Monetary Metals Supply and Demand Report: 25 Jan, 2015

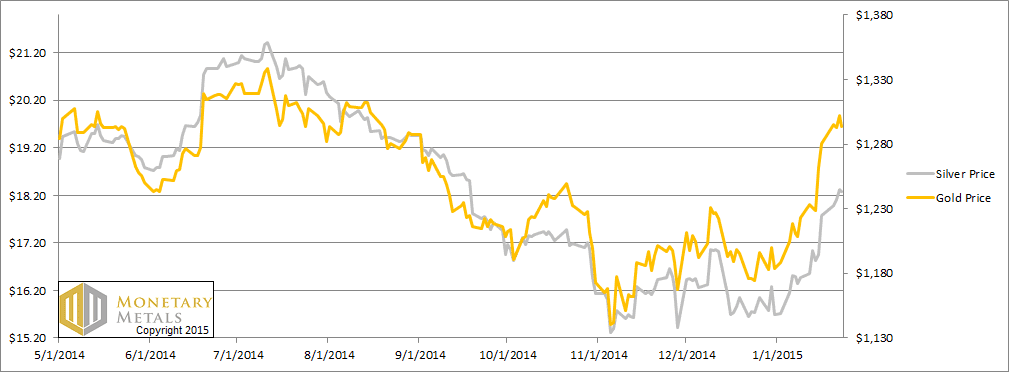

The price of gold jumped a little from Friday to Tuesday (Monday was a holiday in the US) and then went sideways. The price of silver continued to rise through Thursday, up about half a buck. This means that the ratio of gold to silver fell substantially this week.

As everyone knows, a falling ratio means rising prices for both metals. One of these days, we need to treat this topic in its own article. For now, let’s just say that we continue to look at the supply and demand fundamentals, rather than market prices, as our indicator.

For an updated picture of that, read on…

First, here is the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

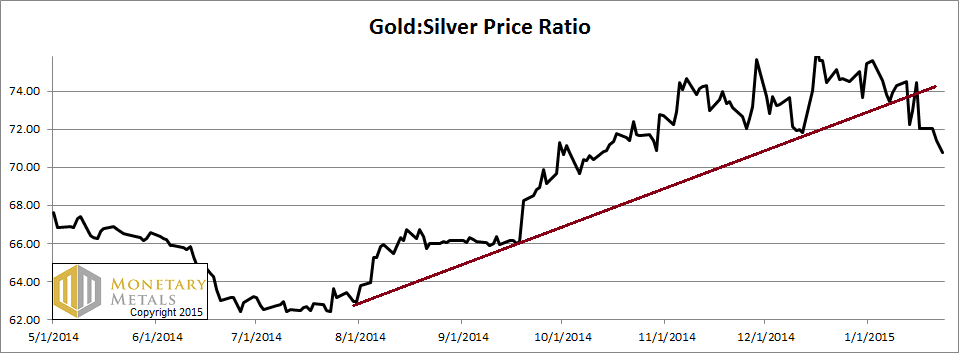

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It moved down quite a bit further.

No question that from a technical standpoint, it’s broken down and by a large margin. This shows sentiment, at least of the marginal price setter, is changing. The question is who is now the marginal price setter?

Keep reading…

The Ratio of the Gold Price to the Silver Price

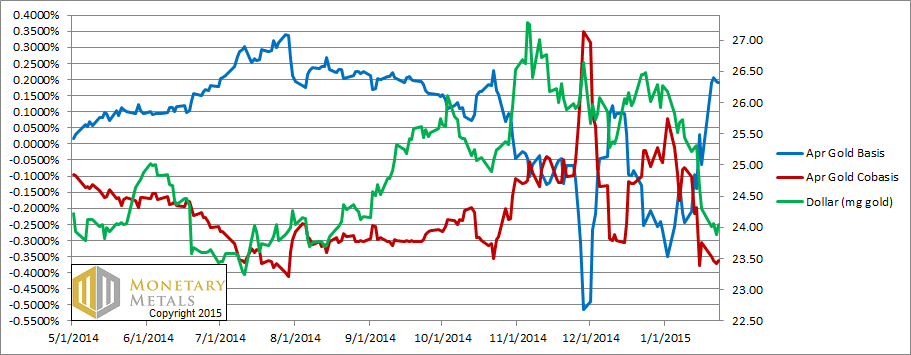

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

As we are rapidly approaching First Notice Day for the February contract, we have switched to showing the April contract.

