Is the BRICS Currency Real or Hype?

In this episode of Debased, host Jeff Deist, EJ Antonio, and David Waugh, discuss the proposed BRICS currency. Is it real or hype? They delve into the mechanics, economics, and geopolitics of creating a gold-backed currency among the BRICS nations, which could potentially challenge the US dollar’s status as the world’s reserve currency.

Connect with Jeff and Monetary Metals on Twitter: @JeffDeist @Monetary_Metals

Additional Resources

“When Money Dies” by Adam Fergusson

The Dollar Milkshake Theory by Brent Johnson

“The Bell tolls for Fiat” by Alastair McLeod

“More Gold Backed BRIC currency silliness dethroning the dollar”

The Case for Gold Yield in Investment Portfolios

Podcast Chapters

[00:00:01]: Introduction to the BRICS currency proposal

[00:01:13]: The privilege and obligations of the US dollar’s reserve status

[00:07:04]: The possibility of a gold-backed currency among BRICS nations

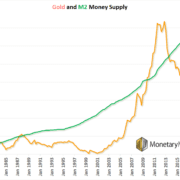

[00:10:51]: The devaluation of the US dollar and rising inflation

[00:13:19]: The advantages of alternatives in a changing monetary system

[00:15:09]: The slow shift away from the US dollar as a reserve currency

[00:17:21]: The potential risks of a rapid de-dollarization scenario

[00:20:06]: The possibility of a gold-backed currency

[00:24:18]: Questions about the issuing entity and trust between nations

[00:30:26]: Critiques of gold as a currency

[00:35:43]: Potential consequences of a gold-backed currency

[00:38:20]: Geopolitical implications of a currency switch

[00:43:14]: Bottom-up demand for sound money

[00:47:23]: Harmful Effects of Unstable Currency

[00:52:27]: Impact of Alternative Currency Backed by Gold

[00:55:22]: Possibility of Hyperinflation in the US

[00:56:37]: Gold Backed Currency Requires Discipline

[00:57:53]: Subscribe to Debased

Transcript:

Jeff Deist:

So we’ve heard for many, many years that the US dollars, the World’s Reserve currency, and that other countries around the world sure would like to unseed its status as such. It’s a geopolitical angle. Of course, people on this call know that really, since at least the Bretton Woods Agreement in 1944, and especially perhaps accelerated since the end of that agreement or the de facto end of it under the Nixon administration in 1971, the United States dollar has enjoyed a status that perhaps it has not earned. In other words, a political status rather than a truly economic status. And of course, the French called this our exorbitant privilege. The French finance Minister named Gestang. And so the reason becomes why? What’s the privilege here? Well, in effect, arguably, the dollar’s reserve status over all these years has allowed America to export inflation. And by doing so, it’s allowed us as Americans, those of us on the call who are Americans, to enjoy this privilege and potentially feel a lot wealthier than we really are in terms of the actual productivity of US businesses and firms. And so by creating this world’s reserved currency status for the US dollar, that imposed a lot of obligations on the rest of the world because not only national governments and national central banks, but also companies and individuals around the world in large part needed and still need US dollars to engage in trade.

They often need to borrow in US dollar denomination, often to settle international transactions. They need dollars often to buy oil, they need dollars. So the world is a wash in dollars. And the idea that the rest of the world might not be so thrilled with this privilege that we enjoy is undoubtedly true. And some of the countries among the BRICS nation undoubtedly feel this acutely. However, we have to remember that the rest of the world also has an interest in the dollar because maybe half of all US currency in existence is held outside the United States. So if the dollar were to experience a crash or a rapid decline in value, those foreigners would be hurt as well. Maybe a third of all US treasury debt is held by foreigners, somewhere along the lines of one third, 33 %. So again, if those treasury’s decline in value, it won’t just be us that will be hurt by this. So what we know is that all these decades of the world’s reserve currency status have enabled us to perhaps live beyond our means. But it’s also, I would argue, hurt the US. And it’s hurt Americans in that, like an alcoholic that you continue to slide and drink across the bar to, it has allowed us to live beyond our means at the governmental level as well.

And that has resulted in things that I would argue are very bad and very harmful for the United States, like wars of choice for example, which costs trillions of dollars beyond what we raise in taxes. Of course, an enormous entitlement regime, especially Social Security and Medicare. And when we look at the rapid aging in the US population inflation, where the over 65s are set to double, folks, by 2050, it has been estimated by an economist named Lawrence Kott l’E coft that the expected future tax revenue versus the expected future obligations to people under social security and Medicare, there’s maybe a $200 trillion gap between that. So entitlements are a real problem for America. And then beyond entitlements, which are welfare for middle class old people, there’s regular welfare ism. So we’ve had welfare and warfare as a result, in part of our ability to spend with deficits, to sell lots of treasury debt and know that there will always be ready buyers for treasury debt, even if it’s the Fed all around the world. So again, the United States benefits, but the rest of the world, which might like to see this change, they also hold dollars, they also hold treasuries and their government and their central banks and their investment funds and at the individual level.

