Monetary Metals Supply and Demand Report: May 5, 2013

Sometimes not a lot happens. The dollar fell this week about 0.1g, which means gold “went up” $8. The gold bugs may be feeling somewhat better, but what is the basis saying?

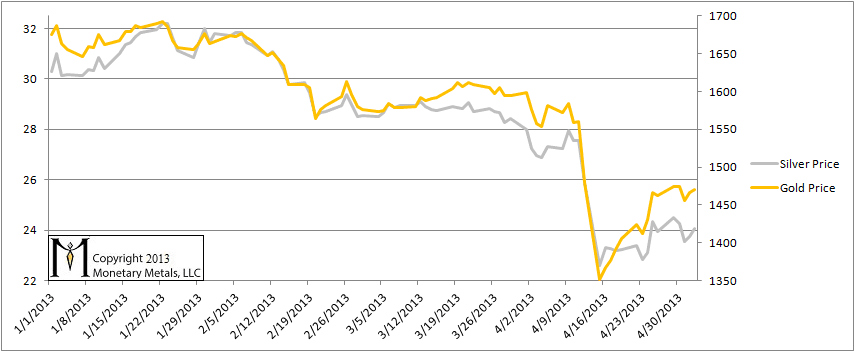

First, here is the graph showing the prices of the metals in dollar terms. As with last week, there was some up and down motion, but overall the prices ended slightly higher.

Gold and Silver Price

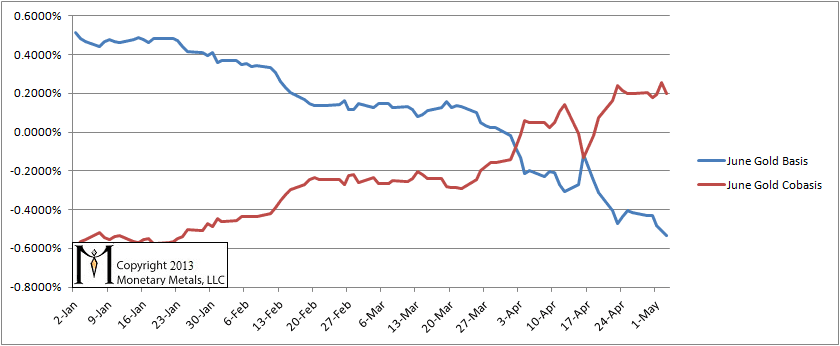

One cannot truly understand the gold market in terms of the quantity of dollars the Fed “prints”, nor by looking at price charts. One must look at the basis (see here for a basic explanation). Week after week, we have been saying that the positive basis, i.e. contango is disappearing (hence the name of this report). This is a process of gold withdrawing its bid on the dollar. One cannot understand this if one lives in the dollar bubble, looking at the gold “price” as if it were comparable to the wheat price or the Mercedes E500 price. What would a falling gold “price” mean? The gold “bull market” is over? And when it rises, does that mean sell to take “profits”?

In this report, we have been tracking the temporary backwardation in both metals.

This week, the gold basis continued to fall but the cobasis moved sideways. A falling basis at this stage of the contract roll is “normal” for the post-2008 new reality. A cobasis that is not rising (the action was the same in farther contracts too, btw) indicates gold is not becoming more scarce in the market. The higher price is discouraging buyers and/or encouraging sellers. Of physical metal.

Never mind what you read about one-ounce coins and other retail products, the cobasis is telling us about the real condition of the market. We will have to watch it closely this week, but as the roll accelerates (naked longs must sell June and buy August), if we do not see a rising cobasis that will be like the dog that did not bark in the night.

Gold Basis and Cobasis

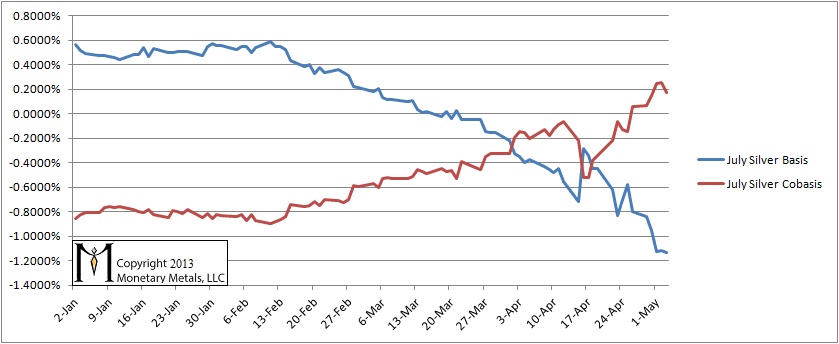

Here is the basis chart for silver. Like gold, the cobasis is reluctant to rise and has even fallen a bit more. Unlike gold, the basis is not looking like it wants to fall. If silver falls out of backwardation, that would definitely not be bullish for its dollar price. We shall have to watch and see.

Silver Basis and Cobasis

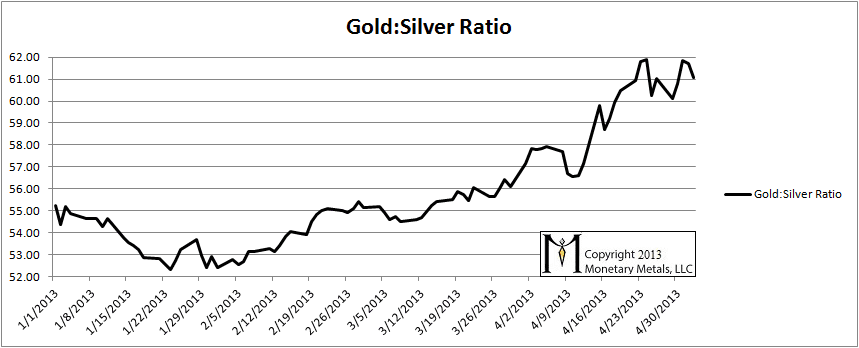

Here is the graph showing the ratio of gold to silver. The ratio moved sideways, with some extreme volatility on Friday (it varied between 60.5 and 62.2!)

We remain cautious on silver, priced in gold. We think the ratio is more likely to rise than to fall.

© 2013 Monetary Metals

Aha!

You say that silver does not look like its basis will fall unlike gold yet you are caution on silver priced in gold. Aren’t these statements contradictory or are you expecting that silver will fall out of backwardation?

Another thing that confuses the hell out of me is that you are tracking the temporary backwardation due to contract rollover. The data to track this is and ‘non temporary backwardation’ is the same right? Wouldn’t it be more appropriate to say that you track backwardation but to explain short term movements with the contract rollover?

Then you say that there is a new post 2008 reality? Was there no temporary backwardation pre 2008 due to contract rollover?

An answer is very much appreciated.

Don’t waste your time reading this useless so-called basis report. It doesn’t mean anything.

I wouldn’t go that far Mr Schmid-h, but certainly I’m sceptical it is the measure it is being claimed to be.

So what do you take out of it?

My guess: nothing!

You guess wrong. An obligation can trade at a discount & gold futures surely will.

My scepticism stems from the simple fact that $ are junk & have been for decades already. That central bank credit trades ‘money good’ is irrational. You cannot rationalise i.e. measure, the irrational. Central bank credit is the South Sea Company, Mississippi bubble, tulips & tech stocks all rolled into one & injected with steroids & then some nitrous.

There are also some who claim, or at least have claimed, that the basis “foretells all”. Which is patently bullshit.

The basis/cobasis is recognized as the most sensitive indicator there is in the gold/silver market and are definitely not useless but worthwhile to read,

> An obligation can trade at a discount & gold futures surely will.

Good luck!