The Out Has Not Yet Begun to Fall, Market Report 31 March

So, the stock market has dropped. Every government in the world has responded to the coronavirus with drastic, if not unprecedented, violations of the rights of the people. Not to mention, extremely aggressive monetary policy. And, they are about to unleash massive fiscal stimulus as well (for example, the United States government is about to dole out over $2 trillion worth of loot).

The question on everyone’s mind is what will be the consequences?

The standard analysis is that governments will print massive amounts of money. And, this will, of course, cause massive inflation (i.e., skyrocketing consumer prices). There’s just one problem with this analysis.

Reality.

One price to look at is crude oil. Crude oil is now so cheap, you’d have to go back as far as 2002—before the last 18 years of massive money printing—to see the price this low. Many analysts, not to mention chart followers, expect that the price will go even lower.

Copper is within a few cents of breaking down to a low not seen since 2009. And, wheat, while it’s not breaking down to a new low at the moment, is, at best, in a moribund pattern at a relatively low level.

The fact is: governments aren’t printing; they’re borrowing. And, debt does not behave the same way as free gifted money.

So, moving on from this Ptolemaic notion (Ptolemy proposed that the earth was the center of the universe, with the sun and planets orbiting around it), let’s make some observations and then develop our logic and see where it leads.

We mentioned that governments have enacted draconian controls which have curtailed and even shut down major sectors of the economy. For example, in the United States right now, all the restaurants, bars, night clubs, sports arenas, gyms, and many other businesses have been ordered to close. Others, such as the airlines, may not have been ordered to close but are facing what must surely be a 95% drop in revenues. All the stores in the major mall here in Arizona voluntarily closed. Whether due to lack of customers or fear of the virus, it doesn’t matter.

The first-order effect of these closures is felt by many vendors and service providers. This includes wholesale food and beverage distributors, companies that service soft drink fountains and aircrafts, clothing and car manufacturers, etc. Companies that you wouldn’t necessarily even think of, such as Airbnb, have already lost hundreds of millions of dollars.

Monetary Metals has our offices in an Industrious coworking space (Industrious is a competitor of WeWork). As we look at the cleared-out offices of businesses who have already moved out, and the empty offices of most of the other businesses who haven’t cancelled their leases yet, we see the obvious problem that Industrious (and WeWork) are facing a dramatic drop in revenues. The not-so-obvious problem (though it’s been written about by other analysts before) is that the coworking model has an extreme mismatch between asset and liability. They have a long-term mortgage or lease on the space, plus loans on their expensive interior build-outs, but their tenants have short-term leases (such as month-to-month). These companies have not yet been tested in a significant downturn, and the world is about to find out just what will happen.

The obvious move by every restaurant, bar, and retail business is to call their landlords, the mall developers, and tell them, “Your job is to bring people to our front door so we can convert them to customers and pay rent. Right now, no one’s coming to our door, so we have no revenues, and we’re not paying. What are you going to do? Evict us and replace us with somebody who wants to pay rent in this environment?”

The mall developers, in turn, will have no choice but to call up the banks and say, “Sorry, we don’t have any revenues right now, so we can’t pay on our loans right now. What are you going to do? Foreclose and find somebody else who wants to pay you in this environment?”

Who will the banks call?

Before we get to that, consider the millions of workers laid off from all of these afore-mentioned businesses. This week, the unemployment number came out at over 3.3 million new claims. This number is so gargantuan that it makes the worst of 2008 look but a ripple on a pond compared to the wall of water of a tsunami. We expect more big unemployment numbers to come. So far, many companies are choosing to pay their employees at least part of their normal paychecks, as a gesture of goodwill, but they will not be able to continue this for long. These laid off workers will be calling their landlords, their credit card companies, auto, student loan, and home lenders, and telling them the same thing: “we can’t pay.”

If the banks are forced to write down this enormous quantity of loans suddenly gone bad, if their balance sheets are blown full of such large holes, then the banks are surely all insolvent.

Even the behemoth JPMorgan Chase has but $260 billion in equity (much of which is not liquid, let alone cash). That will be insufficient to absorb the losses described above, the way a child’s sandcastle would be insufficient to stop a tsunami.