And I would like to add, as I think an important point, countries don’t trade, countries don’t have interests per se. Individuals trade, businesses trade. But when I say countries, what I really mean is the political class, politicians have interests. And it may well be in the interests of certain politicians in Brazil or Russia or India or China. And that’s what the BRICS acronym stands for, to see the US dollar dethroned. So what we’ve heard, of course, along with these five countries, I mentioned, there’s also about 19 other countries who are now signed up as BRICS members, including some reasonably stable Middle Eastern countries. What we’ve heard is that, of course, in August, at the meeting of the BRICS Nation’s group, which is going to take place in South Africa, that there may be a proposal to create a gold-backed currency of some kind amongst the BBRICS Nations. Now, this is a little strange because the Russian embassy in Kenya, of all places, floated this news story and a lot of different outlets picked it up. The Indians, by the way, have denied this. So it’s not so clear this didn’t come out of the Kremlin itself.

This certainly didn’t come out of the TCP in China. But there’s been a lot of talk about it for years. And there’s a little added extra intrig because, presumably, the leaders of those five BRICS Nations would attend this conference in South Africa. However, South African government is the signatory to the ICC, the International Criminal Court Agreement, and the ICC has what is in effect a criminal warrant out for one Vladimir Putin. So in theory, if the South African government were to permit this, and if Putin were to actually attend in August, there could be an international incident or a showdown of some kind. So I don’t know if that’s going to happen. I don’t know if he will attend. I don’t know if the South Africans would allow it to happen. Some people have said, Well, they should move it to China because China is not part of the ICC. So there’s some interesting background here. And some people, including Dr. Paulett have written about this. There’s a gentleman named Alastair McLeod at Goldmoney. Com who’s written a really substantive article on how all of this might work. And he thinks it is not hype.

So I’ll just throw this out at Goldmoney.com. The name of the article is the Bell tolls for Fiat by Alastair McLeod, just written a couple of days ago. On the other side of it, our friend Mish Shedlock, I think some of you probably follow him. He’s got a website called Mish Talk, and he has an article called More Gold Backed BRICS currency Silliness underthrowing the Dollar. So I want to throw this out now to our speakers, but my last comment will be there’s three elements to this notion. First of all is the actual mechanics. What would it take to implement or to even begin to implement or think about a gold backed currency? That’s the first idea. The second is the economics of it. Is there demand? Would money flow into this idea? Would trade actually occur? Is there an economic market for all of this? And then the last point is, of course, the geopolitics. This would almost be viewed as… Maybe I shouldn’t say an active war, but it would certainly be viewed as an active hostility towards the United States government and our dollar supremacy. So these are all very, very important points to consider.

So let’s start. Let’s ask EJ Antoni from Heritage.

EJ Antoni:

Well, thank you, Jeff. I think one of the things that’s important to remember here is the speed at which this thing occurs. I mean, specifically de dollarization. The reason I want to start off with this is because for literally decades now, many conservatives, especially fiscal conservatives, have been saying that we are on the precipice in terms of runaway government spending and financial collapse here in the United States, etc. And while they’re right about the trajectory, they’ve been completely wrong about the magnitude. And by being hyperbolic and saying things like, Oh, we only have a year or two until things go south, or Once we hit this % of debt to GDP, things are going to go south, etc. And so every time that hyperbolic messaging is incorrect, what happens is more and more people start to ignore the warning signs, and more and more people think, Oh, this is fine. This is sustainable. No big deal. I think we’ve seen the exact same thing with de dollarization, except probably to an even greater extent because it’s been going on for so long. I don’t just mean de dollarization has been going on for so long, but all of the things that are going to cause de dollarization have literally been going on for decades.

Now when you have an administration which, frankly, has no respect for the dollar, either at home or abroad, they are et’s take those two things. At home, they’re devaluing the dollar at an astonishing pace. We’ve heard time and time again, fastest pace in 40 years. But also if you look at the trend of the consumer price index over the last year, it’s been rising very steadily at an annualized rate of 3 %, which is different from the annual rate of 3 %. The annual rate is just the change over the last year. But the annualized rate would be if you look at individual months over the last year or the last 13 months, you see it’s astonishing how steadily prices have been rising. What I’m trying to get at here is that 3 % inflation is the new normal. There is no indication that things are going back down to 2 %. We have not been trending towards 2 %, we have been trending towards 3 % and we’ve arrived. And again, there’s no indication we’re going lower. So that’s the mess at home. What about abroad? We have taken the unprecedented step of seizing dollars that do not belong to us.

