Bitcoin: Oh Why Did You Have to Crash?

During the recent exponential rise in the price of Bitcoin, there were jokes all over the Internet about the fall of the dollar—more than 80% in Bitcoin terms. Why not measure the value of the dollar in terms of tulips? One must measure the more variable unit with the more constant. Dollars are used to measure Bitcoin, not the other way around (and one must measure the value of the dollar using gold).

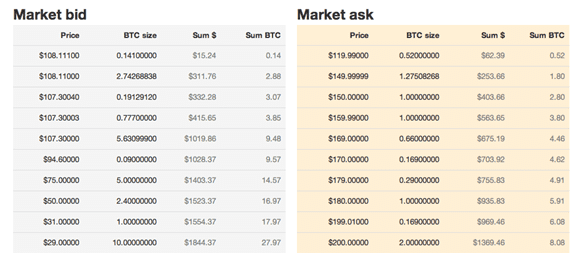

As we can see in the table below (taken after the crash on Wednesday) the stack of bids and offers was quite thin. If one needed to sell $10,000 worth of Bitcoins one would push the bid down to $29. Copper, even late at night, has vastly more liquidity than this. Bitcoin might be more similar to options on May 2017 molybdenum futures.

(source: https://bitcoin-24.com/market)

Regardless of whether or not Bitcoin is a “good”, the bid-ask spread is the opposite of what we would expect to see for something that is claimed to be money. Money is the most marketable good. The key attribute of marketability is a narrow bid-ask spread that does not widen much as the quantity increases. Needless to say $10,000 is not a large quantity. It’s just a handful of gold coins. Bitcoin is not very marketable (I also argue that it is not a good).

A wide bid-ask spread, with a thin stack of bids and asks, is conducive to spikes and crashed. The moment someone enters the market who must trade immediately (and hence must take the bid if he is a seller or the ask if he is a buyer), he will move the market disproportionally. This creates a feedback loop for a while as the market makers pull back, concerned with the volatility. If another seller jumps, the market could collapse.

Bitcoin also has another problem. It can be disrupted by denial-of-service attacks. A DOS attack may have begun the cascade of events that turned into the crash through the stack of bids from $265 down to $108.

The time may not be right yet, but we would love to see a similar technology to provide a gold-redeemable cryptographic based currency. “BitGold” would not be based on the labor theory of value (i.e. “mining” to generate new coins), the quantity theory of money (i.e. absolute cap on the quantity of coins). It would not be plagued by a ridiculous bid-ask spread. In short, it would behave as dollar bills did before the advent of the Fed. Arbitrage would set the value of BitGold. There could be competing BitGold systems. With Bitcoin, the system depends on the network effect. Multiple competing crypto-currencies would dimish the value of one another (not to mention blow away the whole idea of the cap on the number of currency units in circulation).

Anyone interested in this should contact us. We have some ideas and may be able to help.

While I am a big fan of gold, and of silver to a lesser extent, I need to take some issue with your comments. First, Bitcoin has only had any sort of a market cap worth mentioning for about 3 months. That is hardly enough time for a market to develop. Secondly, Bit coin is not based on the “Labor Theory of Value”. Value is determined strictly by supply and demand. Mining is only a (rather ingenious) method of bringing Bitcoins into existence and limiting their number.

Taking a snapshot of the “book” after a crash where trading had essentially ceased is hardly indicative of the viability of any tradable item. Prior to the crash, spreads had been razor thin and there were 10s of thousands of orders on either side of the ledger. The market is certainly thin compared to almost any other market but the market is far younger.

DDoS is a definite problem and needs to be addressed, as does the lack of competing exchanges.

I think more studies and comparisons are very useful but you need to start from a solid grounding. By the way, I do agree that Bitcoin, while it may be a medium of exchange, is not money. It has no intrinsic value outside of its limited use.

Shitcoin? Scamcoin? Baloneycoin?

Your “gold-redeemable cryptographic based currency” sounds good but isn’t the question just how does one make such a cryptographic based currency REAL?

Mind you, the $ is doing a good job of making fools out of us all, no?

worth to listen … http://www.goldmoney.com/podcast/the-great-gold-vs-bitcoin-debate-casey-vs-matonis.html?gmrefcode=upner

for now bitcoin is just a starting project if it is currency we will see or money in secondary order;

money will be gold and silver – not sure if bitcoin and if we are able to find infinite sources of energy to mine gold by nano-technology from sea water … money will be somethig else …

interesting point in the GM podcast is taht bitcoin has its intrinstic value as a network of individuals to be able to use it as payment system … I think to diversify some part of portfolio into the BTC is reasonable (up to 5%) …

Keith, I already mentioned on the Facebook post you commented to, that using bitcoin-24.com’s USD market to judge the BTCUSD market depth is ridiculous. That’s like saying the gold market depth is tiny because I can’t dump a ton of gold on the guy down the corner that sells me 1 oz Eagles.

Mt. Gox has 80% of the entire BTCUSD market [1]. bitcoin-24.com’s 30-day USD volume is a tiny 0.14% of that of Mt. Gox [2] (bitcoin-24.com mainly deals in EUR).

[1] http://bitcoincharts.com/markets/currency/USD.html

[2] http://bitcoincharts.com/markets/btc24USD.html http://bitcoincharts.com/markets/mtgoxUSD.html

Bitcoin is an experiment that is fun and interesting and obviously very volatile. I believe the fiat dollar has had it’s ups and downs too relative to other moneys. I find no benefit in mocking the attempt to help unshackle the world from the yoke that fiat money keeps us tied to. Rather we should be looking at what is good and helpful about bitcoin and how it or something like it (bitcoin tied to precious metals?) could completely get us away from the sorry state of affairs that passes for economic policy today.

Actually, bitcoin is irrational, but so is a lot of human behaviour.

You are attacking a revolutionary new currency that is still in its infancy, expecting it to show the market depth and liquidity of a currency that is 5,000 years old? The wide bid/ask is a result of the fiat-to-BTC bottlenecks. This will change. Gox is not a proper exchange.

“Multiple competing crypto-currencies would dimish the value of one another (not to mention blow away the whole idea of the cap on the number of currency units in circulation).”

Not so: the network effect is obviously an asset and first-move advantage ensures that any competitor would need to be overwhelmingly superior. The other currencies add to the value of bitcoin because they offer refuge from fiat volatility. Personally I never intend to exchange bitcoin for fiat.

Yes gold is a “good.” It is a good that is CENTRALIZED in the hands of what, 5% of the world’s population? Not so good for everyone else.

If a liquid exchange develops between gold and bitcoin, why would bitcoin not be your Bitgold? (Outside of the theoretical objections about what money is.)

Thanks for your comments.

mossmoon: One recurring theme on this blog is that gold is not centralized. Also, redeemability does not mean that there is a market price. Redeemability means that there is someone who will honor a committed redemption value or be forced into liquidation in the attempt. Redeemability cannot be created after the fact.