Going All-In On a Weak Argument

In Poker, to go all in means to bet everything you have. I do not think it is an exaggeration to say that, at least so far as the mainstream audience is concerned, we gold advocates have gone all in. We have made one argument: we should adopt the gold standard, because inflation. By inflation, it is generally meant rising consumer prices (this is not my definition), again at least so far as the mainstream audience goes.

It’s true. Prices have been rising relentlessly since the Federal Reserve Act of 1913. We certainly have made the argument that inflation happens in paper money, but not in gold. I think most people believe that, despite the obfuscations of the diehard apologists for the Fed.

I think people care about inflation—but not that much.

People who work for wages mostly get mad at their boss for not giving them a big enough raise. People who are retired on a pension mostly get mad at the politicians for the same reason. They complain that the cost of living adjustment is not enough.

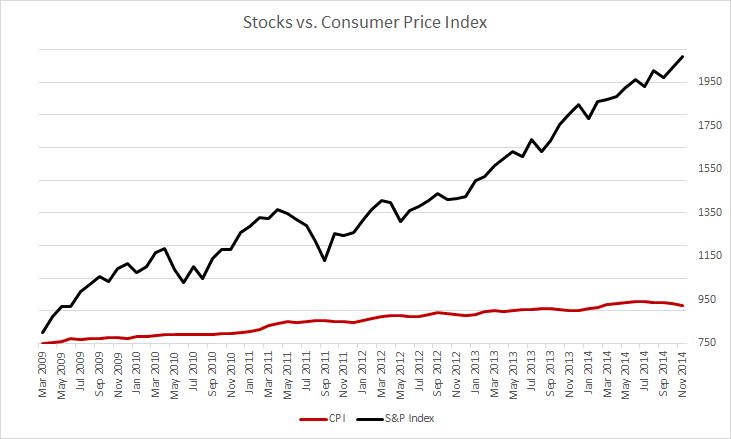

What about the rich? This graph explains why the rich are not at all unhappy.

Their stock portfolios are going up at a much faster rate than consumer prices. I have scaled the CPI curve to the same proportions as the S&P index. If consumer prices had gone up by 2.8X, as the S&P did, then the two curves would match.

Astute readers will note that I cherry picked the start of the graph at March 2009. That was quite deliberate, as I think stock investors have a pretty short memory, possibly not even that long.

If this is it, if the argument for the gold standard is merely that prices are rising, then the wealthy would prefer we stay on the dollar system. It’s making them wealthier.

A few months ago, at the Shadow Open Market Committee meeting in New York, the keynote speaker put a sharp point on this. Richard Fisher, president of the Dallas Fed, was asked a question in front of a room where 99% of the people were in the 1% (the remainder were young, still working on getting that grant or planning to transition out of government and into an investment bank). The question was about the wealth effect.

“Yes,” he said wryly, “the wealthy have been … very affected.”

We need to make other arguments about the failings of the dollar, and the virtues of gold.

That’s true : monetary inflation is unjust, whatever the money is going ie commodities in the seventies or in Financial assets into the 21st century, that’s just unfair and must be banned once for all.

The real point is that when the money system disfunctions, you will not get paid. Regardless whether there is hyper-inflation or deflation, your claims to underlying income streams will not get you the purchasing power once thought. It is about other people going broke, not about profit or prices.

It is true that if you have cash (or gold or real things) you will be able to scoop up a lot of stuff from those going broke at bargain basement prices. But the income such assets may generate might still be disappointing.

It might take 20 years before the things you scoop up start getting more valuable. Don’t believe me: here’s my deed to the planet Jupiter. Or would you prefer to exploit the low wages of labour in Mozambique?

The enduring mystery of the 30’s depression is that with just as many farms, apples, and factories people were starving, because social organization could not keep production moving. In our day and time, the chaos and dislocation would be exponentially greater. (Half the unemployed back then survived by going back to the farm!)

The problem here is that it takes more than 5 minutes to understand the real reasons gold must circulate and how many people are willing to take that much time to comprehend that point.