We have taken them from the rightful owners. We are threatening to now get gift them to other third parties to whom they do not belong. And now you also have a lot of countries around the world who disagree with the Biden administration on a variety of issues, whether it’s global warming and fossil fuels, whether it’s abortion, whether it’s laws related to sexual behavior, whatever the case may be. You have a lot of countries right now scared that the Biden administration is going to take similar steps and seize their own dollar reserves, for example. What all of this does is it makes people painfully aware that the dollar no longer holds its sacred place in monetary policy, and it has become a political weapon. And as such, it is subject to forces that are essentially at odds with the monetary system. And this is where things like gold, like Bitcoin, really stand out because I don’t care whose image is stamped on a gold coin. And I don’t care in what country a particular Bitcoin was mined. The fact is that these things are universal and they are entirely apolitical and they have no loyalties, traits which are highly advantageous, again, for a monetary system.

And so as people begin to reevaluate the dollar as the reserve currency status, you see moves like we’re seeing today where countries are beginning to move away from using the dollar for settling international transactions. They’re beginning to use their own currencies. And all of this is happening right now, very, very slowly. And it will probably continue to go slowly for a while. But eventually it does pick up steam. And when it does, it happens incredibly quickly because once everyone realizes… It’s like a bank run. Once everyone realizes the gig is up, everyone rushes for the exits at once. And there’s not enough left to pay everyone, just like in a bank run. So that’s where you get your hyperinflation scenario. And as everyone is rushing for the exits, most people don’t make it out of the building. Most people either get trampled or they’re stuck when it collapses.

Jeff Deist:

But EJ, here’s the thing. If you’re China, for example, China has unbelievable amounts of dollars that which it obtains by selling us cheap stuff at Walmart. China has lots of treasures. It’s like a game of musical chairs. If the dollar were to plummet expeditiously, then China itself would be harmed. In other words, this is what classical liberals have always argued is one of the great things about trade is it actually reduces friction between countries and decreases the likelihood of war between them because goods and services are crossing borders and that we need China and China needs us. So I wonder what the calculation would be among CCP leaders who clearly don’t like us and view us as an adversary. But nonetheless, if you look at the amount of Chinese imports into the US, they’re in bed with us.

EJ Antoni:

To a certain extent, yes. But as much as there’s a lot of talk today in the United States about decoupling, you have to wonder what is going on behind closed doors in China and if they’re having similar conversations because China is reversing what they were doing 20 years ago, for example, when they couldn’t get enough US debt and were gobbling up every treasury they could. They’re doing the opposite now. They have been liquidating their position, not only by allowing the runoff of securities. In other words, as they mature, those securities are not being replaced, but they have been actively selling as well. And they’re only a few years away from completely eliminating their entire position of US treasuries. So I’m not sure that they’re nearly as closely tied to us as they were in years past. But to your point, Jeff, we really are truly moving in or returning, I guess, to the age of begger thy neighbor economics, where instead of free trade, instead of this idea that, look, you and I are both better off if we specialize in something and trade with one another for what we need. And that reduces the chances that we’ll ever fight against one another because we become interdependent.

A lot of that is going away. And I don’t think actually it has anything to do with nationalism. Nationalism, I think, gets the bulk of the blame. But I don’t think it has anything to do with that at all.

Jeff Deist:

I don’t know if anybody caught earlier today, Tucker Carlson interviewing some of these presidential candidates, and he had Mike Pence on. And the bellicosity that Pence has for China, he’s talking about how they’re building an aircraft carrier every day or every month or something. It’s like, Well, to go where? Are they going to fly it into the Gulf of Mexico and put it off the shore of Galveston? No, that’s what we do in the South China Sea. So it’s interesting that someone like Pence, we talk about why would the Chinese ever do that? Well, because they hear complete psychopathic morons like Mike Pence speaking about them as though they are some absolute devil that can’t have rational interests with respect to Taiwan, for example, that they’re just complete monsters and there’s no reasonable explanation for this. So in many ways, given the US foreign policy record of the last many decades, which, by the way, aided and abetted by this world’s reserve currency status, in a sense, you can’t blame the Russians and the Chinese for seeking alternative arrangements, to put it mildly. David, I want to get your thoughts. I know you said sent me a couple of articles from Kitco and everything.

What’s your take on how fantastical this is or how real this is?

David Waugh:

I really liked EJ’s point about the duration of how all of this will play out. I think that these things take a lot of time. BRICS itself is pretty new. I think that they’re still admitting members, getting trade agreements signed. And I think that all of that stuff needs to play out before they fully launch a currency. And then there’s also the question of is this going to be almost a similar way to CBDCs? Is it going to be wholesale or retail? I think that it makes, from a geopolitical perspective, rolling out a gold backed retail currency is just way messier than one just for trade settlement. So I think how I’m interpreting it, at least how it’s been proposed is for trade settlement. But I think that the largest driver of this is the threat to the US dollar as we’ve gone over is it’s domestic, it’s not foreign. It’s not like this isn’t really an attack. This is a response, I think. And I think that it could happen over 10, 15, 20 years. I think we could see this rolled out maybe in the 20 30s. So I think it might sound like hype now, but if we continue on this trajectory, I mean, Biden is talking about basically making Ukraine a forever war, that’s really expensive.

The interest payments on debt, basically our monetary and fiscal situation are creating this domestic attack on the dollar rather than some foreign attack.

