Monetary Innovation in the Ancient World

We think we are the only generation to be smart. In the 19th century, they did not have the internal combustion engine. In the 18th century, they did not have the railroad. In the 17th century, they did not have the piano. So, most people assume, they were dumb. They did not know about smart phones, so they would not have understood anything. Such as money.

So let’s tell the story of the ancient city of Orinthus. They were innovators in money, millennia ahead of their time…

Division of Labor

Orinthus was inhabited by the first people to settle down with agriculture and fishing. Soon, a new class of evolved: those who crafted goods out of riverbank clay, animal hides, and even stone quarried from the local hills. With the advent of real production and trade, they soon discovered it’s terribly inefficient if the guy who made leather needed to find a fisherman who needed shoes whenever he was hungry. They realized they needed money.

Now, you may assume you know where this is going. Orinthans mined some rock, found gold, and lived happily ever after. But that is not what happened. Most of them were intelligent and innovative. So they came up with something much better, and only a few fools grubbed around in the dirt for gold.

Even before money, they had built a grand temple to their venerable gods. The temple was the center, not just of religious life, but of social and commercial life. It was natural for the temple to be involved in their invention of money. They decided that the Conclave of Clerics would keep a ledger of who had what money, chiseled into the Righteous Rock Tablets. On these sacred stones, they record the precise number of money units—called orincors—possessed by each citizen.

Money—orincor—was traded for goods and services in their nascent economy. When two people traded goods, an acolyte would inform the High Priest who would order new marks to be chiseled into the rocks, to record the new owner of the orincors. The temple would also chisel an entry to add to its own monetary balance, as a fee for providing this valuable service.

For a while, it worked without a hitch.

The Problem of Trust

But one day, Arginus was excommunicated. He was thrown out of the temple, and told never to return. He was no longer a member of the Orinthan religion, and not eligible for marriage or burial rites. More worrying, however, was the question: will the temple still honor his money?

There was no way to find out, because one of Arginus’ enemies used the opportunity to kill him in a dark alley, and that was the end of the matter. No one dared ask the High Priest what happened to the dead man’s money.

However, some began to think that it might be good to trade some of their money for a commodity which seems to have steady demand, if not openly in the temple piazza. Perhaps there was something to those grubbers who dig up the shiny yellow metal. The grubbers, as they were known, were never called miners. That term was reserved for the special members of the clergy with the privilege to chisel marks into the monetary ledger. It was an extension of the name originally given to those who quarried the stone, which even at the beginning was considered sacred.

Then one year, a major temple donor got into a dispute with another citizen. There had always been disputes, but not with the priesthood or their big supporters. People were wary of offending the gods, and the clerics were careful about such things. Until now.

To make matters worse, the king ruled in favor of the citizen. The high priest himself was said to be unhappy about this outcome.

Again, people began to wonder what could happen to this citizen’s money. Again, some citizens turned to the gold grubbers to exchange some of their money for this metal. Rumors swirled that the citizen involved in the dispute did this too, but he would say nothing openly.

And the donor seemed to be able to give and give to the temple. He was moderately prosperous, being in the business of selling nets to the fishermen. But how could he have so much to give? Is it possible, a few people asked far away from the temple quarter, that the acolytes are adding marks to this man’s monetary tally?

How Is Money Created?

Over time, that led to another uncomfortable question. What is the money creation process? How much is supposed to be created? Who determines this? To whom is the new money given?

The temple decrees that to address these concerns, they will display the Good Granites in the atrium, for all to see. Everyone comes to look, but there is a lot to read and the record of transfers is too complicated for a layman to understand.

More citizens turn to the grubbers. They wanted a physical good. To take it home, and keep it safe. With commerce spreading, some thought they might move to another city, but they worried that the tally marks at the temple in Orinthus would not be accepted by people elsewhere.