The gold price is up $14 (i.e. the dollar dropped 20mg), and what do we see? The cobasis hasn’t fallen any further. A sign of firming up, perhaps.

Our fundamental price for gold is $10 over the market price. This does not mean that the market price necessarily has to rise (much less rise tomorrow morning). It’s just a way of putting supply and demand into context, and estimating a likely path for the gold price to take.

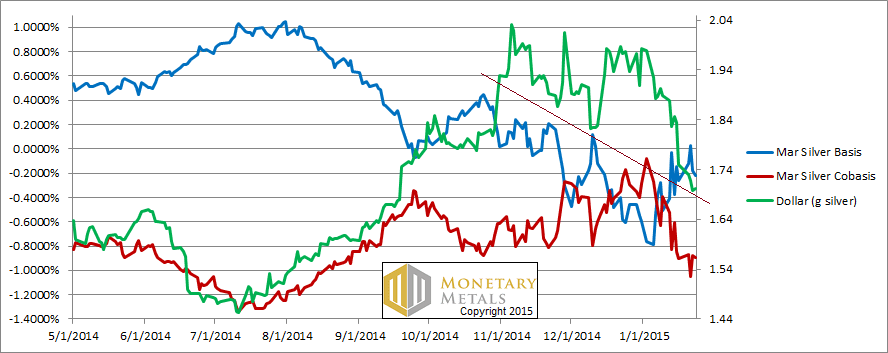

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

Unlike on the ratio chart, we don’t see an obvious place to draw a trend line in the price of the dollar measured in silver (which is just the inverse of the silver price in dollars). We’ve drawn a tentative thin line. By this metric, anyways, the dollar hasn’t broken down (i.e. the silver price hasn’t broken out).

OK, technicals aside, look at the cobasis. Now go back and look at the gold cobasis. Gold is -0.36% and silver is -0.89%. In addition, silver is much closer to First Notice Day and silver tends to have a bigger rise in its cobasis at this approaches.

FRODO: “Gandalf, I wish this low silver price need not have happened in my time.”

GANDALF: “So do I,” said Gandalf, “and so do all who live to see such times. But that is not for them to decide. All we have to decide is what to do with the price that is given us.”

We don’t recommend buying at this price. We reiterate our caution to NEVER NAKED SHORT A MONETARY METAL You have no idea what the central banks may do next (and we suspect some pretty crazy things may be queued up.)

Our calculated fundamental price is a few bucks under the market price. This means that the marginal setter of price is the leveraged futures speculator.

© 2015 Monetary Metals

Keith,

In all the data you are going through do you have any analysis / document that would describe the action of “normal joe” facing evolution of the price of Gold in different countries .

Let’s say to illustrate my question : when price of gold go down then people sell the real stuff in Occident but not the case somewhere else.

Thanks a lot for your help and your great job

Physical buyers/hoarders are just able to put a floor on the gold/silver prices but the price has been done by the western speculators (COMEX especially) for decades. Nothing new here…

Rueffallais: It’s a constantly-evolving dynamic. There are times when the marginal seller is group X and they behave a certain way when the price goes up or down. And then at other times, it changes.

This is the problem with the static stories: “the Chinese/Indians/whomever are buying when the price dips.”

Think marginal seller or marginal buyer. Price is moved by action at the margin. Also, the marginal actor is a role, not a particular person or group. who holds that role changes over time.

This is the basis (pun intended) of the basis theory. :)