Jeff Deist:

Yeah. And I think even our friends, but certainly our enemies. And again, we’re talking about we’re using the political euphemism, countries don’t have interests, countries don’t have enemies. But the political class has interests and enemies collectively. Let’s look at it that way. But if we think of China or Russia, the way Mike Pence does as an enemy, they know that we will never, ever get our fiscal house in order. If you look at the United States federal government budgets since, let’s say, really the ’30s, but certainly the ’60s, the Great Entitlement era of LBJ, the spending has increased so rapidly and without regard to tax revenue because of our ability to paper over deficits using treasuries, which are held the world over as virtually a kissing cousin of the dollar itself. I mean, holding a treasury is really only one tiny step removed from holding a physical dollar, at least in terms of the world’s view of treasuries. The world knows we will never get our fiscal house in order. We will continue to spend, spend, spend, regardless of tax revenues. Our members of Congress will continue to consider our job to police the world.

They’re still locked into this idea that there is a unipolar arrangement now since the fall of the Soviet Union and the United States is the unrivaled king set to basically run the world and act as a beacon of freedom. And of course, the BRICS arrangement or the BRICS proposal, to the extent it’s happening, is a recognition actually that we’re moving into a multi polar world and that there are regional interests that no longer align with the United States. Now, David, you bring up this idea of a trade settlement currency. Look, that’s very different. If you created a currency that had gold backing to some extent and just used it between certain member nations of the New BRICS currency and only to settle between them. That’s very different than what we think of as a gold backed currency in the classical gold standard sense of things where even an individual could literally exchange paper currency for gold in return. Now, sometimes that was at a fixed exchange rate, which caused a lot of problems. We don’t need a price fixing scheme. We need that to float independently in a free market setting. But nonetheless, there was a brilliant period in the history of the West where paper money was physically redeemable in gold.

But not coincidentally, that was also an era of huge technological progress, material and economic progress, and really a golden era, the later part of the 1800s into the early 1900s. In my opinion, anyway, that is not at all a coincidence. But when we say a gold backed currency and when we read some of the hype on Twitter, that’s what most of us think of. But when we look at this proposal a little more closely, the idea of a trade settlement currency where it’s really the redeemability in gold is only between the central banks themselves of the various BRICS currency members, then that’s a very different matter. I mentioned earlier this article at goldmoney. Com by Alastair McLeod called the Bell tolls for Fiat. It’s dated July 12th, just a couple of days ago. He was going to join us. Unfortunately, he was traveling today. But it’s really a brilliant article in that I don’t agree that this is happening in the way Alistair does. But nonetheless, the way he lays out the mechanical possibility, how this might unfold as a trade currency is really interesting. And I recommend the article to you. Ej, this idea of the mechanics, there are questions as to how this might…

What percentage of gold would be required? What would be the issuing entity? Would the members actually have to turn over some of their gold from their central bank to be housed by the issuing entity, or would they just keep that within the physical confines of their own central banks or treasury vault and basically pledge it as a percentage back ing to the new currency? These are all very fraught, I think, mechanical questions. And moreover, while we might, in the West, say Russia and China have a vested interest in unseeding the US dollar between themselves, they may have very different geopolitical interests and might not be so eager to trust one another and just turn over physical gold to a new issuing entity?

EJ Antoni:

All really good questions, Jeff. For the mechanics of this, though, there’s a surprising amount of flexibility. I think part of that is explained by a story of a depositor in New York City in the 1907 panic, and he was worried that his bank did not have enough gold to actually be able to redeem his notes in specie. In other words, that he could take his bank notes, the precursor to the Federal Reserve notes, and that he could not actually turn those bank notes in and get physical gold. So even after JP Morgan & Company had essentially announced a rescue of this man’s financial institution, he was still worried, so he went and got about $2,000 worth, which back then was a lot. Today it’s only about an ounce of gold, but back then it was many ounces, and tried to withdraw 2,000 ounces of gold. And as soon as the teller put all of the physical gold coins on the window ledge for him, he didn’t want it. Why? Because he just wanted to know it was there. Essentially it’s so much easier to transact with paper, for example, or just digitally with ones and zeros that you don’t want to actually have to lug gold around.

So the value of the currency is not the fact that it physically handicaps you by making you move around bits of precious metal. It’s that it provides a breaking power to government’s ability to simply inflate away the currency in order to pay for unfunded government spending. So All right, with that in mind, mechanically, how do we make something like this work? Well, countries’ currencies today already have floating exchange rates with gold. So countries can simply just begin buying gold at whatever the exchange rate happens to be for their given currency. And then they will then use that gold to issue a currency against that gold. In other words, let’s say I have 100oz of gold and I want to set a price of this new currency, we’ll call it the new dollar, at one new dollar equals one ounce of gold. I can now hand out a hundred of these new notes, this new currency, this new dollar, to different people and say, you now have a claim against this ounce of gold that I will basically just keep here for safekeeping. And maybe we can give some limited circumstances under which you can actually withdraw that gold, whatever the case may be.

