Irredeemable Currency De-tooths Savers, Report 18 Feb 2018

Arbitrary Interest Rates

In the past few weeks, we have argued that interest rates will not rise. We have made our arguments based on observable cases of soft credit demand that falls with rising rates, and analysis of the incentives on creditors and debtors. Ours is a case that rates can’t go up much, for long, because demand for credit won’t chase rates up. In the postwar period up to 1981, borrowers chased rates all the way up the moon. But not since then.

Now, we want to make a theoretical argument that rates in an irredeemable currency are arbitrary (we promise to return to the topic of capital destruction soon).

Consider a real good such as beef. If a disease suddenly strikes down 20% of the cattle, this will reduce the supply of beef. Assuming all else is equal, the price of beef will rise. Perhaps substantially—there is not necessarily a linear relationship between the 20% reduction in supply and the price. The price could go up 2%, 20%, or 200%.

We can be confident that the price will go up. That’s how the market determines which former beef-eaters will become chicken-eaters. The marginal beef eaters.

Conversely, if beef somehow becomes more abundant—say if China began to subsidize cattle ranching by the thousands of square miles (using borrowed dollars, no doubt), then the price of beef would drop. So we can say, without much controversy, that ceteris paribus price moves the opposite to changes in quantity of a good brought to market.

Money is different from a real good such as beef.

As we have said many times, money is not consumed in a transaction (technically, beef is consumed shortly after the transaction). So there is no reason that comes out of quantity theory to explain why the same money cannot be used to endlessly bid up beef prices to infinity.

There is a reason, of course. We say “of course” because it does not happen. One needs to study the individual to discover this reason, as quantity tells you nothing. In our example, the rancher who sold you the beef is the one in possession of the money. He has no reason to bid up the price of cattle—more likely he will buy the feed and other inputs to raise more cows to bring them to market, and push down the price.

We are not, today, discussing the value of money (we will only reiterate here it is not 1/P where P is the price level, and it is not 1/N where N is the number of units or quantity). Our purpose in discussing cattle is to establish some ideas that we will use in our discussion of the interest rate. And what is the interest rate?

Interest is the price to use someone else’s money.

A Free Interest Rate Market

Let’s first look at a free market. A free market is when people can choose what money to hold, what money to set prices in, what money to use as unit of account for their books, and what money to lend and to borrow. It means there is no central bank, no lender of last resort, no bailouts or bail-ins or deposit insurance or other moral hazards. It means no irredeemable currency. It means the absence of force, and the respect for the rights of property and contract. In a free market, people use gold.

A free market means that people are free to pursue their interests, and express their preferences. There are two critical preferences that affect the rate of interest. One is the time preference of the saver. Think about this for yourself. Would you lend us your gold at 0% interest (our recent deal priced at 2.75%)? Of course not! Everyone has a time preference. If interest is below time preference, people will just keep their money.

The other preference affecting interest is the preference of the entrepreneur to make a profit. If he can earn 10% on capital, then how much is he willing to pay to borrow it? Whatever the number, it must permit him to make money for himself. It must be under 10%.

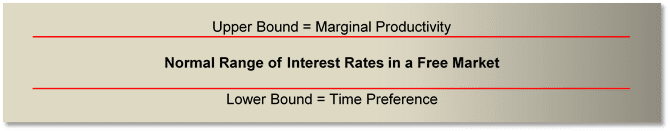

Lending occurs only if interest > time preference. Borrowing occurs only if interest < productivity.

This an iron law, in a free market. However, we don’t have a free market. We have a regime of irredeemable paper currency. We are forced to keep our books using the irredeemable dollar. We must pay tax if we trade our gold at a higher price in dollars than when we bought. We borrow and lend in dollars. This regime is so pernicious, that even those who prefer gold get angry when the price of the metal goes down in dollar terms—in terms of the not-money dollar which these folks hate.

