Is Dollar Supremacy Over?

Join Jeff Deist and his guests as they delve into the future of the US dollar and its position as the world’s reserve currency. With discussions on the potential challenges from the Russian and Chinese perspectives, the risks of the dollar’s dominance, and the emergence of alternative currency arrangements, this episode explores the complexities and uncertainties surrounding the global economy.

Connect with Jeff and Monetary Metals on Twitter: @JeffDeist @Monetary_Metals

Additional Resources

The Dollar Milkshake Theory by Brent Johnson

“The Bell tolls for Fiat” by Alasdair McLeod

The Case for Gold Yield in Investment Portfolios

Podcast Chapters

[00:00:01]: Introduction

[00:01:27]: Is US dollar supremacy really over?

[00:02:45]: Alasdair Macleod

[00:05:42]: Joe Consorti

[00:09:46]: EJ Antoni

[00:09:59]: Geopolitics: US vs. Russia and China

[00:12:42]: The new trade settlement currency

[00:14:11]: Counterarguments

[00:21:02]: The concerns of a monetary war

[00:25:01]: The view of the Western banking system by China and Russia

[00:27:31]: The Triffin’s dilemma and the current crisis

[00:29:21]: The dollar’s entrenched position in the global economy

[00:32:06]: Allocating to hard money as an individual

[00:37:03]: India

[00:45:34]: Fossil fuels

[00:48:25]: Unreality in US policy

[00:54:12]: Subscribe!

Transcript:

Jeff Deist:

Good afternoon, everybody. This is Jeff Deist from Monetary Metals. I want to welcome everybody to our usual Friday afternoon Twitter space. Hope everybody’s ready for a great weekend. Hope everybody’s ready for a great topic, a great hour. So last week, we had a discussion of the B Ricks currency proposal. Our topic this week, our show this week, really dovetails with that in the sense that the flip side or the macro portion of whether the Bricks currency idea could ever work, if in fact it is attempted, really depends on this larger, broader macro question, international global question of whether the US dollar… But that’s what we’re going to discuss today. We’ve got some guests who are going to be joining us here momentarily. Interestingly, there’s been some new developments since that Bricks announcement. Various members of the Bricks saying, Well, it’s actually not going to be on the agenda during their August meeting in South Africa. So more evidence that perhaps it was just floated as a trial balloon, but we don’t know for sure. And there’s a couple of articles we’re going to be looking at because actually we want to have some diversity of opinions on this question today.

Is US dollar supremacy really over? And of course, by diversity, I mean the real kind people who have disagreements, not the fake kind. But nonetheless, back in January, Joe was the co author of a really interesting article called Reports of the dollars death has been greatly exaggerated. And just a couple of days ago on the 19th, Alasdair was the author of an article called Why the Dollar is Finished. So a pretty strong title by Alasdair. So I’ll just start off before I want to ask our speakers just very briefly, maybe in a minute or less, to summarize their view, their current view of the US dollar, because as I’m sure a lot of listeners know, the dollar index, the D XY index, which gages the US dollar against a basket of other currencies, the euro and about five others, including the Japanese yen, the British pound, has been on a steady, if not precipitous decline really since about November of ’22, so almost a year now, the dollar index is down. So maybe if we start with Alasdair Macleod, if everybody could just give a quick 30 seconds or one minute recap of where they think the dollar is right now.

And then we’ll get into the two articles I mentioned. So Alasdair, do you mind going ahead?

Alasdair Macleod:

The answer, basically is that the Russians and Chinese are now in a position where they want to destabilize the dollar. This is becoming very important as far as the Russians are concerned, simply because if you look at the exchange rate, that has been collapsing. If you look at interest rates on the bond yield, that has been rising. If you look at Russia’s surplus on the balance of payments, that has been falling quite rapidly. So they need action. They need action, and that action basically is to push up commodity prices, which put another way is driving down the dollar. Now, as far as China is concerned, they have switched their priority from protecting their export markets, if you like, to another danger. And that is that with higher interest rates, emerging markets are being destabilized. Of that, there is absolutely no doubt. Now, these emerging markets, basically, roughly 41 of them are meant to be attending this conference on the 22nd of the 24th of August in Johannesburg. It is immensely important for China to protect those countries from being destabilized by higher dollar interest rates. Now, she does believe that this is done on purpose as a matter of geopolitical strategy by America.

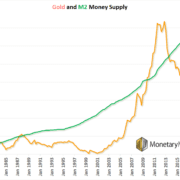

Now, Jeff, I think as an Austrian economist, you would agree with me that this is probably more a question of the bank credit cycle than that. But nonetheless, it’s what the Chinese believe that matters. Now, this plan for a new gold back trade currency has actually been well worked out by Sergey Glaziev, the Russian, who was appointed to do this for the Eurasian Economic Union back in February March last year. Now, he has obviously formulated his plans. It’s been working for some time. It’s actually quite a simple thing to do. That will come in and I think it won’t necessarily start on August 25, but I think you’ll find that the plans are actually quite far advanced. Now, that being the case, quite simply, there’s going to be, I think, a switch in many central banks’ reserve portfolios away from the dollar towards gold. So I think it’s good for gold, bad for dollar. And it’s just amazing that the inside knowledge, it seems to me, has tipped the dollar trade weighted down below that very, very important 100.5 level and essentially signaled that the next bear phase of the dollar is on us. That is a summary of the situation as I see it.

