Guest Post: Pater Tenebrarum – US Stock Market – Giddy Bulls Abound

Barron’s Big Money Poll Bullish Consensus Reaches a Record High

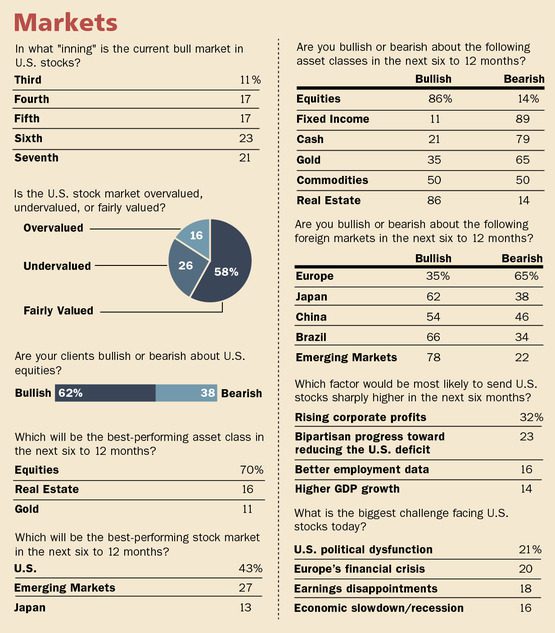

This week’s Barron’s magazine contains the latest Barron’s ‘big money’ poll. Evidently they interviewed a herd – there was once again near unanimity on a number of markets. The bullish consensus on US stocks clocked in at a new all time high for the Barron’s poll with 74% of those surveyed declaring themselves ‘bullish or very bullish on US stocks‘. Only 7% are pessimistic. By contrast, only 45% were bullish in the spring of 1999 and 54% in the fall of 1999. One third of those taking part in the survey expect the DJIA to reach 16,000 points within about one year, 25% think it will go higher than that.

That is just for the US stock market, mind. Apparently there is a separate category asking about ‘stocks in general’, as well as about real estate. This has to be seen to be believed:

“Even so, the managers aren’t just bullish on U.S. stocks, but on equities generally. Some call it the TINA trade, for “there is no alternative” to stocks in a slow-growth, ultra-low interest rate world. Eighty-six percent of poll respondents are bullish on stocks for the next 12 months, and a whopping 94% like what they see for the next five years. Real estate has similar approval ratings.”

(emphasis added)

Nothing can go wrong! Maybe we should type that in all caps, so that it goes better with the “94% that like what they see for the next five years”. An appropriate cartoon accompanied this unabashed show of giddiness.

The ‘big money’ is up to its eyebrows in stocks and giddy like never before …

Not surprisingly, the bearish consensus on treasury bonds was once again the standout of the poll (for the umpteenth time in a row, bonds proved to be the most hated asset class by far) with 89% bearish on bonds and a full 92% declaring bonds ‘overvalued’. Gold bulls can finally breathe a small sigh of relief: In October last year, 69% of money managers declared themselves bullish on gold, but this has now been cut down to just 35%, with 65% bearish and only 11% believing it will be the best performing asset class over the next year. Japan’s stock market has found new converts – in October of last year, only 24% were bullish on Japan, right on the eve of the biggest rally since 2005. Now 62% are bullish on Japan, but only 13% think it will be the ‘best performing market’ over the next six to 12 months.

The details: 86% are bullish on stocks and real estate, only 11% are bullish on treasury bonds. Cash is the second most hated asset, gold is in third place, with 65% bears.

Our conclusion would be that it is probably best hold cash, treasury bonds and gold. Whenever this poll reveals extremes of opinion, it is usually a good time to look the other way.

Read Pater Tenerbrarum’s commentary on U.S. Stock Market Technical Conditions in the second part of the article.

Pater Tenebrarum is an independent analyst and economist/social theorist. He has been involved with financial markets in various capacities for 31 years and currently writes economic and market analyses for independent research organizations and a European hedge fund consultancy. He is also the main author of the blog ‘Acting Man’, which presents articles on the markets and the economy, a mixture of commentary on current events as well as economic theory and history, mainly from the perspective of the Austrian School.

Leave a Reply

Want to join the discussion?Feel free to contribute!