Gold and Silver Divergence, Report 5 Feb, 2017

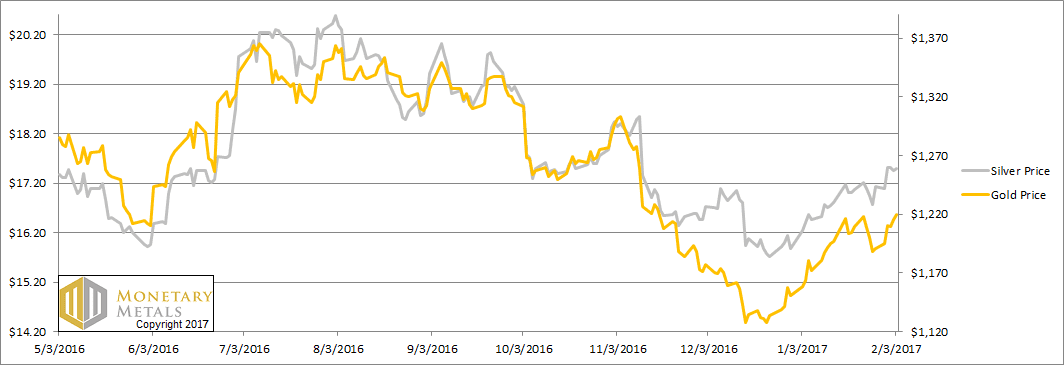

This week, the prices of the metals went up, with the gold price rising every day and the silver price stalling out after rising 42 cents on Tuesday. The gold-silver ratio went up a bit this week, an unusual occurrence when the prices are rising. Everyone knows that the price of silver is supposed to outperform—the way Pavlov’s Dogs know that food comes after the bell. Speculators usually make it so.

This will be a brief Report this week, as we are busy working on something new and big.

Below, we will show the only true picture of the gold and silver supply and demand fundamentals. But first, the price and ratio charts.

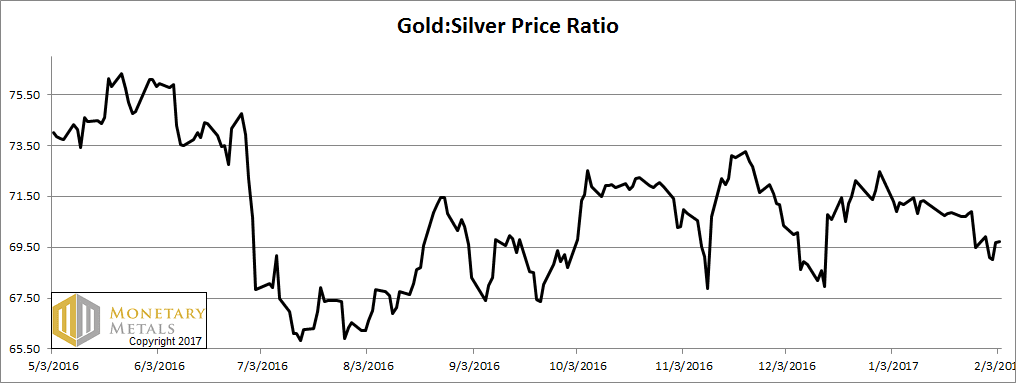

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It rose slightly this week.

