Cheering for Bitcoin, Gold and Silver Report 17 Dec 2017

We have published many articles, arguing that bitcoin is unsound. Yet for all those arguments, there is a bright side to bitcoin. It is exciting to see that there is an audience of millions of people—mainstream people, not wild-eyed End-The-Fed gold bug preppers who keep their gold hoards with their stockpiles of ammo—who are looking for an alternative to the Fed’s failing fiat currency. Or if not looking actively, at least receptive to it.

We believe that the most important force contributing to dollar inertia is not law (and it’s certainly not the US military). It’s in your head. And in the heads of everyone else. To see what I mean, do a Google Images search for “money”. You will see pages and pages of green printed paper. And you won’t see pictures of gold coins (for that, do a search for “bitcoin”!)

Even most of the gold owners who have an implacable hatred of the Fed, think of the value of their gold as measured in dollars. Indeed, the number one complaint in the gold bug community is that the banks are pushing gold down. Down? Yeah, reducing its price as measured in dollars. Less dollars exchanged per ounce means gold is less valuable—what else could it possibly indicate?

Money means the dollar, and the dollar means money. This is how people think, at the moment. It’s a perfect example of a phenomenon described by Johann Wolfgang von Goethe.

“None are more hopelessly enslaved than those who falsely believe they are free.”

Sure, it’s good to get out of being a creditor to the Fed by owning gold or even bitcoin. But if you accept the Fed’s core principle—that its counterfeit paper is money—you are still trapped in their system. Your chains are self-made, and self-imposed.

That said, we find it encouraging that so many people see at least some serious flaws in the Fed’s irredeemable currency, and its central planning. Social change is a non-linear process. It is expressed in an old (perhaps as old as a union speech in 1914) quote about social movements that is often attributed to Ghandi, “First they ignore you, then they laugh at you, then they fight you, then you win.”

We don’t refer to the bitcoin movement (and we are aware some will regard this point as irony, coming from us after we have written so much criticism of bitcoin). We refer to the movement away from central banking. The meteoric rise of bitcoin popularity proves we are past phase I. No Fed apologist can ignore the sheer number of people, nor the fact that they are clamoring for an alternative.

The realization that the dollar has fatal flaws is, of course, a one-way journey. Once someone sees this, he cannot unsee it. People do not go backwards. So there is a kind of ratchet effect at play here.

There may be many other attempts to develop alternative monetary systems, as people design new currencies without some of the flaws of bitcoin. This is healthy and all to the good. We may decry the billions of dollars of capital consumption fueled by the bitcoin boom, but we have to acknowledge the good of market discovery seeking a monetary solution that serves the people.

And we may (will!) continue to say that no irredeemable currency can work, whether central bank imposed or whether attempted in the markets. We may (will) keep saying that the gold standard—which is when anyone who wants to can earn interest on their gold, in gold—does work.

But a part of us is cheering bitcoin and all the other market experiments.

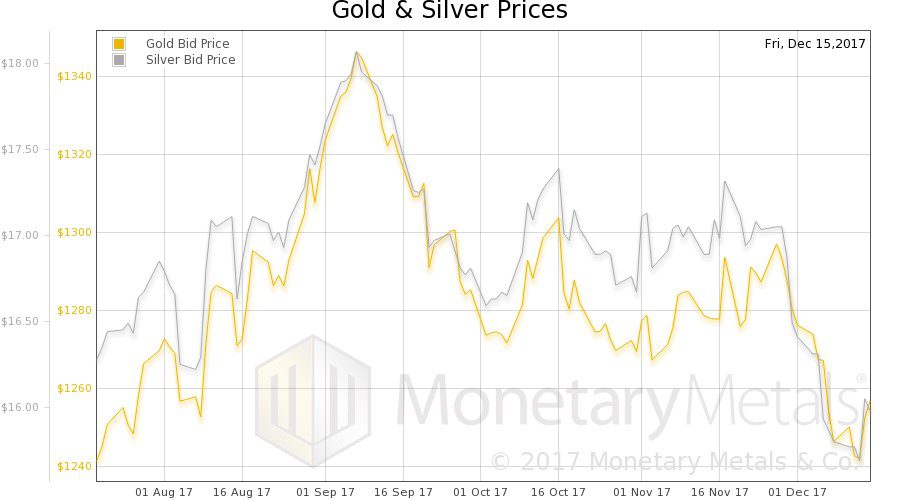

This week, the prices of the metals rose, $7 and $0.34 respectively. As the price of silver rose by a larger percentage, the gold-silver ratio fell. Which last week, we said we were betting on in our fund.

