Silver Gone Wild Report, 20 Mar, 2016

Early on Monday morning (Arizona time), silver began to rise. From its close on Friday of $15.46, it ran up to $15.82. Then it began to slide, eventually dropping to $15.17 by midmorning on Wednesday. Then…

*BAM*

The Fed said not a lot. It will go on manipulating the rate of interest rate to the same level as it had been previously. This was not what the market was expecting, as many believed the Fed was on the war rate-hiking path. Lower interest means more quantity of money dollars which means more rising prices which means gold and especially silver should go up.

And go up, silver did. At least, if you measure it using muggle money. Silver ran up 44 cents on the Fed announcement. Then consolidated before running up over $16. It finally exhausted itself $16.15.

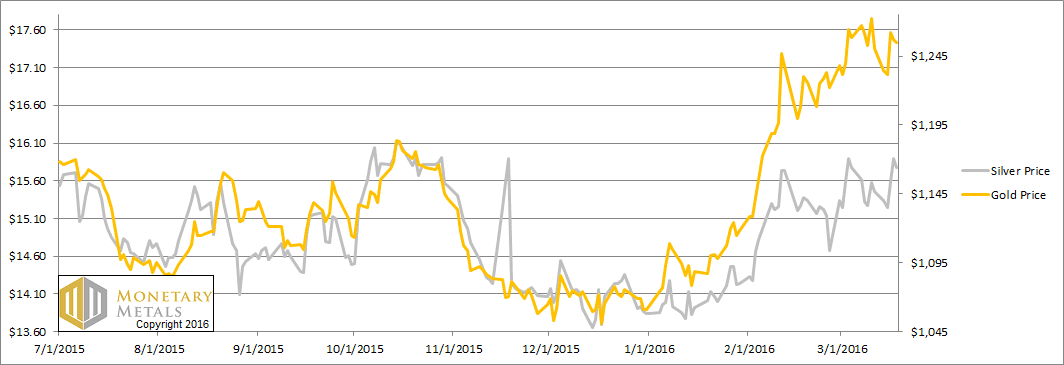

It ended the week at $15.78, about 30 cents higher than it began. As the muggles would reckon it, gold went up $5.

As always, we’re interested not so much in the price chart as the fundamentals of supply and demand. We like to know if a move was just leveraged speculators buying or selling futures, or if it was buyers or sellers of actual metal. The latter can tell us if a move will likely be durable or not.

This is a segue into an interesting question asked by a reader last week. He noted that the speculators are trying to predict the next price move. What if they’re right? Then a speculative move may lead a fundamental move.

That is true enough—if they’re right. The catch is knowing if they’re right, on a case by case basis. We have lost count of the number of times silver speculators have gotten excited and falsely predicted a breakout. There have been many corrections as the price of silver has dropped over the three years that we have been publishing our analysis, and the period before that when we had a private email letter. And when each of those corrections has exhausted itself, the downward price trend continued.

Have we seen the price bottom? We think it’s likely. At least, there is no fundamental reason for silver to go back to a 13 handle. On the other hand, if silver speculators became as depressed about their metal as gold speculators are, then that is exactly what would happen.

On the other, other hand—quick, somebody get me a one-handed economist!—we think it is more likely that bearish gold sentiment will slowly fade than that bearish sentiment will bleed over from gold to silver.

Price bottom aside, is there any reason to expect a skyrocketing silver price? Read on for the only true picture of the gold and silver supply and demand fundamentals (For an introduction and guide to our concepts and theory, click here.)

But first, here’s the graph of the metals’ prices.

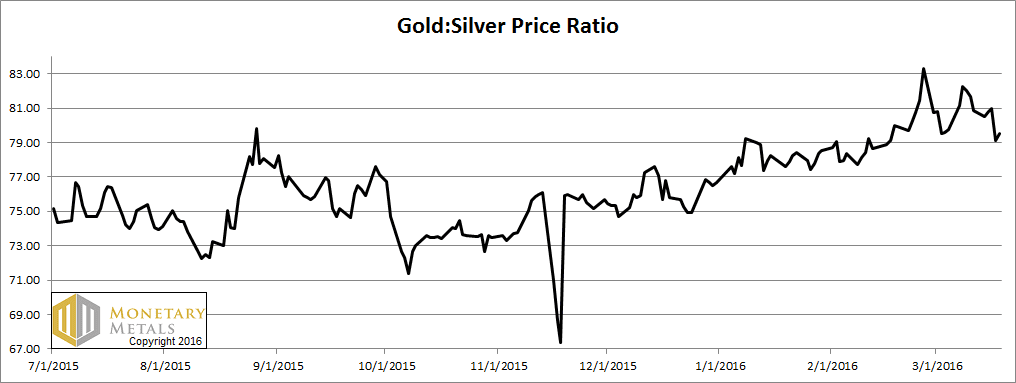

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was down again.