We would do that mostly just to reduce transaction costs as opposed to saying, no, you can’t get your gold because I’ve secretly lent it out to other people. That’s a fractional reserve banking system. Again, with that in mind, you now will have multiple countries, in this case, the pseudo alliance of BRICS. You have multiple countries now who have all issued the same new currency with the same amount of gold backing. And so it’s very easy for each of those countries to keep the gold in their own vaults and not have to move it around at all. And this is remarkably similar to what we saw under Brett and Woods, but even before Brett and Woods, the pound exchange standard that we had in the late 1920s, and even before that, the full blown gold standard. So the notes themselves simply tell you that this is gold and it can’t be inflated away, which again is the real value of it. And again, going back to Bitcoin, Bitcoin represents that same promise. Bitcoin doesn’t have the advantage of gold where it has inherent value. You can’t use a Bitcoin, for example, in industry for jewelry, whatever the case may be.

But it has the exact same property of gold where a government can’t simply just at will create it and devalue the assets that you already have. Again, in terms of the actual mechanics, though, you could conceivably be in a situation where these countries don’t trust each other. And that’s actually okay, too, because if they don’t trust each other, then what you can do is simply just say, Okay, in international trade or whatever, I actually am going to give you this new currency and I want the gold for it. And that threat, much like in the gold standard or even the gold exchange standard, that threat also provides a limit as to how much of this currency countries can issue without being called on the carpet and frankly, getting caught with their pants down and having to admit, oh, we don’t actually have enough gold on hand here. It is the threat, if you will, that makes this all viable.

Jeff Deist:

Well, I think it’s worth noting, David, Devil’s advocate, there’s a Bitcoin or critique of all this, of course, of gold in general, but a gold currency as well. And that is first and foremost, that gold is big and heavy and cumbersome and expensive to maintain and guard in a vault, expensive to assay for purity, and very expensive to ship and move about for settlement purposes. Whereas Bitcoin, you can press a button and basically instantaneously send stats. But I think the digital world solves a lot of this. The digital world says, We don’t really need to move physical gold around. And if you read Alastair McLeod’s proposal or idea, the member nations wouldn’t even move their physical gold from their central bank vault into some centralized holding something. They would get a credit for it and pledge it. But of course, possession is not intense to law, as they say. So that would indicate that, let’s say, the Chinese and the Russian s, they were willing to engage in this new currency, but they weren’t 100 % sold on it. And they’d like to keep their gold under their own control. Thank you very much. And the additional Bitcoin critic critique is that since gold is big and slow and heavy and cumbersome and expensive to move.

It sits there. Of course, you want to issue paper certificates for that, which are a lot easier to go out and trade with in the real world. But over time, that opened up the former gold standard and basically converted it into something that central banks controlled and ultimately national governments controlled. And then the paper became the thing unto itself. Instead of the representing redeemable in the thing, the paper became the thing. These are critiques that Bitcoiners make. But nonetheless, when we look at this proposal, we do know, to be fair to Mr. Mcleod, that particularly the Russian Chinese, Indian central banks have been on gold buying sprees over the past many years, even before COVID, but it’s accelerated since COVID. Now, the United States and some of the European countries are still well ahead of them in terms of physical gold holding, or so we’re told. It’s very hard to know that for a fact, but so we’re told. We know that the United States probably has the most. So Thorstein Dr. Paulett, Thorstein Paulett, he’s having issues with his phone, internet. He’s in a hotel in Switzerland. But if you’ll bear with me, he asked if I would read something.

So just consider this in his German accent for us because I specifically invited him because I’d seen him interviewed a couple of times, I believe, in the European press just over the past couple of weeks on this issue. So here’s Dr. Paul, he says, how might the BRICS manage to Swim Away From the US dollar? No details are available yet about how the currency might be structured, but it shouldn’t stop us from speculating about what lies ahead. And here’s his idea. The BRICS could establish a new bank, the BRICS Bank, funded by gold deposits from BRICS Central Banks. The physically deposited gold holdings would be shown on the asset side of the BRICS Bank’s balance sheet, the individual balance sheet of these member countries, and could be denominated, for example, brix gold, where one BRICS gold represents one gram of physical gold. So this would actually bolster the asset side of the balance sheet of these countries. He continues here, The BRICS Bank can then grant loans denominated BRICS gold, for example, to exporters from BRICS countries and or to importers of goods from abroad. And it could also accept further gold deposits from international investors.

You can hold interest bearing BRICS gold deposits this way. So here, Dr. Paul, it’s getting us a little away from just the pure governmental trade currency and actually bringing private parties into it. So that’s interesting. I hadn’t heard that explained. BRICS Gold could henceforth be used by the BRICS countries as international money, as an international unit of account in global trade and financial transactions. Incidentally, the new de facto gold currency would not even have to be physically minted, but could be and remain an accounting only unit while being redeemable on demand. So guess what Dr. Pollet is saying here is that you can simply use the digital accounting unless and until a redemption demand is made. And I think that probably makes sense. However, the transition, the use of BRICS gold as an international trade and transaction currency would most likely have far reaching consequences. One, again, I’m speaking for Dr. Paul, it would presumably lead to a sharp increase in the demand for gold compared to current levels. You can hear the gold bug salivating. Oh, my gosh, $5,000 gold. With not only gold prices measured in US dollars, euros, etc. But also in the currencies of the B Ricks countries, increasingly, increasingly substantially.