Let’s look at that a moment. Why does the price of gold matter? Let’s leave aside the fun and profit of speculating for dollar gains. And also the brainwashing, which has convinced everyone that its dollar is the unit of measure. There answer is simple.

Nearly everyone has dollar debt.

We owe dollars. It is therefore a risk to own an asset which can go down in dollar terms. When the market value of your asset drops relative to the fixed value of your debt, you are moving one step closer towards bankruptcy.

It used to be illegal to own gold. President Roosevelt criminalized it as part of his process of breaking the gold standard. Three decades later, President Nixon finished off the gold standard. After that, gold no longer had any role in the monetary system. A long-forgotten relic, it was legalized again in 1975. Gold no longer mattered. Our monetary masters could ignore it, as hoarding gold, like hoarding cans of tuna fish, is cumbersome and involves considerable friction. Not to mention price risk.

In light of our discussion about interest rates, we can say definitively that hoarding gold coin today is not a good alternative to lending for most people, if the interest rate is too low. Before 1933, holding gold coin had no price risk. It was a choice of gold coin or gold-redeemable bond. Today, the gold coin has price risk, and so is a not a comparable alternative to the irredeemable dollar bond. Indeed, those who own gold are doing so in a belief that the dollar is going down (which many mistakenly call gold going up).

Looking beyond price risk, we see that gold is no alternative to lending at too-low interest. The reason is that the dollar is a closed-loop system. Dollars do not come into the system, nor leave the system in ordinary transactions.

Consider a simple example. Joe buys gold from Mary, because he doesn’t like the interest rate. OK, fine, by buying gold Joe avoids lending too low. However, Mary in selling gold is buying dollars. She inherits the interest rate dilemma from Joe, when she gets his dollars. The dollars are trapped. They remain in the credit system. If Joe buys gold (or anything else), it results in nothing more than changing the name on the banking system record of the dollar deposit.

In a free market, by contrast, one does not buy gold. One sells the bond and receives the gold coin, which is the money. This pushes the price of the bond down. The interest rate is a strict mathematical inverse of the bond price, a see-saw. In his time preference, the saver causes the interest rate to tick up.

Depriving Savers of Choice

In the regime of irredeemable paper, by contrast, one does buy gold. Which means one sells the dollar. The price of the bond in dollars is not affected. The transaction affects the price of the dollar, but not the interest rate.

At the heart of it, the regime of irredeemable currency deprives savers of the choice of whether to lend or to opt out. Everyone who owns a dollar owns the credit instrument of the Federal Reserve. A dollar bill says “Federal Reserve Note” on it. It’s the Fed’s paper, to whom you are granting credit. It is not a positive thing, an entity that you own. It is a negative relationship, where an entity owes you.

The nature of this relationship, that someone owes you, does not change if you deposit the dollars in a bank. You do not have dollars in a bank. The bank owes you dollars. Which it will use to buy bonds, thus the bond issuer owes the bank. Or instead of depositing the dollars in a bank, you could buy the bond directly. Then the bond issuer owes you. In all cases, a dollar is a relationship between creditor and debtor.

This is the full meaning, nature, and consequences of the regime of irredeemable paper currency. The conservative investor (especially if leverage is used) must buy bonds, because of the risk of a price drop in gold. The price of gold could fall more than the interest rate deficiency. In a day.

The dollars are trapped in the system, like cattle in the pen. Even if the owner of a dollar deposit gets out, the dollars remain. And thus the saver is disenfranchised. He may be unhappy with the interest rate, but he cannot affect it. If the price of beef goes up too much, he can affect it by not buying beef. In the gold standard, if the price of the bond goes up too much / the interest rate falls too much, he can affect it by not buying the bond.

In irredeemable currency, the saver has been de-toothed.

If you want proof, look at the negative interest rates that occur in Switzerland and other countries. No other theory can satisfactorily explain how this could happen and why. The study of aggregates by comparing interest to consumer price index is unsatisfactory. Our proof is simple. Above, we asked a question, “would you lend us your gold at 0% interest?” No one answered by saying “well, sure, if consumer prices are falling.” Unless a saver is paid sufficient compensation for the time (not to mention risk), he will keep his gold.

