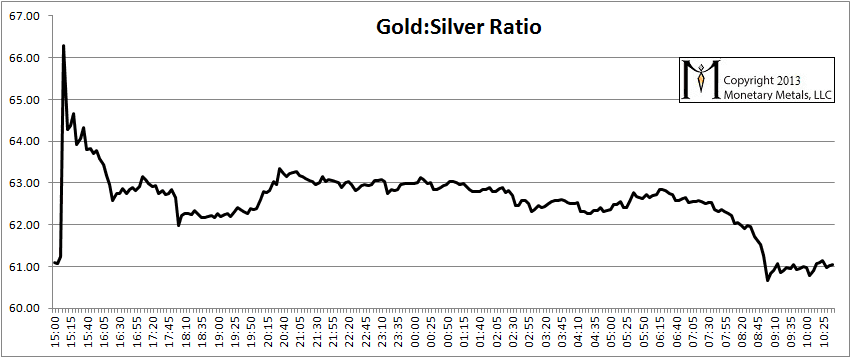

Gold:Silver Ratio spikes over 66!

Yesterday in the Gold Basis Report, we wrote:

“…we reiterate that we are cautious about the price of silver (measured in grams of gold) and think the ratio is more likely to rise than to fall.”

Little did we know. As this 5-minute chart shows, the ratio rose to over 66(!) before coming back down to 61, around Friday’s close.

Is the bear market in silver over? Is it safe to get back into silver again? We shall see, but we don’t think this crash and spike prove much. If anything, it is a negative for silver as volatility is not usually a sign of a bull market.

The Hong Kong futures exchange is shutting down, due to insufficient revenues to the exchange (i.e. trading volume). Because it is settling contracts in cash (what else is it supposed to do?), the spin on the story is that they are defaulting. You guessed it, they haven’t got the gold and silver. We have been saying for a long time that lighter volumes are a sign of liquidity drying up and wider bid-ask spreads. The chairman of the exchange said, “Global commodity demand continues to shift towards Asia as the region undergoes sustained growth…” And yet trading volume has dwindled to the point where it does not cover the expenses to run the exchange.

In a cycle that resembles a manic-depressive’s mood swings, politicians and economists swing back and forth from decrying lending standards that are too lax … to decrying that the stimulus of Zero Interest Rate Policy is not going to the real economy. If the banks are borrowing at near-zero, what are they supposed to do with the money? Buy Treasurys at under 1.9% yield for 10 years? Buy Italian government bonds?

Leave a Reply

Want to join the discussion?Feel free to contribute!