David Waugh:

I can’t add much to that, besides saying that the dollar and the gold are basically been maintaining opposite long term trends. So that confirms what you just said, Alasdair.

Jeff Deist:

Yeah. Let’s hear from Joe.

Joe Consorti:

Hey, everyone. Hey, Jeff, Alasdair, this is my first time hearing from you. So really well done there. I appreciate your perspective and I’m sure we’ll have a really good discussion today about the dollar’s future and where it’s headed. My view tends to be obviously long term bearish on the dollar, but long term bearish on basically all other government currencies. Of course, as they are faced with this ever mounting problem of ever increasing debt and hard money becomes more attractive, not just for individuals to own, but also for eventually central banks to allocate more towards and have that as a part of their foreign exchange reserves rather than other government fiat currencies. The way that I view it right now is that the dollars position at the top of the heap is cemented. I don’t necessarily view any gold backed currency as being one that could threaten the dollar purely because I don’t think we’re going to move globally into a regime of global economic growth that will allow for anything other than debt to be what backs that growth. I don’t think we’ll be able to be I don’t think we’ll be able to move into an era out of an era right now of a debt based economic system, a debt based monetary system into one that will be a hard money based, at least not without some very significant deflationary event where a lot of the global debt that underpins the global economy is unwound.

Jeff Deist:

And there’s a pretty painful de leveraging before we can have something like a hard money standard. So I tend to think that the dollar is going to stick around for a while as it has been. Reason being, of course, we both know that US Treasury is the most popular form of government debt around the world, and we know that it’s used as collateral by basically every major player on the world stage. And the way that I’ve analogized it, just to put it super simply for people is that make up the the foreign exchange reserves within big world governments. They’re not necessarily like a video game cartridge that you can unplug and then plug a new one in. They’re more so… Let’s take the dollar for example. Being around at the Bretton Woods conference and having the dollar agreed upon as the World’s Reserve currency postwar when we were really coming and building this new economic regime, we really hit the jackpot, frankly, because now in the year since, we’ve built this big, gargantuan spider web of interconnected economic relationships that all rely on the dollar to function. And because of that, we really hit the jackpot.

When I say we, I mean the United States, the US dollar, because now in order to unplug that would necessitate an unwind of all of those relationships. Like I said, it’s not really a cartridge you can unplug and plug it back in.

EJ Antoni:

I see now as remarkably similar to spring of 1942. We’re in a very precarious place. We have a lot of enemies around the globe. I don’t mean in the sense of militarily, but at least monetarily. And there are a lot of forces arrayed against us, and we are very much behind the eight ball. That’s not to say the dollar is doomed. That’s not to say there’s no recovering from this. But we certainly have a long way to claw back before we can achieve. So even just stabilizing the dollar for our own purposes as our own currency. That is the very quick and dirty version of my take at this point.

Jeff Deist:

Alasdair, could you start for us by just addressing this question of the US posed against Russia and China as competing hegements. What’s the geopolitics as you see it?

Alisdair Macleod:

Well, the geopolitics is quite simple, and that is that Russia and China have a common enemy, I’m afraid, in the form of America and her allies. And you’re particularly saber rattling over Taiwan and the Pacific and all the rest of it. Whereas, of course, Europe is very much tied up with the Ukrainian situation. Now, the Ukrainian situation, there’s so much disinformation. It’s very difficult to know exactly what people have heard. If you read the mainstream media, the Ukrainians are doing jolly well. But that’s actually a load of bullshit. They are on the losing end here. They are losing men at a horrendous rate. And not only that, but we can see that Putin now has got this situation where he can progress with it. It will probably bring in Poland in the final rush side, which we’re tipping towards World War III. Now, this is very worrying because certainly America and the NATO do not want to back down. They cannot back down. They’re in this situation where there are no negotiations. So the only way in which this can really be resolved is with a financial war. And I think this is a point which most people miss.

Alisdair Macleod:

And certainly, I find that American commentators think, I think we’ve seen this reflected in the comments just now that the dollar is the dollar, the dollar is there, everybody needs it. But just remember one thing. There is 32 trillion dollars worth of financial assets of which 7 trillion is less than one year, including about 6.5 trillion of deposits in foreign hands. This is more than the whole US GDP. That is the situation which Russia and China are resolved to change. And this is a very serious situation. The run on the dollar could be quite quick and really catastrophic. Because if you look on the other side of it, foreign equities are all in ADR form. If you sell your foreign equities, there is no currency transaction. The amount of according to the treasury tick figures, the amount of foreign exchange owned by domestic residents and their businesses in America are only to the tune of around about $650 billion. Now, so $650 billion plays $32 trillion. This is not a good ratio. And if you look at the way currency swaps work, they do not work in the quantity which is required to deal with this situation and support the dollar.