So there’s a run up shot for the BRICS. Two, such an increase in the gold price would devalue the purchasing power of the official currencies, not only the US dollar, but also the BRICS currencies against the yellow metal. Also, the prices of goods in terms of the official fiat currency currencies would also most likely skyrocket, debasing the purchasing power of presumably all existing Fiat currencies. So what he’s saying here is even the Fiat currencies of these new BRICS member countries would be affected, which, of course, makes sense. I mean, there’s no reason for them to be exempted. So again, another weird geopolitical reality where it’s in their interest in maybe the long run, but it’s painful in terms of their short term interests. And it’s like a game of musical chairs. Number three from Dr. Paul, the BRICS countries would build up gold reserves to the extent that they run or will run trade surpluses. Well, we know China certainly does that. They would presumably be the winners of the currency switch while the countries with trade deficits, first and foremost the US, would lose out. Another reason for the Mike Pences of the world to maybe even lash out militarily against something like this.

By the way, the BRICS Gold Reserves amounted to 5,452.7 tons in the first quarter of 2023. Market value around US$ 350 billion. So that’s not a lot, folks. The rough US dollar value of all physical gold in existence today, which is almost all physical gold ever mined and refined, by the way. Gold never really goes away. It’s about $13 trillion. So 350 billion US dollars against that broader market of 13 trillion isn’t all that much. But it’s enough to stake a currency, I would imagine, not on a full 100 % basis, but on a percentage basis. Continuing in Dr. Pollett, these few considerations already show how disrupting the topic of creating a new gold backed international trading currency could be. The BRICS could well trigger landslide like changes in the global economic and financial structure. Those are comments from Dr. Paulett, who is a cautious guy and no bomb throwers. That’s very interesting. I don’t know if you saw, but Janet Yellen was in China recently, was asked about this by a reporter, and she said, Oh, don’t worry about it. We’re confident the US dollar is going to continue to be the major player.

And she’s probably right. A lot of people like me who think like me were claiming doom for the US dollar back in 1971, and that really didn’t happen. So you put all this together and you really see that this is an idea I think, who’s talking about time has come in that the US dollar, both as a tool of profligacy here at home and a tool of empire, a bludgeon abroad, not only in terms of our own far flung military empire, which we generally fund with deficits, but also in terms of all the money we use as carrots and sticks to bribe other countries, to do our bidding, to give them all kinds of weapons. Look what we’re doing with Ukraine right now. So it’s definitely an idea whose time has come. The question is whether it could actually be implemented. And Dr. Paul, I think, brings up some pretty interesting questions. So even even if this is not at hand, the idea that the ball could get rolling today for something that takes place 20 or 30 years hence is certainly not that incredible. I mean, in the early 1980s, if you had gone around saying, Oh, the Soviet Union is about to collapse and it’s going to be just a unipolar Uncle Sam driven world, people would have absolutely thought you were crazy.

So sometimes nothing happens until it does.

David Waugh:

But we.

Jeff Deist:

Had Daniel with us earlier. I think Daniel had to fly. But let me go back to David Waugh. How about the geopolitics? I’m not going to beat up on Mike fence anymore. I got that out of my system. I’m feeling better. What are the realities, apart from the mechanics, of whether Uncle Sam would stand by and all of a sudden see, for example, Iranian oil priced in a BRICS currency. Presumably, we would have a response.

David Waugh:

Yeah. And I think that it’s interesting seeing the Ukraine conflict play out in American politics because it definitely hasn’t garnered the same immediate support that something like the Iraq War did. T he propaganda push really fell flat to some extent. In certain areas, you drive around and you see Ukraine flags everywhere. But I think that the appetite for escalating conflicts abroad has really declined in the United States. And I think that another thing that’s interesting is as this continues to play out, I think politically, you could almost see camps emerge around basically dollar supremacists and then people that want sound money, whether it’s Bitcoin or gold. And I think that’ll be really interesting to see politically because I think that historically, the demand for sound money has doesn’t really come from top down, it’s come from bottom up. And that’s why I think this whole BRICS discussion is very interesting because I think that it does seem really odd that top down leaders would impose something for retail that resembles a sound money. So I think that ultimately the desire to do that, it doesn’t make sense from my perspective. But in turn, terms, back to geopolitics, I think that it will be interesting to see how…

The market where I would look for this is energy trade. I think that if energy continues to move away settlement for oil, basically, in dollars, then I think something like this makes more sense. It continues to harm people who like dollar, basically dollar supremacy. And I think there will be people that will call for escalation. But what’s unknown is how much power they’ll have.

