Metals Silver Fundamental Price fell another 32 cents, to $14.73.

© 2018 Monetary Metals

Thank you for another great report. Difficult to see how it all rebounds from here. Après bitcoin, le déluge?

PREMISE:

Medical service providers are just that, service providers. In that regard, doctors are no different in the market than automobile mechanics. Automobile mechanic income depends on the average income of car owners. Doctor income depends on the average income of patients. Every country, though, has figured out some way to pay medical service providers more than automobile mechanics so that the poor get some access to the care only the rich can afford and to minimize public health risks affecting all classes. Calls in the USA for market-based reforms to the health care affordability problem conveniently overlook this basic fact. This is not surprising considering the increasingly oligarchic trends within the US economy since health insurance first became popular after WWII.

Instead of floundering in our traditional economic cynicism we could instead, like every other developed country in the world, undertake simple reforms to keep health care spending down to a reasonably low percentage of GDP . No constitutional roadblocks exist.

SUGGESTED REFORMS:

1. Lower the Medicare start age to 55. This would most efficiently remove the most difficult to insure group from the suggested reform process that will be undertaken by each individual state (as suggested at item #4 below).

2. Simplify the Medicare benefit structure so that there is one simple annual deductible for all parts of Medicare (A,B,and D) based upon a progressive income and asset test; and re-structure the Medicare Part B premium so that it is also based upon a progressive income and asset test.

2.1 Make Health Savings Accounts (HSA) available to anyone on Medicare who still has active employment income regardless of the size of their new Medicare annual deductible and also regardless of the structure of any employer benefits. People will be able to draw on tax-free HSA accounts to pay these deductible amounts.

2.2 A unified income and asset based Medicare deductible would eliminate the need for Medicare Advantage, Medicare Supplement, and Medicare Prescription Drug plans; saving the government and consumers hundreds of billions year in and year out. This would also stop the disgraceful “system complexity torture” perpetrated upon our seniors.

2.3 Some percentage of current insurance workers could be leased by current insurance companies to the government during a transition phase, while those losing their jobs would get unemployment assistance.

3. Make Medicare the primary payor when coordinating with large employer group plans as it is for retiree plans and small groups today so that large employers would feel encouraged and justified to offer an option to employees to forgo actual coverage in exchange for a company contribution to a HSA.

4. For everyone through age 54 each state individually or in concert with other states could adopt some form of the proven models provided by other developed countries. Large states, who have larger populations and economies than many model countries, have the tax base and economies of scale to easily set up such model systems. If smaller states run into difficulty they can join together with other states, whether regionally proximate or not, to adopt models that work best for them as a group.

POLITICAL AND ECONOMIC FACTORS:

I believe these reforms could be politically viable because they feed into hot button issues of both the right and left. I know “Medicare at 55” is not as powerful a political phrase as “Medicare for all”, but the Medicare for All placards usually also have the catch phrases “Love it” and “Improve it”. But Medicare at 55 could be an attractive compromise since almost no right wingers would suggest doing away with Medicare so implicitly they approve of it and thus extending that approval down to age 55 to preserve the “free market” of healthcare ideas at the state level is a position right wingers could support. The left would be thrilled by the income and asset based unified Medicare deductible so they would feel like they got some extras in terms of love and improvement for Medicare. Right wingers in red states would like the individual state control aspect and the ability to push for a return to a cash-based system for the poor and concierge plans for the wealthy; while socialists in blue states will like their new found ability to push for public options. Large employers will like having most of the claims of the over 55 group removed from their plans. They will like it even more when the wide establishment of public state plans makes it unnecessary for them to bother to provide health insurance at all. Leveraging the benefits that large business will enjoy into the reforms makes it easier to build political consensus since big businesses are large political donors. Ultimately the state plans that best satisfy consumers, medical service providers, and taxpayers will also best compete for doctors and businesses. Red, blue, or purple then; each state should be able to build an adequate plan.

Though insurance companies would be able to offer policies that would cover or lower the unified Medicare deductible, most people would find it simpler and more cost effective to just save most of the premium instead in an HSA . Most middle-income people would have relatively small deductibles and thus would be willing to devote some savings to such an emergency fund. I could imagine most banks/insurance/brokerage companies offering HSA accounts that pay higher than market returns simply as an inducement to use the other services of the company.

Even though big health insurance companies would probably have an advantage over smaller firms as they find a way to profitably downsize to basic employee leasing enterprises that provide administration services to Medicare and the state model plans; they, like all companies in the healthcare market, would be faced with the need to either adapt or die. I believe the big companies seeing the writing on the wall would actually support the reform process since they would be in the best position to morph into profitable survivors of the process.

Big Pharma…well big pharma would take a hit, but so be it…they will just have to deal with bulk discounted sales to Medicare and the state plans who in turn can simply continue have the discounted drugs fulfilled through existing pharmacy outlets.

I’m not a “right winger” (already signed-on to the medicare social contract), but I would certainly oppose #medicare@55. Although, given today’s news item of a decline in life expectancy, I think you’ve identified the trend.

Just got to reading this sermon on moral rectitude. I found it “deplorable” in all the positive senses of that word.

I especially liked the sound-bite that breaking a window adds to GDP (by which I think you mean the repair work

is “product” whereas an intact window is merely wealth). Are you sure that insurance claimed losses are not negative

entries into the GDP bookkeeping?