The Dollar Is Rising, Report 20 November, 2016

“The problem with central banks is that they increase the quantity of money in the same way that the problem with piping sewage into a swimming pool increases the quantity of water.”

It’s not really about the quantity, is it? It’s about the quality.

We believe that millions of people can see that the quality of the dollar and its derivatives—such as the euro, pound, etc.—have falling quality. Most of them are not (today) betting that therefore an ounce of gold will buy more of them. They are in stocks or real estate, which “should keep up with inflation” they think. We wonder if their child was in the pool, if they would think that an inflatable duck would keep up with the effluent…

However, sufficient numbers of people are speculating in gold and silver. This is what adds energy to these markets, and it’s energy that causes the price to move in both directions. There is little agreement (in the broader sense) about whether gold is going up or going down in the intermediate term.

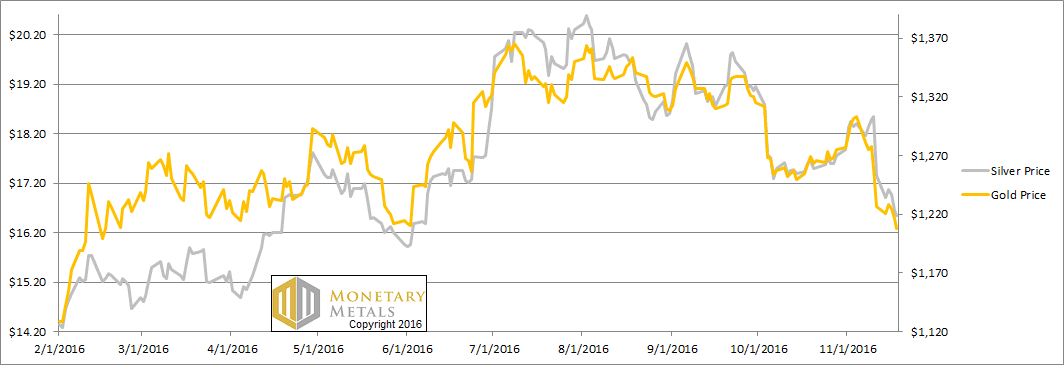

There was some agreement that the Trump election would cause the former. That was when the dollar was a lot weaker than it is today. Before the election, the greenback was worth about 24mg of gold or 1.7g of silver. As of Friday, it rose to 25.7mg gold and 1.9g silver.

We suggest that you think of the dollar’s value in gold, rather than gold’s value in dollars. You know that the dollar has unstable value, which is generally falling for many reasons including that the Fed has a deliberate policy of debasement. We believe the dollar is not suitable for measuring value especially over longer periods of time, and manifestly not suited to putting a value on gold. Price is not the same concept as value.

Now it appears president-elect Trump is talking about a trillion-dollar stimulus program. Will this finally cause a breakdown in the dollar? Will it cause a breakdown in the Treasury bond market?

These, by the way, are separate questions. The dollar could be sold, if savers prefer pounds or euros or yen or yuan or some other dirty shirt that happens to be derived from the dollar. We see the usual suspects claiming that the dollar will collapse soon, or even that its collapse is imminent. From their writings, you would not know that the dollar is in an uptrend. A strong uptrend. An uptrend that goes back to 2011 or arguably 2008.

You would not know, from reading this stuff, that the dollar is higher in terms of the other paper currencies than it has been since 2003. It’s at a 13-year high. So far.

The dollar could be sold, in preference to gold too. However, that is not really happening in a big way right now, obviously.

The question of the interest rate is separate. The dollar is a closed loop system. So whether the dollar sells off against the euro, or whether it is bought against the yuan (as now) the interest rate is unaffected. The interest rate is set inside the dollar system. It is the inverse (conceptually) of the price of the bond.

Nearly everyone today believes that the bond has to head down because Janet Yellen. Or because Donald Trump. Or because quantity of effluent money. Nope. That is not how it works. For those interested, Keith has written a theory of interest and prices.

By the way, the same market that has given us a weak Treasury bond price is also giving us a strong junk bond market and endlessly rising equities. At least one of the three (A) falling Treasuries, (B) rising junk bonds, and (C) rising stocks is wrong. And possibly all three.

The dollar is literally backed by the Treasury bond. If you don’t like the low interest rate on the bond, then why would you prefer the dollar? Dollar cash has no yield. If you don’t like the risk of default of the Treasury, then you are no better off holding the dollar. There are few guarantees in finance, but I guarantee you that if the Treasury defaults on the bond, the Fed will default on the dollar.

