Something for Nothing, Report 20 May 2018

Money has a dual function. Please allow us to go deeper, and more philosophical than we typically do. We promise to tie this into our ongoing discussion of capital consumption. In the following, we will discuss some examples that use the dollar. We are not conceding that the dollar is money (i.e. the most marketable good, or the extinguisher of debt). We just need some simple cases to consider the medium of exchange. Today, that medium is obviously not gold but the dollar.

Money’s first function is flows. People experience this as income. If you work for an hour as a plumber, you might earn $25. If you work for an hour as a lawyer, you might earn $250. If you set up and operate a successful restaurant, you might earn $500,000 in a year. Every job, every profession, and every business earns a certain amount. The market value of everything is finite. These values are set by other market participants, who bid what they are willing to pay for what you do.

Money as Exchange Medium

The dollar is the general medium of exchange. This is how you take what your employer pays you, to buy something from a third party.

At any given moment in time, the market value of everything is fixed. You can take your wage or your profits to any other market participant, and buy whatever he produces. For example, the plumber might exchange an hour of his labor for a meal at the restaurant. Or he could exchange a day of his labor for an hour consultation with that lawyer.

We can abstract away the dollar, and see that there is a finite ratio of exchange of any good or service for any other. A plumbing repair is worth one restaurant meal, or one tenth as much as legal advice.

Of course, everyone wants to get paid more for what he does. Equally of course, everyone wants to pay less for what others do. The plumber would love to be paid $250, pay $2.50 for dinner and pay his lawyer $25. Yet, the market is an efficient mechanism to sort out what they will be paid, and what they will pay. At this moment, the plumber gets $25 but the lawyer is worth $250.

By the way, this is why pure wage earners don’t care that much about what we call inflation. Does the plumber care if he makes 25 cents, so long as dinner is 25 cents and a lawyer is 2 bucks and fifty cents? Or if he makes $25,000 an hour if restaurants charge $25,000 and lawyers bill $250,000 for an hour?

By pure wage-earner, we mean those who spend what they earn (see Savers are Just Collateral Damage for a discussion of why the savings rate has been falling since 1981). They care only about the ratio of exchange. How much can they buy with their wage?

We said the market is an efficient mechanism for sorting out relative exchange rates, or ratios between plumbers, meals, and legal advice (and everything else). There are many plumbers, cooks, and lawyers. Anyone is free to set his offer price, but no one has the power to set the bid price on anything he sells (or the offer price on anything he buys). The bid price on your labor emerges from the market (specifically, from the competition between all who offer the same labor).

The market being efficient means there is little opportunity to cheat, to obtain more goods and services from others than they want to pay for your product (other than go to the government). To express this in terms of a popular expression, the purchasing power of your labor does not go up arbitrarily. The only thing that can raise it is efficiency gains by producers of other goods. In other words, increased capital invested in production.

Money as Savings

However, money has a second function. Consider that money (i.e. gold) has the highest stocks to flows of any commodity. The dollar also has very high stocks to flows. So it should not be a surprise that its second function is stocks. People experience this function as savings.

Incidentally, savers (those who are able to save in this wacky falling-rates world) have a high ratio of savings to income. For an interesting example, Monetary Metals offer certain investments only to accredited investors. They qualify either by having net worth over $1,000,000 or income over $200,000. The vast majority of investors qualify by net worth.

Drilling down into savings, we see it is not as simple to analyze as income. Some savings is just deferred spending. An example of this is a plumber who lives in a cold climate. Construction is limited to the warmer months, and the rest of the year is lean times. Most of his income comes during half of the year, but he must make it last for the whole year.

Spending can be deferred for longer periods. Homeowners must plan for replacing the roof. If a roof is expected to last 20 years, and a new one costs $10,000, then the homeowner should set aside $500 every year (if he could earn interest, then the set-aside would be smaller). Like with the seasonal labor market for plumbers, this is simply deferred spending on a predictable expense.

However, some saving is not for spending. People set aside part of their wages, and in so doing, convert income to capital. For example, consider a farmer who takes a year’s profits from his 100-acre farm, and acquires another 10-acre piece of land. He removes the rocks, and levels it, both at additional expense. Now the land is a field that can grow crops every year, forever.