Speaking of tsunamis, walking in Scottsdale, Keith noticed the street sweepers out on the nearly-empty Scottsdale Road. Our first thought is: this is silly, the streets hardly need sweeping. Next, was hey shouldn’t they be cutting back on expenses. Then finally, they are about to face a total collapse in tax revenues, most of which comes from retail sales tax and property tax.

All cities and municipalities, and likely all states too, will face this massive revenue shortfall. They have few choices. They can cut spending, not likely especially not the pension obligations. They can somehow try to extract more taxes from those businesses and residents who are not impacted by the economic shutdown, not likely. Or they can borrow more. A wall of municipal bonds will soon hit the market.

So now let’s lay out our logic. One, irrevocable damage has already been done. A large number of restaurants, bars, and retailers simply do not have the capital to withstand even a month of zero revenues. JPMorgan found, in 2016, that the median independent restaurant has enough cash to last just 16 days. Soft drink fountain servicers and many other companies up and down many supply chains are in the same position. These businesses are finished. Their debts are defaulted. Their employees are jobless.

Two, as we are not political prognosticators, we will not attempt to predict what further economic controls governments may impose. We simply observe that, if the case existed in mid-March to shut down these sectors of the economy because a virus is spreading through the population, that case will continue to exist for at least several more months (if not a lot longer than that).

Three, the government will no more allow the banking system to collapse than it will allow millions of people to perish of starvation. Therefore, the government will continue to spend whatever it takes to protect people from the consequences of this bust.

Four, this is the bust of the false boom created by the Fed and other central banks after the bust of 2008. True, the draconian response to the virus has catalyzed the bust and, certainly, made it worse. But, the bust was already certain to come because of the colossal destruction of capital (which we have been writing about for many years). Further, this bust comes at a time of massive leverage. A business without debt may be resilient, but a business leveraged up to its eyeballs is brittle.

Five, the problem with paying all of these newly-unemployed people is that it comes from the capital of people in businesses who are still solvent. This is the bare naked essence of socialism: it converts capital to income, which is spent. It consumes the seed corn. And, now, this process will accelerate massively.

Six, this fresh $2 trillion stimulus will be added to already-oversized government spending that, according to the U.S. Treasury, was about $1.5 trillion more than government tax revenues (though, by some accounting gimmick, the official deficit number is quoted much lower than that). So, we will have an annual deficit now approaching $4 trillion, but it gets worse. Tax revenues will fall massively. So, the deficit may turn out to be $5 trillion or more. Back in 2016, when Donald Trump was elected President, we predicted that he would be called “$20 Trillion Trump” for the amount that the debt increased on his watch (assuming an 8-year term). That may have seemed preposterous at the time, but we’re now tracking for that result.

Seven, many industries will be deemed essential, which is, of course, a political distinction. Industries deemed essential will be given whatever subsidies necessary for them to continue to operate in the face of stupefying losses. For example, the people will not countenance shutting down the airline industry. They will demand a solution (a subsidy).

Eight, going back to the banks, they will need massive injections of capital (i.e., subsidies) and/or further alterations to time-honored principles of accounting. Do you remember when, back in spring of 2009, the Financial Accounting Standards Board changed the rule and said banks no longer had to mark their assets to market. That means, if a bank had an asset with a $500,000 market price, it could still keep it on its books as a $1 million asset. Remember that this accounting rule change caused the end of the bear market and brought about the longest bull market in history, which has now recently ended.

In other words, the banks will either need subsidies equal to the value of all the loans that will default in this bust, or they will need the right to publish financial statements that mislead investors into thinking that they have not suffered the losses that they have, in fact, suffered (which would have other consequences).

Nine, one way for the government to subsidize the banks is for the Fed to buy the bad loans from the banks at full price. Perhaps the political calculus might determine it would be easier for the Fed to conceal the defaulted loans in its portfolio than for the commercial banks. However, there’s a risk. If the Fed renders itself insolvent with assets less than liabilities, or, perhaps more importantly, with negative net interest margin, the Fed could enter into a death spiral. This will be when the Fed is borrowing (the Fed doesn’t print, it borrows) not to buy good assets but to finance the negative cash flow.

