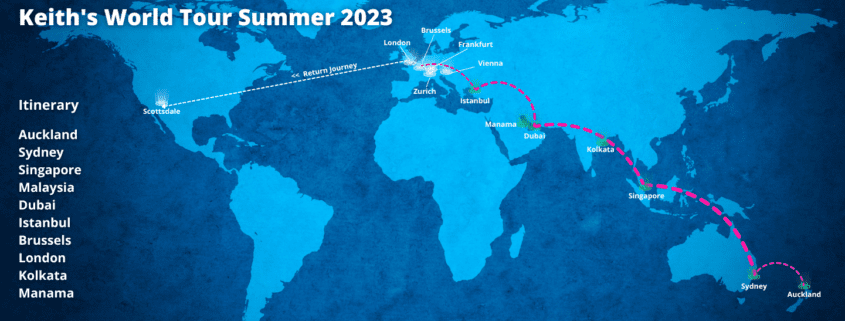

Keith’s World Tour Summer 2023

Where in the world is Keith Weiner?

I set out on the road, for another around-the-world trip, on June 13. My stops include: Auckland, Sydney, Singapore, Dubai, Istanbul, Brussels, Frankfurt, Vienna, Zurich, and London.

My twin purposes are to raise awareness of Monetary Metals, and meet prospective clients. They are mostly corporations who can bring more gold into our program (which pays interest on gold) but also prospective lessees and borrowers.

Here’s where I’ve been so far:

Auckland

Sydney

Singapore/Malaysia

Dubai

Istanbul

Brussels

Kolkata

Bahrain

Over the next several weeks, I’ll be posting brief updates here from each of my destinations. Sign up to our newsletter to follow my progress.

First Stop: Auckland, New Zealand

In Auckland, I took this photograph after breakfast. It captures the essence of the city in one composition: water, boats, urban landscape, and especially the big banks.

It says something about our business, that even in a small country like New Zealand (population around 5 million), there are several opportunities that fit my criteria.

The devastation from New Zealand’s long and harsh lockdown is clearly visible, not least of which in the low hotel prices not to mention the low price of the kiwi dollar.

While I was here, I met with Terry Verhoeven. He is the founder of the Rights Institute (rightsinstitute.org). He has been a long fan of my work to restore the right of people to use honest money, and gave me the silver round you see pictured here.

