Why does the “Paper Gold” Price Track the Physical Gold Price? Postscript

This article is a follow-up to Part II. I expound upon a point I touched on, and also address some questions raised by readers.

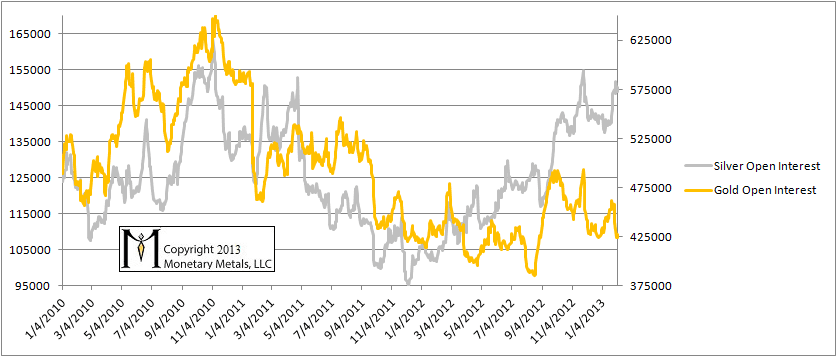

First, let’s look at an update of the open interest numbers as of Feb 6. Gold’s open interest actually declined further.

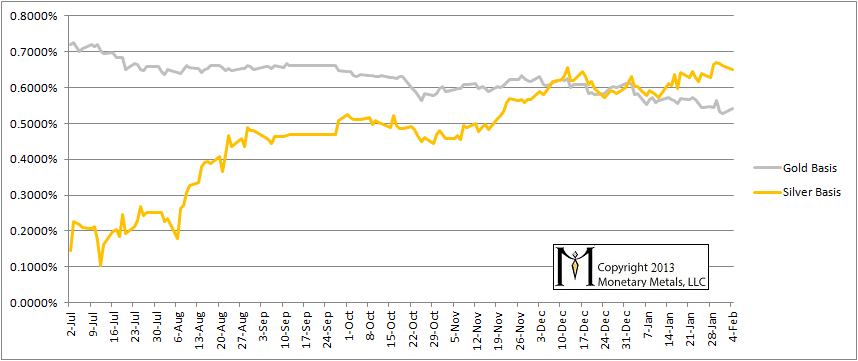

Next, here is an update of the bases. The gold basis continues its descent. The silver basis has declined a hair.

OK, in Part II I said that if we have a combination of (1) rising open interest, (2) a rising price, and (3) a rising basis, we know that the price is being driven by speculators bringing fresh money to the futures markets.

Let’s take a deeper look. There are two ways Open Interest (OI) could increase. Sellers are selling new contracts onto the bid. Or else buyers are purchasing new contracts at the offer. The rising price rules out sellers pressing down the bid. The rising basis is an additional and more sophisticated confirmation.

If a seller of futures were an arbitrageur, he would buy physical metal and sell a future. This would cause the price in the physical market to rise, and the price in the futures market to fall. By definition, the basis would be falling. There would be a similar effect if the seller of futures were “naked”. He would push down the price in the futures market, and thus the basis. But a rising basis rules out a seller of futures on the bid.

It must be a buyer of futures paying the ask. This would lift the price in the futures market, and thus the basis.

Thus I stated in Part II that silver but not gold is being driven at the moment by speculators. We don’t know that they are all using leverage, but we can assume that most are. Leverage is one of the benefits of the futures market.

One reader asked how the basis analysis measures physical demand if there are naked short sellers in the market. The first answer to this is that if someone were selling futures, not to carry silver, but to manipulate the price, he would push the price of the future contract (that being the whole point). It would fall below the price of the metal in the physical market. He would have no ability to cause the price in the physical market to fall—indeed the only force that connects the two markets is arbitrage. This would be an instant and very large backwardation.

To put this into perspective, the basis is around 0.63% annualized. The carry for December silver is less than 20 cents. To sell enough futures to cause the price to drop by a significant amount (say a dollar) would cause a backwardation of around 2.4%. I don’t think I would be the only one screaming if that happened!

For a deeper answer, consider the case of a simpler commodity, wheat. Imagine if you drive a truck up to a town with several grain elevators. You arrive 2 days before the wheat harvest begins to arrive. The workers are hosing off the equipment in preparation, and of course there is no wheat anywhere. You ask how much they would charge to fill your truck with wheat right now. After they are done laughing, they quote you a price: $17.50 per bushel. They suggest you sign a contract for delivery next month, at $7.50 a bushel.

If you take the $17.50 wheat right now, they will have to pull wheat out of the supply chain. Some bakery will be paid more profits to sit idle for several days than it would have earned making bread, in order for you to load up your truck. Of course if you can wait, wheat will be plentiful in a month.