Ten, another distinct possibility is that the government directly injects equity capital into the banks (i.e., buys a large share holding or even majority of the banks). This is not only a major step forward towards outright government ownership of the corporations and it is also a way to create a zombie banking system. This will be when the banks are managed by the government, perpetually on the edge of insolvency, and hence unable to perform their primary function which is financial intermediation. This is how Japan has had several lost decades so far.

Eleven, speaking of government ownership of the means of production and zombies, the government’s subsidies of industries such as aircraft manufacturers and airline service will provide additional examples of both.

Twelve, we’re now going to make a call, for the first time, for certain consumer prices to rise. This call is absolutely, positively not based on rising quantity of money. It is based on three things. First, as we said in item number one above, many vendors and service providers in many supply chains will be ruined. This will make manufacture and distribution of consumer products less efficient, slower, and more expensive. Second, the government will be ordering, or in many cases outright owning, the means of production. We see this already with President Trump ordering General Motors to manufacture ventilators, a product with which GM certainly has no experience, expertise, or efficiency in producing. It should go without saying that government-directed production is expensive (and, of low quality). Low quality, it should be noted, itself makes things more expensive for everybody. Third, in the new normal that is to come, there will simply be fewer restaurants and fewer stores of every type who remain in business. Lessened competition will enable the survivors to charge higher prices.

There’s a lot more that we could say, but we’ll stop here, as thirteen is an unlucky number. Instead, let’s segue to the gold market and the incredible skyrocketing of the gold basis.

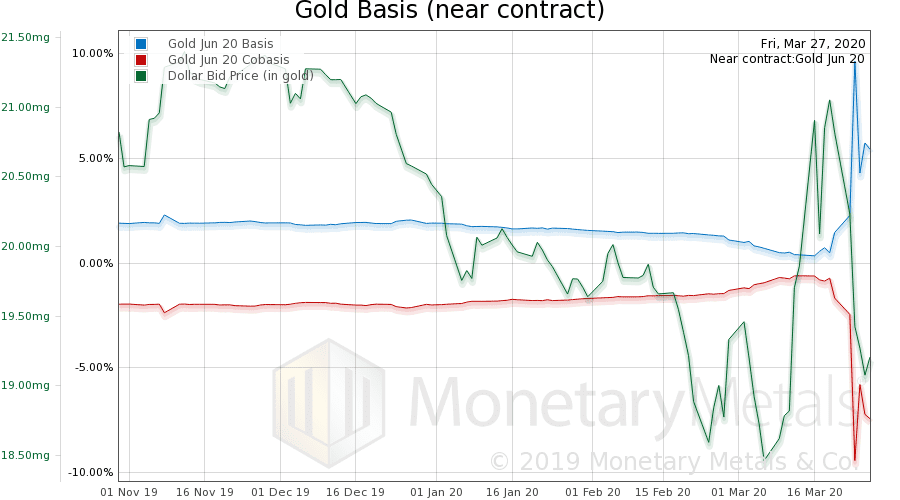

Recall that to profit from a high basis, which also has the effect of compressing it, one needs only credit. Anyone who can borrow at near zero interest rates can buy a gold bar, sell a future, store the bar for a few months, and pocket 5% annualized.

The more we think about the ideas we discussed this week in Gold’s Gone Wild!, it reinforces that (not withstanding what we said about the Fed’s Zugzwang above) gold is not scarce to the market at the moment. That said, we refine what we said on Wednesday in ascribing the extraordinarily high basis, not to extraordinarily high abundance of gold to the market, but to the extraordinary scarcity of credit to the banks.

As we just said, one needs only credit to make this guaranteed fat profit. And, yet, the banks are manifestly not taking the profit.

If the banks aren’t zombies yet, they may be rapidly undergoing the zombification process.

Thus, we’re not inclined to believe our own Monetary Metals Gold Fundamental Price currently showing as $1,116.