However in irredeemable currency, he has no choice but to lend his dollars, francs, euros, pounds, etc. In software jargon, this is not a bug but a feature.

The bottom line is that concerns about US government risk, fretting about the enormity of the debt, fears about inflation, etc. do not motivate the saver to withdraw his savings, do not drive the saver to sell the bond and take his money home. He cannot withdraw his savings—the currency is irredeemable, which means not withdrawable. He cannot take his money home—there is no money in the monetary system. He could buy gold, if the price risk suits him, but this is nothing more than swapping places with the former owner of the gold.

The interest rate is totally unhinged. It can go up, obviously it did from 1947 to 1981. But not by the mechanism of a free market as is assumed to be the case today. It can do down. Obviously it went down, 1981 through present (not counting the current correction).

However, we must say this. Whatever may be driving the trend, it is not savers becoming tired of too-low rates. Whether the trend changes after 37 years or not, that change will not be driven by quantity of dollars, consumer prices, the magnitude of the debt problem, etc.

The driver since 1981 has been interest rates > marginal productivity.

Declining Workforce Participation

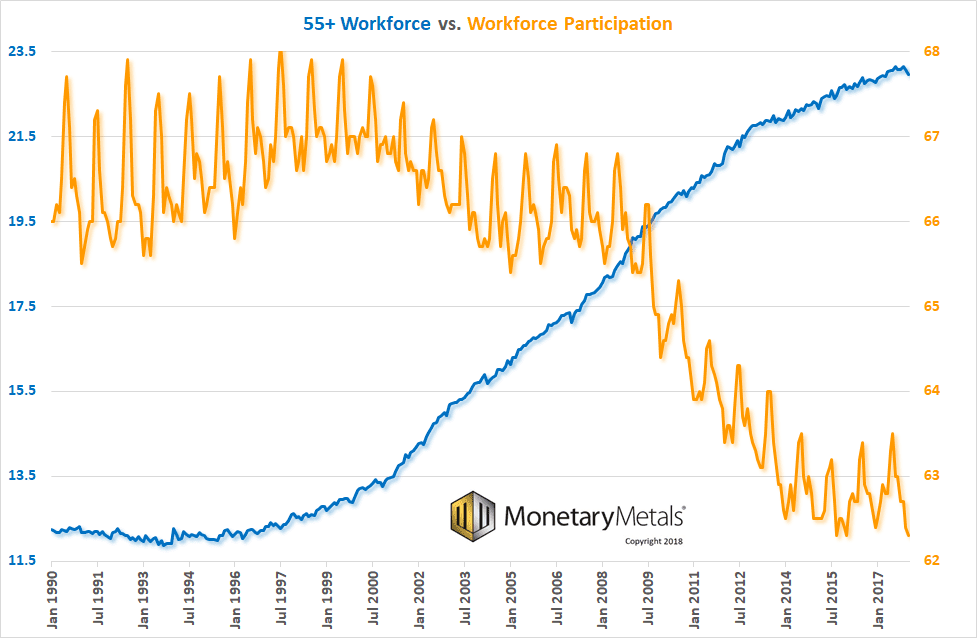

We want to publish a chart. By now, it’s well known that the labor force participation rate has been falling. Nearly 100 million Americans are not counted in the workforce. They are neither employed nor unemployed (only a government statistics bureaucrat could utter this phrase with a straight face).

There is a glib explanation often given to this. Well, the economy (read: stock market) is doing so well that many older Americans are taking early retirement, to spend their income (read: capital gains) on the golf course, and at Michelin Starred restaurants.

The technical word for this is: bullshit. Here’s a graph showing the falling total workforce participation against the workforce participation percentage of older workers).

First thing to note, falling participation is not an Obama creation. It begins under Clinton and continues under Bush. And yes, of course, accelerates under Obama.

