Gold Always Wins, Report 6 November, 2016

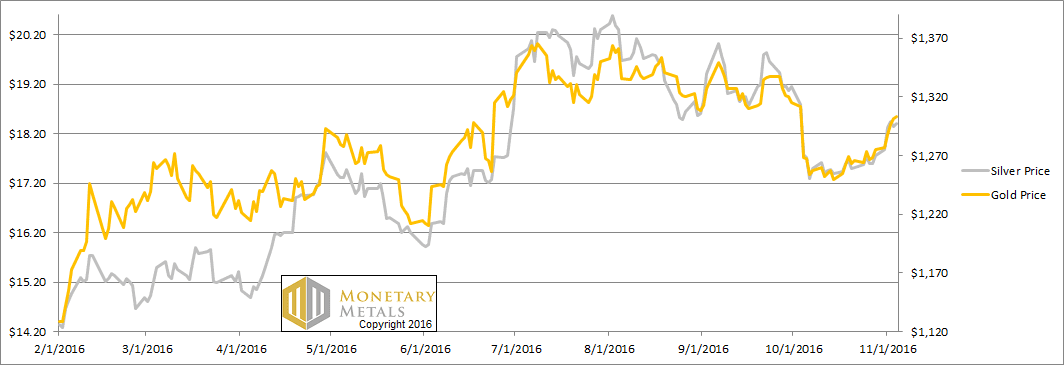

This week the prices of the metals, as measured in terms of the much-abused and much-hated but much-preferred US dollar, went up. +$28 and +0.66 respectively.

That’s a pretty big deal. So big, in fact, that a prominent voice for the use of gold as money tweeted about it. You may want to skip past this anecdote if you think the dollar is money and gold is just a commodity, like any other, that lets you make money by betting on its price.

Anyways, this guy said that gold is the best performing currency in 2016 adding that gold always wins (we prefer to focus on ideas, not people, so we have altered some details of the tweet).

This is a curious statement. To illustrate, let’s picture a country where slavery still exists (sadly there are such countries even in 2016). A man on the street declares “I will defy the Master.” That is not the statement of a free man, but of a disobedient slave.

Such it is with “gold is the best performing currency,” coming from someone who professes to believe that “Money is gold, nothing else,” as John Pierpont Morgan once put it. If you are a free man, you do not defy any masters. You simply go on about your life. And if gold is money, then it does not go up and down. It is simply the measure of up and down for everything else.

There is something else worth addressing in this tweet. Even if you think the dollar is money and gold is just another chip for betting in the speculation casino, you cannot say “gold always wins”.

We are not proponents of regulation, for the financial industry or any other. However, it is worth nothing that regulated financial professionals would never declare an asset to be a guaranteed winner. That is a false and misleading statement. In the case of gold, have we forgotten about 2012 through 2015 so soon (not to mention the dramatic drop in 2011 from well over $1,900 to close the year at $1,565)? The price of gold went down every year during this period, closing at $1675 in 2012, then $1,205, $1,184, and $1,069 for 2013 through 2015.

Regulation or no, the first principle has to be to tell it straight, risks and all. The price of gold can go down. Indeed it did go down in recent years. While many seem convinced that the price is likely to keep moving up from here, we have been sounding a cautionary note about gold and even more strongly about silver. They are currently bid in the market above the levels justified by their fundamentals.

We will update the pictures of those fundamentals below. But first, here’s the graph of the metals’ prices.

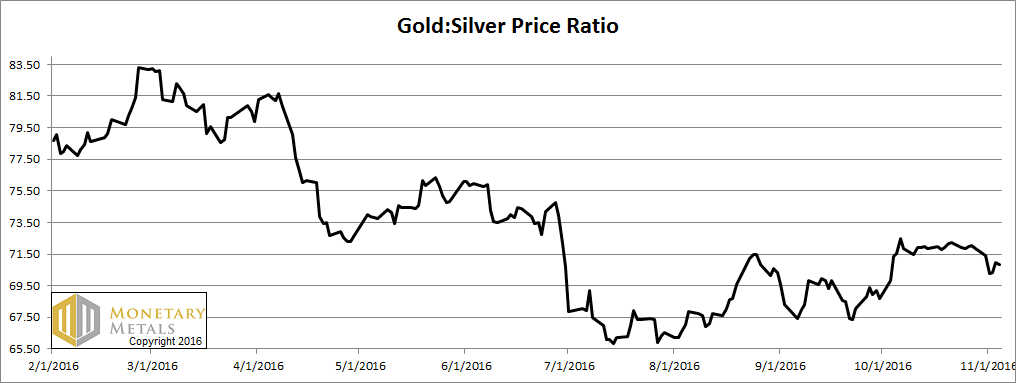

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It dropped this week, which is typical when the prices of the metals rise. Especially when they rise on speculation. Speculators favor silver over gold.

