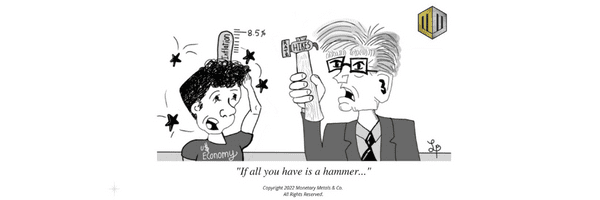

The Fed has a Hammer, and You’re a Nail

Our present moment is precarious. Like it or not—we don’t—we live in the age of Central Banks. And as we witness, and alas participate in, the global drama to create or destroy wealth, there is a great and tragic irony at work. On the one hand the rhetoric we hear from Fed Chairman Jay Powell […]