Next, it is still at the bottom. If it is recovering, there’s no evidence to suggest it yet.

And finally, our point. Participation by older workers moves inverse to participation by other age groups. As more and more people are pushed under the margin, to become permanently unemployed and unemployable, older workers are staying in their jobs at higher rates. We are just about at the absolute highest rate historically.

One could offer the glib explanation that older people have never had better health. And that is likely true. But we assume they have the same desire for that golf course and Joel Robichon restaurant as they ever did. It’s just that, despite—or because—of rising assets / falling yields, they are unable to attain their goals.

Falling interest causes two relevant effects. One, the net present value of wages rises. The net present value doubles for each halving of interest. Workers who cannot increase their productivity are laid off. Two, the net present value of the cost of retirement also rises. We see both effects in the falling workforce participation of younger people, and the rising participation of those older people who are highly productive.

To close our discussion of interest rates, we will ask one final question. Do you think that either the unable-to-work or the unable-to-retire are eager to borrow more as rates rise, chasing interest rates up?

To repeat something we often say, the dollar is failing but not in the way most critics assume. It is not imminently about to burn up in a thermonuclear explosion of hyperinflation. It is slowly falling colder, into a heat death of the monetary system.

Supply and Demand Fundamentals

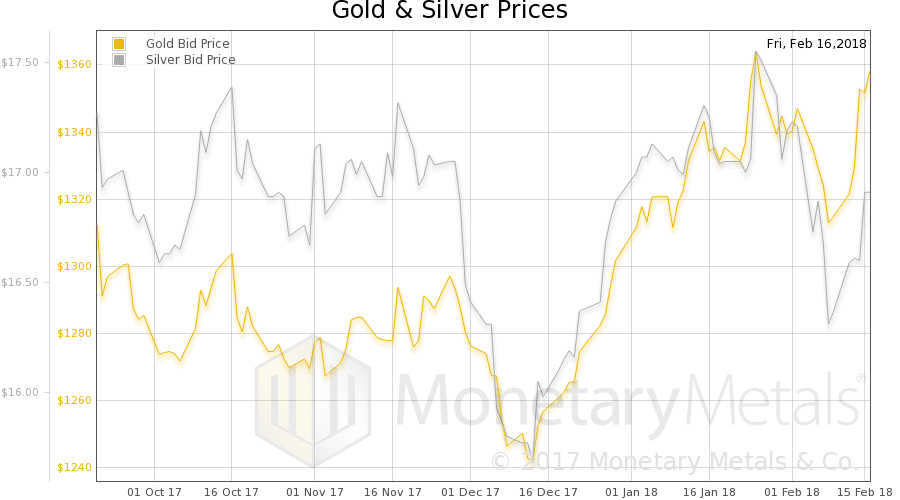

This week, the prices of the metals rose, gold a bit more than silver. We have to note that everything went up in dollar terms: stocks, dollar-derivatives (e.g. euro, pound, etc.), and non-food commodities (oil, copper, etc.) Most people would say “inflation!” even if they would be hard-pressed to explain why stock yields should go down in a rising bond yields environment.

We would say that following the bout of volatility in stocks, this was a week of unbridled credit expansion and buying risk-on assets. Great, but with even this little timid rise in interest, the risk is increasing. The marginal debtor will default, we will find out who that is. Soon enough.

Now let’s take a look at the only true picture of the supply and demand fundamentals for the metals. But first, here is the chart of the prices of gold and silver.