Alisdair Macleod:

So I think the danger to the dollar is being underestimated. Now, I do not dispute that the dollar is still going to be used for foreign transactions, but the whole point about this new trade settlement currency is it is actually easy to set up. And I’ve illustrated this in my articles, and not only that, but being restricted to trade finance and the purchase and sales of commodities across the members of the states, which would be an enlarged bricks come Shanghai Cooperation Organization, that can be priced in both dollars and also in this new gold currency. And using the new gold currency for these transactions will be mandated, I think, for the members of this new enlarged bricks come Shanghai Cooperation Organization. And incidentally, I think on the agenda will also be a proposal to merge the Shanghai Cooperation Organization with bricks, because if you look at the attendees, they are virtually all Shanghai Cooperation Organization members, associates and dialog partners, as well as quite a lot of South of Saharan Africa and of course, the whole of the Middle East. This is a very big deal. And I can see why, I can fully understand why, resident Americans just don’t see this danger.

Alisdair Macleod:

But believe you and me, this really is a danger and it mustn’t be underestimated.

Jeff Deist:

Joe, you talk about FX reserves, how Russia has lots and lots of US dollars, China has lots and lots of US dollars and US treasuries. Is that the counter argument here?

Jeff Deist:

Well, not necessarily. So there are a few things, and well said, Alex, there. I want to go into… So Russia basically has no US strategies anymore. Ever since, I think they peaked out at roughly 150 billion, 160 billion in 2010. And now they’ve dwindled to 2.1 billion, which effectively is nothing other than just general needs for some partners, just very minute cash management stuff. And throughout that time, the Central Bank of Russia, their FX reserves have ballooned to they have only risen in that time. So in the same time that they’ve dropped US treasuries, their FX reserves on that have risen. So it becomes a question of like, okay, what is still comprising their FX reserves if they’ve dropped US treasuries? Well, the reality is for Ruckub, 16 and a half % as of January of this year of their FX reserves are still in dollar denominated assets. So while US treasuries are no longer there, dollar denominated assets still make up a pretty good chunk, although they’ve decreased over the last two or three years, still a pretty good chunk of Russia’s FX reserves. And that paints the issue with dropping the dollar entirely.

Jeff Deist:

It’s a pretty tall order to stop you. Like I said, we basically are like the bedrock underneath the global economic machine that’s been building for over half a century. And so you can’t necessarily remove that bedrock without some pretty major economic pitfalls. And the way that I phrased it was that it’s a tall order to stop using the world’s primary settlement currency when you’re the only one abstaining from it. And therein lies the problem with other nations who are attempting to do the same. If you stop using dollars, even if you’re a big nation like Russia or China, okay, that’s awesome. But what about all of the other 250 some odd nations around the world that still use it and you still need to deal with them? So therein lies the problem. And that’s also the same issue that China faces. So China similarly dropped a lot of its US treasuries and now only holds 870 billion, whereas it held 1.3 trillion about a decade ago. So reducing those at a steady clip. But if we zoom out to world currency composition, so if we break it down to all of the globe’s FX reserves, what percentage of them is what currency?

Jeff Deist:

So what percentage of them is in gold? What percentage of them is in in all these other currencies? And over the last 25 years, almost since 1999, if you factor in things like gold, which on the BIS’s website is categorized as unallocated reserves, then the US dollar is basically flat at roughly 50 % over the last 25 years. So there was a trend from about 2000 to 2015 of de dollarization, where this percentage of dollars in foreign exchange reserves at central banks dropped from 55 % to around 30 %. But in the last decade, or in the last nine years, more accurately, it’s risen back up from 30 %, back up to 50 %. And so the reality is that in this world that we’re in, and if the issue is that the world is too much debt, and that’s the problem, and we’re a global economy that’s reliant on more and more debt, then the solution wouldn’t be to kneecap yourself and say, All right, we’re going to be the only players who don’t fund ourselves with debt, fund our expansion with debt, and particularly with dollar denominated debt, and then switch to something like a gold backed currency.

Jeff Deist:

And this reality is actually something that bricks themselves have faced. If you look at China’s bricks Development Bank, which the official name is the New Development Bank, and that was established, it’s headquartered in China by Zizhenping. It scuse me, it’s headquartered in China, and it is a bank developed for all of the major bricks counterparts, those being Brazil, Russia, India, China, and South Africa. And it’s called the New Development Bank. Just recently, they stopped making new loans. And according to an examination of their finances and interviews with bankers and others familiar with the matter, per a Wall Street Journal report about a month ago, they’re having trouble raising dollar funds. And so a little bit ironic, but it helps illustrate the major issue that the world is contending with this idea of unplugging from the dollar and moving to something else. Even this development bank that is trying to fund operations for the expand of member nations and for de dollarization still has this entrenched need for dollar based funding. And in fact, they’re facing a dollar funding shortage. So that just paints the issue. Even though a few people may want to unplug it, the reality is that because the world still use it, it’s a strange situation where you can’t necessarily leave entirely.