The temple decrees that it has thought of a solution. Treaties have been signed. Transfers of money from ledger stones at the temple of Orinthus to corresponding stones at temples at other important cities can now be done. Carrier pigeons have been exchanged with the other temples. Transactions can be settled within the same day.

Then one day, a new high priest was appointed. He was a disreputable man who seemed unworthy of the office. He was a proven liar and a cheat. The tally marks on the sacred stones no longer seemed as trustworthy as they had been.

The people, and not just those inclined to whisper in dark corners with grubbers, began to perceive that the balance of risk and reward was tipping.

The politically astute deacons may not have been able to replace their leader, but they recognized the mood of the people. They had enough power within the temple to force through a change. No longer would the sacred ledger stones be kept by members of the clergy. Instead, they will be entrusted to the biggest donors. Those who give most generously to the temple have the most at stake. In addition, they have proven their faith and loyalty. No longer are citizens asked to trust in the central authority of the priesthood.

Proof of Stake

Our uneasy citizens increasingly feel the need for a good that can be taken home and buried under the floorboards until needed to trade for something else.

They are told that no True Orinthan can object to the system of donor-maintained stone tablets, as no one is obliged to trust in anyone else. The stones are in public display, in the care of those whose proof of faith and stake is beyond question. And beyond reproach. Or at least no one is allowed to openly disagree.

Next, the politics outside the temple grew ugly. The king was killed. Factions contested for power. Civil war raged in the streets. The temple closed its gates, and for a time people did not have money. That may have been a factor in settling the struggles quickly. In any case, part of the city split off and became independent. Orinthus installed the king’s grandson as the new king, but the newly sovereign city of Argacus had a council of governors.

The people wanted to get back to work, producing and trading. So the temple of Argacus establishes the money of the realm. Its priests come to visit the Orinthus temple, to copy its sacred stones. The Argacus monetary system begins as a copy of the Orinthus. Everyone who had an orincor balance in Orinthus now also has a like quantity of argacor at the new temple.

The Spoon

Some of the citizens are excited at their newfound wealth. Spooning Day as it is called—the chisels used to carve into the stones are curved—is celebrated and is declared an annual holiday.

A few worry about this, despite the assurances of the smartest priestonomists. Something about it does not feel right. Some storytellers recite the old parable, about the legless and truthless creature with the forked tongue.

In any event, both cities begin to prosper. By immigration and by birth, the population begins to swell. It is argued that a larger total quantity of money is needed to support the greater economy in this new area of prosperity. Who is to determine the right quantity, and how is the newly-created money to be distributed?

The latter question is simply answered. The big donors, whose loyalty is proven beyond reproach, perform an invaluable service to the citizens of the cities. They should get the newly chiseled money.

However, the other question is thorny and has no easy answer. So they invite a mystic from a city far to the east. He comes one night, cloaked and his face kept shrouded in shadow. He says that it is true. The number of people is growing. And the quantity of trade goods per person is growing too. So the number of monetary units must grow. But it shall grow at a slower and slower rate, regardless of the needs of trade, and no matter how the population.

Increasing Purchasing Power

To the muttered questions of the crowd, he says what is supposed to be assuring. The value of one unit of money will increase. Everyone who obtains some now will get rich beyond his wildest imagination.

The mutters of a few were nearly impossible to hear, over the cheering throngs of True Orinthans. However, if one listened closely, one could hear the question how many money units did this soothsayer get?

Indeed, some people were in the throes of such enthusiasm, or madness, as cannot be described to those who did not feel it. They felt they were getting stupendously rich, and those who disagreed were quickly shunned.

One last idea was needed, to make it click for the commoners. Money’s price, they were told, is measured in terms of goods. For example, an orincor was selling for 2 barrels of dried fish, and an argacor sold for 1 barrel. With this idea, it was possible to see that the orincor was going up. Already, it had doubled. Families could expect to eat well, with even the youngest child eating until full. They could buy many things that were only luxuries, before.

