Monetary Metals Supply and Demand Report: April 7, 2013

The Last Contango Basis Report

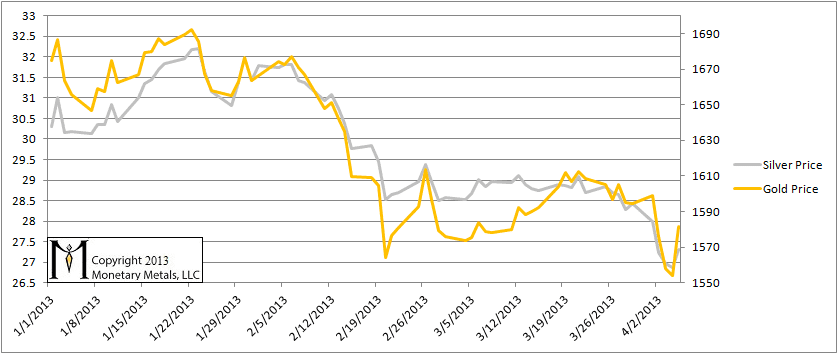

It would take $12 less to buy an ounce of gold at the end of the week, compared to the beginning. It takes more silver to buy an ounce of gold than it did at the beginning of the week, i.e. the gold:silver ratio rose from 56.4 to 57.9 or 2.7%.

Here is a picture of the gold and silver “prices”, measured in dollars.

Gold and Silver Price

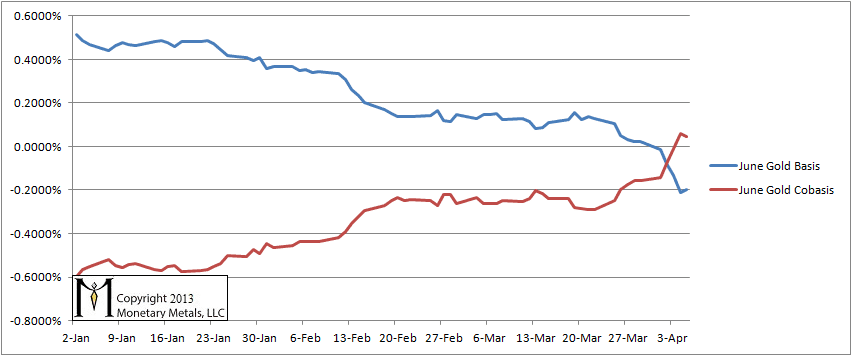

This report is named for the idea that the positive gold basis is disappearing. The word for a positive basis is “contango”. Gold is in contango now (aside from temporary backwardation, also discussed in this video). Once it is gone, once backwardation in gold becomes permanent, then gold no longer bids on the dollar and the dollar game is over. We also aim to shed some light onto market dynamics. A rising basis tends to go with a falling cobasis and this is not a bullish sign for the dollar price. A falling basis along with a rising cobasis is a bullish sign.

We are now firmly into June being the front month for gold (April still trades, but it is past first notice of delivery and so is illiquid). The basis has fallen below -0.2% and the cobasis is positive—backwardation! Welcome to temporary backwardation once again.

Gold Basis and Cobasis

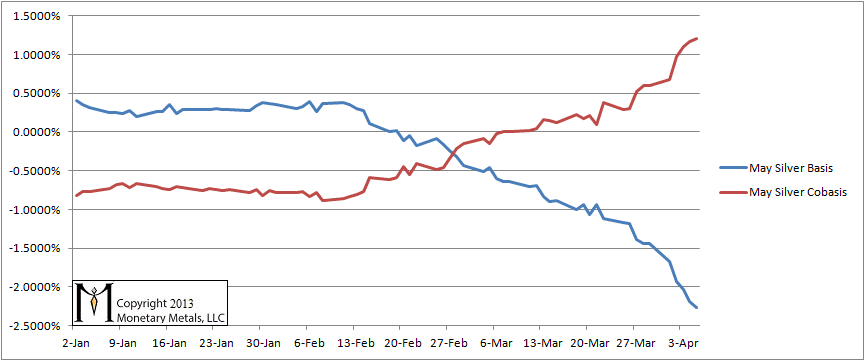

In silver, the price made a new low for the move on Thursday, before rallying with gold on Friday. The basis is down further and the cobasis is now up to about 1.2%. The scarcity of silver has been rising, and it’s written all over this chart.

NB: you cannot compare this silver chart to the gold one above because the gold chart is for the June contract and the silver chart is for May. A month ago, when the May silver contract was as far from expiry as the June gold is now, there was no backwardation, though the basis was already around -0.5%.

Silver Basis and Cobasis

Our previous call for the gold / silver ratio to continue to rise is unchanged at this time.

So with gold in temporary backwardation – and silver clearly in backwardation – shouldn’t silver rise relative to gold? Can you elaborate why you think the opposite will happen?

Silver’s backwardation, like gold’s, is temporary backwardation.

I plan to write a longer piece about this soon.

Why aren’t gold and silver prices rising given the temporary backwardation that reflects rising distrust of the futures market driven by sovereign bankruptcies, money printing, negative real interest rates, etc.?

I wonder what the basis told us about the late crash in the precious metals. Not so much that I can see.