Sydney, Australia

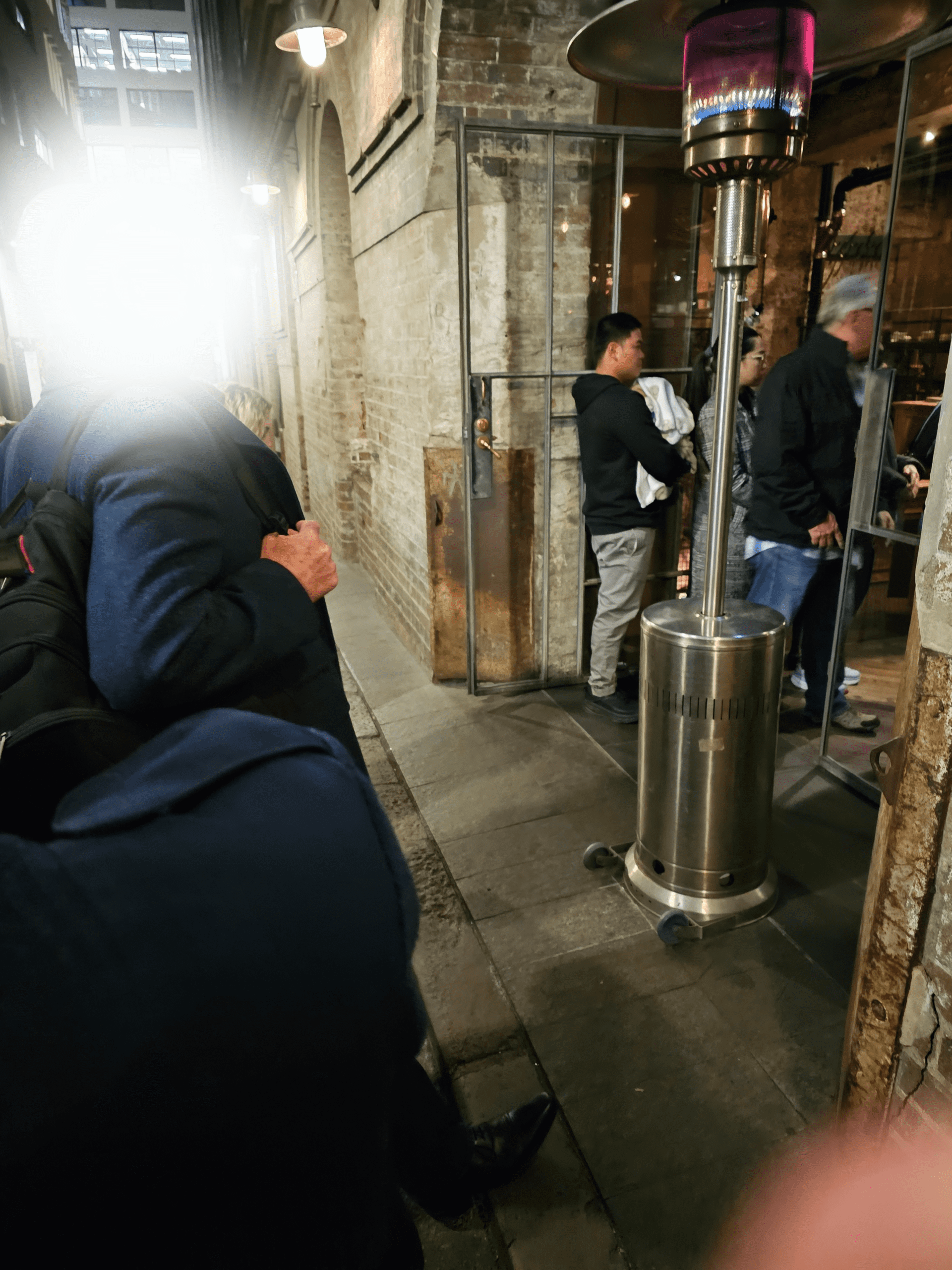

I visited Sydney in “winter”. Temperatures were in the high 60’s Fahrenheit (about 20C). Nevertheless, just like in Phoenix, locals often feel that they are suffering from an absolute Ice Age. Here is a picture of a local, who is wearing a shirt, a jacket, a wool overcoat, and even a scarf (which is visible above the coat, on the back of his neck).

A full and productive week, seeing old friends and making new ones, furthering existing business and developing new. Plus many conference calls back to the US, late at night and early in the morning. On Friday, I had nine video calls then met people for lunch, afternoon drinks, and dinner meetings (yes, there is a business where they do shots of excellent Scotch in the office on Friday afternoons).

Singapore/Malaysia

Singapore is bursting with new and unique skyscrapers. Here’s a picture of a particularly exhilarating view. The whole floor is exposed to the outside air (though sheltered from sun and rain, both of which Singapore has to excess).

Deals were discussed and Asahi (of course!) was consumed. We did not take off our shoes and socks so, alas, I did not partake of that unique conference table. This trip.

In this part of the world, gold is much more widely owned and accepted. You don’t have to explain it. You can just get on and talk about what you’re doing with the gold, which is unique.

I am glad we have someone on the team who lives in this time zone. We have a lot of follow up work to do…

See you in Dubai next week!

Dubai

This city combines the boom of Singapore, only bigger. It’s hard to believe unless you see it—with the every-building-must-outdo-the-prior-buildings aesthetic of Las Vegas. There is less regulation than other places, and no income tax.

People come from all walks of life, to make money in Dubai. They are certainly not here for the weather, which can get to 50 (that’s Celsius)—which is like Phoenix. With 70% humidity—which is not at all like Phoenix.

And all industries, most especially gold. I met Indians, Arabs, Germans, Brits, and even Swiss. I saw a large mall entirely dedicated to jewelry and gold, plus service providers such as vaults.

Did I mention no income tax? Yeah, well, that benefits citizens of other countries but not Americans. You see, the US government taxes its citizens no matter where they live and no matter where their income comes from. Whereas Indians, Arabs, Germans, and Brits can make money tax-free so long as they make it in Dubai.

I met an American who actually took the extreme measure of renouncing his US citizenship.