Jeff Deist:

And then it comes to the question of, okay, well, who’s going to take up the mantle? Who’s going to head up this new gold back or this new bricks currency? And then the way that I analogized it was that if you’ve seen the film Reservoir Dogs, and I hate to use so many analogies like this when explaining my position, but I think it helps. If you’ve seen the film Reservoir Dogs at the very end in the final, there are three guys all pointing guns at each other. I think it’s four guys, actually. And it’s a several man Mexican standoff. And that’s one of the ways that I envision how the argument or conversation would be a better way to put it around, okay, if the dollar is gone, who’s going to replace it? And then it just becomes like a several country Mexican standoff where there isn’t really a clear strategy for any one of these countries to achieve victory over the US dollar in absence of cooperation. And as we know, it’s difficult. I presume it’d be difficult, particularly with the threat of war now being pretty global, that all these countries would cooperate and agree that say, oh, Russia will be the new primary reserve currency for our foreign exchange reserve.

Jeff Deist:

So China will or Brazil will. And so then even if you’re able to displace the dollar, it becomes an even bigger question of who’s going to replace it and all of the countries that will take issue with it. So that’s a bit of a hodgepodge. But basically, where my mind stands right now.

Jeff Deist:

- J, is this a war? Tell me it’s not a war.

EJ Antoni:

Oh, goodness. Thank God it isn’t yet in the military sense, but to a certain degree, this very much feels like at least the prelude to a monetary war.

Jeff Deist:

Because let me just say, it feels like Americans are deeply unservice about Russia and their war with Ukraine, and that that unseriousness could lead to this grandiosic sense of hubris with respect to the ongoing power of the US dollar?

EJ Antoni:

I think it’s a very real concern. And what I think is probably the biggest concern, the biggest threat right now is bilateral trade agreements between countries to use their own currencies instead of the United States dollar, at least when it comes to settling international trade. So if you have two countries, A and B, and they trade with the rest of the world, but also with each other, it does them no harm to simply conduct their trade in their own currencies and just get rid of the dollars they used to use for that purpose. They will still be trading with other partners around the world. And the trade that they conducted with each other and dollars was essentially a wash. The dollars just… It very much was a revolving door where it went from country A to to country B and then back again. And so it is reminiscent to a certain extent of what Hjelmar Schock did in Germany in the 1930s, which was absolutely brilliant. And he essentially conducted these bilateral trade agreements between Germany and various countries, mostly in Eastern Europe, and by those agreements was able to really break the fiscal domination that Great Britain had over continental Europe.

EJ Antoni:

And so that I think is a huge concern right now for the United States dollar. And it is, frankly, a way by which countries like China, like Russia, that have a tremendous amount of international trade, particularly when it comes to exporting real assets, it is a way that those countries can wage economic war against the United States.

Jeff Deist:

David, I thought we bought so much cheap crap from the Chinese that they would never interfere with this arrangement. We were told this is the end of history types. The neoliberal Francis Fukuyamas told us that this was not going to happen.

David Waugh:

Yeah. One thing that comes to mind when thinking about that is this was glossed over with all the SVB stuff, but there came an island branch of SVB that had a decent amount of Chinese venture capital firms and Chinese nationals kept some money there. And that was actually did not bailed out. And those individuals and institutions have had to go through legal machinations in the Cayman Islands to try to recover some of those funds. So I think that this whole Chinese dollar system, it depends on Chinese institutions and individuals being able to park the money that they get for selling us the cheap stuff into the United States or into the dollar system. But if the banks are failing and we’re bailing out only the American part, I think that sends them the signal to send their money elsewhere. So I think that’s just one example of something that I think could get pretty interesting if this credit crunch commercial real estate starts to hit and then US banks start failing, what happens to the foreign deposits in those banks? So yeah, just a lot of interesting stuff going on.

Alisdair Macleod:

I mean, I think David actually makes a very good point that what we don’t know is how the Chinese and Russians are viewing the Western banking system. I mean, you don’t have to be terribly clever to know that all those major central banks are deep into negative equity. In other words, if they had to behave like the rest of us, they’re bust. And the directors and all the rest of it should be in jail. That is the underlying situation. And it’s a situation which is particularly serious when it comes to the Eurozone, because I’ve made the point on that one that it’s quite easy to rescue the Fed. I’ve illustrated the balance sheet manoevers to do that in my writings. But when it comes to the Eurozone, you’ve got the whole Euro system. So you’re not only recapitalising the ECB itself, you’re recapitalising nearly all the national central banks and they’re huge creating balances in target two, which are unexplained and all the rest of it. I mean, this is a legislative nightmare and there is absolutely no way that can be dealt with. Anyway, moving on from that, you’re asking about the triphens dilemma.

Alisdair Macleod:

Yes, I mean, Robert triphin, I think this was in evidence to Congress or the Senate back in the 60s, I think about 1966, where he said that in order for a currency to act as a reserve currency, then what the country issuing the currency had to do was to run deficits so that there would be sufficient currency in circulation outside the country to act as a reserve currency. And the suitably, these are economic policies which are destructive economically as far as the issuer of the currency is concerned. And so what you have is you have, okay, the dollar gets exported in huge quantities and there’s demand for it and all the rest of it and it remains strong because everybody wants it. But there comes a point where the consequence of running deficits, budget deficits and matching trade deficits and all the rest of it is that you end up with a crisis. And certainly, we’re at that position at the moment, but the timing of it, I think, is very much in the hands of Russia and China. And it’s rather like the, if I can go, you know use an analogy rather like Joe does.

