Gold-Silver Ratio Reversal Report, 6 Mar, 2016

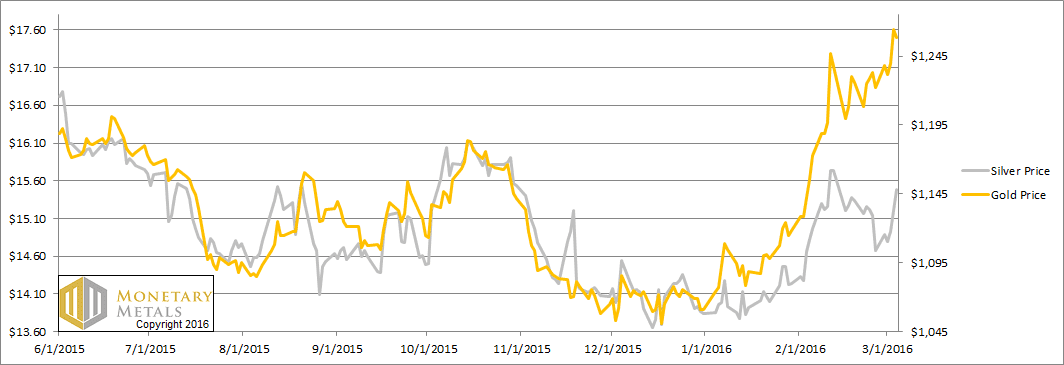

So the price of silver rocketed up 80 cents, while the price of gold jumped $37. Silver is now more expensive than it was two weeks ago; the price decline of last week was more than overcompensated.

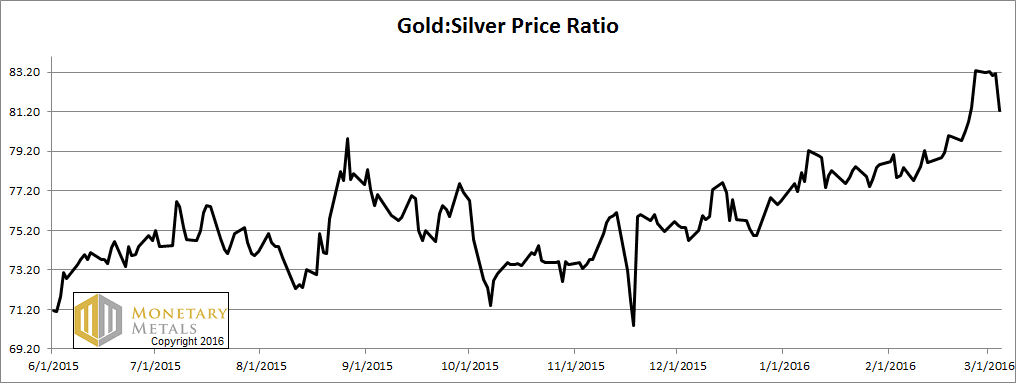

This pushed the gold-silver ratio down about two whole points, with virtually the whole move on Friday.

Last week, we said this:

Monetary Metals has been predicting a ratio well over 80 for a long time. And for two months, we have been calling for it to go much higher still. Could there be a correction? Absolutely. Could the fundamentals change? We expect they will—at some point. We will call that when we see it.

Is this a correction? Or is this the reversal of the fundamentals? Was this price-lifting buying spree stackers, taking delivery of bars and coins? Or was it leveraged speculators placing their bets on paper contracts?

Read on for the only true picture of the gold and silver supply and demand fundamentals…

But first, here’s the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was down.

The Ratio of the Gold Price to the Silver Price

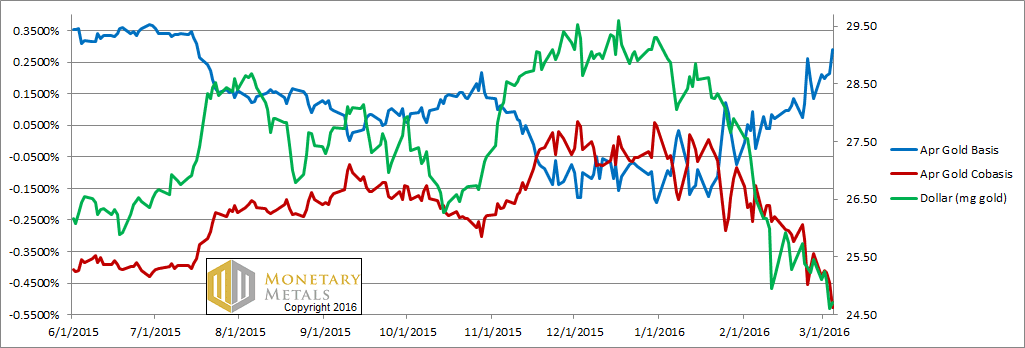

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The picture couldn’t be clearer. The green line is the price of the dollar, measured in gold. It is falling (the inverse of what people think of as gold going up). The red line is the cobasis, our scarcity indicator.

Gold is becoming less scarce as its price is rising.

It’s almost eerie how well the gold scarcity tracks the dollar price, as they both descend. Almost as if there was a connection. Or something. ;)

We have a proprietary algorithm that calculates a fundamental price for each metal. The concept is simple. What if we could back out the price impact of speculators, and see where price would be if supply and demand for metal were balanced?

The answer is $1,431.