The Ratio of the Gold Price to the Silver Price

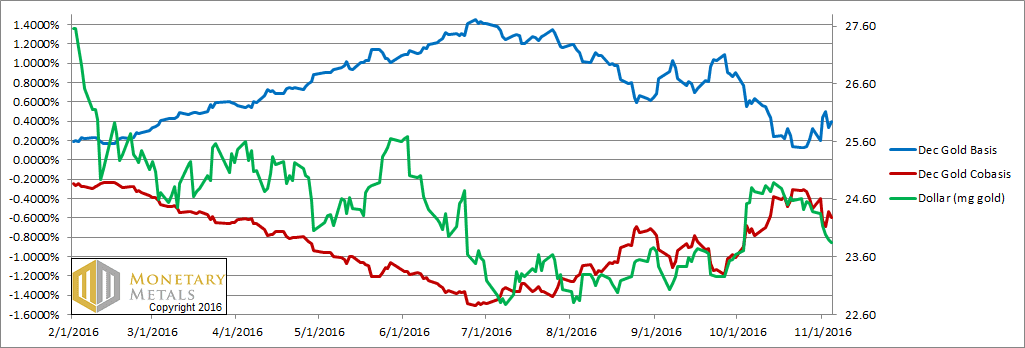

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

Last week, we asked:

“Could the scarcity (i.e. cobasis, the red line) be rolling over? It’s too early to tell, but bears watching.”

This week, the price is up but the basis (abundance) is up and the cobasis (scarcity) is down. And sure enough, our calculated fundamental price is down $11 to $1,239.

Are we predicting a crash, much less on Monday morning (as we write this, the price of gold is down in Asian trading by $11)? No, but we are saying gold is not looking like a good value here. If you don’t have any, then there is never a bad time to buy. But if you’re trading a position, we could think of better times to buy than now. Maybe now (especially at Friday’s price over $1,300) might be a good time to consider selling a covered call.

We like to reiterate our advice to NEVER NAKED SHORT A MONETARY METAL. Something crazy can happen on the weekend and before you can get out of your position you could suffer terrible losses. Case in point this weekend, FBI Director Comey apparently re-cleared Hillary Clinton. Then when Asia opened for trading, the prices of gold and silver fell and the S&P stocks spiked up 1.3%.

There’s another lesson to be learned from this. Beware facile assumptions. Hillary would be bad for business, therefore bad for major corporations, therefore bad for the stock market (that is actually two facile assumptions).

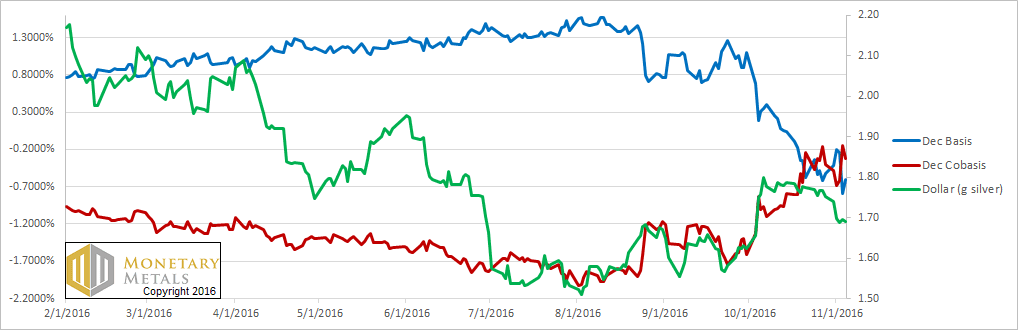

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The December contract is definitely under selling pressure. If you own a Dec silver then you have to sell it before the end of the month. And obviously if you are opening a new position, you have little reason to buy December. Your broker will likely recommend March at this point.

Silver is much more affected than gold.

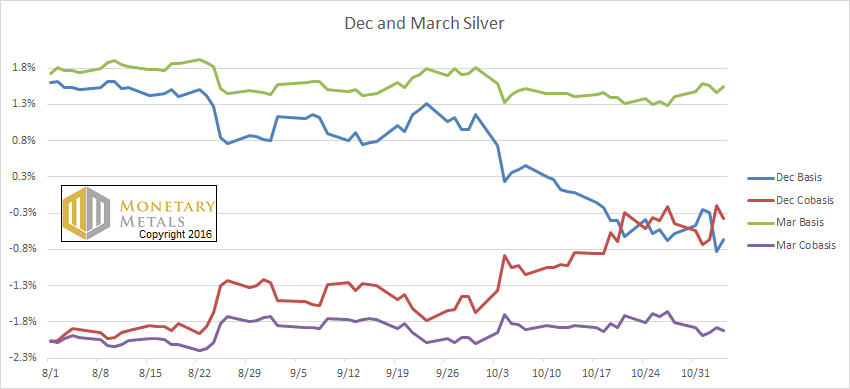

Let’s look at a graph of March and December silver bases to get some perspective.