Let’s look at the only true picture of the supply and demand fundamentals of both gold and silver. But first, here are the charts of the prices of gold and silver, and the gold-silver ratio.

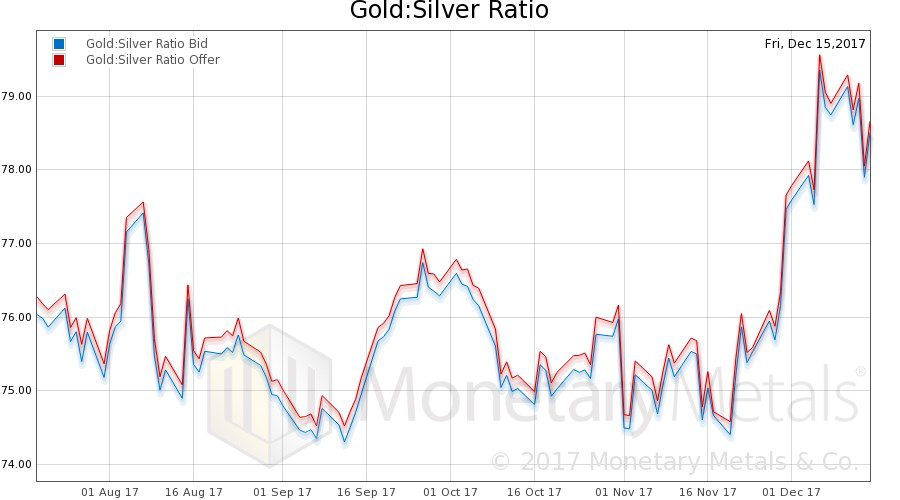

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio dropped.

In this graph, we show both bid and offer prices for the gold-silver ratio. If you were to sell gold on the bid and buy silver at the ask, that is the lower bid price. Conversely, if you sold silver on the bid and bought gold at the offer, that is the higher offer price.

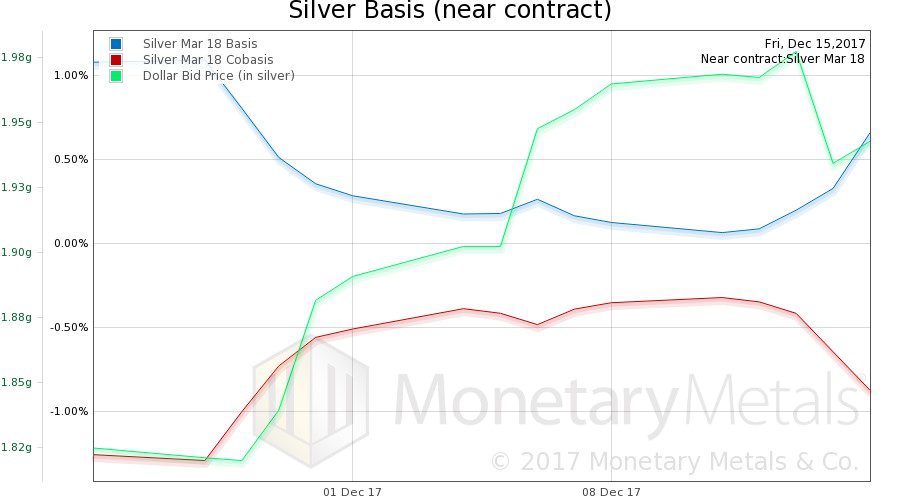

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph showing gold basis and cobasis with the price of the dollar in gold terms. We have again zoomed in to see recent developments in the basis.

Note the drop in the cobasis as the price of the dollar fell (i.e. price of gold, measured in dollars rose). Our measure of scarcity has fallen almost to the level it was when the dollar was considerably lower (i.e. the price of gold was $30 higher).

Our Monetary Metals Gold Fundamental Price fell $39 this week, to $1274.

Now let’s look at silver.

We see the same thing, silver is simply less scarce at the higher price.