Alisdair Macleod:

It’s rather like the cartoon character, where Tom has been hit by a plank or something, and Jerry just with one finger just pushes him and he falls over. And I think we’re probably, in terms of tripping his dilemma, at that point.

Jeff Deist:

Yeah, I’d like to open it up to our speakers for any back and forth. I would say my heart is with Alasdair. Maybe my thoughts are with Joe. I think we have to accept that a lot of people have been calling for the US dollars demise really since the 70s, and that things can go on a lot longer than we imagined they can.

And they have. I mean, the United States is an absolute bully with respect to its dollar, is absolutely profligate with respect to its spending, and its lack of fiscal discipline, not only on the monetary policy side, but as we all saw on the fiscal side since COVID. Oh, my goodness. And the rest of the world never seems to get its act together and punish us and say, We’re not going to deal in this currency anymore. We’re going to demand junk bond rates to buy US treasury debt. Quite the opposite has happened. And so as a result, and I think Joe’s article, and I’ll link to both of these on my Twitter after the show, I think Joe’s article really makes the point that this currency is so entrenched, it’s still such a huge part of the composition of worldwide FX that the liquidity provides is so important just to the day to day. It’s like the oil in your engine for the world’s economy. Those are my thoughts. And I do think the Bricks proposal itself is not nigh. I think that was a trial balloon, and maybe that comes in two years or five years or whatever it does.

I’m not sure Alasdair agrees, but I would just open it up to speakers.

Joe Consorti:

Right. Thanks, Jeff. Alasdair, well said. Great analogy, by the way. Thanks. At the end of the day, I believe that as you mentioned, people have been calling for the death of the dollar since the ’70s. And so to me, the first thing that I did back in January when I really wanted to understand this was just dig into the data. And if you’re looking at just purely what makes world reserve currency, the composition of foreign exchange reserves, then the dollar is just sitting pretty. The dollar is sitting over the last two decades, it’s sitting at roughly 50 %, 55 % of total global foreign exchange reserves factoring in currency and non currency assets. And so then it just becomes a question of what are the risk factors? And are these risk factors unique to the United States or are they also a global problem? And the main risk factor is the ever increasing debt problem. And is that a factor that’s unique to the United States? And to me, it doesn’t seem like it is. And it seems like the debt problem is actually something that’s worse elsewhere. And so at the end of Alistair’s article, and I think he’ll be able to talk about this as well, he talks about how all Fiat currencies are threatened.

And so to me, it doesn’t seem like a uniquely United States issue. The one that is currently facing it and the one that a lot of people say will undermine the US dollar with time. And that is debt. It doesn’t seem to me that that’s a uniquely US issue. And for that reason, I think that because of how entrenched and widely used the dollar is for global trade, and as I mentioned, as a percentage of foreign exchange, I think it’ll probably be the last one to fall as a function of this debt issue. Other unique risk factors, of course, aside, I think the dollar sits pretty currently just from a data standpoint at the top of the fiat heat that’s devaluing and crumbling. And so then it becomes a question of whether or not you believe the dollar is here to stay for another five years or another five decades. It becomes if the debt problem is here and it’s here to stay and austerity is something at a government level that we can’t even hope for in our wildest dreams, then it becomes like, what do you want to allocate to at an individual level?

And that’s hard money. And whether you believe that is something like gold, or whether you believe it’s Bitcoin or whether you believe Bitcoin is worthless, whatever you believe to be hard money, that is something that a central bank can’t get its grimy claws on and create more of, then that’s probably what you want to allocate to. Alistair and I may disagree on the path for the US dollar specifically, but I think we both agree that austerity at a government level is probably a bygone hope. And if that is the case, then you’ll probably want to, at an individual level, spend time thinking about how you’re going to allocate away from it. But that’s my piece. I’ll hand it over to any of the other speakers.

Alasdair Macleod:

You do make some good points, but I think the one overriding point which we must understand, well, the two things, first of all, I agree, we’ve all been crying wolf for a very long time, but one of these days the wolf comes along and probably when we least expect it. But the second point I’d like to make, Joe, is that I think we’ve got to look at who is long of what. And there is no doubt that the international players, as it were, foreigners, are very, very long of the dollar. They are hugely long, not only just as reserves, not only just as liquidity, not just as having some liquidity in order to pay down US dollar debt, but also portfolio investment. I mean, this is huge. Now, the other thing in the background is that in the West, we have a credit crunch. And what that means is that the shortage of credit because banks are now contracting their credit will drive up interest rates. So this is no longer under the control of the central banks. And of course, all the markets hope that this inflation dragon has now been dealt with and this interest rate problem will start emeliorating.

