Monetary Metals Supply and Demand Report: April 15, 2013: Update

The Last Contango Basis Report: Special Update

Since we wrote the Basis Report on Sunday afternoon, the markets have imposed further violence on the prices of both gold and silver. The gold price is $150 lower, and the silver price is $23, $3 lower.

We were so curious about what would happen to the basis on Monday that we assumed readers of the Basis Report would be as well.

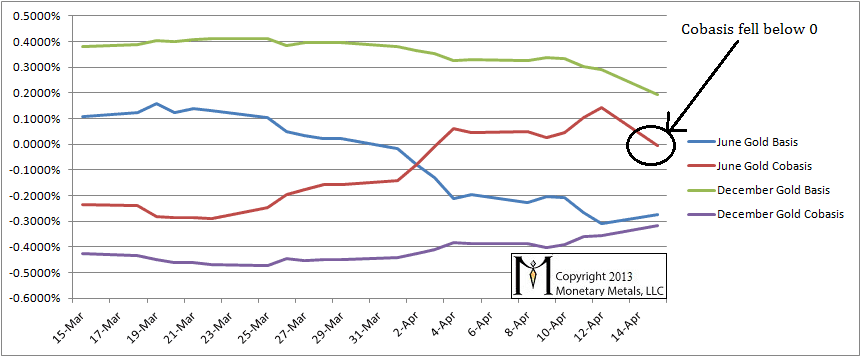

Gold Bases for June and December

There has been backwardation in the June gold contract. The June cobasis fell in all this selling! This means there was more selling of physical than of futures. While this does not mean that there will be further price declines from here (the price was $1400 when this data was taken), it is hardly a bullish sign.

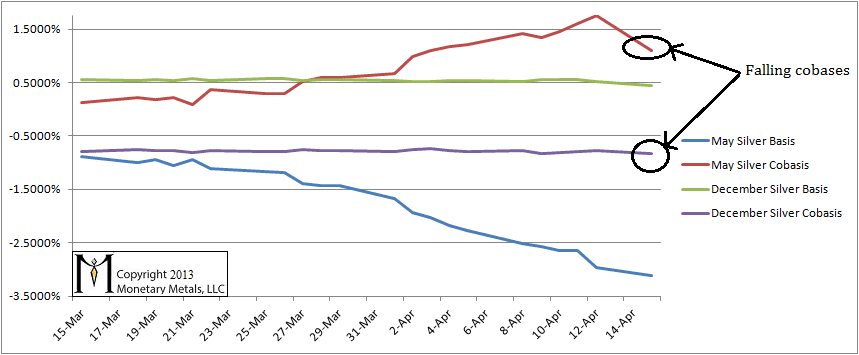

Silver Bases for May and December

In silver ($23.70 at the time this data was taken), we see the cobases for both May and December falling.

Cobasis = Spot(bid) – Future(ask)

In order for the cobasis to fall, either the future is bought, which lifts the ask. Or spot is sold, which presses the bid. I think we can safely conclude it was the latter.

Conclusion: holders of metal capitulated. There could be more capitulation coming, though we would not recommend a naked short position here. Our recommendation of long gold / short silver has done well so far, and we do not change that call today.

So who’s the fool?

Actually Keith, this does beg the question;

You’ve said a falling basis & backwardation implies a reluctance of gold to bid for $, & that the basis is a measure of this reluctance. Even though I’ve previously said I’m skeptical, it makes sense. I understand the idea of an obligation trading at a discount.

Now we see that despite backwardation “holders of metal capitulated”, that there is in fact little reluctance for gold to bid for $ after all.

What kind of measure is it?

JR: The basis isn’t a guarantee. Something flipped in a lot of people’s heads on Monday. People who had been holding real gold metal decided to sell it. They are dollar thinkers, and they want to sell to avoid taking “losses”. The basis is a measurement, a snapshot if you like. The thing being measured changed on Monday.

This is why we posted an update one day after the Basis Report, which is normally weekly.

Is it possible that they got margin calls? After all, futures positions are hedges for physical positions. So if selling hit the market, then an overabundance of metal was available leading to collapsing cobasis?

Does the basis theory require at least somewhat stable ‘boundary conditions’? If you shake it up enough, weird stuff can happen short term?

In our credit based economy, for gold to really move, wouldn’t that require problems to be exposed? It seems that right now all appears hunky dory with the stock market rising.

Is it possible that the falling cobasis in gold and silver was driven by physical purchases on credit and that these guys are getting margin calls as the prices fall?

petter: Sure, there could have been some buying of physical on credit and then forced liquidation. Though my guess is that there was a lot more selling than that.

Look for my article on what has pushed down the gold price soon.

Keith– do you think that arbitrage forces become “stronger” during such panic selling? i.e. are there greater opportunities for arbitrage profits to be realized

I would think that arbitrage would help to stabilize and reduce volatility on days such as yesterday when dollar liquidity is at a premium.

did the bid-ask spreads widen?

thanks!

Sure, if you’re positioned with capital and real time trading screens, volatility will present brief opportunities that are larger than on normal days.

They may or may not be trying to arbitrage the price of gold from one minute to the next (i.e. volatility) but they will be arbitraging the basis and cobasis.

When you see both a falling basis and a falling cobasis, this means widening bid-ask spreads. That is what occurred in silver on Monday.

“The thing being measured changed on Monday.”

Maybe it’s your measure that’s the problem, not what you purport to measure.

What makes you say that?

“Something flipped in a lot of people’s heads on Monday.”

Seriously?

Seriously.

He gave a pretty good explanation and compelling reasons why it happened,

here:

https://monetary-metals.com/what-is-pushing-down-the-gold-price/

And here:

https://monetary-metals.com/what-is-pushing-down-the-gold-price-part-ii/

Turn off selective reading and try to keep up…

Cheers.

Gold and silver backwardated by as much as I have seen them in the bull market. I have seen the effects of large contango on the natural gas maket in the past, it tanked , bad. Let’s hope the Doc and Keith have made the correct diagnosis. By the way, my money is still on silver, it always moves last but catches up and passes.