If the banks can’t get the credit to take the fat and risk-free gold carry trade, then they’re certainly not able to lend to home and car buyers and business borrowers. The problems that will come from this have yet to be felt. As, right now, few people have any desire to borrow to buy a car or house, and few businesses want to borrow to expand.

Of course, this relative abundance of gold to the market—but not that abundant—occurs against the backdrop of the subsidies and capital consumption described above, which will be both massive and perpetual. There is, of course, a finite limit to how much capital is available for the government to consume in order to keep up the pretense that its prior boom has not impoverished the people. When that capital runs out, things will break (but, that’s an article for another day).

Gold’s abundance to the market will also run out (but, today is not that day).

Right now, is a tug-of-war between those buying gold to avoid the consumption of their capital and those forced to sell gold to stay solvent despite the forces of credit contraction. The former will win, as there are only so many of the latter.

This, by the way, puts a fine point on Monetary Metals’ mission to move to the gold standard. The principal virtue of the gold standard isn’t to keep consumer prices in stasis, it’s to keep the government from consuming all the capital. It should be remembered that the government has free reign to use its irredeemable currency to consume capital because the saver is disenfranchised. Irredeemable means you can’t present the paper currency for redemption and take your money (i.e., gold) out of the bank. But, that very feature of the gold standard—that an unwilling saver can withdraw his money entirely—means that credit is a voluntary transaction which occurs if and only if both parties stand to gain. Credit is not granted in gold under any other circumstances (which is why the government cannot retroactively declare that the dollar is once again fixed to gold).

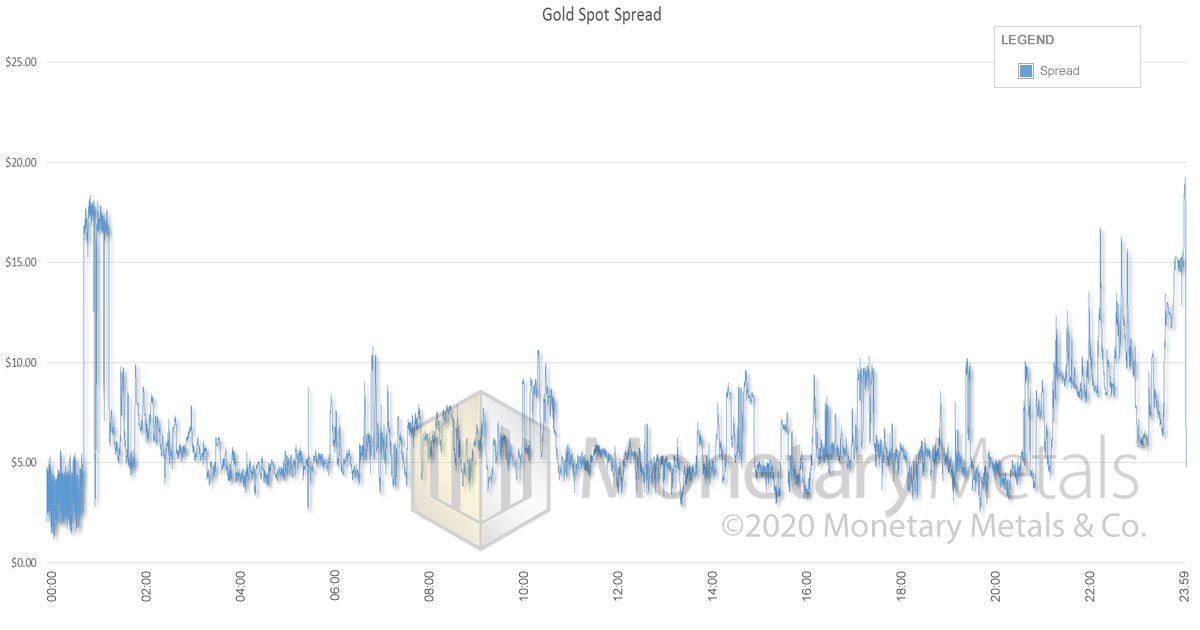

Below is a graph of the bid-ask spread in gold for Friday, March 27.