That’s not going to happen because we’ve got a credit squeeze. And that credit squeeze, credit crunch, will drive up interest rates, drive up bond yields, drive down equities. So where’s that 32 trillion of foreign ownership of dollars going to go? There’s only one way it can go, and that’s get the hell out of the dollar. Now, I would admit that the alternatives like the Euro, Sterling, Yen, and so on, so forth, are all in the same boat, but to a lesser degree or for different reasons. But they are not owned as much around the world as dollars. And it will be dollars which really do suffer. They will all go down. But of course, the central banks will be adjusting their reserve portfolios. They will be reducing the amount of dollars and increasing their amount of gold. I mean, it’s a dead cert. I think it’s as simple as that.

Jeff Deist:

So to your point that regardless of what central banks do, the market is saying that there’s a huge demand for liquidity and there’s not as much credit available. That means higher rates. And of course, that’s also bad for Congress trying to finance US debt. It’s already approaching a trillion dollars annually. So am I paraphrasing you correctly?

Alasdair Macleod:

You’re dead right. Yeah, absolutely, Jeff. It’s I mean, every way you look at this, I mean, it’s just bad, bad, bad. I mean, I’ve been looking at bank lending in the UK. It’s collapsing. I mean, what does this tell us? It tells us that interest rates are going to go up because there’s a credit shortage. And my friends in the insolvency trade have never been so busy. The banks are saying, Help, we’ve got loan customers here who we think are probably not going to repay us. Go in and sort them out. This is going on all around the world. But I tell you, this is a very important point. The one part of the world which is actually fairly well insulated from this is the Bricks and Shanghai Cooperation Circus run by Russia and China. And they have a vested interest in pursuing their own strategy, which is completely different from our collapse. And not only that, but gold. If gold backs the currency which is used in the trade currency and that spreads to the other currencies, think of it from the point of view of Russia. At the moment, if you’re a business, let’s say a reasonable sized business in Russia trying to borrow money, you’re going to be paying over 10 %.

Once gold comes in, that falls down in time as confidence gets regains about the currency situation, that will fall down to around about two and a half to three %. This is the prize that they have in the whole of the Shanghai Cooperation Organization and the Bricks tribe. And I think they will probably include as many countries as they possibly can on an associate membership basis, because obviously it’s very bureaucratic getting these countries in as members of Bricks. But there is this divergence, and I don’t think it’s really fully appreciated that one half of the world, which is our half of the world, is going to hell in a hand cart, but the rest of it has actually got very good prospects because of the industrialisation that is going to occur really amongst the world’s, the majority of the world’s population. We’re talking about 64 %, 65 % of the world’s population benefiting from this. And it’s all the growth areas, if you like, in Keynesian terms. So this is a very big deal. And the world is splitting in two. And unfortunately, we’re in the bad half.

David Waugh:

How does India factor into this? Because I think that in the West, we underestimate how aligned on some things India is with Russia. They’ve refused to condemn the SMO. They have really ramped up their oil purchases. But India is also in bed with the United States. And I’m wondering, just from a geopolitics perspective, are they waiting it out? Could they mix this whole BRICS gold backed currency? I’d love to Hear your thoughts on that. Yeah, sure.

Alisdair Macleod:

I mean, if you look at history since Partition after World War II, Russia has always been pretty close to Russia. And indeed, one of the reasons that Partition happened the way it did was that the British wanted to see a separate element, if you like, in the form of Pakistan, which would not be aligning with Russia. And that was part of the problem, I think, that arose at Partition. I think the current policy, and we see the same in Turkey, is there’s a lot of fence sitting going on. Now, we know which direction they’re going. We know that they’re now very much tied in with the massive Asian project by the Asian hegemon s. But of course, you don’t turn around and spit in the face of America and the Western Islands. Our allies, you don’t. I mean, apart from anything else, your markets. No, this is all diplomacy. So that’s the way I look at it. And I think this won’t stop their drifting in that direction. It won’t stop them supporting a new gold linked trade currency, though they may not be ready to put the rupee on a gold standard.

And this is another point which I think is well worth understanding. We are completely unable to go away from a fair currency system because of our welfare costs and because of the commitments that we have when the economy goes down. But if you look at the finances of pretty well all the Bricks and Shanghai Cooperation members, they don’t have these burdens. So they could actually put their currencies either on a gold standard or on a currency board system with a more stable currency, which itself probably ends up on a gold standard.

EJ Antoni:

I think one aspect about the United States dollars staying power, I guess you could say, is the fact that we sometimes think of a country’s default risk and the reliability of the currency, or at least people’s willingness to hold that currency as having a linear relationship. But in fact, it’s really exponential. Part of that is because of how treasuries have historically been rehypothicated, which is basically just a fancy way of saying the same United States treasury can effectively be posted as collateral over and over and over again and essentially pledged multiple times similar to the way a single dollar that you put on deposit in a bank can be loaned out multiple times as well. So there’s that aspect to it. The United States dollar is in many ways just the least bad Fiat currency. In terms of going forward, though, again, the risks here are incredibly real. And the fact remains that you have a lot of countries that, as was just stated, not only do they not have the welfare states that we do, not only do they not have the obligations that we do, but on top of that, they have real assets that they can export.