For purposes of this discussion, we make no distinction between buying a business, buying a tool, or keeping a money balance (ideally lent to earn interest, but not necessarily). Savings, in this context, is a capital asset. Capital is not normally for spending—one may be forced to liquidate even the family farm in case of an emergency. But the normal case is to keep the business, and operate it to earn income.

The same concept applies, even in small scale. A plumber could save a week’s worth of wages, and buy a power pipe-rooter tool. When he gets a job to clear a clogged sewer, such a tool might enable him to earn $50 for the hour instead of his previous $25.

No one would expect the (used) pipe-cleaning tool to go up from one plumber-week’s wages to two, and then to double to four, etc. However, most people expect that farm field to go up, from 10 years’ profits to 20 years’ worth, and then to 40, etc. (Keith gave a talk about this at AIER, called Yield Purchasing Power). This is a perverse outcome due to perverse incentives imposed by central banks doing monetary policy to us.

The topic today is not perverse incentives, but the dual role of money. So we will focus on when money is a capital asset, as opposed to farm acreage or tools of the plumbing trade.

Money’s Purchasing Power

We must address a key principal before we proceed. The value of money cannot be measured in terms of consumer goods Consumer goods do not have a stable value, and averaging a basket of them does not fix the problem. Many nonmonetary forces can push them up: regulation, labor law, litigation, compliance, zoning, taxes, environmental law, etc. And some nonmonetary forces can push them down: efficiency gains, greater capital investment, economies of scale, etc.

There are (at least) three ways that consumer prices can drop, and hence the purchasing power of the money rises. One, as we just described, nonmonetary forces can push consumer prices down. Two, as we have written extensively elsewhere, the falling interest lures producers to go deeper into debt, while it pushes down gross margins. This puts producers in the difficult position of having to produce more and more goods, which they dump on the softer and softer bid price, to generate the cash to pay the interest expense.

We are not addressing these two cases today, because they are not examples of the problem we are presenting. The third way that purchasing power can rise is if demand for money rises. Speaking now of gold, and not of the dollar, this could come about if people generally begin expecting a shift in the monetary order, i.e. a shift towards precious metals. In that case, people will buy gold and drive its price way up. Assuming the price of food is not rising, this will increase the purchasing power of gold.

Let’s tie this in to the first part of our discussion, above. We described a farmer who put savings into farm land and a plumber who put savings into sewer-cleaning tool. We raised the issue that capital assets are not intended to be exchanged for consumer goods. To do so is to liquidate, and consume one’s capital.

What’s true for level farm fields and rusty pipe snakes is also true for money. If one does not intend to consume it, what good is it if the price of the capital asset rises? The bad is that it makes it harder for younger people to buy capital assets. Whereas if one does consume, then rising prices are the perfect perverse incentive. John Maynard Keynes wanted to stimulate consumption. What better way than a rising price of capital goods—including in this case money?

Those who consume their capital do not see Keynes’ subtle plan to “euthanize the renter” (i.e. kill the saver) via pushing down interest rates to zero. They see only the flip side: asset prices rising to infinity. Everyone cheers a bull market.

We began by discussing how the market sets the exchange rate between your labor and the things you want to buy. Naturally, everyone wants the exchange rate to tilt in their favor. But the market does not oblige. This brings us now full circle.

Nothing for Something

Speculation—betting on a rising price—would seem to offer a way around this iron law of markets. It tantalizingly promises to allow the plumber to work 5 hours, set aside his wages, wait a bit, and then spend the money to buy an hour legal consultation. That legal work would have cost him 10 hours of his plumbing work. But by exchanging 5 hours of plumbing work for gold, and waiting for the purchasing power of gold to double, he gets the legal work he needs for only 5 hours of his own work. A good deal, eh?

While the plumber may think so (if he ignores the drop in his own wage!), we don’t agree. In order for someone to get something for nothing, someone else must get nothing for something. Speculation converts someone else’s capital to the plumber’s income.

This is the heart of the argument for stable interest rates, and hence the gold standard. While prices will always change, including the prices of capital assets, the most pernicious changes are due to unstable interest rates. Unstable interest is inherent to any irredeemable currency.