Normally, the spread is $0.20, but we see several spikes here approaching $20. That’s about 100 times too big.

This would be another indication of extreme credit stress. Would-be market makers may be unable to fund their typical gold positions.

Below is a graph showing the gold basis.

Yes, there is really a 5% (annualized) profit to carry gold for June. We can only reiterate that, to take this profit, all you need is credit.

Let’s add one additional thought to the idea we stated above that gold is abundant, but not that abundant. The high basis may not be indicative of the absolute level of gold’s abundance to the market. However, it does show the direction of the market’s pressure—i.e., a higher price of gold futures compared to the price of gold metal.

It’s important to note that, if the pressure were in the other direction, credit would not matter, there would be no gold carry trade opportunity, and the basis would be negative. In such case, we would be writing about gold’s scarcity and seeking for explanations as to why no one was taking the risk-free gold decarry trade.

As is often the case, what’s true for gold is true for silver, but even more extreme. We won’t even tell you what our calculated Monetary Metals Silver Fundamental Price is right now! Let’s just say, take it with a grain of salt.

© 2020 Monetary Metals

Brilliant Keith! Wishing you and your family & team good health!

Excellent as always – thank you.

There are 2 points I’d like to see developed, as the statements made (below) are not so obvious to me:

1) the Fed doesn’t print, it borrows

2) the principal virtue of the gold standard is to keep the government from consuming all the capital

1: I believe that most readers here are familiar with the notion that bank reserves at the Fed are different from the “money” in circulation. But that’s the 1st time I read that “the Fed borrows rather than print”. Could you please add a footnote link to where this is explained on your site?

2: I also believe most readers here are familiar with the concept that the government doesn’t produce anything, and therefore the “money” spent by government doesn’t go to produce any useful capital. However, the use of the word “consume” is perplexing to me – it would mean that capital is destroyed for ever. I’m surprised. I would have thought that capital is not immediately available for the private sector, but it eventually does return to the private sector – it is not destroyed (eg as in a loan repayment). Could you please elaborate or put a 2nd link where I can read more?

Thank you.

I know Keith can do way better, but I’ll offer my, perhaps over-simplified, explanation:

1: The Fed has a balance sheet, like any bank. The assets are credit instruments owned by the Fed representing others’ debts – mostly the Federal Government. These debts are what backs the Fed’s liabilities – the currency it issues to the people and commercial banks – as credit. So, the Fed issues credit with zero maturity to buy credit of longer maturity, which backs it. That’s called borrowing, in the technical sense. For more of Keith’s writing on what it means, in the psychological sense, maybe take a look at: https://monetary-metals.com/slaves-to-government-debt-paper-report-25-mar-2018/

2: Keith has written many articles on this topic. It is very difficult for new readers to wrap their heads around it, which explains why he often writes about it using new examples and analogies, with the “eating the seed corn” being the analogy most often repeated. If you don’t yet get what he means by this analogy, just use search, and read whatever of his past article headlines pique your interest: https://duckduckgo.com/?t=ffnt&q=monetary+metals+%22eating+the+seed+corn%22&ia=web

Best.

@Augustin,

Re your question #2: Look at history for your answer. The Russia of the czars, although primarily agrarian, still produced capital. Following the Revolution that capital was used up, i.e. eventually destroyed. There was no “return of capital to the private sector”. In fact there was no private sector. Yes, it means that your statement is correct that capital is destroyed forever.

Hello Keith , from your brilliant analysis I understand the timing is near to snatch Silver given its current fundamental price .

Can you please inform us of this data ?

Best for you

If you want silver at a low premium to spot, the challenge for now is to find a vendor offering that. Most vendors’ premiums have blown out these last few weeks such that the cost to purchase has actually gone up while the spot price has plummeted. I don’t know if Keith will recommend any vendors, but there are some offering bulk silver (not 1 oz. mint coins!) at lower premiums to spot.

But your question actually makes you sound like a speculator. So maybe silver futures is where you want to trade?

@alfaght,

Why would one want to “snatch” silver – at any price?