If you are not an Emirati, you can’t get citizenship which means of course you have no say in the government. And it’s best not to criticize the government, as there is no equivalent of the US Constitution and its First amendment here (or in any other country, for that matter). There is no right to own a gun here. Don’t think about drugs. Or pork.

But you really have to understand that many people want to achieve financial success. Less government interference in business—and did I say no tax?—makes it a helluva lot easier to succeed. Many people may not stay here, once they’ve made their money. But they choose to come and stay at least for a while.

Although the United Arab Emirate dirham (AED) is pegged to the dollar and has been table flat stable since at least the last 20 years, the universal currency here is, you guessed it, the dollar. I met with hedge funds and other institutions whose balance sheets are denominated in dollars. I met with folks who get the Monetary Metals vision and would like to be a part of it. And, as with every other city, I met companies interested in leasing gold here.

Until the next city (Istanbul).

Istanbul

I only had two and a half days in this city, to meet some prospective lessees. The city is the opposite of Dubai in so many ways. Its rabbit warren of cramped tiny streets and old, often dilapidated, buildings is the opposite of Dubai’s wide streets and wide fake river that loops from the ocean to the ocean. It is authentic, it obviously evolved over millennia of commerce, trade… life. It shares this with Dubai, it is about trade, people producing, exchanging, and making money.

I often say that Americans understand gold the least. While (mostly) American goldbugs traffic in the rumor that the BRICS countries are going to do a gold “backed” currency, hence the price of gold is about to skyrocket… in Turkey where EVERYbody has at least 10g gold, they have an expression “Under the pillow gold”. Even the government recognizes that gold hidden under the pillow (mattress) is useless. It’s not contributing anything to the economy.

Why do they all hold gold? Their currency, the lira, is constantly being debased. It went from $0.85 before the Global Financial Crisis, to $0.037 now. That is a loss of -95%. So of course they turn to something that doesn’t lose value.

At the Bazaar, every other shop, it seems, is a gold shop (I am told that there are far fewer spice shops than there once were and many more gold shops). I lost count, and I only had 30 minutes to make a quick walk through a few corridors. I saw only one bitcoin shop.

In the dollar standard, banks don’t buy your dollars. They borrow them. You put them on deposit, and the bank uses your capital to finance productive industry (and increasingly government, but that’s another issue). In Turkey, the banks aren’t buying gold, they’re taking it on deposit and paying interest on it. I am told that anyone can open a gold account.

What do they do with it, to earn interest on it for themselves, so they can pay depositors? They lend it to the central bank. What does the central bank do with it? I did not get any clear answers. (If you know, please contact me!)

Turkey, which many Americans would dismiss as “third world”—it’s per-capital GDP is 86% lower than in the US, but it’s more complicated than that—has the right ideas about gold. Two right ideas. One, the gold is not doing anything productive by sitting “under the pillow”. Two, it’s not about buying and selling at a higher price (in lira terms, the gold price is going up, fast). It’s about depositing gold, and earning interest on it. The third idea in the trifecta, which Monetary Metals has, is using gold to finance productive enterprise.

Let’s just say there are many opportunities for Monetary Metals to help the Turkish people and businesses.

Brussels

Julius Caesar famously said, “veni, vidi, vici”—“I came, I saw, I conquered.” Well, I came to Brussels, saw food and gold and prospective clients, and conquered—the food at least. The gold, well, it is like that scene from The Hobbit, where they have to leave it behind in the troll cave. I didn’t buy any, I didn’t sell any (see picture below), and I didn’t lease any. Yet.

I did not see any overt sign that the economy is grinding to a halt. Either due to decades of falling interest, with its attendant capital consumption, or due to the rate hike shock (here, it moved from zero to 4% over the past year). It’s like the scene in Lord of the Rings, where Pippin is talking to Gandalf in Minas Tirith. They know the orc armies are marching, but there is no battle. Yet.

Volavi, conveni, edi, volavi.

On to London.

Kolkata

So I was in London, enjoying the nice cool weather (60-68F, or 15-20C) with my wife. Even the occasional rain wasn’t too bad. And then I had lunch with an industry colleague.

“Keith, are you going to Kolkata next week?”

“I heard of the gold conference there, but I hadn’t planned on going. I was planning on flying home—”

“You. Need. To. Go.” This was replete with finger waggle.

