Deutsche Fuels Silver, Report 2 October, 2016

Last week, it was the Fed’s magic boosting up the price of silver. This week, the slow slide in the silver price resumed, going all week except during peak fear about the woes of Deutsche Bank. When it looked bleakest—and the potential size of the capital-eating fines was highest—there was a wicked little rally in the metals, spiking silver up from below $19.10 to $19.70 in a few hours. However, the price reversed just as fast, on news of a settlement with the US Department of Justice.

Folks, what do we know about the price of the monetary metals? But if we had a thought, it would be that when the real run on a major too-big-to-fail bank occurs, the primary flight will be into the dollar, with some capital flows into gold. There will be a rising gold-silver ratio. Not a good time to bet on silver.

In any case, that does not appear to be happening just yet, or at least not the week of Sep 26.

In yet another variant of irony, our running inside joke-slash-point bears repeating for a third week in a row:

Just repeat after me: “the Fed makes the economy more stable.”

A major money center bank is in the throes of, well, the throes of something serious.

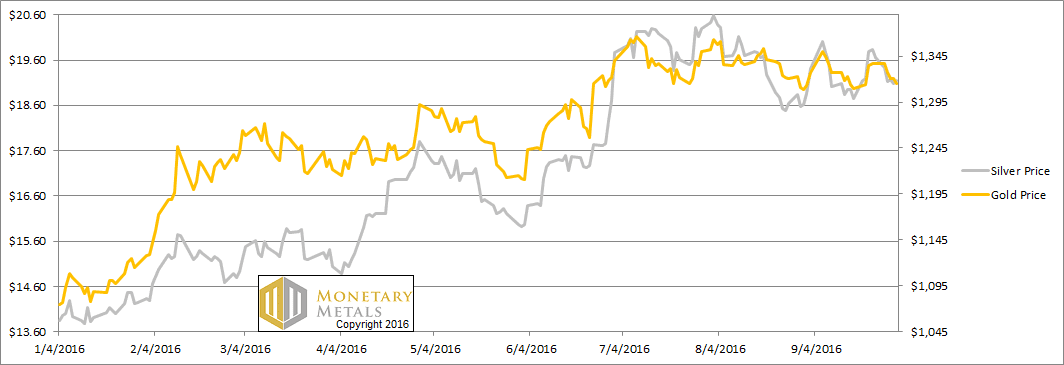

As always, the central question to be answered in this Report is simple. Is this a change in the fundamentals of supply and demand? Read on for the only true picture of the fundamentals of the monetary metals. But first, here’s the graph of the metals’ prices.

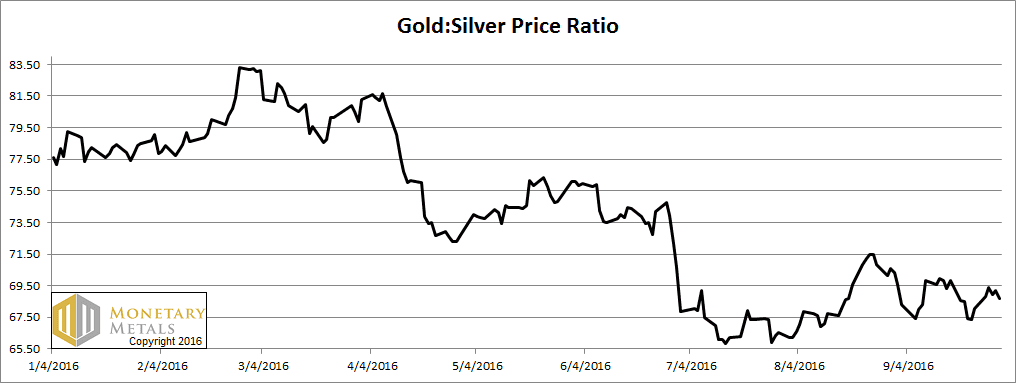

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It was up this week.

