Cyprus Targets Its Savers in Bailout Agreement: Part I

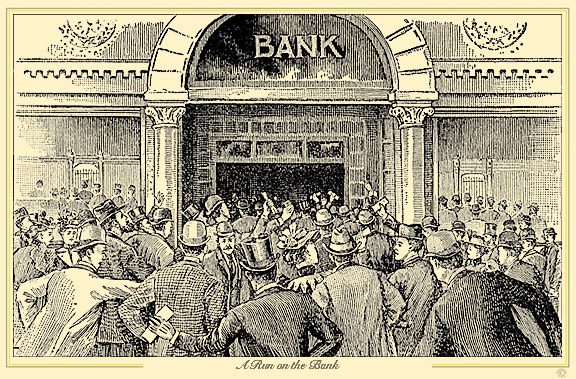

After markets closed on Friday, it was announced that Cyprus worked out a deal with the European Central Bank, European Commission, and the International Monetary Fund (“the Troika”). Here is a typical article reporting on the story. Cyrpus has been in desperate need of a bailout, and was in discussions as early as June last […]