The Monetary Metals Silver Fundamental Price dropped 24 cents from last week, to $16.37.

This means that Monetary Metals Gold Silver Fundamental Price fell about 1.4 points.

© 2017 Monetary Metals

I watched an interesting segment with Catherine Austin Fitts, (whom I admire immensely), over the weekend. She’s in agreement with you that cryptocurrencies have very large issues and due diligence cannot be done on them.

https://www.youtube.com/watch?v=85z5hkXVfE8

Be well.

Theo

Be careful what you say! Lauding Bitcoin and cryptos as evidence that people are willing to consider something other than the Federal Reserve Note as currency is like voting for Trump over Hillary because you couldn’t stand 4-8 more years of the corruption! Now, whatever happens economically will be blamed on Trump and on capitalism (because everyone knows Trump is a capitalist). Harder to say what would’ve caused more long term damage: Hillary & her corruption or Trump and his aideology which will cause economic harm (at least fail to prevent it). When the cryptos crash and governments world-wide finally conduct their investigations, it will lead to banning of cryptos and tighter government control over what is used as currency. Most likely, they’ll co-opt the cryptos in their effort to go cashless while banning all free market competition for crypto currencies.

To have a strong economy money needs to be anonymous people need the ability to hide and hoard their money the more control Government has over money and people the weaker an economy becomes because incentives to work and save are reduced. I agree cryptos are the first of many attempts to return to free and independent money Gold is perfect to assume this role again. Notes and coins can be loaded with gram weights of gold easily with today’s technology, and for larger transactions blockchain can be used for bars.

The jump in the gold basis looks proportional and correlated timing wise to to Fed’s 0.25% interest rate hike this week. It would seem that this statement is not an “apples to apples” comparison:

“Our measure of scarcity has fallen almost to the level it was when the dollar was considerably lower (i.e. the price of gold was $30 higher).”

It was mentioned one time on here that cost of money, ie. interest rates, were a factor in calculating the fundamental price. The ~1% carry for the February contract (around 2 months) is still significantly less than the 2 month USD Libor rate (1.53863 %).

@Ross: The lack of anonymity is one of the issues with Bitcoin. It’s also why governments aren’t fast to shut down cryptocurrencies. They know a) who owns them, b) when (at what price) people bought them, and c) (using FIFO accounting), know exactly what one’s capital gains are. It’s also why .govs and banks are keen on them as it leads the way to the cashless society, (the control of your money units). If all your cash is digital, they, (banks & govs.) can control you simply by denying you access to your “money”, (their scrip). It’s also why China, Russia and India are in the process of accumulating PMs. These countries, (and others), know what JP Morgan knew. Money is gold, and nothing else.

@Stephen: I’m not sure where you come by your assertion that I am “lauding Bitcoin and cryptos”. If anything, I actually said the opposite. People are speculating in cryptocurrecies due to greed almost exclusively. Bitcoin can hardly be described as “a good store of value”. If you are playing in cryptos, have no more in it that you can afford to lose. It is the latest play in the casino, no more, no less. If you are playing in cryptos, be sure to keep very accurate records. The IRS will too.

Merry Christmas, Happy Hanukkah and Joy-filled Holiday season to all, and most of all, to a prosperous New Year! May your hot tub overflow with guacamole! (proverbially speaking)

Theo

Of course people will be inclined to value gold in terms of dollar…. that’s currently the assumed unit of account if we want or need to sell some gold for a short term need. I’m quite sure that most of your readers, followers and certainly your fans agree with your fundamental concept — that gold itself is money and need not be traded for dollars to have value. That’s the issue, isn’t it?

Unfortunately, we still live in a world that rarely accepts gold as final payment. But, unlike BTC, at least it’s true that millions of people are willing to hold gold for its own sake, and for great periods of time at that. That is not true of most other assets, except perhaps precious gems.

I like to ask a question of the trusting-in-fiat crowd: “If you wanted to make certain that your children had the benefit of your savings 50 years from now (this is a gun-to-head question) what would you leave for them: an unbacked, irredeemable paper currency of your choosing (which has eventually been printed or borrowed into worthlessness in every situation) or GOLD, a successful store of value for 5000 years?”

P.S. “Fiat” being understood as a generic term for irredeemable paper. Technically the value of the U.S. dollar in the year 2017 is not ‘by decree’.