We, of course, believe that the price of gold in dollar terms will skyrocket (and today is not that day). Keith has published the seminal paper on When Gold Backwardation Becomes Permanent. This thesis calls for skyrocketing consumer prices in dollar terms, and falling prices in gold terms. On the surface, it may appear to be a great opportunity for gold speculators.

Cheering for Disaster

However, be careful what you wish for. The price of gasoline may fall massively, and the Ferrari into which to put the fuel also. However, we would not use the word “opportunity” to describe a general collapse of civilization. Today in Venezuela, you would not dare drive a Ferrari—the hungry mobs would kill you for it. We are nowhere near this scenario in America yet. Then again, we are nowhere near permanent backwardation of gold either.

We who own gold should be always be aware of the full context. More effort should go into averting this disaster, than to planning how to spend gold savings when its purchasing power rises.

Let’s put this another way. When the Fed deprives us of yield on investments, we are forced to seek speculations. Blame for this is on the Fed, not on the speculators. We understand that people will trade gold, if they can. But please, please, do not cheer for disaster.

We have seen the headlines scream “Nuclear war with North Korea would be good for gold.” When you see a headline like that, please keep in mind that along with the rising price of gold will be a rising death toll and likely privation such as most Americans alive today have never experienced. This is not something to cheer for. Even if the price of gold shoots up to $10,000.

The same (and worse) is true for permanent backwardation and a gold price that may be multiples of that figure. Besides, in that scenario you may be obliged to spend your gold on unanticipated expenses—such as bribes and protection.

The only way to avert this disaster is to bring back the gold interest rate, and for people to earn interest on their gold.

Supply and Demand Fundamentals

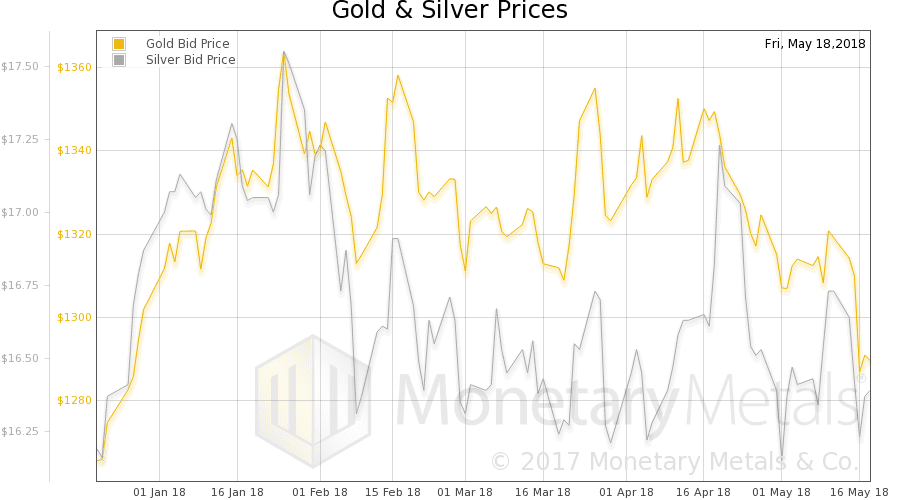

There was no rise in the purchasing power of gold this week. The price of gold fell $22, and that of silver $0.19.

One question that comes up is why is the fundamental price so far above the market price? Starting in January, the fundamental price began to move up sharply, and the move sustained through the end of April. The market price moved up $52 through January 25, but it did not move further. After the market price peaked, the fundamental price moved up an additional $168.

Why?

It would be facile to say the cobasis moved up. Yes, the near contract cobasis rose from -1.87% to -1.61% (though the gold basis continuous did not). So what’s going on?

Consider the gold lease rate. We calculate this in the traditional way, except we use the futures market which is transparent, as opposed to the forward market. The gold lease rate GLR = LIBOR – GOFO. This is how dollar-based financial institutions such as bullion banks look at it (not to be confused with the rate on Monetary Metals direct leasing of metal).

This calculation determines the hypothetical “zero arbitrage” point, where the marginal arbitrageur is willing to earn nothing to borrow dollars at LIBOR, buy gold, selling it forward, and lease it for the duration. The absolute level of the lease rate is not important to this discussion. What matters is the change.