The Ratio of the Gold Price to the Silver Price

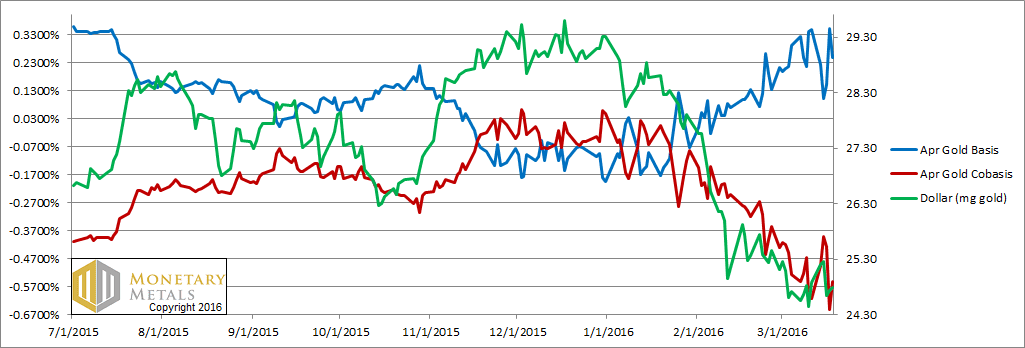

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The green line is the price of the dollar, measured in gold terms (i.e. the inverse of the price of gold). As it falls (i.e. the gold price rises) gold becomes less scarce. The red line is the gold cobasis, our measure of scarcity of the metal. From last week:

Gold is becoming less scarce as its price is rising.

It’s almost eerie how well the gold scarcity tracks the dollar price, as they both descend. Almost as if there was a connection. Or something. ;)

The uncanny tracking of gold scarcity with the price of the dollar continues.

Our calculated fundamental price of gold fell a few bucks again, but it’s still well over $1,400.

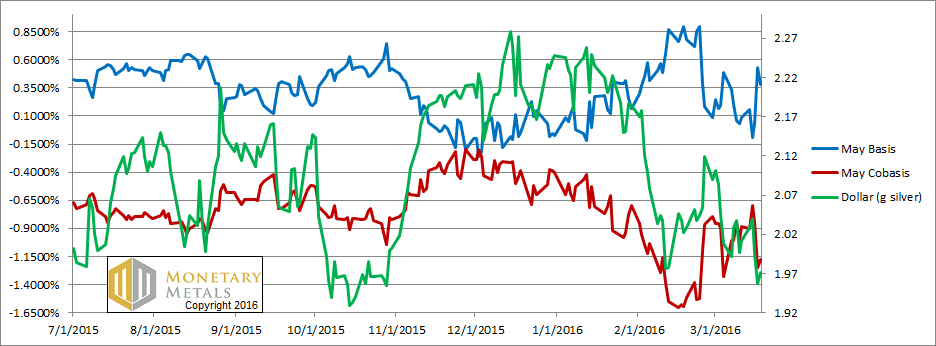

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

Last week, we noted that the silver fundamentals firmed up a bit. That was last week.

This week, scarcity synced back up with the price of the dollar again. Note the big drop in the cobasis, and big rise in the basis. Silver for May delivery is in a nice contango, though the 38 bps you could earn to carry silver is a bit under LIBOR.

The silver fundamental dropped over a nickel this week. It’s more than a buck below the market price.

Will the speculators be right this time? Is silver headed to $20, much less $50? We would not put our money in harms’ way (to borrow a phrase that Kevin O’Leary has used on Shark Tank) to bet on that thesis.

Monetary Metals will be in Hong for Mines and Money, and in Singapore for Mining Investment Asia. If you will be in town for either conference, and would like to meet, please drop us a line.

© 2016 Monetary Metals

Thank you Keith. I continue to enjoy reading your well-written perspectives and ideas.

Have you considered platinum as a precious metal investment? Notice that the dollar price of platinum is reacting to market stimuli much more like a precious metal than an industrial metal, and for good reason I believe. The world is awash with gold and silver, and more awash with yen, dollars, pounds, and euros. But the world in not awash with platinum; in fact it is quite scarce when viewed as a store of value rather than an industrial input. And the dollar price, a discount of $270 compared to gold, may be a genuine bargain in front of our noses.