OK, so I booked my flights, got the visa, etc. The only country I’ve seen so far, that asks about your religion on the application. Also an expensive fee. Also print everything out, as the officials at the airport don’t have electronic connections.

These things are all over the road. In some cases, they make a snail shape, like a public restroom in a crowded place like an airport. These are on highways with four or more “lanes”—I use scare quotes, because most drivers seem to be zigging this way and that, when they aren’t playing Pac-Man. Did I mention blowing horns?

There is such a vigorous gold trade going on here, that if you were sitting in the US or Europe you could scarcely imagine it. Mostly due to the Indians’ love of the yellow metal.

But some of it is fueled by tax and regulation. Perverse incentives lead to perverse outcomes. Put on your economic thinking hats for a minute. What outcome would you expect, if I told you that the import tax rate on bullion is 15% and the rate on doré (raw gold from the mines which needs to be refined) is 14.35%?

Yes, the price of doré is bid up above the price of bullion, despite needing input of labor and energy to be refined. The tax rate spread is intended to subsidize the refiners here in India, and it really has. There are many refiners, each running at part capacity. And they have bid up the price of doré.

Government interventions (like these import duties) in the economy are always sold on the idea that they improve outcomes. But India (and the whole world) need to discover an iron law of economics. Intervention causes perverse outcomes, not better outcomes.

There is a good analogy somewhere between import tariffs, regulations, and teel fencing plunked down onto the highway in random locations. It adds friction and risk of occasional but serious casualties.

Bahrain

I saw some traditional jewelry manufacturing, in an old part of town with narrow streets that were clearly there before cars. There are rows of people at their benches (mostly Indians) filing, polishing, setting stones, etc. Very labor intensive. Workers’ feet are scrubbed of any gold dust when they leave their areas, they are not allowed to use hair oil and must wear company-provided hats, to prevent gold dust from “sticking to” their hair. They must go through metal detector before leaving.

The industry is hurting from a new tax imposed on sales of gold jewelry. And grumbling that a jewelry “expo” has become a flea market, where this tax is not imposed. Jewelers sell to the public there, with the result that many Bahrainis wait until the expo to buy jewelry (their currency is pegged to the dollar, and has been pretty stable for a long time, so there is not the constant demand for gold that occurs in India and Turkey). I don’t know what King Hamad (or Prince Salman) intends to accomplish with this tax, but the net result is that domestic gold buying is reduced. The wealthy can hop over to Dubai. Many others buy, often from from foreign vendors, at the annual expo. Worse, demand is concentrated at one time of year, rather than a steady flow throughout the year.

Gold businesses, including jewelry manufacturers, are low-margin businesses. Even a 5% tax has a big impact. The end result of all government intrusions into the market is reduced coordination in the economy.

Speaking of a stable currency, there is a problem with a dollar peg. Economists such as Steve Hanke and Warren Coates who tout the benefit—stable purchasing power—do not discuss this problem. If one has a choice to hold either real dollars, or not-dollars-which-are-pegged-to-the-dollar-for-now, there is an incentive to hold real dollars. The risk is all one-sided, that the peg will slip and the local currency will be devalued. How do they maintain the peg? By imposing a higher interest rate. This imposes a higher cost of capital on Bahraini producers than American producers with whom they might compete.

For my American friends who are seeking a higher yield, the Bahraini Dinar is stable and pays higher rates. Any takers? Please let me know!

For what it’s worth, I spoke to wealthy Bahrainis who said they prefer dollar denominated deposits and assets.

I saw no sign of bitcoin whatsoever, and no one mentioned it. At the airport you can buy luxury goods, mobile phones and SIM cards, and all sorts of things. And gold. But no bitcoin vending machines.

Manama is quite different than Dubai. It does not have the hustle and frenetic energy, or the traffic. Or the incredible gold trade. And mostly, with a few exceptions, it doesn’t have the wealth….

Additional Resources for Earning Interest in Gold

If you’d like to learn more about how to earn interest on gold with Monetary Metals, check out the following resources:

In this paper, we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF – GLD, and mining stocks against Monetary Metals’ True Gold Leases.

The Case for Gold Yield in Investment Portfolios

Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold pays a yield? This paper answers those questions using data going back to 1972.

Godspeed Keith. You’re doing good work my friend.