They have commodities, right? They have coal, they have oil, and granite. We have some of those things too, but we’ve, thus far, proved very unwilling, at least recently, to actually export them. We’re talking about countries that have rare earth minerals and even non rare earths. They just have them in very great quantities. So they have actual things that they can trade with as opposed to what we’ve been trading with, which is debt. Now, that’s not to say we haven’t been exporting very valuable services around the world. We certainly have. The United States has proven to be a world leader when it comes to that. But again, we’re going up against countries that have something that the dollar does not, which is real value behind it.

Jeff Deist:

Yeah, EJ, what would the rest of the world be without Deloitte and McKinsey? Well, we definitely export some of some things, culturally, let’s just say, not just economically. Joe, if you’re still with us, I want to get to a really interesting point you made in your article that, first, you said, Well, the world is decentralizing, so I want to understand what you mean by that. But as a result, the US dollar actually becomes more essential, not less, because a lot of people are talking about a breakup in this regional currency’s regional trading zones in this current. Can you explain what you mean by that?

Joe Consorti:

Well, the reality is that, like I said, since Britain Woods, I think the way that I viewed it and the way that it’s worked for the last 50 years, and of course, it’s not good to get complacent. It’s not good to say because this is the way things have been, this is the way things will continue to be, not a good thing, not a good way to invest. We always got to be probabilistic in assessing the real risk factors. But yeah, the general idea is that we really lucked out at Brighton Woods. And since that time, we’ve basically been the beneficiary of the world’s economy getting built on top of US dollar rails. And so as the world, as communication mechanisms get better, as technology improves and trade partners now are not just the big ones like China, Russia, the United States, but rather small countries can now trade with one another without the need for a big intermediary because of how communication has improved so much. We’re all talking to one another. Granted, I imagine a lot of us are on the Western hemisphere, but a great deal of us are just spread across the world.

And now we’re talking, it’s beaming up to a satellite and beaming back down to your phone almost instantaneously. That’s pretty crazy to simplify it to an extreme degree. But that technology has also allowed trade partners to move from having to be interconnected with big trade hubs to now being far more fragmented. And I guess a word to use, the word that you used and a word that I may have used, again, I wrote this six months ago, was decentralized. We’re far fewer major trade hubs, far fewer major intermediaries, much more fragmented. And what that means is that if the global economy is built on rails of the United States dollar, then if the trade is being more fragmented and flowing through less major hubs, then that stands to reason that the currency that underlies all of it would become more ossified. But also, again, this is a new arrow we’re moving into. It could also mean the opposite. What I just said was total conjecture. It could also mean the opposite. It could also mean that because the trade partners are now far more fragmented and they’re not using these big intermediaries, then that means they have more leeway to decide what currency they use between one another.

And that may also open the door for dollar dominance to wane. It could open the door for these countries to start using a currency of one or the other rather than having to use one World Reserve currency. But that remains to be seen. Basically, what I illustrated was that the relationship between trade partners and the currency that they use is shifting because the way that trade works is shifting. These big intermediaries are now no longer necessary as much as they were. And because of that, it could either mean that the dollar gets ossified in its role or the dollar gets displaced. But that remains to be seen. I’m curious what other people think of that general idea up on stage.

Alasdair Macleod:

Well, it remains to be seen how that actually pans out. But I’d like to make another point, and this is, I think, one of the things that’s all coming together to some crisis. I mean, we’re turning our back on fossil fuels. We have, in effect, said to the Middle East, we don’t want your product anymore after 2030 or 2035 or 2040, whenever you’re talking. So what they’re doing, quite simply, is they’re turning towards China. And we’ve seen this. We see that they’re accepting Renminbi. We’ve seen, particularly, the policy of the Saudi Arabians. And it was fascinating to see Joe Biden turning up. I think it was last December to see MBS to try and persuade him to turn on the oil taps because they were a bit fed up with supplying oil out of the strategic petroleum reserve. But he was just basically half an hour with the big man, and very nice to see you bugger off. And the next week, literally, in comes President she with fighter jets escorting him. And you had black Arab stallions riding along by the car. I mean, this was real medieval pantomime. He was welcomed with open arms.

Alasdair Macleod:

And you know something? I don’t know if you’ve really noticed it, but ever since the Americans and us have effectively been kicked out militarily from the Middle East, peace has returned. Suddenly you’ve got Iran talking with Saudi Arabia. The Houthis who’ve been funded by the Iranians are now talking peace. President Hassan visiting Riyad. Peace has broken out now that we’ve left. I don’t think there’s any clearer signal of how important this whole change is. We’re turning our back on fossil fuels and we are killing ourselves in the process because the most important thing we have in any manufacturing situation, indeed in our survival, is energy. We’re doing away with it. We’re killing our own folk. This is just crazy. Whereas this is something which, as far as China and all the rest of them are concerned, they welcome with open arms. They’re burning coal. I mean, China is opening God knows how many new coal fired power stations. They’ve paid lip service to this climate change thing, but they don’t treat it seriously. We are killing ourselves in this. This is a very big change we’re seeing. The pace of events, I think, is likely to accelerate a lot more quickly than is generally realized.