It is true that platinum may revert to being valued simply for its industrial applications, and, if so, the fundamentals are not cheery. However, perhaps the markets are telling us otherwise, a distinct possibility. If so, we may be early on board for a gratifying move upward.

Disclosure: I own a substantial amount of both physical platinum and platinum futures.

sreed: thank you for your comments.

I don’t consider buying something in hopes of a rising price as an investment at all, but a speculation. By contrast, an investment is something that generates an operating yield.

Another way to look at the world being “awash” in gold and silver is that this is exactly what you should expect of a monetary commodity. There is no such thing as a glut of gold, nor a shortage. Man has been accumulating virtually all of the gold ever mined in human history. The stocks-to-flows ratio–inventories divided by annual production–is measured in decades for gold. Platinum does not have this. Gold is not scarce, and its value as money does not come from scarcity (I realize this statement flies against the conventional wisdom).

If platinum has had a declining contango, that may be a bullish sign and there may be lots of dollars to be made trading it. However, platinum is not like gold and silver–it is not money.

Of note: The relatively small platinum contango (by the way, almost zero for palladium), muted compared to gold and silver, speaks to your theory of relative scarcity and underlying physical demand. My theory is that the persistently muted platinum contango represents some genuine investment demand, rather than mostly speculative demand, or demand as an industrial input. However, truth be told, the COT data does not yet bear out my theory. As always, the market as the ultimate arbiter will render its verdict eventually.

Thanks for your response Keith. In my opinion, governments determine what is money, provided that said governments don’t totally debauch their fiat currencies, e.g. Zimbabwe. Especially given the capital gains taxes on gold and silver.

I believe gold and silver are alternative investments, a hedge against inflation of fiat currencies, a store of value competing with stocks, bonds, real estate, artworks, etc. for investment purposes. During a period of negative real interest rates, preservation of real capital is no small matter. Assuming this belief is correct, I simply view platinum as a superior store of value (a relative bargain) compared to gold and silver, provided that it continues to trade as a precious metal rather than a pure commercial commodity. I also believe, given my above assumptions, that platinum is a risk adjusted bargain compared to stocks, bonds, and other passive investments, at least for a small percentage of one’s portfolio, especially in view of limited supply.

Cheers,

Stew

Hi Stew,

I recommend this article I wrote last year: https://monetary-metals.com/a-salvo-in-the-battle-for-the-gold-standard/

The laws of supply and demand are alive and well. As you correctly intimate, if hoarders including central banks demand more gold than miners and dishoarders / investors are willing to supply at a given price, and speculators remain neutral, then the gold price in reserve currencies will rise, and visa versa.

I agree with you that speculator demand is far far less important than hoarder demand over the intermediate term because the above ground stocks are huge. Store of value / investment perceptions by hoarders will easily drown out speculative noise given adequate time. Consider a scenario whereby ten gigantic new gold discoveries of extremely rich easily mined ore come on stream simultaneously. Annual gold mine production doubles or triples. In that instance, it is likely that the gold price would have declined anticipating the increased supply. Scarcity matters, in dollars, yen, euros, iron ore, and gold and silver, and hopefully in platinum too.

This is why I’m relatively bullish regarding platinum, the scarcity of mine production and especially above ground stocks. Granted, platinum is a less well accepted store of value compared to gold and silver. It’s not a pure play. Yet platinum has a long history as a precious metal with demand driven by somewhat the same perceptions as gold and silver. Recent market action confirms the correlation, which seems to have intensified. The above ground available stocks of platinum are relatively small; stocks of idle currencies are enormous. IF platinum becomes even slightly more perceived as a store of value than it is currently, even though still a “poor relation” to gold in this regard, then supply and demand considerations can easily drive the price substantially higher. Negative real interest rates could be an important driver. And, platinum is priced at an historic discount to gold.

In short, why not hold 10% of one’s portfolio in platinum? If a relatively few hoarders / investors agree with me, then we could see a most substantial rally. In corporate speak, it would take much less demand to move the needle.

Cheers,

Stew

Thanks for your article Keith. I generally agree.

Yet there are flies in the ointment. The government has the means to enforce its definition of money, and is determined to do so. And all taxes must be paid in fiat currency, the “coin of the realm”.