The Ratio of the Gold Price to the Silver Price

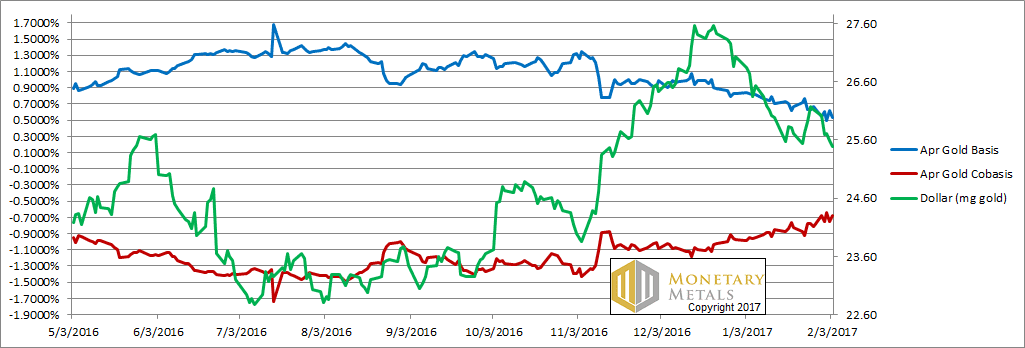

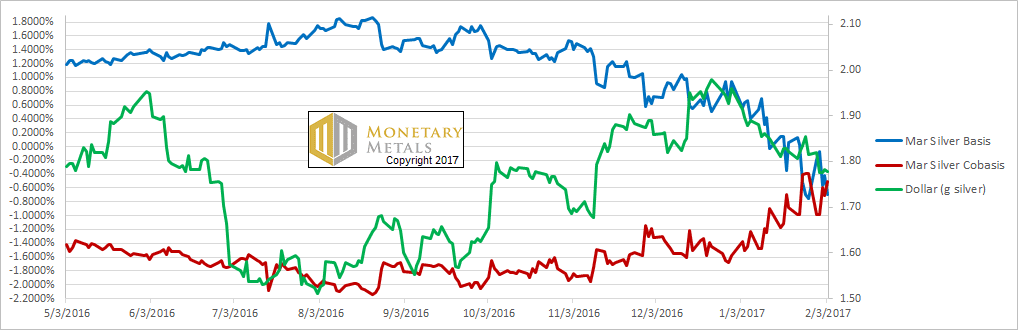

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

Do we have rising price of gold, up $25 (i.e. falling dollar, from 26mg to 25.5mg gold)? Yes. Do we have rising scarcity of gold (i.e. the cobasis, our measure of scarcity)? Why yes, we do.

This resumes the pattern that began the last week of December. The price of gold made a low of $1,127 (i.e. the dollar made a high of 27.6mg). Since then, the price of gold has been rising (i.e. the dollar has been falling) while the scarcity of gold has been rising.

Not a lot. Not Defcon 5, gold is going to spike to $10,000 (i.e. the dollar is going to crash to 3mg gold). Not a big obvious crisis-looking sort of move. Just a gradual move from -100bps to -68bps. What makes it significant is that it occurred with rising price. Gold is becoming scarcer as its price rises.

So far, this move has been driven by buyers of physical metal.

Our calculated fundamental price is up $40 to stay about $100 over the market price.

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

In silver, there is quite a bit more volatility in the basis. And though the March cobasis is up, farther contracts do not show the same move.

Our calculated fundamental price did move up a bit—15 cents. However, it did not keep up with the market move. So now it’s basically even with the market price. It turns out speculators did think that silver ought to outperform gold, and they tried. They caught up to and passed the buyers of physical metal.

We note that in the futures market, the open interest in gold turned down sharply starting last week. However, silver open interest diverged, and continued to skyrocket.

© 2016 Monetary Metals

Yesterday whilst reading ZeroHedge I spied this story:

Arizona House Committee Passes Bill To Support Sound Money

Knowing your history with trying to make this happen, I suspect you had something to do with moving the ball forward. The more one thinks about it, individual states moving away from FRNs to gold and silver specie seems about the only way to return to a responsible monetary policy, especially if the federal government refuses to do so. Thanks for your good work, Keith!

“busy working on something new and big.” Will this be something the retail investor be able to use, or is this another product for the “institutional” investor. As always thanks for the great work!

P “retail investor extraordinaire” Chapuis =D

Yes it will be something retail investors can benefit from.

“This resumes the pattern that began the last week of December. Gold is becoming scarcer as its price rises.”

Monster bullion flow via Switzerland into China/Hong Kong happened in December… and December imports into Switzerland from America were the highest since April 2013 (33mt) and from United Kingdom the second highest since May 2013 (148mt).

What’s interesting is the currently contrasting behavior of the basis/cobasis with that bearish period in 2013 and a similar West –> East dynamic.