Backwardation should be thought of as a synonym for shortage. One proof of this is that if there were no shortage, then anyone with wheat could sell it in the spot market for $17.50 and buy back their position for $7.50. The fact that no one is taking this free profit means that no one can, because no one has any wheat.

In the case of the monetary metals, there is no such thing as a shortage. Gold and silver have stocks to flows (inventories divided by annual mine production) measured in decades. Backwardation means metal is scarce in the market. This has severe implications (https://monetary-metals.com/when-gold-backwardation-becomes-permanent-3/).

At the moment, we have OI at a level it touched briefly last fall (when the price was $3 higher) and before that in April 2011 (when the price was $17 higher). We have a basis that’s high and rising (though not in the past week).

Silver is not scarce in the market. It has become more un-scarce over the past several months. The demand for physical metal at the margin has not been from industrial consumers or hoarders (who take it out of the market). It has been from the arbitrageur, to carry the metal for buyers of futures. Abruptly, this source of demand can evaporate when leveraged longs become exhausted. Then a new source of supply begins to dump silver into the markets. The liquidation of the “naked longs” will cause the unwind of all those silver carry positions and dump silver in a physical market that has suddenly lost a big part of its demand.

Argentum emptor caveat.

This is fascinating.

However perhaps there is a contrary analogue. From roughly August 6-August 20, 2012, the silver OI was rising (with a sideways price) and the basis was moving much more strongly positive than the present scenario. But the silver price exploded from $28 to $35.

We have exactly this situation presently.

Short this silver market at your peril, Keith.

As I always say when discussing a bearish-looking environment for gold or silver:

NEVER NAKED SHORT A MONETARY METAL!!!

Since the first video introducing this idea, I have been advocating for an arbitrage; long gold / short silver.

So, if the silver basis is up, implying an increasing spread between silver spot and silver futures, this in turn indicates no shortage/availability of silver on the spot market, right? Assuming I have this right, how does this square with sold-out conditions at the US and Canadian mints based on the purported shortage of physical?

Dennis: As I said in one of the recent videos, US mint sales are a weak proxy for world silver demand.

I do not quite agree that “indeed the only force that connects the two markets is arbitrage.”

I have been in equity markets for a few years and observed that the scenario “The tail wags the dog” does exist. It means when futures drop, the bid of its underlying will retreat (I did move down my bid of underlying in real case in anticipation of falling offer prices). Arbitrage is not the only force that connects the spot and futures markets.

Psychology may have a role in price discovery. Most people agree that futures markets are a faster market and more information-sensitive. The rising basis on the one hand shows the rise in price may not be sustainable, but on the other hand may draw more futures/ spot /ETF buyers into the markets. The original leveraged long may then sell the futures to the now heated futures/ spot/ ETF markets. The spot markets, being also driven by speculators of ETF, may become so overheated that temporary backwardation happens. The arbitrager in this case found it harder to do the arbitrage as the supply of spot silver, a giffin goods, shrinks in anticipation of higher price. The backwardation draws even more leveraged long until, said you said, it exhausted itself. I think it happens in April 2011 (I admit it’s my guesswork only).

By longing gold and short silver in the first sign of rising basis, rising OI and rising price of silver may bankrupt you before backwardation corrects itself back to normal contango. Please correct me if I am wrong :)

Allen: are you saying that rising contango causes backwardation?

By the way, I think the word for someone who maintains a bid in the spot market and who lowers it when he sees the bid on the future drop is … “arbitrageur”. :)

When rising contango (even though spot lags futures in the rise) causes a change in psychology in favour of price rise and the stock readily deliverable shrinks (some stocks are under mattress), is it possible a rising contango will turn to temporary backwardation?

I think not only arbitrageur will lower the bid in the spot market, but all buyers (incl. bullish new naked spot long) will. So the subsequent drop in spot is not entirely due to the arbitraging activity (i.e. long spot and short futures in positive basis case).

I argue that when arbitrageur’s unwind met with leveraged long and short unwinds, the aggregate impact is just rising basis. You said “The liquidation of the “naked longs” will cause the unwind of all those silver carry positions and dump silver in a physical market”. But the missing piece is “naked short” will also liquidate and gives a source of demand in futures.

Allen: Of course backwardation can follow contango. The question is does the latter *cause* the former.

I propose a broader concept of arbitrage that includes someone who maintains a bid in the spot market lowering his bid in response to changes in the futures market. That is no mere speculator buying (spot or future) and then waiting for price to rise. And even that would be arbitrage in the broadest sense, but that’s outside the scope.

I have written papers in the past looking at this alleged naked short position, and how the mechanics of the contract roll would work. The observed data is opposite to what we would expect if there was a large naked short. If you mean there are some speculators who naked short, of course, but I would imagine not too many during a period (like last Aug-Sep) of rapidly rising price, rising OI, and rising basis. Maybe once the price had hit a plateau, but in this case rising OI was accompanied by rising basis. Shorting futures would produce a falling basis…