Why does the “Paper Gold” Price Track the Physical Gold Price? Part II

In Part I of this article, we looked at arbitrage between the physical metal market and the futures market. We saw that there are arbitrageurs who straddle the spread between these markets, who don’t care about price but about the difference between two prices. They seek to profit, not from a change to the gold price, but from the positive gold basis.

The basis is Future (bid) – Spot (ask)

If the basis is positive, they can buy metal and simultaneously sell it forward in the futures market (called “carrying“ the metal), and pocket about 0.6% annualized. This is far more than they could make in the Treasury market. In putting on this trade, they compress the spread because they are pushing up the spot price and pushing down the futures price.

This fact is what helps us understand what’s going on in the market. If we see a combination of (1) rising open interest (the number of futures contracts that are active), (2) a rising price, and (3) a rising basis, we know that the price is being driven by speculators bringing fresh money to the futures markets. How do we know this? Rising price means someone is buying. Rising basis means futures are going up faster than spot. Rising open interest means that new contracts are being issued (if this is unclear send us a question or comment using the form on the right side of the page and we will publish additional discussion of this point.)

Speculators in futures can bid up prices considerably. Because they are typically using leverage, they must eventually liquidate to take profits, or they can be forced to liquidate if the price falls due to stop orders and margin calls. Speculators can therefore cause great swings in the price above and below where the underlying buyers of the metal value it.

Everyone understands that the contract buyer wants the price to rise. They commonly assume that the seller of the contract wants the opposite. There is a certain appeal to this. A futures contract is zero-sum. Every dollar the price moves in either direction results in money transferred from one party to the other. There is a lot of discussion (and controversy) about this. Although there are speculators who short gold and silver hoping to profit from drops in the price (especially at certain times), I think it’s clear that most sellers of futures are arbitrageurs.

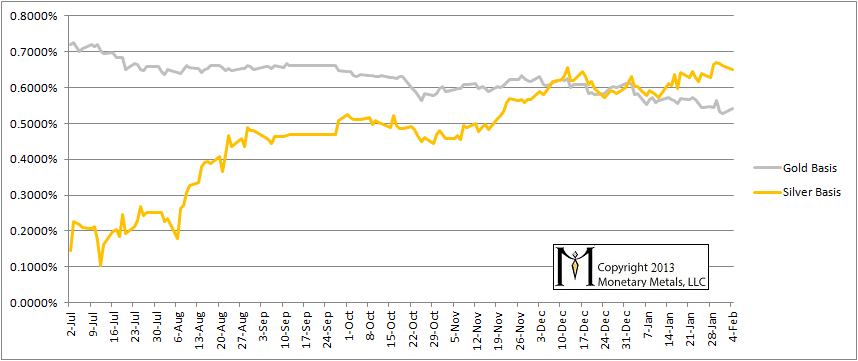

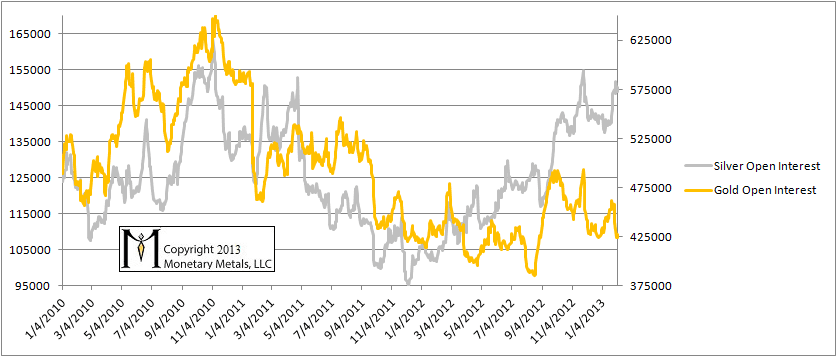

Our goal is to understand to make profitable trades by understanding the data. In brief, a falling basis indicates rising scarcity and a rising basis indicates declining scarcity. This one fact enables us to cut through the rumors that swirl around the Internet and focus on the reality in the market. Below are two graphs. One shows the basis for gold and silver (December contract). The other shows the total open interest for both gold and silver.