“Recall that to profit from a high basis, which also has the effect of compressing it, one needs only credit. Anyone who can borrow at near zero interest rates can buy a gold bar, sell a future, store the bar for a few months, and pocket 5% annualized.”

Please, let me present my idea:

The problem might be that NOT “anyone can buy a gold bar”. I mean for this trade to work, you will need to be able to deliver the gold bar at the term of the future contact. If you cannot take delivery of a gold bar on spot for some logistic reason, you know that you will default on your future contract. So, you do not make this carry trade.

It may explain why nobody is arbitraging this.

Yes, so most would prefer to reverse the trade prior to expiry which means going through two bid offer spreads which have been widening.

There’s another side to that transaction, too. In the past, a typical contract buyer wasn’t going to hold the contract for delivery. Now, maybe that isn’t so certain.

@Anonymous,

Despite the fact that you quote Keith exactly, you appear to not understand the mechanics of the trade nor the timing of the cash purchase and futures sale.

Well, the spot purchase and the selling of the future are made at the same time. The delivery of the spot purchase should be in a matter of day and The delivery of the future at the expiration of the contract. May be you can be more explicit.

Once again, I would take exception with your explanation as to the lack of arbitrage in the metals market. It seems you are operating under the premise the CME is a legitimate market. If it were, your interpretation of the rising basis would have some merit. Once you accept the CME is just a Carnival game (read: rigged) – it becomes clear the Rising basis is just another ploy by the Carnies to separate Longs from their physical metal.

The idea credit is the only requirement to put on your Basis trade is patently absurd. I could put the trade on right now without credit – because I have Gold. Gold is the only requirement, Not Credit. All the credit in the world will not allow you to put on this trade if you can’t source the Gold.

In a legitimate market, backwardation would indicate tightening supply. Longs are offered the opportunity to bring their metals to market today for a paper promise to replace them at a future date – at a discount, thereby locking in guaranteed profit. This has the effect of pulling physical into the market, thus increasing supply. It only works in a legitimate market where the Long has faith his metal will be replaced.

In an illegitimate rigged market, an increase in basis (contango) is indicative of a tightening supply. Longs are offered a risk free paper profit where the only requirement is their metal be brought to market. Matters not if the metal is brought to market today (by selling to some entity with credit-lol), or some point in the future – the risk free profit is there to pull metal out of hiding, thus increasing supply.

The thing about rigged markets which makes them different than normal markets (moved by supply/demand) is the people doing the rigging know where the price is headed. Whether the riggers pay $1600 in the spot market for an ounce of gold, or $1700 at some future point in time matters little to them if they know the price is headed orders of magnitude higher. Their only goal is to pull more metal out of hiding into the market. In a legit market, backwardation is the best tool to mobilize supply. In a false market, where people have lost their faith in paper promises – and Cash is king – an increase in Basis will best mobilize supply.

I prefer to see it as an act of CME deleveraging: paper gold price is driven down (because settlements are more likely to be done in cash) while future paper becomes dearer; net result is to motivate longs to move their bars closer to the market floor (get them assayed to trade).

The higher basis has held for a week now… even as the (paper) spot price recovers its crisis highs. Paper left weak hands, is now in the hands of deeper believers in the paper scheme, but longs keep upping their future offer. If it’s fraud, it is being played for ever higher stakes, and the players will have to eventually ask how the endgame is to be played. That puts them in the same camp as we mere humans.

And isn’t it in keeping with Keith’s macro-picture of an economy in liquidation mode?

Many gold longs are business-minded families; faced with a severe contraction of their income streams, they’ll dip into gold reserves. When capital structure is as radically impaired as it is today, liquidation mode becomes the plan of the hour. Basis says the warehousers will be paid for making this market liquid.

Part 1 and Part 2 of an hour long podcast provide some tremendously detailed insight into the conditions surrounding the current supposed “decoupling” of

physical/paper prices (spoiler: the hype is disingenuous, but the markets are under stress, could fail, but your retail coin market IS NOT the “spot physical” market. Part 2 cuts to that chase immediately, but Part 1 is essential background.