Monetary Metals Supply and Demand Report: 2 Mar, 2014

The gold price didn’t move much this week, but the silver price dropped 68 cents. The fundamentals of supply and demand show something clearly that price charts cannot. Read on…

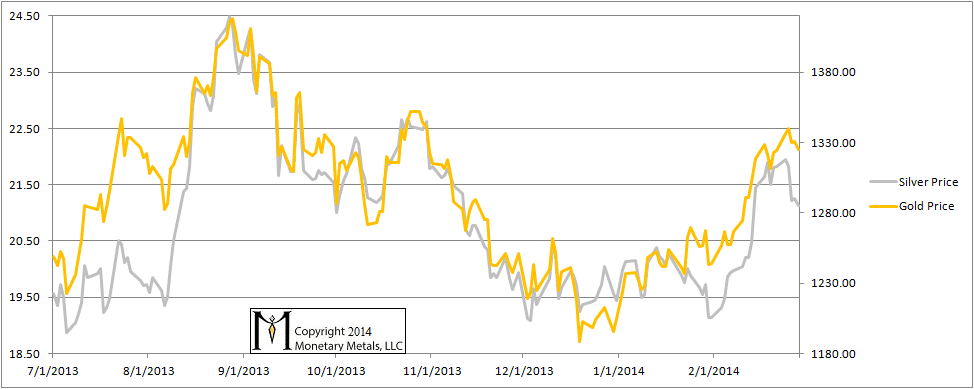

Here is the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

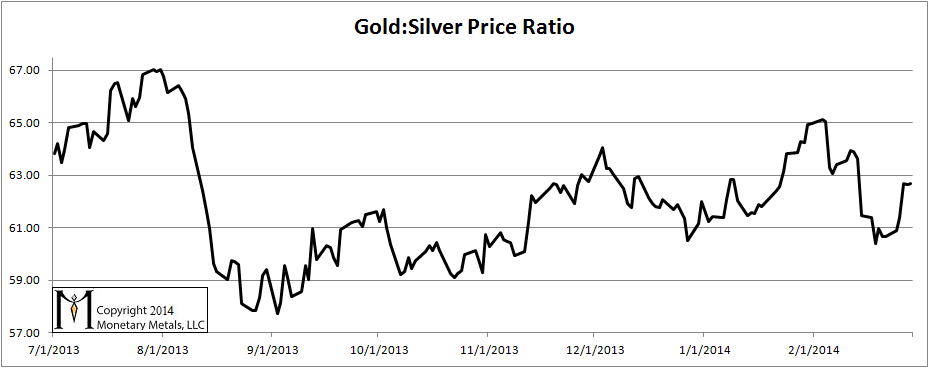

Here is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio rose 2 points—3.3%.

