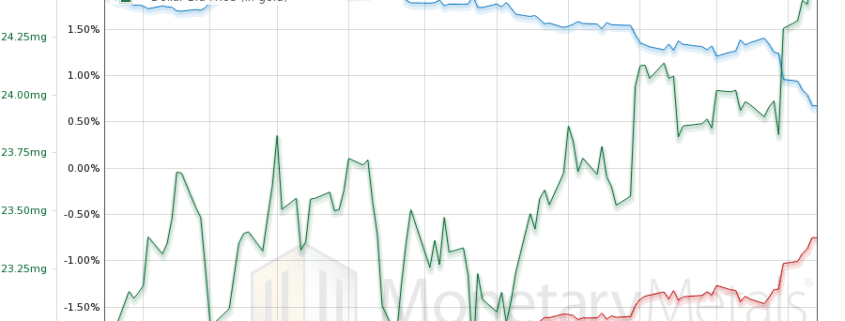

Central Planning Vs. Economics, Report 29 Dec

We have spilled barrels of electronic ink, making the point that central banks are wreaking havoc. They hurt the poor, the middle class, and the rich. They hurt the wage earners, the business owners, the investors (aka the “rentiers”), and the pensioners. They have variously inflicted rising interest rates, too-high rates, falling rates, and too-low […]