Jeff Deist:

That’s actually a great point about the bottom up versus top down. Again, when we talk about whether the US would allow this or whether the US would oppose it, we’re talking about the political class. We’re not talking about us. And I think you’re correct. Gold bugs, for God’s sake, have always been very bottom up. Not always the most sophisticated people financially, not the wealthiest. Wealthy people certainly hold gold. As a matter of fact, they hold a lot more than they lead on, even as they are very dismissive of gold bugs. But nonetheless, adjacent to the political class is the banking class. And the banking class has always benefited enormously from leverage, from the dollar status, from arbitrage, a million different ways that one can play against that a sound currency would eliminate. In other words, there’s all kinds of financial incentives for the banking class to keep the US dollar system and the ultra leveraged, many multiples credit thing going forever and ever because the wealthiest elite in the US have all benefited from that. I mean, if you look at even people who are not just financially engineering things, even people who have created actual productive companies that make our lives better, that produce a really valued, good service.

I would let’s say Jeff Bezos. To me, Amazon is an absolute wonder and a miracle. Washington Post, not so much, but okay, he’s got to have a hobby. Even there, what’s the share price of Amazon? How juiced is that by monetary and fiscal policy versus the actual productivity of the company? That’s always the question. And economists are supposed to help us see the unseen. Okay, we know a share of Amazon cost X. Oh, great. Wow, blue chip. But what would a share of Amazon be absent all the fiscal monetary machinations? Not to mention the COVID shutdowns, by the way, political machination of the last few years. We don’t really know. It’s very hard to say because we don’t have a sound money yardstick to weigh it against. All we know is number go up and if it go up faster than other numbers, that’s a good investment. And so our dollar policy, our express policy of inflation, inflationism as a goal of the Federal Reserve, has pushed people into the stock markets to chase yield. And what has that meant for Amazon stock, for example, and Jeff Bezos’ personal fortune as a result? It’s very hard to say, but I think we could, those of us who are critics of central banking per se, not just as practice, would have a colorable argument that Jeff Bezos’ net worth is probably juiced above and beyond the value he’s created for society.

And remember, Amazon doesn’t really make money. It’s cloud services, which unfortunately sells to spooky government agencies, makes money. But its day to day delivery does not. When you get that toilet paper sent to your house overnight, you say, Oh, my gosh, this is so great. Well, part of the reason it’s so great is because it’s losing money. So that to me is a very interesting point. This bottom up versus top down. People, Bitcoiners and gold bugs, it’s in our interest to have a sound currency so we don’t have to go out and twist ourselves into pretzels chasing yield in financial markets, which we don’t really understand ably or capably as individuals, much less going up against algorithmic traders. Most people lose their shirts in the stock market. That’s just a fact. Well, maybe they may not lose their shirts. Most people lose money if they go out and try to actively pick stocks as opposed to an index fund with Vanguard or something. I think that is something we could say. And I would argue that a big part of that is the fact that we have this unstable currency, which people have to go out and juice for leverage or for yields.

And that’s been a very harmful thing to the United States, not a good thing. So what hen we see a black rock creating an ETF for Bitcoin, that starts to make you worry that the Bitcoin enthusiasm has been packed into by some bad actors. But nonetheless, I think Bitcoiners and gold bugs can agree on the fundamental problem and the fundamental solution. And we can hardly blame the BRICS countries for floating this and for trying to rattle US hegemony. Why wouldn’t they? Why should they just put up with this with Uncle Sam’s dominance forever and ever? So that said, EJ, I want to get back to you on… I want to ask you to weigh in on hype versus reality. Is this something that’s far off, if ever, or is this real?

EJ Antoni:

It’s certainly real. We’ve already seen examples just in the last couple of months where countries have actively taking steps to de dollarize. That part of it is real. In terms of the collapses is imminent, that part of it is the hype. We don’t know where the point of no return is. At some point, you do get close enough to the falls that your momentum is just going to take you over. That’s when you’re basically in the panic stage. But until then, tulip o mania is real. This idea that somehow this can’t be happening because it’s irrational. Hey, the market can stay irrational longer than you can stay solid, as a man once said. So I don’t have any doubt that we are moving in the direction of de dollarization. Almost all, not just indicators are looking that way, but also if you look at what we are doing as a nation, both at home and abroad, it is pushing other countries to de dollarize. And there are viable alternatives today. You have not just gold, but you have Bitcoin. So you have things that are decentralized. You have things that are universal and can function as money.