The Silver Basis and Cobasis for Dec and Mar

Other than for December, the basis is rising and cobasis is falling.

By the way, this is one proof that debunks the manipulation conspiracy theory. If there was a massive naked short position in the futures market, then the banks would be forced to buy back the expiring contract with urgency (not being able to deliver metal, they would have to close their positions before First Notice Day).

Massive buying of an expiring contract would cause the basis to rise. However, that is not what we see as contracts approach expiration. We see a falling basis.

It is the longs who must close their position—i.e. sell—before First Notice Day. They’re speculation, and don’t have the cash to stand for delivery. The banks are arbitragers, buying metal and selling a contract to pocket a small profit.

This small profit is called the basis. For the March silver contract, the basis is 1.5%. Not a bad rate of return for an investment that is guaranteed to redeem your principal in less than five months. For reference, the 6-month LIBOR is 1.25% and the 6-month US Treasury is 0.5%.

Buying of farther-out contracts is so robust, that speculators are overwhelming arbitrageurs. Speculators are pushing up the price of the futures faster than market makers can borrow cash to buy metal and sell contracts to the speculators.

Despite the market price of silver going up, the Monetary Metals fundamental price of silver dropped by 21 cents, to $15.85.

© 2016 Monetary Metals

Thanks Keith, much appreciated. I suspect this election is going to be a good time to buy on the rumour and sell on the news, and the basis is suggesting that.

Why didn’t the basis give any forewarning of the four year bear market? Was the basis somehow less sensitive, or was it simply telling us something in a more subtle fashion? This is an issue that deserves some straight talk.

“If there was a massive naked short position in the futures market, then the banks would be forced to buy back the expiring contract with urgency (not being able to deliver metal, they would have to close their positions before First Notice Day).”

Incorrect – Short sellers are not required to deliver metal until the last trading day of the month, approximately one month after First Notice Day..

sreed: As I understand it, they need to make the decision by First Notice Day. They have until the last day to deliver.

But no matter. They must buy that contract. It is better to buy it when there is liquidity. Much worse to try to buy it in the illiquid market after First Notice Day. And there is another proof point. There is nowhere near the kind of volume that would have to exist, if the kind of massive positions regularly discussed in conspiracy circles were short.

Keep in mind also that most contracts are not delivered in metal. Cash settlement is normal, delivery of metal is the exception. An expiring contract is normally rolled into the next one, profit/loss booked in USD.

Both longs and shorts are under pressure to roll forward before First Notice Day (liquidity / trading volume is much higher). Still, longs are generally under somewhat more pressure to roll, because some shorts may choose to deliver metal for payment the next business day. Shorts have no duty to deliver metal until the last trading day of the month (December in this instance), and need not commit to their intentions. During the spot month, on any trading day, shorts can decide to roll forward, cover short positions, or give one day’s notice to deliver metal for payment. This flexibility is an advantage, especially if one owns registered physical metal. Rolling forward is a never-ending game of chicken, all the more so if one is highly leveraged.

The above facts are not contrary to your fundamental ideas, contango and backwardation are still interesting, and generally help one to understand speculative positions together with open interest and Friday COT numbers. Cheers.

Bullion Banks prosper by both spreading and directional bets. Directional bets are accomplished by varying their short positions against physical bullion on hand. Spreading profits are generated by taking advantage of favorable contangos, a willingness to take delivery of the spot or a future month while selling an equal quantity of a more distant month. If backwardation exists, bullion banks will spread by delivering metal while buying an equal quantity forward at a lower price.

Commercial and investment banks are less active than in the past due to Dodd Frank, thereby offering more opportunity to others who employ this strategy.

Keith… great talk a few weeks ago. (Just need a haircut, that’s all…lol) But you’re ability to articulate key economic concepts is commendable, and I found the presentation entertaining as well.

You should post up more of those if/when you get a chance. It could only help build your reputation.

The “fundamentals” can change at any time.

On apparent Trump win:

Nov 09 2016 00:29:25 EST

Gold Dec’16 Cobasis: -0.479%

Gold Dec’16 Basis: 0.182%

Dollar @ 23.43mg gold

Rising “scarcity” on a falling dollar.

The Gold Basis goes negative, drops and crosses below the Gold Cobasis:

Nov 09 2016 23:02:36 EST

Spot Gold Bid: $1,284.84

Spot Gold Ask: $1,285.11

Gold Dec’16 Bid: $1,284.80

Gold Dec’16 Ask: $1,284.90

Gold Dec’16 Cobasis: -0.034%

Gold Dec’16 Basis: -0.180%

Dollar @ 24.20mg gold