From Jan 25 to April 26, the 6-month gold lease rate more than doubled, from 0.25% to 0.56%. A rising lease rate indicates a rising scarcity of the metal. It should intuitively make sense. But let’s drill down into the specifics of what is called “gold leasing”.

It is an unnatural process, an artifact of declaring money (gold) to be a commodity, while forcing non-money (the dollar) to be used as if it were money. In a free market, there would be no leasing market in money. It would be an interest rate market, aka the gold bond market.

But there isn’t a free market in money and credit. There is an imposed regime of the dollar. So to lease gold, a bank begins by borrowing dollars to buy gold to lease out. However, this creates a risk. What happens if the price of gold drops? So the bank must hedge. It sells a futures contract.

We note that the would-be gold lessor has an expense, namely LIBOR (and likely a spread above this benchmark). And it has a variable, which may be either revenue or expense, depending on market conditions. That is, the spread between future and spot. GOFO is a close cousin of the basis.

Leasing is a gold carry trade plus a credit transaction. The carry trade makes more as the spread between spot and futures rises. It makes less, as the cost of borrowing goes up. The lease rate is calculated to so these net to zero (LIBOR – GOFO – GLR = 0).

So why does a rising lease rate indicate rising scarcity? We first note something that is true in all markets. A high price discourages utilization. Without knowing why, we know if the price is rising then the good is less available and a smaller quantity will be purchased.

In the case of gold, the elephant in the room is rising LIBOR. 6-month LIBOR began the year at 1.84%. However, by April 26, it had jumped up to 2.52%. However, there was no corresponding leap in GOFO.

The cost of carry increased, but the revenue of carry did not. This is a picture of robust demand for the physical metal, relative to demand for futures. And you can see it in the open interest in gold futures, which peaked in late January and hit a low on May 9.

Here is the chart of the prices of gold and silver.

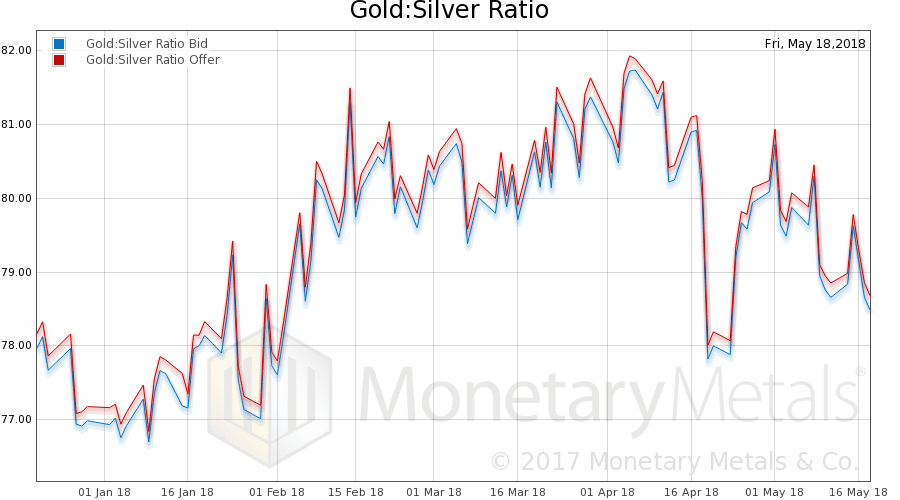

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It fell a bit this week.

