Monetary Metals Supply and Demand Report: 19 Apr, 2015

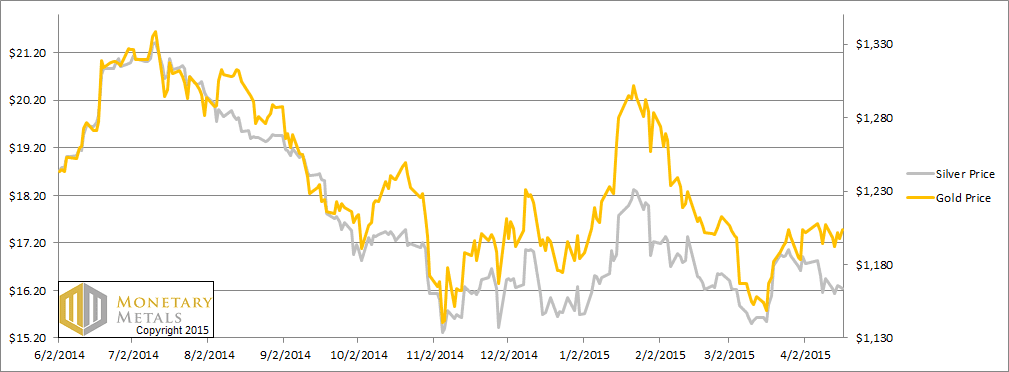

The price of gold went sideways this week, while that of silver fell 20 cents. For those waiting for The Big Dollar Collapse, i.e. the gold price to skyrocket, it may seem like watching paint dry right now. Or maybe watching the grass grow. Or even waiting for a pot of water to boil.

Gold bugs must face the fact that demand, at present, is moribund. Russia could declare a gold standard at any moment. Or China. Or India could open up the floodgates of imports. And all of these things could unleash the unwashed masses to try to front-run demand by buying gold in front of these supposedly price-insensitive buyers-at-any-cost.

But “could” is not “is”.

It’s not happening now. Read on for a picture of supply and demand, and some interesting data from the London Bullion Market Association…

First, here is the graph of the metals’ prices.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production (stocks to flows) can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price, and under the right conditions. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

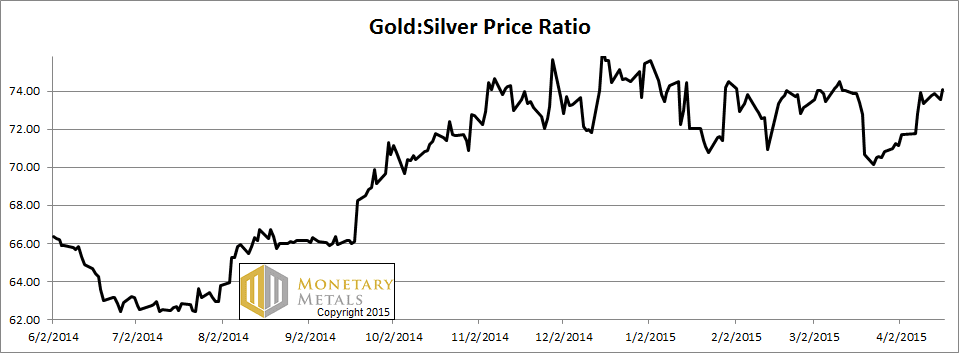

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It moved up further this week. Could it breakout further? Read on…

The Ratio of the Gold Price to the Silver Price

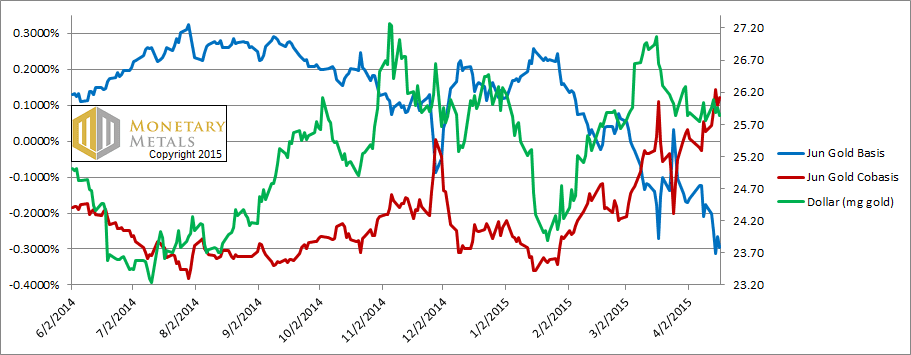

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

Not a lot happened. The price of gold is down $4 this week. The cobasis is up a scosh (backwardated).

The fundamental price didn’t move much.