Jeff Deist:

Well, that’s interesting because you bring up the climate change movement and some of these calls to abandon fossil fuels by X date, which, of course, anyone who understands fundamental reality, who has read Alex Epstein’s book, knows that these are just absolute pie in the sky. To even attempt this halfway would result in unbelievable economic harm to any country that tried it. So we have this unseriousness, this unreality, and it seems to manifest itself in US foreign policy, the idea that we can go remake Afghanistan. It seems to manifest itself in dollar policy. There will always be a market for our treasuries. We don’t have to worry about debt, deficits don’t matter. And there’s this unreality also in our so called environmental energy policy or climate change policy. And you put all this together and then no offense to anyone, but when you talk to especially people under 40 who have never seen a true bear market other than COVID, which was a bit of an artifice with it actually was an artifice. People just simply imagine that the United States can will things into existence, things that go against economic reality, things that go against physical reality with respect to energy.

And that’s what frightens me is this idea that we don’t have to worry about the laws of nature, the laws of economics, because we’re the United States and we’re wealthy. We’re the hegemon since the former Soviet Union collapsed. And it will always be this way. Wealth materializes out of thin air. And everywhere we go, there’s a Starbucks and hot and cold running water and electricity and air conditioning. And I think Southern Europe, especially, could use some of that air conditioning right now. You begin to wonder whether we are blundering our way into an epic car crash here.

Alasdair Macleod:

Yeah, I think you’re right, Jeff. I mean, it’s for certain, let’s face it. But this is something that the Middle East has been expecting for some time. I mean, we’ve been telegraphing the way we’re going. And I’m not going to talk about the merits or demerits of the climate change argument because I find that detracts from people listening to me about economics. But the reality is that we basically pissed off the whole of the Middle East. And they are, along with Russia and along with Iran, Saudi Arabia, they are the only real low cost producers of oil in the world. And what are we left with? We’re left with shale and all the rest of it, which requires an awful lot of energy input. And I’ll tell you something else on this story, and that is that in Europe, still, 98 % of logistics is driven by diesel. Now, how are we going to overcome that in the next 5, 10 years? It’s just cloud cuckoo stuff. It really is. So we’ve got this death wish, I think. Looking at the press reports, the mainstream media reports about what’s going on in Ukraine and so on and so forth, I mean, it’s a sense of complete unreality, propaganda, the whole thing.

I think it’s very sad that we’re not allowed to even stand back and look at the truth in these matters. And so everybody thinks that there is no problem, as you very, very correctly point out.

Jeff Deist:

Well, I want to give David the last word, give us your wrap up, and then I’ll provide some show notes and we’ll send everybody off to hopefully a great weekend.

David Waugh:

Thank you. And I’d just love to add, in March, Peter C. Earle wrote a great article called ESG is an Artifact of Zerp or Zero Interest Great Policy. I think that today I saw in the Wall Street Journal there’s an article called the Rise and Fall of the Chief Diversity Officer. I think that people still don’t really… They’re still grappling with the fact that you can’t afford these corporate bobbles when money is expensive. But I would just love to really enjoy this space and I love to see a Bitcoin and gold crossover between Alistair and Joe and just wish everybody a happy weekend.

Jeff Deist:

Well, folks, if you want to send this show to anyone or give it a second listen again, within a few days it’ll be produced as a YouTube at Monetary Metals YouTube channel and also generally run on Zero Hedge. I want to encourage everybody, be sure to follow our speakers on Twitter. Joe Castority has a really interesting substat called the Bitcoin layer. So check that out over on Substack. And be sure to check back on my Twitter because usually on Thursday afternoons, I announce the Friday subject matter. We’re always going live Friday at 2 PM Eastern. And just hit me up on Twitter messages if you have any ideas for guests or potential show topics that you’re looking for down the road. But we’re always talking about money and the effects of money and issues the surrounding money. So it was a great conversation today. I want to thank everybody. I want to thank Alistair for spending some of his Friday evening time with us. I want to thank Joe, who’s new to the show, and hope everybody has a great weekend. We will be back next Friday.

Alasdair Macleod:

Thank you very much indeed, Jeff. Thank you for organizing it.

Jeff Deist:

Absolutely. Thanks, Jeff. Thank you, Alistair. Wonderful discussion. Yeah, despite the name of the sub stack, the Bitcoin layer, we do cover global macro quite a bit. We view Bitcoin as an asset in a universe of assets, and hence why you see a guy with Bitcoin and his bio arguing that some of the death of the dollar stuff may be a little bit hyperbolic, which is generally something you don’t see. So despite the name, the Bitcoin layer, we do cover global macro as our focus and how Bitcoin fits in that universe. And once again, Jeff, David, Alex, they’re EJ, wonderful conversation. I hope you guys have a tremendous weekend.

Alasdair Macleod:

Thanks. Thanks very much. Thank you.

Additional Resources for Earning Interest in Gold

If you’d like to learn more about how to earn interest on gold with Monetary Metals, check out the following resources:

In this paper, we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF – GLD, and mining stocks against Monetary Metals’ True Gold Leases.

The Case for Gold Yield in Investment Portfolios

Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold pays a yield? This paper answers those questions using data going back to 1972.

Leave a Reply

Want to join the discussion?Feel free to contribute!