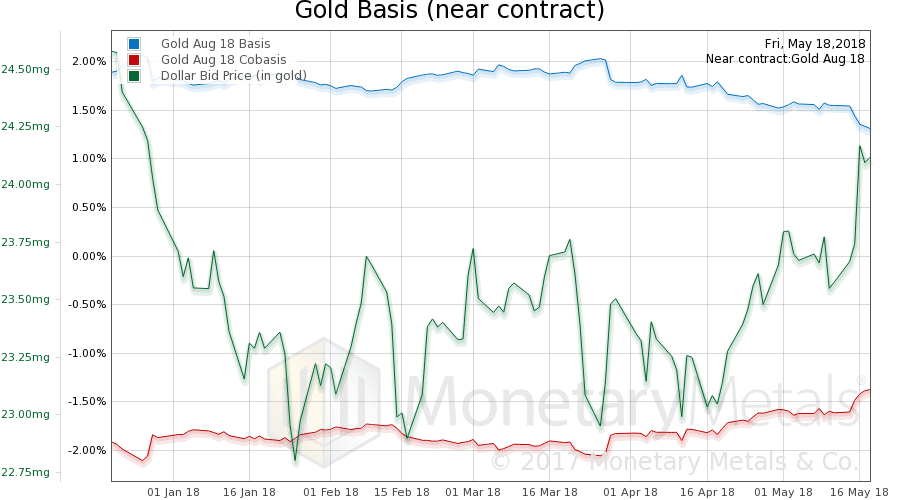

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

The August cobasis rose a bit this week, though not commensurately with the falling price. The gold continuous cobasis did not.

The Monetary Metals Gold Fundamental Price fell $71 this week to $1,422. Now let’s look at silver.

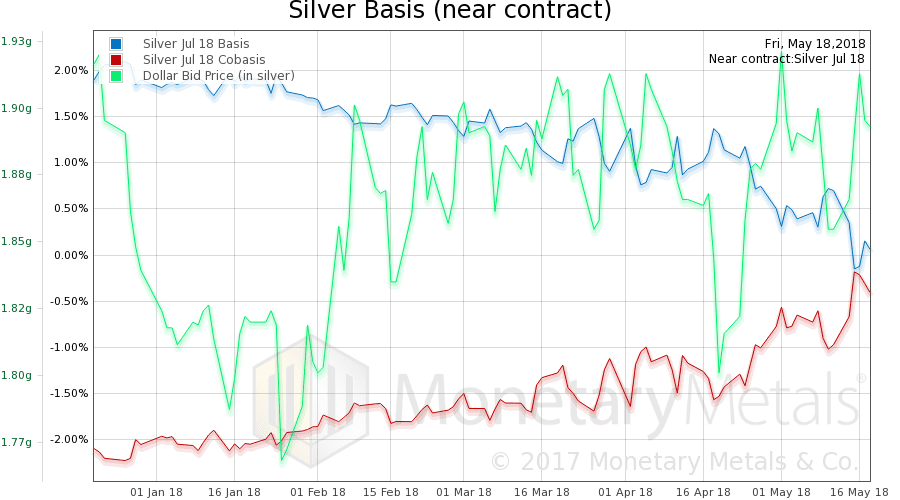

The price of silver fell less in proportion. And the near silver cobasis rose more (and silver continuous basis rose tolo).

So opposite of gold, the Monetary Metals Silver Fundamental Price rose 32 cents to $17.92.

This brings the Monetary Metals Gold:Silver Ratio Fundamental down from around 84 to 79.

© 2018 Monetary Metals

Keith,

Thanks again for your work. Here is an acrostic memory device I give my students. Your perspective on monetary metals and capital is unique and conceptually sound. No other treatment comes close.

A positive value of basis:

a

B a s i s

u

d

a

n

c

e

…….shows abundance.

A positive value of cobasis:

s

C o b a s i s

a

r

c

i

t

y

……shows scarcity.

Have a good day.

Gold fundamental down a whopping $71. No surprise at all. Exactly as discussed last week.

Once again… crickets. Crickets because my ongoing premise doesn’t gel with the notion that a psychological component can weasel its way into the model. Let me be clear: WHEREVER there is a market — in anything! — there is a psychological component to that market. Prices can never be divorced from emotion. Markets don’t have opinions, people do. And it’s that urgency of people bidding and offering prices “at market” is what causes prices to move.

As i’ve been saying in the business of trading for 36 years:

“Markets make opinions” … if a market advances, lo and behold, you’ll find people suddenly bullish. If a market declines, the opposite occurs. Go back and check for yourself. When were you most bullish or bearish? Naturally it was near a price extreme.

People like to think that they know the fundamentals, and that they therefore determine prices thereafter. Wrong. Strong opinions only come after the market has moved, not before.

I’m done here, folks. Good luck. (If you look at the website stats there’s nobody here anyway)

P.S. Not only is bearishness at a possible extreme (meaning be alert to buying opportunities) notice that silver is outperforming gold, both in term of price but also in terms of Keith’s fundamental… and there you have even more evidence of a turnaround.