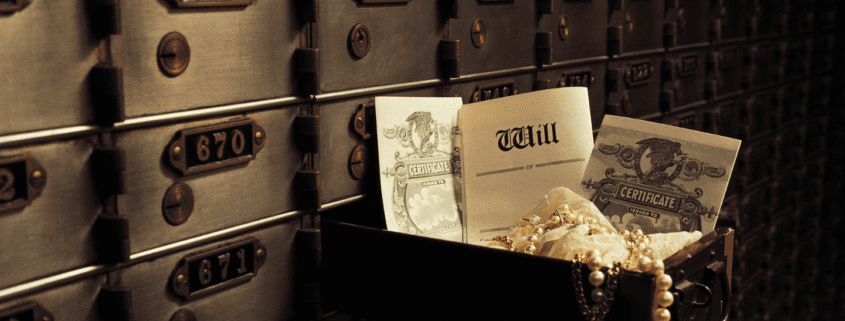

The Risks of Safe Deposit Boxes

In the past, safe deposit boxes at local banks were considered a secure way to store valuable documents, jewelry, cash, and even physical precious metals. However, the changing landscape of commercial banks and recent events have shed light on the potential risks involved. This article will delve into the reasons why safe deposit boxes may no longer be a reliable option for safeguarding your assets and provide alternative solutions for securing your wealth.

Bank Failures and Non-Performing Assets

The recent high-profile bank failures serve as a cautionary tale, highlighting the vulnerability of banks and the potential risks associated with their operations. While many regional and local banks may have a solid financial standing, the current contagion differs from previous situations. Treasury debt, traditionally seen as a secure asset on a bank’s balance sheet, has become a non-performing asset due to interest rates. This means that banks holding such assets could face insolvency, even with seemingly safe investments. In the event of a bank going into FDIC receivership, its branches are closed, and the FDIC can transfer its assets without requiring your consent, which can leave you in a precarious situation.

Low Interest Rates and Wealth Concentration

Another reason to reconsider safe deposit boxes at commercial banks is the significant disparity in interest rates on deposits compared to inflation and money market rates. Many depositors, as reported by The Wall Street Journal, opt to move their funds to one of the Big 4 megabanks, assuming that the US government would likely prevent their failure. Wealthier individuals might even choose to invest in money market funds offered by renowned financial institutions, such as Vanguard, which provide higher interest rates while still enjoying FDIC insurance. In these scenarios, the larger banks become wealthier, while local banks become riskier, potentially endangering the security of your assets.

Lack of Insurance Coverage and Privacy Concerns

Contrary to popular belief, “safe” deposits within locked metal boxes are not insured by the FDIC or the bank itself. Banks often include disclaimers in fine print stating that they are not liable for any losses or damages beyond a certain value, typically around $500. These safe deposit boxes do not fall under the category of “deposit accounts,” and federal laws do not mandate banks to compensate you in the event of any mishap. Furthermore, with the frequent merging and changing ownership of banks, horror stories have emerged about the lack of safety associated with these boxes.

Privacy is another significant concern when it comes to safe deposit boxes. While government agencies generally require a court order to examine the contents, there are exceptions, such as the IRS, which can freeze your access to the box with a simple pre-judgment Notice of Levy. The regulations surrounding safe deposit boxes vary among states, and some even permit estate tax officials to audit the contents before the family is informed. Instances like the FBI raid on safe deposit boxes in a non-bank private vault in Beverly Hills in 2022 further erode the perception of privacy and protection.

Phasing Out of Safe Deposit Boxes

Lastly, banks are increasingly moving away from offering safe deposit boxes due to various reasons. These boxes require physical space and administrative efforts, while providing minimal profitability to banks. As home security systems improve, many banks are notifying their customers to close their safe deposit boxes, indicating a potential future where this option may no longer be available.

Alternative Solutions to Safe Deposit Boxes

Given the risks and uncertainties surrounding safe deposit boxes at commercial banks, it is crucial to explore alternative methods for securing your assets. Consider the following options:

- Private Vaults: For storing physical precious metals, such as gold and silver, private vaults offer enhanced security and privacy compared to commercial bank branches. These facilities specialize in safeguarding valuable assets and provide customized storage solutions.

- Home Safes: If you feel comfortable storing a portion of your wealth at home, investing in a secure home safe can offer convenient access and added peace of mind. Ensure you choose a high-quality safe that meets your specific security requirements.

- Physical Cash Reserves: In an era of potential bank failures and shutdowns, it is prudent to keep a few thousand dollars in physical cash at home. This ensures you have immediate access to liquid funds during unforeseen circumstances.

- Precious Metals Leasing: If you want to own physical precious metals and earn a return on them without exposure to the banking system, you might consider gold and silver leases through Monetary Metals. Gold and silver leases offer you the ability to earn interest on your metal, paid in more ounces of gold and silver, instead of having to pay storage fees. Click here to learn more about how Monetary Metals True Gold Leases work and if they’re a fit for you.

Conclusion

The landscape of commercial banks and the risks associated with safe deposit boxes have evolved significantly. Considering the limitations, lack of insurance coverage, privacy concerns, and the phasing out of this service by banks, it is advisable to reevaluate the security measures for your assets. Exploring alternative options, such as private vaults, home safes, and maintaining physical cash reserves, can help mitigate potential risks and provide greater peace of mind. Don’t let the changing times catch you off guard – take proactive steps to safeguard your wealth and financial well-being.

Additional Resources for Earning Interest on Gold

If you’d like to learn more about how to earn interest on gold with Monetary Metals, check out the following resources:

In this paper we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF – GLD, and mining stocks against Monetary Metals’ True Gold Leases.

The Case for Gold Yield in Investment Portfolios

Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold pays a yield? This paper answers those questions using data going back to 1972.

If monday, your bank does not open, you will have no access to your safe deposit boxes.

What is the point of holding coins in it?