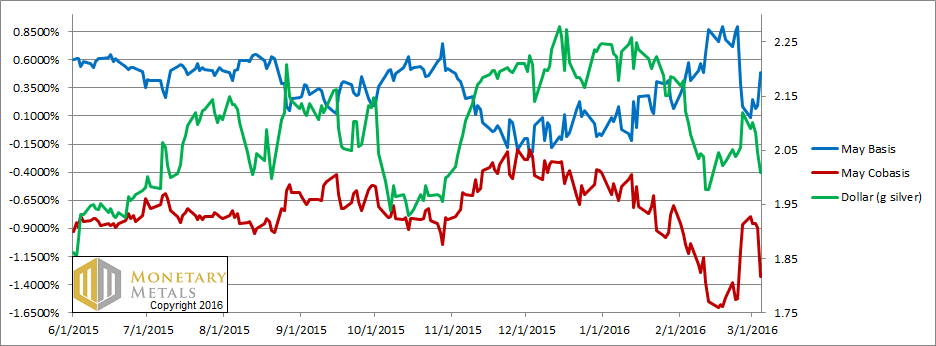

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The same story exists in silver. As its price has risen, it has become less scarce. The difference with silver is the absolute level of the cobasis. It is -133 basis points, compared to -53 in gold.

What if we could calculate what the price would be, if supply of physical metal matched demand?

$14.09.

While speculators are pushing the price of gold down, $170 below its fundamentals, they are pulling silver $1.40 above.

As we said last week, we suspect some of these speculators are precious metals fans, who feel that an 80:1 gold-silver ratio is excessive. It’s just about touched the 2008 high (but nowhere near the level hit in 1991). Is time for the ratio to reverse and move back towards the low set in 2011?

Perhaps a reader can suggest a quote from Firefly or Star Trek or some other science fiction show. The key point that this quote must make is: “don’t bet on it.”

Unless these would-be gold-silver arbitrageurs get lucky, and the silver fundamentals firm up soon, their trade will end in tears.

In the meantime, silver is correcting along with junk bonds, crude oil, and other assets.

Keith will be speaking at Mines and Money in Hong Kong, April 5-7, and Mining Investment Asia April 13-15 in Singapore. Please contact us if you would like to meet up around either conference.

© 2016 Monetary Metals

I got a bad feeling about this.

– Han Solo

Uncertain, the future is.

– Yoda

Mal: Well. Looks can be deceiving.

Jayne: Not as deceiving as a low down dirty… deceiver.

-Firefly

Neo: One way or another, I’m getting on this train.

Trainman: You don’t get it. I built this place. Down here I make the rules. Down here *I* make the threats. (Launches Neo to the wall)

– Matrix Revolutions

Kirk: Khan, you bloodsucker! You’re going to have to do your own dirty work now! Do you hear me? Do you?

Khan: I’ve done far worse than kill you. I’ve hurt you. And I wish to go on hurting you. I shall leave you as you left me, as you left her; marooned for all eternity in the center of a dead planet… buried alive! Buried alive…!

– Star Trek, Wrath of Khan

Love it… great quotes! Thx.

1,5 USD/oz above fundamental ? What a very interesting shorting opportunity !

By the way how sad it is to quote some hollywood turnips in each report…

Keith:

What’s the macro or micro basis for assuming there is any relationship between the price of gold and the price of silver? They operate in totally differdnt worlds and industries.

Given tht much of copperis either silver plated or is connected (electrically) to silver components, I’d be more inclined to suspect a relatively loose correlation between copper and silver.

Gene McManus

Thanks for the GSR update Keith. I have some Au that I have been thinking about trading for Ag. I have not pulled the trigger on that idea for a long time now due to your teachings. Left to my own devices I’m sure I would have done it by the time the GSR hit 70:1 which SEEMED inordinately high to me at the time.

Over the weekend I was fretting that perhaps the fundamentals had suddenly changed drastically & I had missed my chance to make the trade @ 83+:1.

Thanks to this update I now know that I have “nothing to fear but fear itself” :-)

Thanks for your comments, and especially coastalcruiser for some quote ideas.

With due apologies to RD, one or more of those may appear in a future Report. :)

Gene: Gold and silver are hoarded in vast quantities, accumulated over millennia. Their stocks to flows ratio (inventories divided by mine output) is measured in decades. No other commodity has this. In all other commodities, a blip up in inventories is a glut. In other words, gold and silver are money.

Thank you for continuing your weekly notes, essential reading IMO.

My question is: Apparently the Shanghai Gold Exchange is fully operating this year, can you see any changes in the pattern of trading in gold that may be caused by this ?

There’s another reason to prefer physical gold over silver — transaction costs. On a percentage basis, it costs several times to ‘trade’ silver (i.e., purchase and sale of the same item) than it does gold.

Everybody has their favorite silver and gold coins, so do a little exercise and figure out what you’re paying both in and out… and don’t forget that coin premiums don’t always last. All you can really count on is that each coin, whether gold or silver, will be worth intrinsic value.

In fact, with many coin shops and local dealers it’s far more common for silver holders to take a serious haircut when selling. Here in the California Bay Area a friend reported getting only $2.00 under spot when he had to sell some 100oz bars recently. That was from a coin shop.

I had received similar offers long ago myself. (I walked out and didn’t sell) While those are extreme examples it makes the point: silver’s transaction costs are high. Even if you pay $1.00 over spot and get paid spot when selling, on a percentage basis it’s still something to consider.

Gold, on the other hand, is almost always worth spot, or 1 – 2% under spot worse case.

The lesson is simple; if there’s any chance that you might need the money in the next several years, go for the gold. Sure, the market might hurt you some, but at least you won’t get killed by the spread… as you would in silver. At a minimum, if you absolutely must buy silver, stick with 100oz bars or anything with a low premium and/or tight spread to begin with.

… stack on, amigos