The Wealth Effect

Indeed, the orincor went up and up. Its goods-power seemed to have no limit. Until one day, it went down. In the morning, its power was so strong that it could command 10 barrels of dried fish plus 10 barrels of beer. But by evening, it commanded only 8 barrels of fish and no beer as remainder. This was dismaying, and some families had to tighten their belts.

But something else happened, that people did not expect. Speculation ruined many people, including a number of prominent pillars of the community. Not only were they buying tablet money, to ride it up. But they were borrowing. It seems many had gone deeply into fish-debt and beer-debt, borrowing all the food and drink they could, to sell it and buy money. When tablet money went down, they could not honor their debts.

Unfortunately for them, Orinthus had a debtor’s prison and they had to work as near-slaves until their debts were fully repaid. Though deprived of some of their smartest and most energetic people, Orinthus life went on.

The problem with borrowing did not go away, however. A few merchants with growing businesses borrowed, this time not fish and beer, but orincors. When the orincor went up beyond the hopes of most, and the debt capacity of these merchants, they were ruined and also sent to prison. A shortage of astute merchants became apparent,

The root of it is not a shortage of merchants. It is the lack of any viable way to borrow to finance business growth. After some of their group lost their businesses and their liberty, the rest realized that orincor was not for borrowing.

Without credit, merchants could not expand to replace the business lost by their colleagues, nor could young merchant apprentices grow fast enough to fill the gap. Shortages developed. It felt to many people like Orinthus was moving backwards, retrogressing.

Mutters of the Four Letter Word

Nothing else existed that was suitable for borrowing either… or did it? Though it was considered grubby by all True Orinthans, gold inevitably came back into the conversation. And with it, the idea of prices measured in money as opposed to the price of money being measured in fish or beer.

Even the True Orinthans could not deny that the prices of all goods—even including fish and beer—were more stable when measured in gold. The merchants could begin to see that borrowing was possible. If they borrowed in gold, they reduced the risk of falling prices which means rising burden of debt.

Our story ends when the temple money stones were no longer used, but kept on display in the manner of an old artifact in a museum.

Supply and Demand Fundamentals

Gold went down $21, while silver dropped about 1/3 of a dollar. Not quite a heavy metal brick in free fall, but close enough.

Frankly, we are sick and tired of waiting for gold to go up! And silver… sad.

Maybe it’s really manipulated and we were wrong to disagree with Ted Butler. Or maybe Keynes was right, and gold is a barbarous relic that nobody needs except for jewelry—the hip young people are wearing titanium and tungsten carbide—and electronics. Whatever it is, every time gold goes up it just goes back down. It is never gonna happen.