The Ratio of the Gold Price to the Silver Price

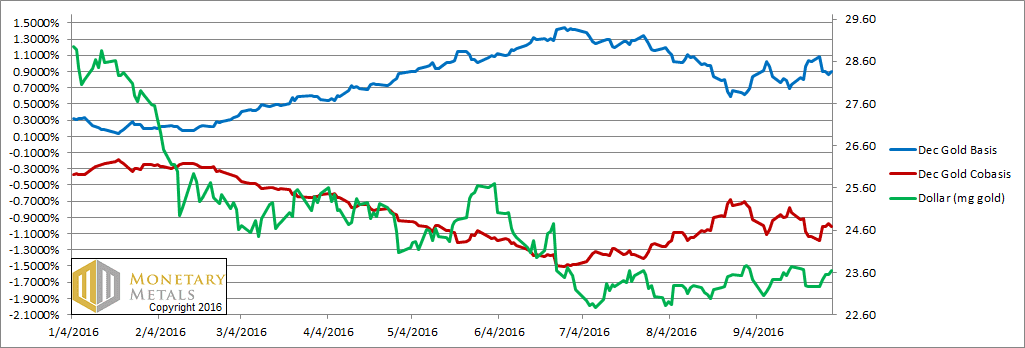

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

Well, the price of gold is down some twenty one bucks (seen as a small rise in the green line, which is the price of the dollar as measured in gold). With that, we see a small rise in the scarcity (red line).

The fundamental price that we calculate—the price at which the metal would clear, absent the leveraged speculators—is down $12, now below $1,300.

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

The price of silver fell greater than gold, in proportion. There was a slight increase in scarcity at the new price. But not a lot.

We calculate a fundamental price drop of 58 cents, to just above $16.

Yes, the fundamentals call for a price $3.30 below the market price. This does not mean to go out and short silver (we never recommend naked shorting a monetary metal). It does not mean that the price of silver will drop immediately in the morning. If a rumor of crisis at Deutsche could cause the price to spike 60 cents last week, then it could cause it again this week. If traders have simple heuristics of what to buy and what to sell (the silver price chart looks a bit like the inverse of the Deutsche share price chart), then that will not likely change so quickly.

One thing’s for sure, silver is a lousy bet at this price with these fundamentals. Buying silver right now—at least if you’re buying it on speculation of a price gain—is almost the textbook definition of a Ponzi scheme. Previous buyers will only get their capital out if new buyers come along and bid up the price even more. But the only certainty is that one day, they won’t.

© 2016 Monetary Metals

Hello Keith,

I have two questions that I can not find explanation.

Why is the Sep Cobasis so much higher than LIBOR?

Also, the Gold futures curve is very stepened. The implied yiedls are very high compared to LIBOR.

Many Thanks ,

Antonio

Antonio, LIBOR is currently around +8% while the Cobasis is around -1.7%. So the Cobasis is much lower than LIBOR, not higher. But the basis is around the same level as LIBOR now, although it was above LIBOR last week.

As far as the implied yield curve being steepened is concerned, it might be because people who are warehousing gold are expecting higher LIBOR in the future (possibly from a supposed Fed rate hike). Therefore, they want to take a greater share of the profits from gold “leasing”.

Maybe Keith will have more to add to this. But this is what I’m thinking is happening, at least.

Nevermind. I just realized you were talking about the Sept Cobasis, not the Dec. one.

October 4, 2016

Smash of $42

Accurate time stamp for spot and futures Oct 04 2016 15:15:59 EDT

Spot Bid: $1,269.89

Spot Ask: $1,270.16

Gold Dec’16 Future Bid: $1,272.00

Gold Dec’16 Future Ask: $1,272.10

Days Till Expiration: 86

Dollar in gold: 24.49mg

Cost of carry: $1.84

Cost of de-carry: -$2.21

Dec’16 Gold Basis: 0.615%

Dec’16 Gold Cobasis: -0.739%

Sorry, I wanted to say basis instead cobasis.

Dec Basis is arround 0.9% (I was near 1.3%, so much above Libor)

3M Libor is 0.87%

Pizza Genie, How do you calculate the Basis? Do you take into account the storage cost?

Thanks, Antonio

Basis as it appears to be calculated:

Future (bid) minus Spot (Ask) = Cost of carry

{(Cost of carry ÷ Spot Ask) x 100} X {365 ÷ days to contract expiration) = Basis in annualized %

Storage costs, execution fees, exchange fees etc. would vary based on volume. It is probably best to calculate the basis/cobasis without them and then subtract them later after a “raw” profit for carrying or de-carrying has been established.

If I calculate it this way I get a DEC’16 gold basis of 0.633% at Oct 06 2016 22:40:47 EDT.

How have you been calculating your numbers differently?