The Ratio of the Gold Price to the Silver Price

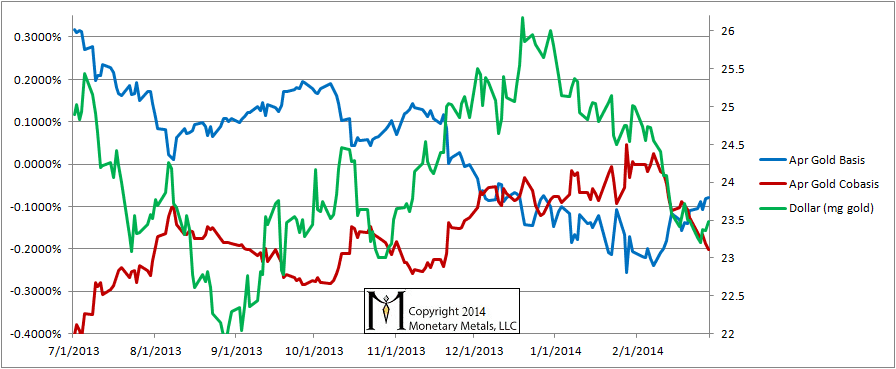

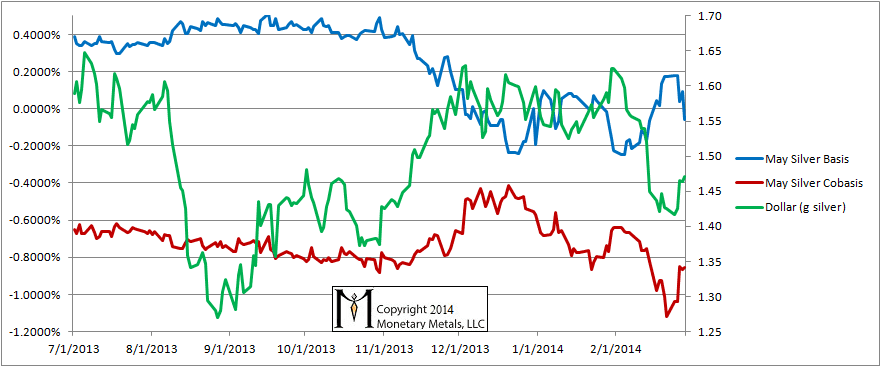

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The basis rose and cobasis fell. Gold is a bit less scarce to the market today, compared to last week while its price is unchanged. This bears watching. If gold continues to become more abundant and especially if this occurs with a flat (or falling) price, then the price could easily drop again.

At the moment, the fundaments in gold suggest a higher price.

Now let’s look at silver. We have switched from the March to the May contract.

The Silver Basis and Cobasis and the Dollar Price

Silver’s pattern hasn’t really changed. We see a rise in the dollar price as measured in silver (i.e. a drop in the silver price as measured in dollars). And with this price move, we see the cobasis rise a bit. Silver futures sold off late this week.

The cobasis, it should be noted, is still quite negative. More silver price dropping is likely ahead, in dollar terms. And it is all but certain to drop in gold terms; the gold:silver ratio is heading higher.

© 2014 Monetary Metals

Hi Keith, I don’t quite understand this:

“One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.”

Are you saying that your indicators are telling you whether sellers of gold are putting their proceeds into some sort of carry trade? I do not see how the basis and the co-basis could conceivably tell us where proceeds are being invested, either geographically, or indeed in terms of any particular asset class. Interpreted this way, the statement above makes no sense.

Gold, as such, when sold in the physical market, changes hands, that’s all. As you say, it does not go into, or out of anything. So, the statement above must refer to the money that sellers get for their gold, and, again, I cannot see how your indicators could conceivably say anything about where sellers of gold are investing their money.

But maybe you have some other explanation for making sense of the above?

cbarton: thanks for your comment.

No, I mean if someone buys a gold future then the seller of that future buys gold in the spot market, and carries it. So gold goes into the warehouse. Gold goes into a carry trade.

Is it always the case that a seller of a gold future always has to buy spot gold immediately? Can he wait until a more favorable spot price? I.e. he is selling “paper” for now?

Derek, that is a very good question. The obvious answer would be, NO, they do not have to. Indeed, many claim that this is exactly how metals prices are manipulated downwards, large players naked selling paper gold and staying net short for extended periods of time.

I personally do not know if this is the case, but prominent and apparently credible manipulation theorists claim that the ratio of paper claims to physical gold is, at best, 100 – 1, and that when the legendary hits the fan, many who now believe to own gold, will be left holding little more than (not so worthy) paper. Only time will tell, but my understanding is that Keith does not give much credence to these claims and theories.

I will give this to Keith, however, that when a crisis point is reached, when people with gold will refuse en masse to bid on paper, gold will have gone into permanent backwardation. What is unclear is the critical part: WHAT HAPPENS NEXT?

This, in turn, is anybody’s guess. My hunch is that the powers that be will declare gold ownership illegal and will try to force the populace to surrender it, probably at some seemingly attractive profit, or face penalties. Some suitable combination of carrot and stick will persuade most people into compliance. Keith, I think, considers confiscation of this nature unlikely, but I cannot remember his reasons.

*****************

Keith, you might want to comment on this again? The powers that be will not simply slink away from a failed Ponzi scheme, but will try rescuing it. Can you think of a more likely approach they could take than some sort of coercion?