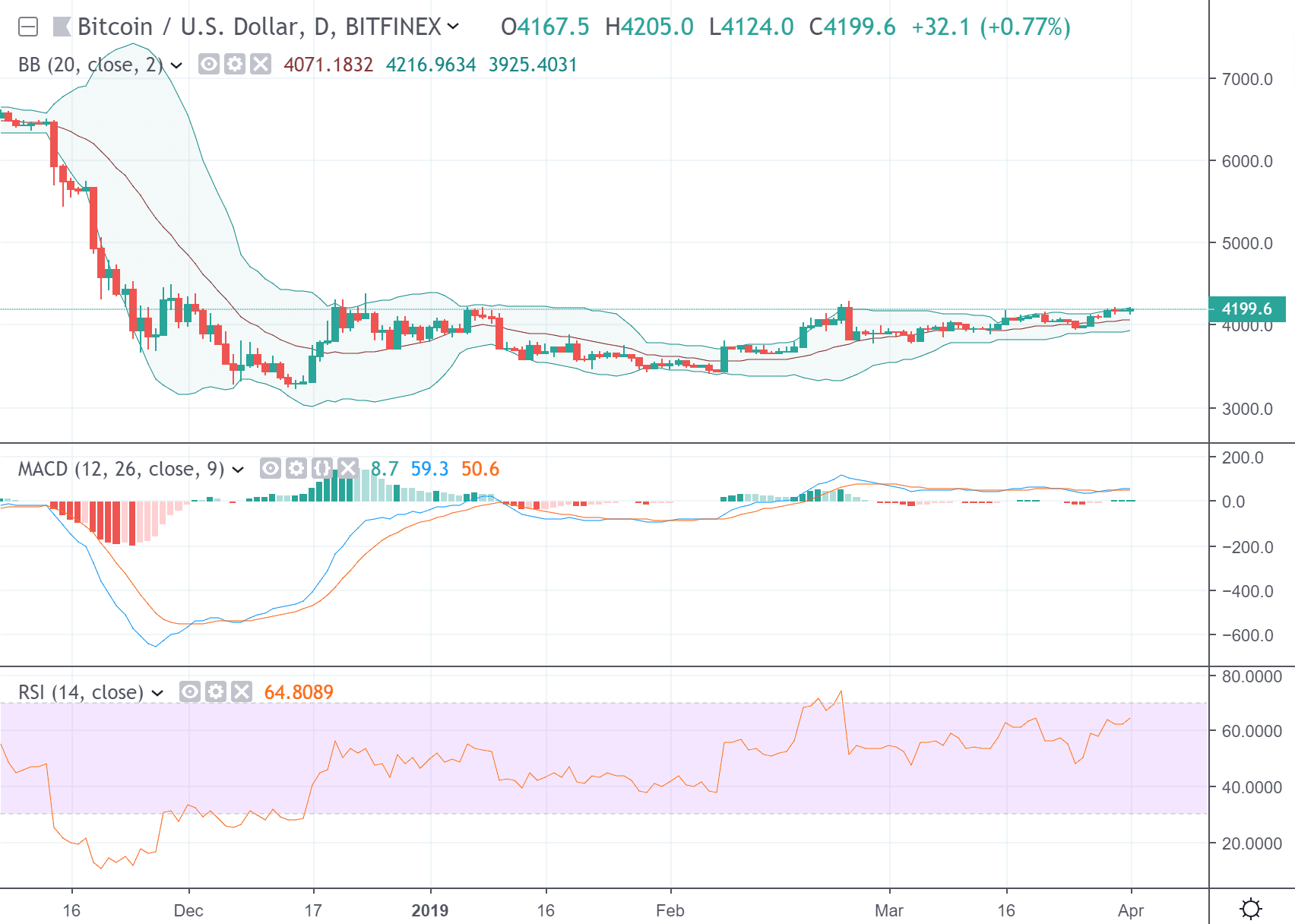

So we thought we would turn to bitcoin. Let’s look at the technicals of this newfangled form of money.

As you can see, bitcoin fell (we don’t yet have the software to calculate the dollar priced in bitcoin, but it would have been skyrocketing by this even-more-objective-than-gold measure).

The technicals say “buy” because, bitcoin is just breaking out above its Bollinger band, the RSI is high but not above 70, MACD is good, and because hope springs eternal. But mostly because hope springs eternal.

Look, we are totally throwing in the towel on this change-the-world thing, on the gold standard. Wealth is just a static sum. You can get wealth off other people by stealing it, which is bad, or by trading it, which is good. So go out and there and trade for someone else’s wealth. Really make it your own!

Oh, and one other thing. April Fools!

Make sure to subscribe to our YouTube Channel to check out all our Media Appearances, Podcast Episodes and more!

Additional Resources for Earning Interest on Gold

If you’d like to learn more about how to earn interest on gold with Monetary Metals, check out the following resources:

In this paper we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF – GLD, and mining stocks against Monetary Metals’ True Gold Leases.

The Case for Gold Yield in Investment Portfolios

Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold pays a yield? This paper answers those questions using data going back to 1972.

Leave a Reply

Want to join the discussion?Feel free to contribute!