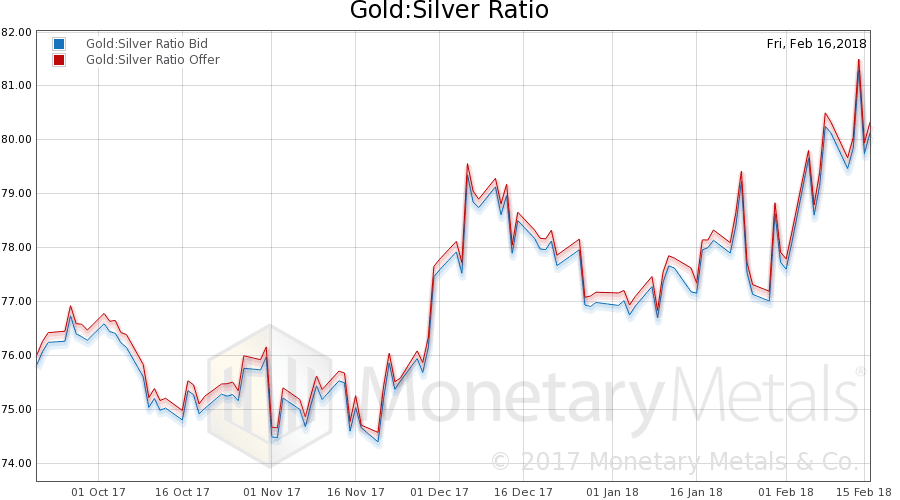

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio rose slightly.

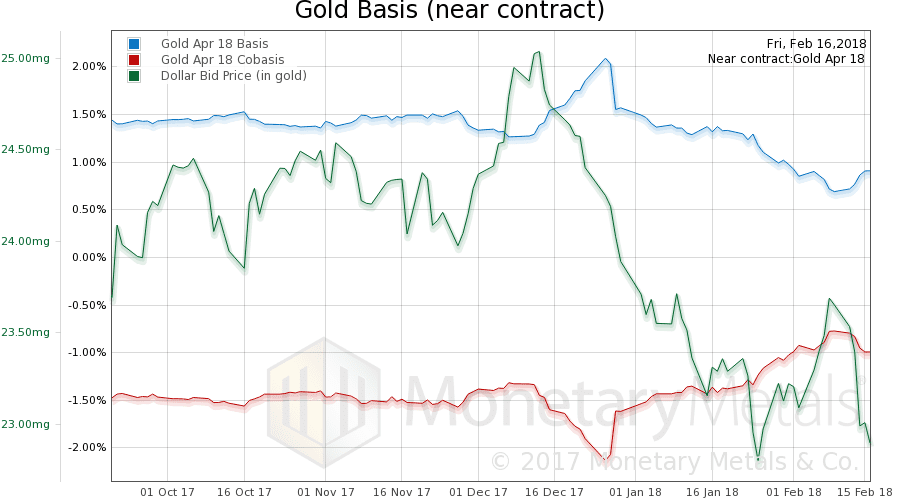

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

As the price of gold went up, we look at it as the price of the dollar falling about 0.8mg gold. With that drop, we see gold becoming a bit more abundant (blue line, i.e. the basis).

The Monetary Metals Gold Fundamental Price rose $25 this week, to $1,411. Recall our prediction for the price of gold by year’s end. Now let’s look at silver.

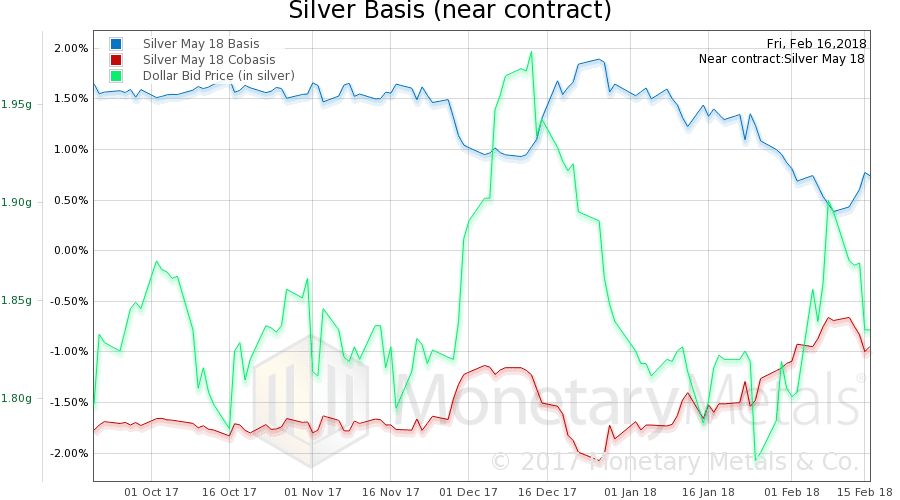

We see the same pattern in silver as in gold. Price rises (i.e. dollar falls) and along with it, rising abundance of the metal. The Monetary Metals Silver Fundamental Price rose 26 cents.