And likewise, if you don’t like the Treasury, because inflation, you are definitely going to hate junk bonds. In a rising interest rate environment where there are gazillions of dollars of debt that have to be constantly rolled (not to mention the use of short-term financing of long-term assets), the marginal debtor will be squeezed to default. The US government is most certainly not the marginal debtor. That would be a junk bond issuer. Or many.

And in a rising rates environment, you will take no comfort in stocks. Forget the linear thinking of “keeping up with inflation”. Think of the yield of a stock. Why should stock yields go down and down, while Treasury yields go up and up? Why should stocks—with all the risks of owning the equity tranche of the capital structure—have a lower yield than the Treasury bond?

The Treasury bond is not riskless, contra the propaganda taught in finance since the end of the gold standard. However, stocks are certainly risk-full.

So where to from here?

We will update the pictures of the gold and silver fundamentals below. But first, here’s the graph of the metals’ prices.

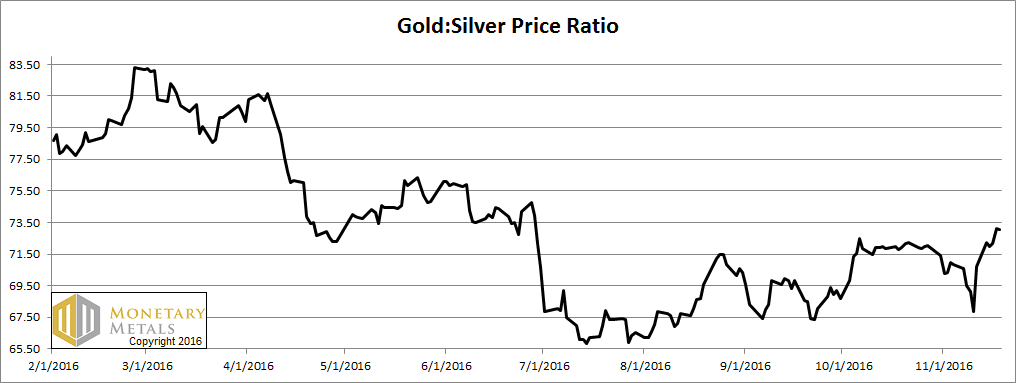

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It rose some more this week.

The Ratio of the Gold Price to the Silver Price

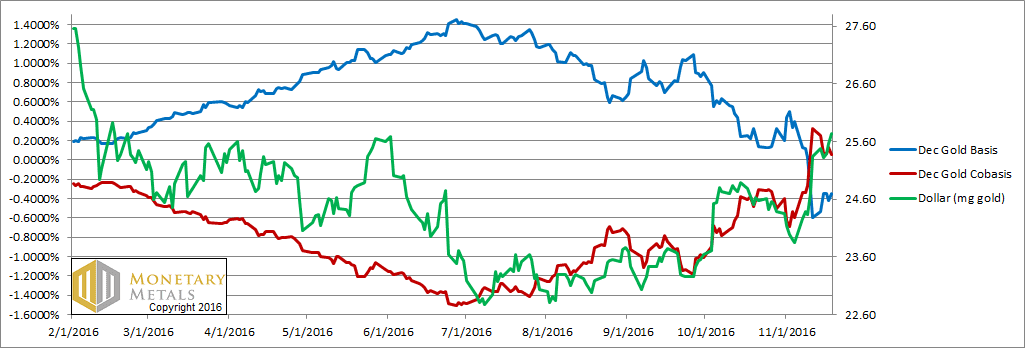

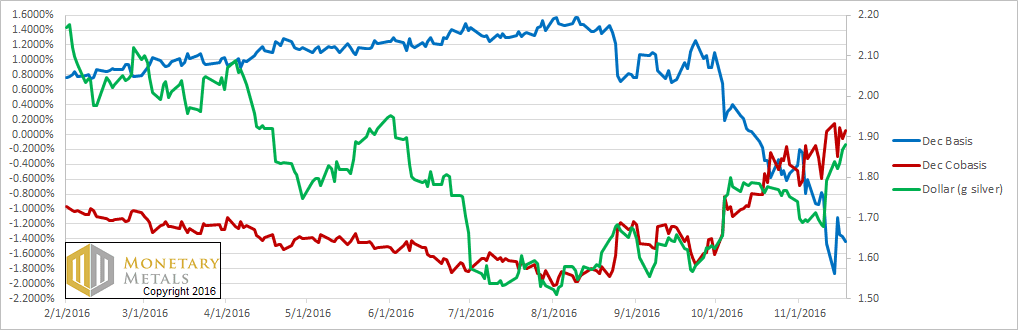

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The price of gold, measured in dollars, dropped twenty bucks this week (shown as a rise in the price of the dollar, measured in gold, the green line on the chart). The scarcity as depicted by the cobasis fell. And remember, at this point there is unbalanced selling of the December contract as all longs have to sell unless they have $121,000 per contract to stand for delivery.