Julian

Most people seem to be in such a hurry these days, chasing after the almighty government issued peices of paper(the almighty dollar), they don’t have listening skills. Things need to be delivered in a 5 second sound bite.

Makes it very hard to get through. I’ve decided I won’t talk much about things unless someone is willing to agree to sit down for a considerable period of time first, to talk. To have a discussion, a discourse.

People alive today have been brainwashed for their entire life to equate fiat currency with money, rather that equate gold with money. It’s really that simple – overcoming that brainwashing is monumentally difficult for most people. The concepts of money, debt, currency, and wealth are all conflated, and most people can’t actually understand the difference between these concepts. It will only ever be “obvious” to all if and when there is a major crisis that forces the recognition of these things being vastly different.

I agree bgoldman. It’s looking more and more like there will need to be a total collapse in the confidence of what today, is called money. The Almighty Dollar and other fiat currencies. People don’t seem to think, or care(?) that other things were used as money at previous periods in human history, and how it is that they came to be money.

Here’s my two zinc-filled cents, or rant or whatever:

I would think that, maybe, strong arguments would be Article 1 Section 10 of the Constitution and the fact that it has not been amended to change it or remove it, and the fact that both Gold and Silver were demonetized from the system by Presidential Executive Orders. A Strong Aurgument would be to say that that is not how money is chosen by society. It’s not done by ‘Executive Order’. Or is it? I think that needs to be talked about.

Long-term nominal “inflation” isn’t actually so weak an argument, except that it only recognizes a symptom, and not the root of the problem. Your stock v CPI chart and 1%-cabal anecdote get closer to the problem: that fiat currencies are an oligopoly, not a market Good.

That there is some “cost” to having sufficient money around to clear transactions should not be a surprise to anyone with decent common sense (the free-lunch crowd exclude themselves here). What we’ve been brainwashed to believe is that the cost is inevitably this high – that FRN dollars are the lowest-cost way to encapsulate “moneyness”. In this mistaken belief we’ve begun paying this high a cost to the monopolists in and surrounding the Federal Reserve. Among themselves, they then play a very expensive game of trusting each other too much, trying to each grab a bit more than the next guy, and counterfeiting credit rather than assessing it rationally.

I think our weakest argument is the one saying “this must inevitably collapse”. Surely we all recognize that imperfect goods can dominate their market even once their inefficiencies are exposed – there is an OS called Windows still dominant after 20 years of admitted imperfections. There are fewer examples of the triumph of Ideals – winning is not inevitable!

Both politically and logically “gold” should not be the center of our arguments; the center should be humans, their needs, the economies that arise to meet those needs, the natural possibilities of trust between humans, and the equitable laws and property rights that make a society safe for cooperation. Viewed from that perspective, a monopoly grant of unlimited credit is simply unimaginable – it too-readily deflates the value of hard-won credit that actually makes real goods flow as needed. Gold has its natural place and will find it regardless of our puny efforts. In and of itself, gold is not the goal.

Our “fiat” opponents commandeered the social ground previously given to gold. But being a mere <1% elite they simply cannot behave "as good as gold". The argument behind "gold bills"

and the commercial and banking laws that attend them is that a far larger contingent of free humans democratizes (or at least diversifies) the use of credit, and prevents it from forming synchronized waves of bad market signals. For this latter Ideal to re-emerge, we need to both A) argue against its legal impediments, and B) work to create the terms and mechanisms that can out-compete the oligarchs and cause their counterfeiting to betray them, if indeed our Ideal is true.

Late but germane comment about this. The “rich” have doing what they usually do, that is take advantage of the money making trade, stocks. Looks to me to have been the correct one as opposed to say owning gold. Stocks out performed gold by a fair bit in conserving purchasing power. Which should be the goal? The “rich” seem to be in the know. Why, how? Not being in the”club” it is not for me to say. All of the arguments about owning gold make sense to me. The argument not put forth by gold holders is that gold standards have historically been jiggered, bastardized, etc. ad infinitem by the same people.

Owning political favors seems to be the true road to wealth, sadly, rectitude of the arguments pro gold standard notwithstanding. The gold standard will probably be the way to go just as soon as we figure out how to get honest politicians.