This means that the fundamental gold-silver ratio increase slightly. And that is not a sign of a good economy, is it?

© 2018 Monetary Metals

There is another side to those who convert their dollars to gold, (though I agree that it just makes the gold seller a dollar holder), and that is political. By converting one’s dollars to gold, one is in essence saying, “I’m taking my ball home and not going to play.” There is no impact by one person de-dollaring as it just means that someone else, (the gold seller), has “dollared-up”. But at least one is a) sheltered him/herself from dollar risk and b) made a statement, (even if only to oneself), that one does not support the idea, (nor the practice) of dealing in debt, (FRNs) with no duration and no interest paid, an abomination if I ever heard of one). (See, I have been paying attention, prof!)

I presume that makes one simply a “hoarder”, (as opposed to a speculator). (I say that like it’s a bad thing, huh?) But for many it is more of getting to those golden years that one is less inclined to subject one’s savings to a broader market that seems to allow wide spread financial crime, (the victim invariably being the small saver), to proliferate and when caught, punished lightly with no remediation for losses to the saver. As I like to say sardonically, “Free Jon Corzine!”

As far as the “Declining Workforce Participation” goes, there are many who are still generating an income but they are “declining” to participate in the fraudulent government tracking of their endeavors. Every president since I would say LBJ has cooked the government employment numbers books to be able to crow about some imaginary goal post they had achieved. All one has to do to see this tomfoolery is look how many people fell off the books when they gubbmint unemployment checks ran out. The didn’t become employed, they just weren’t counted anymore. This farce continues to this day. I digress but just to point out that the same government that is cooking the unemployment books is also dealing in fraudulent FRNs.

I get that one isn’t going to drive that mean ol’ Uncle Sam out of the business of dealing in crap scrip. But one does have the choice to a) get out of the debt racket and b) hold their savings in Money, not debt instruments with no duration. Thanks Keith. You make me a wiser man.

Excellent article. One of your conclusions is:

“The driver since 1981 has been interest rates > marginal productivity.”

A question I have is, can an increase in default risk increase the rate of interest?

The driver since 1981 has been interest rates > marginal productivity.

The reverse?

The interest rate rises when the marginal bond is sold at its bid. If the proceeds find a productive capital asset with more yield than the old rate, they’ll buy that (at its ask), thereby driving the marginal yield on capital down. The trades here are effectively at an ‘equal’ relation. Still the dollars themselves just come around again and when at rest they tend to buy more bonds, which undoes the initial upward force. Only an affirmative move into hoarding causes real increase in the interest rate. The quantity of hoardable cash is a small fraction of the dollars on deposit, and it’s an asset class under outright assault in the ‘war on cash’.

The question is whether the FED selling the bond and then destroying the cash proceeds is tantamount to ‘redeeming’ the currency or ‘extinguishing the debt’. The Fed is betting that such ‘Quantitative Tightening’ will suffice. Thus far they’ve mostly let bonds mature away. Not clear whether principal repaid is being written off of their balance sheet or recirculated, They could have some effect, no doubt; but $3T seems puny compared to the $20-30T outstanding. We shall see.

Have you noticed the recent budget “negotiations”?

Party A) Yes, let’s drive off the cliff as fast as we can. Nothing bad will happen.

Party B) No, that’s crazy… let’s drive off the cliff ever faster while “helping people”. Besides, nothing bad ever happens. This is America… we are invincible!

Notice the difference?