With a falling price of gold, and at the same time a falling scarcity, it’s no wonder that the Monetary Metals fundamental price of gold dropped. It’s still more than fifty bucks over the market price, but about fifty bucks below where it was last Friday. It seems the buying of physical gold metal has subsided somewhat.

Our old friend Backwardation is almost gone. The cobasis fell from 30 bps to 6bps.

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

In silver, we had a price drop of about 80 cents. And what did the cobasis do? It went sideways. Silver did not become more scarce at the lower price. And this is according to the December contract with its unbalanced selling. Which affects silver more than gold.

Farther-out contracts have a falling cobasis. That is silver became less scarce, and more abundant. Even while its price dropped almost 5 percent.

The fundamentals of silver, which were weak last week just took a big dive. The Monetary Metals fundamental price of silver was already a buck thirty under the market price. Now, it is more than two bucks under the new, lower market price.

Market participants are warring. A battle is raging between those who think the swimming pool is half full and those who think it’s half empty.

© 2016 Monetary Metals

has capital structurelacks capital structure

Much appreciated, thank you. The fundamentals are definitely not what the mainstream is saying.

Looks like we can call the “fundamentals” very volatile.

Although it is just a move from one corner of the gold market to another, Russian added a very noteworthy amount of gold in October for a sovereign. Russia added 40.44 tonnes to their reserves in October, typically had been adding 7-15 tonnes a month the last few years. This was Russia’s largest monthly addition since 1998 or biggest in 18 years.

Other central banks might keep their accouting in USD currently but there is no guarantee that this will be the case in the future. The theory of interest rates falling in to a black hole, with all fiat currencies failing first and the USD last is certainly possible, but not inevitable.

There is a strong case to be made that the post 2011 dollar rally is phony and based on front running the false premise of the fed raising interest rates multiple times and shrinking its balance sheet. I’m aware there is a perpetual “bid” on the $USD from dollar denominated foreign issued debt. There could also be a perpetual “offer to sell” on the $USD should traders undwind expectation of rate hikes and be blindsided by QE4, QE5 etc. Foreign central banks warehousing all these extra dollars could also add to the selling stampede, while the yen, euro, pound, yuan etc. that had been sold as funding currencies for 5 years are forced to be bought. The perpetual “offer” can overwhelm the perpetual “bid”.

A dollar crisis, with the $USD falling first and hard as espoused by the likes of Peter Schiff is not impossible. The “Feketian” view of the dollar being the last to collapse is also not impossible. Neither one therefore is inevitable.

Economic actors have choice, they are not matter and subject to scientific laws, the future is inherently uncertain.

Keith, your discussion each week usually pertains only to that week’s action. But when one looks at the charts of gold and silver in total, it is clear that something big changed last summer, sometime during June for gold and about a month later for silver. A rising price for gold in dollar terms led to falling abundance and increasing scarcity of the metal. This seems to be counter-intuitive as a rising price should tend to bring out more supply. And the dollar price is virtually the same now as it was 6 months ago, yet the abundance and scarcity curves can be characterized as looking completely different, and have in fact crossed.

Perhaps it is better to view it as gold bidding on dollars? With an ounce of gold buying more dollars, was the new owner of dollars trading his currency for assets like stocks while the new owner of gold is temporarily satisfied (and now short of cash)? This would at least partly explain stock strength and gold languishing during that period.

I would appreciate hearing your views on the bigger picture the charts are portraying. Thanks!

Well said! Gold bids on dollars when the holder chooses to sell his savings for liquidity. Whether its to pay bills, invest, speculate, long cash, etc.

Pertinent to my post above, and with completely coincidental timing, there is a posting on Jim Sinclair’s blog by Bill Holter regarding much higher COMEX deliveries of gold metal for settlement since May compared to prior months, 24 tons/month vs. about 4 tons/month. While Bill and Jim have been crying wolf for a long time, short of independent verification I will assume his basic facts are correct but won’t vouch for any conclusions he reaches. But if a lot more metal than usual is being delivered out of the system since May, that would reduce the abundance/increase the scarcity in almost perfect alignment with Keith’s charts.

Here is the link:

http://www.jsmineset.com/2016/11/22/an-elephant-in-the-room/

On today’s dollar rally:

Nov 23 2016 11:48:31 EST

Gold Dec’16 Cobasis: 0.360%

Gold Dec’16 Basis: -0.728%

Dollar @ 26.19mg gold

Does the sharp sell off in bonds, accompanied by the surge in copper and iron ore prices, mark the official start of the Tacoma Bridge swaying season ?

Thanks a lot