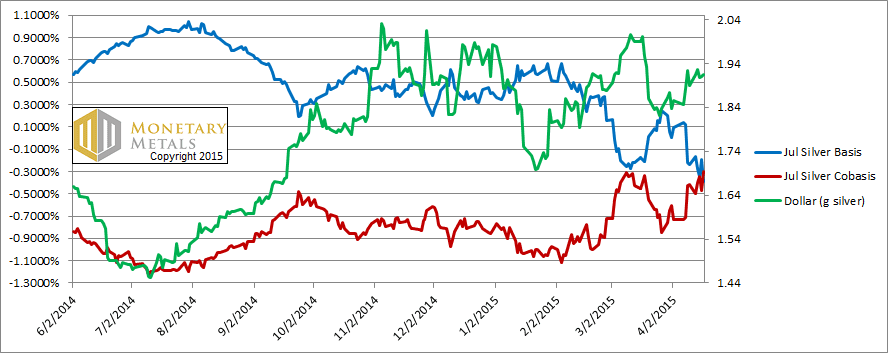

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

In silver, unlike gold, the price fell. This means the dollar rose, and we see that with it, so did the cobasis (scarcity).

The fundamental price fell a bit further.

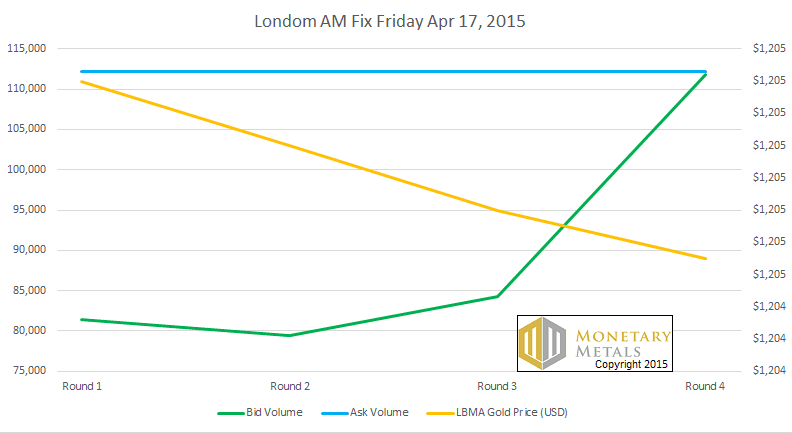

The Bid and Ask Volumes in the Friday London AM Fix

First, let’s explain the graph. The AM Fix on Friday had four rounds. The goal of the fix is to match bid volume with ask volume. In this case, price had to come down. We see bid volume drop slightly with the first drop in the proposed fix price. Then as the price comes down further, bid volume rises as we would expect.

It is noteworthy that the ask volume remains constant across all four rounds. What could this possibly mean?

Sellers on Friday morning were price-takers. Likely gold miners or recyclers, they sell at the fix with a market order (as opposed to a limit order). They get what they get. What choice do they have? They have to unload the commodity to get money (i.e. dollars) so they can book their profits (which come from producing gold at a lower cost) and move forward in their business.

This fits with the picture we see in the basis and price. A moribund market, that seems not to be able to muster a sustained rally in price, and scarcity is not increasing even as the price falls. By this point, those who bought metal hoping for a dollar gain are hanging on for the long haul. They aren’t selling. With the price stuck where it is, others don’t see much incentive to buy gold before the rush. So the market action is selling by gold producers.

To paraphrase another character from Lord of the Rings (Aragorn), the day will come when men repudiate the dollar, renounce all bonds, and desperately get what gold they can—but it is not this day!

© 2015 Monetary Metals

Keith,

Given that gold is more backwardated now than in November, wouldn’t it generally be safe to say, everything else being equal, if gold swooned below $1100 this summer, that the resulting backwardation would likely be strong?

Mark

If nothing changes in the fundamentals, then yes a drop of another $100 in price would increase the backwardation now nipping at the gold market.

“[T]hese things could unleash the unwashed masses to try to front-run demand by buying gold in front of these supposedly price-insensitive buyers-at-any-cost.”

Feeling brutal are we?

Seriously though: I notice that many other, far more likely, headlines in the collapsing-fiat story are missing from your “Things” list. Is that because you’ve concluded that the short- (maybe even medium-) term prospect is that these (Grexit, et al) events will drive up the dollar’s “price”?

The other interesting thing from this fix data is how low the volume has been, only 3 or 4 tonnes traded – $150m. Not highly liquid and probably all mining company selling (3.5t x 505 fixes a year = 1768t), that could be a positive factor, shows we don’t have massive investor liquidations going on, which accords with what Perth Mint is seeing – selling is over, those that have bought are sitting tight, but there is just no new buyers coming into the market.