Consider Cuba. Fifty-five years of extreme repression, disregard of human nature, an illogical economy, yet the government is still in firm control. Government can impose its will longer than you can remain alive.

Fiat currency is money. Gold is a store of value, over the long term a better store of value than money. Therefore, gold must compete for investment dollars (or rupees) with all other assets, stocks, bonds, real estate, art, classic cars, platinum, etc. Supply and demand, and the attractiveness of competing investments eventually rules absent a cataclysm such as nuclear war.

In short, we can’t fight city hall. All we can do is try to preserve and enhance our real wealth.

The noble metals have intrigued me as well, mostly as a supply side argument. And there’s little doubt those arguments are compelling.

What is not so compelling — or at least remains uncertain — are the demand side arguments. Consider, for example, what the growing effects of electric, hybrid, and generally more fuel efficient cars might have on the demand for catalytic converters…. which just happens to be the main source of industrial demand for platinum.

Is this concern behind platinum’s persistent $200 discount to gold? Frankly I don’t know. But with gold I don’t worry about such things. Gold is what it is…. and if I am anti-fiat I must be pro gold…. and little else. Even silver is tainted by it’s weight, imo. I am also uncomfortable that so many people try to get rich off silver, although I do own some. (I am also hedged currently by being short futures) By contrast, I never hedge gold holdings.

Back to the nobles. If anything, I’d prefer palladium… especially when it’s less than 50% the price of platinum. (To me, everything is price because it affects your return) But in noble metals that’s especially important because they are all (platinum, palladium, and even rodium) “catalysts” and often act as substitutes when price relationships provide a sufficient advantage. Remember, for example, the huge preference of palladium over platinum after palladium hit $250? The industry changing affects were profound and persist to this day.

It’s worth remembering that palladium is more of a IC engine play (rather than platinum which is used in diesel engines) but, to its credit, palladium also enjoys a myriad of industrial uses like fuel cells and the creation of nitrogen fertilizers.

In summary, you can by gold anytime as a long term store of value (and occasionally as a short term speculation) while I see the noble metals as always an opportunistic speculation highly contingent on price and inter-market relationships.

After all, gold goes back at least 5000 years while platinum was only discovered recently… in 1735. Think of it this way… if you were going to leave a few coins to your kids and grandkids and you wanted to make absolutely certain they would hold their value for two generations (or roughly 100 years) …. what color would those coins be?

Cheers, mate… thanks for posting!

docarooch

Yes, well taken arguments, in the best sense of the word argument, not to be dismissed lightly.

As an industrial commodity, a utilitarian metal, I completely agree that palladium is a better investment than platinum, and incomparably better than gold or silver. No contest. I’ve admitted this in my posts, early and often. Platinum’s industrial fundamentals are not cheery, and much worse for gold and silver. The question revolves around each metal’s attraction / perception as a store of value versus currencies, and other competing investments.

If platinum is simply an industrial input, devoid of a precious metal’s store of value, then I completely agree that owning platinum is a dubious investment choice at best. Palladium, rhodium, osmium, iridium, etc. are fundamentally industrial metals, although palladium may be interesting as an investment, maybe.

But, if platinum becomes a more accepted precious metal store of value, like gold and silver, even if platinum becomes marginally more desirable as a precious metal store of value, then platinum’s supply and demand fundamentals, and low available above ground stocks may prove telling, and once again exceed the price of gold, as historically it has. It won’t require much change in perceptions. The platinum market may be signaling this because its price fluctuations are closely correlated to price fluctuations of gold and silver.

Rarely, very rarely, is an investment decision stacked entirely in your favor, especially so at a knocked down price. Platinum is no exception. As an industrial metal, I would short platinum. As a precious metal store of value, as an alternative to cash, I’m long and strong. You take your changes when you put your money on the table. You take your chances when you don’t too, especially in a NIRP environment.

For the record, a $2.00 advance in silver hardly qualifies for “Gone Wild” in my book. But I know, different books for different people! I’m currently bearish myself (until I run for cover in about 5 minutes) when a more disciplined approach would require waiting for confirmation of a trend change. I just happen to be loaded with so-called cheap silver these days…. when i’m not so sure it can’t drop $5.00 from here. (And who says it can’t do anything it wants?)

By the way, where’s the new Operations guru, Bron Suchecki? Haven’t heard a PEEP from the new guy. Very strange.

I’m working hard out in the back office, operations isn’t the glamour side of the business :) Short tweets are where I’m active at the moment https://twitter.com/bronsuchecki