Silver Not Stimulated – 7 Oct

“I have instructed my representatives to stop negotiating until after the election when, immediately after I win, we will pass a major Stimulus Bill that focuses on hardworking Americans and Small Business”

So tweeted President Trump just before 8pm (London time) Tuesday afternoon.

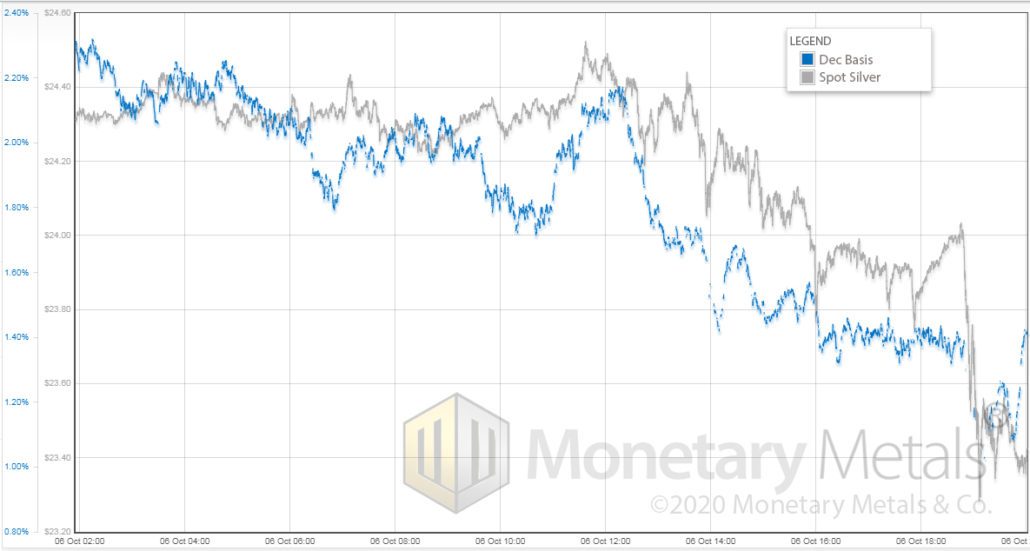

And the price of silver, which was already down 40 cents, fell more than a dollar (some of the drop occurred after the cutoff of this graph, but the graph shows 60 cents).

Look at that! The basis is falling with each drop in the price. It rose with one price blip, but not a few others.

This is selling of futures by guys with leverage, not the selling of metal.

Indeed, the lack of basis rise when the price rises from $24.20 to $24.40 around 12:30, and again at 18:00, suggests buyers of metal are active today.

At the end of the day, the basis is down about 1%. Silver is noticeably less abundant to the market at $23.40 than it was at $24.40.

Tuesday’s Tweetstorm

Speaking of stimulus, let’s look at what the president proposed in tweets later in the evening, seemingly reversing himself.

- $25 billion to continue subsidizes for airline payrolls

- $135 billion to continue subsidies for small business payrolls

- $1,200 free money handout for everyone

According to Wikipedia:

“In economics, stimulus refers to attempts to use monetary or fiscal policy (or stabilization policy in general) to stimulate the economy. Stimulus can also refer to monetary policies like lowering interest rates and quantitative easing.”

We disagree with one word. It says in “economics.” No. This is not economics. This is politics. It is a promise of something which cannot be delivered. Yet so long as voters believe in magic, they will keep voting for stimulus.

We are reminded of the old Native American saying:

“You do not make the blanket longer, by cutting off a strip of cloth at the bottom and sewing it at the top.”

This was said (supposedly) about daylight savings time. But it would be apropos to stimulus as well. Because the government does not have any resources itself. Whatever it gives an airline employee, it must first take from someone else.

And there are enormous losses due to the sieve of government itself. Looting Peter to pay Paul is not zero-sum. It is negative-sum!

Anyone who has studied economics knows this. This is not abstract graduate-level theory here. Any Econ 101 student proposing a stimulus policy in a paper, should get a big, fat F.

Just Keep Borrowing

It would be simpler to see, if the government taxed Peter to stimulate Paul.

However, the government has long passed the point where it can get more tax revenues from the economy. So with every increase in its spending, it turns to borrowing.

The government borrows from Peter to stimulate Paul. This is much more politically popular, because Peter believes he has a good asset. The asset pays interest (though much less than ever before). And the asset goes up in prices, making Peter feel richer.

Got that? Peter’s savings are consumed to stimulate Paul, but Peter feels like he is making money.

God bless deficit spending! Everyone loves it: Peter, as we see is happy. Paul, of course, experiences that unique warm bliss which brings a grin to his face. Economists say it stimulates not just Paul but all the Johns in the economy, too. Wall Street loves it. Republicans. Democrats. Pretty much everyone.

And the economists have, well not a justification, but a rationalization. This stimulus gives people money to spend, and when they do, that adds to GDP. They can claim that the economy is growing!

How Do We Define Growth?

Let that sink in. If the government takes the savings from the prudent and the solvent, to dole it out to those who promptly consume it, this is called growth.

Clearly, we have much more work to do, to show people that, whatever the word for this is, it’s definitely not “growth”.

It’s also not honest borrowing. The government is not financing new production. It’s merely enabling consumption, which means it has neither the means nor intent to repay. That’s counterfeit borrowing. Monetary fraud (which is our definition of inflation).

And why? Why all this stimulus? It is to compensate for the consequences of lockdown.

Compensation is deliberately doing the wrong thing, allegedly to fix something else that you cannot or will not correct properly. Like letting the air out of three tires, if you have a flat.

Or doling out money, if you lock down the economy, causing a reduction in airline revenues of 90% and a reduction of revenues to many New York City restaurants of 100%. Lockdown is unquestioned. Therefore, they want to give free money to all the people whose careers and businesses were harmed.

Unfortunately, there is no such thing as a free lunch. The damage from lockdown is real, and many will not recover from it. But doling out other people’s savings will not undo it. It will just further harm those who are still hanging on.

What To Do?

Every day, we get asked the same questions. Why are people buying gold and silver? Why are they seeking a return on their metal, and becoming our clients? Why are the bullion, refining, and mining businesses happy to pay gold interest to lease and borrow gold to grow their businesses?

It’s because two things are happening at the same time:

One, the return on the 10-year Treasury bond has been driven down well under 1%.

Two, the risk has been driven up to the moon.

The debt was a mere $10.6 trillion when President Obama was inaugurated. It now weighs in over $27 trillion. But now, with all of these well-acronymed stimulus programs like the CARES Act, the debt is skyrocketing much faster than ever before.

Savers don’t love the near-zero interest rates. Nor the increasingly obvious potential of a debt crisis. So they buy gold as a way to opt out. And seek a return as the smart way to hold gold.

It gave me more questions than answers. If the assumption is that a stimulus would not happen, then “guys with leverage” are selling futures, seems to imply they believe spot silver will drop even more and they won’t worry about having to buy spot or unroll their leveraged carry trade ? Or does it mean they think/know interest rates will rise, so they can sell the treasury before it tanks, leg in to the silver carey at a low rate and buy silver before it rises when the stimulus eventually happens ? Or they already have the silver and that’s a nice way to unload it without pushing the price down too much.

But the main question is why ? Is this the new version of front-running the Fed, with less risk than treasuries ?