Gold and Silver Basis (December 2013 Contract)

Aggregate Open Interest for Gold and Silver

Together, they paint a picture of lots of speculative buying in silver and little speculative buying in gold. We don’t know precisely when—this is not a timing system—but we can say with high probability that silver will correct. Right now, an ounce of gold will buy about 52.5 ounces of silver. We predict that this ratio will rise to 60 or perhaps closer to 70.

Our firm only invests in physical gold and silver. At the present time, we are long physical gold with no exposure to silver. However, If we were trading for dollar gains using futures or ETF’s, we would do a direct arbitrage: long gold futures / short silver futures. In the stock market, we would go long GLD / short SLV.

Whenever we’re bearish, we always advise NEVER NAKED SHORT A MONETARY METAL. Postscript to this article.

Great information for my knowledge bag. Thanks.

I don’t see where the conclusion that the silver gold ration will widen follows from what you have??

I have been interested in the basis in futures since the natural gas collapse in 2008. The contango was very wide before the fall. It turned out that a hedge fund (Amaranth) had driven prices too high and the fund was eviscerated by JP Morgan, along with the gas price. The trouble that I can see with this strategy is alluded to in your paper. Timing is very important. Do you have a sense of how to read the basis for timing? What are normal parameters for contango in the silver market?

One more question, why is the basis not a part of analysis for all futures markets?

The color coding is reversed between the two charts. Is this intentional or an error? It would be nice if the color codes are consistent, that is, gray for silver, yellow for gold. Thanks for the great site!

How do arbitrageurs make money off this? From what I understand you can leverage commodities, like gold, in the futures market. But if you’re only selling a futures contract against existing physical metal, you can’t leverage the physical metal. Would you have to have a calendar spread on it with both positions being a future contract? Buy on leverage April ’13 and sell on leverage Dec ’13? .5% is extremely low interest.

“In brief, a falling basis indicates rising scarcity and a rising basis indicates declining scarcity.”

The overwhelming majority of longs that “buy” real metal in this arbitrage never intend to take delivery, so to use this basis analysis as a metric to gauge the status of the physical markets is fundamentally flawed.

Under 1% of the daily volume at the Comex could possibly reference physical metal.

Keith, per your question, I would benefit from a more detailed explanation of the logic here.

I’m not suggesting that you are wrong. But, I fail to follow you logic.

Thanks everyone for good comments. Let me try to address them briefly here, and if necessary write a follow-on piece.

tyonker: Timing is not something one can read from the basis itself. I discussed timing in the video (right hand side of this page) “The Coming Silver Correction”, looking at the extreme level of open interest which was last seen Apr 2010 right before the crash from $49 to $34. I agree that all commodities traders should look at the basis.

samiam: It was a mistake, we intended to make silver silver and gold gold :)

dak: you borrow money to buy physical and sell futures. How much equity vs how much borrowing determines your leverage. The world is moving towards the black hole of zero interest. 0.5% is low, but it’s not as low as Treasury bonds of the same duration!

mossmoon: I agree, the longs are mostly “naked” without means nor intent to take delivery. I discuss this in the video, the longs must inevitably sell. That does not invalidate the basis as a method of analysis.

flvp: I will write a short piece that presents the logic in more detail.

“I discuss this in the video, the longs must inevitably sell.”

This rise in the OI could be the addition of shorts, no?

My other point is that if the basis spread relies on naked contracts then it is NOT an indicator of physical demand, as you say it is.

It will be interesting to see if your call is correct.

The silver basis could not have been rising in Aprill 2011, as silver was in full backwardation. But you are predicting a silver correction based on a rising basis (and a rising OI). I do not follow you.

Do you have a silver basis chart for 2011?

mossmoon: I will try to address your questions in the next piece.

You mention 1).. 2) and (3) a rising basis, we know that the price is being driven by speculators bringing …

Shouldn’t be narrowing basis since i buy spot gold and sell future short? Please advise!