And so when you have those kinds of advantages versus something that is highly manipulatable and has been highly manipulated, such as the dollar, it’s no wonder that people are moving, I think, in that direction, which is away from the dollar. And two alternatives, again, things like Bitcoin, things like gold. In terms of speed, it may sound like a cop out, and I apologize to the listeners if that’s how they take it, but it’s not. We just don’t know the speed. We don’t know how fast we are approaching that change. And I think it’s foolish for us to try to guess. But what we do know is that we are moving in the wrong direction if we want to try to keep the dollar as our reserve currency. One thing I’d like to say, if you don’t mind, regarding if we get an alternative currency that is backed by gold, let’s say that absolutely is going to increase demand for gold. I agree with that 100 %. One of the reasons why gold prices has never shot up as much as anticipated when Nixon closed the gold window, although they did rise just not as much as anticipated, was that there was a tremendous amount of gold that was being used strictly for monetary purposes, and it was no longer needed for that.

So it was available for industry. And as a consequence of that, you actually decreased some of the demand for gold and paradoxically kept the price lower than it otherwise would have been. And you would see the reverse of that if we moved back to gold for monetary purposes. But one thing I don’t agree on is this idea that somehow other currencies… Let’s not talk about the dollar because you have the reserve currency issue, which would obviously see less of a demand there for dollars. But if you take another random currency that’s not a reserve currency around the world and you switch to gold, would that currency inherently become less valuable? Not necessarily. Would the price of gold in that currency go up? Yes, but that’s because demand for gold is going up. But would the price of bread in that currency, for example, rise? No, not necessarily. Because if the demand and supply for that individual currency hasn’t changed, then you wouldn’t expect to see the monetary phenomenon of inflation in that currency. I hope that wasn’t too much of a tangent there.

Jeff Deist:

Not at all. David, real or hype?

David Waugh:

I would say that demand for sound money, real, whether it comes in the form of BRICS I would actually say, it would almost seem ludicrous for these countries to come out and make all of these statements and meet and set up their own basically alternative G7 and for that to just totally fall flat. So I think that’s ultimately real. I don’t know how long it will take. One additional factor that I think is interesting, going back to the bottom up point, is that if you look back at the ’70s, people in America weren’t even able to buy physical gold until 1975. And now we have a regular American can buy physical gold and real Bitcoin. I know that, like you said, BlackRock is trying to make a Bitcoin TM and do the classic Wall Street repackage of something. But I think that that’ll be interesting to observe as well.

Jeff Deist:

Thanks, David. But we’ll wrap this up. I would comment that gold and Bitcoin are not the only options. Watch what humans do, not what they say. There’s a lot of worry out there about the US dollar and inflation, even here at home. And so there are lots of things people put their money into, apart from, let’s say, stock markets or bonds, which have been just miserable this year. The stock market has been great. But physical land, commodities. There’s all kinds of ways to buy commodities, futures, ETFs, etc. All kinds of stuff. I mean, people might put money into prepping. People might put money into trying to produce some vegetables in their home. People might put money into firearms or canned food. There’s all kinds of ways that people try to buy real stuff with depreciating dollars. And if you go read When Money dies by Adam Fergusson about the hyperinflation in Weizmann era. Austria, you will see just how quickly people exchange paper for stuff. And that could be anything. Again, not just gold or Bitcoin. It could be anything. I mean, people were selling musical instruments, people were selling clothing. It’s really a grim book.

And the idea that it can’t happen here, I think, is false. It could happen here. I’m going to have to put myself in the hype camp. I’m not as sold on de dollarization. I would personally subscribe more to Brent Johnson’s dollar milk shake theory. That’s a whole another show. Maybe we’ll have him on sometime. But if you go look that up, I think a lot of what’s going to happen, at least in the near term, is probably actually strengthens the dollar because everybody else has been worse. And when it comes to creating a gold backed currency, regardless of the percentage of backing, now that takes real discipline. You have to purchase more and more gold and you have to exchange whatever you have to exchange for that. And then that gold is sitting there. You’re not building skyscrapers or paying entitlements or doing other things that might make your citizenry happy. And it takes real discipline to have any redemption. It means you have to not spend nearly as much as most governments would like to spend. If you look at it, particularly the Chinese central bank, over the past 20 years, let’s say, it’s really been worse even than our own central bank.

So I’m going to put this down as hype, but I certainly look forward to continuing to read people like Alistair McLeod. Jim Rickards on this. And I think we’ll all be watching what happens in Johannesburg in August to see if there’s anything more about this or whether it fizzes out as a news story. And we’ll certainly be watching our own government’s response to all this. So thanks, everybody. Our hour is up. Every Friday at two o’clock PM Eastern, Monetary Metals, I host a Twitter space on money and monetary policy issues. So set it on your calendar and join us on Fridays. I want to thank EJ so much. I want to thank David so much. I want to thank Doris so much. I’m sorry about his troubles with his throne, but he promises to come back on another space. So everybody, have just a fantastic weekend. We’ll talk to you soon. Bye now.

Additional Resources for Earning Interest in Gold

If you’d like to learn more about how to earn interest on gold with Monetary Metals, check out the following resources:

In this paper, we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF – GLD, and mining stocks against Monetary Metals’ True Gold Leases.

The Case for Gold Yield in Investment Portfolios

Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold pays a yield? This paper answers those questions using data going back to 1972.

Leave a Reply

Want to join the discussion?Feel free to contribute!