Monetary Metals Supply and Demand Report: 22 Sep, 2013

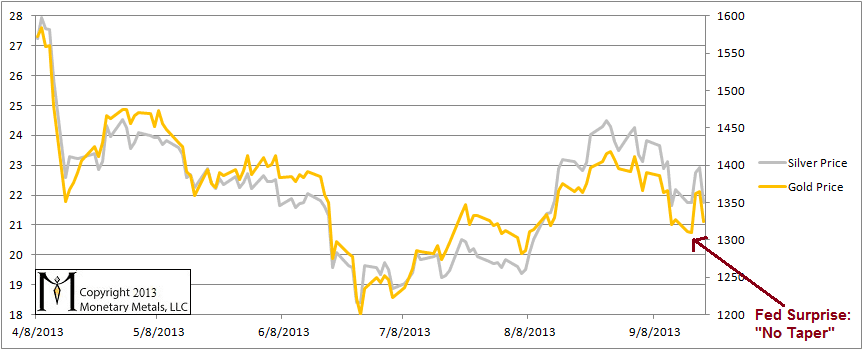

Heading into Wednesday, the prices of the metals were sagging. Then, the announcement from the Federal Reserve took everyone by surprise. They said they would not “taper” their purchases of bonds. And BAM! All prices rose sharply: stocks, currencies, and our favorite metals. In a minute, the gold price went up $25. Clearly, traders are still betting that if the Fed increases the quantity of money, then the prices of the metals should rise. They aggressively met their own expectation on Wednesday.

We had one question on our minds, watching this. Who dunnit?

Was it speculators, using leverage in the futures market? Or was it “stackers”, waiting in their cars outside the coin shops, watching CNBC on their mobile phones, and running in to buy up coins by the double handful? With a few graphs, below, we will show the clear answer to the question.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

First, here is a graph of the prices. We have labeled the big “Bernanke move” with an arrow.

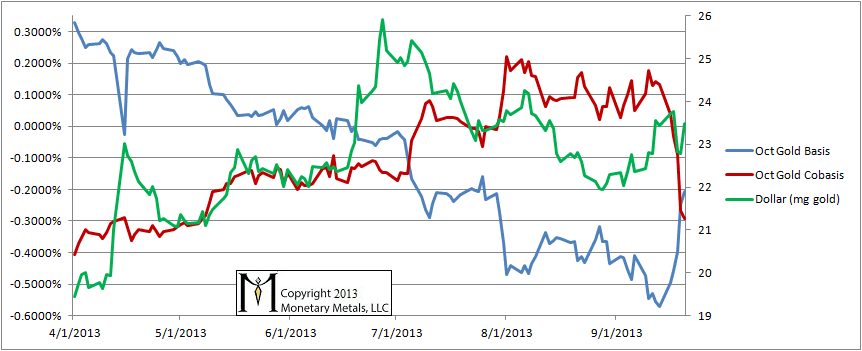

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

We did not label the “Bernanke move”, but it’s the obvious drop in the price of the dollar by about 1.5mg, near the right edge. On Friday, the dollar rose again. But this is not the main focus for us to look at.

The moves in the basis and cobasis are absolutely amazing! Look at that basis skyrocket, and the cobasis drop! Last week, the October gold contract was backwardated. The cobasis was about 0.15%. Now it has fallen to -0.3%. This fall was “against the grain” of the mechanics of the contract roll.

Buyers of futures must make a decision by First Notice Day (which is this coming Friday). They can either put up the cash and demand delivery of one gold bar per contract. Or they must sell the October contract, and buy a farther month if they want to keep their gold position. This past week, open interest in the October contract fell from 20,177 to 17,514 contracts, a drop of 13%.

These contracts must be dumped on the bid, which presses it down. Let’s look at our definition of the basis again:

basis = Future(bid) – Spot(ask)

The basis rose dramatically, in the face of what we know is a lot of downward pressure on the bid on the future. The cobasis moves in the opposite direction.

This is the answer to our question. Speculators dunnit.

They sat at their desks, watching CNBC with their fingers hovering over trading orders. As soon as they heard “no taper” they hit the BUY button. And they drove the price higher, and with it the basis.

We have written several times in the past that these knee-jerk moves after Fed announcements are usually reversed quickly. The move on Wednesday was so big and so popular that reversal did not begin on Thursday. We had to wait until Friday.

Did I mention that gold, which had been backwardated, isn’t any more? That is pretty important, because it means that the extraordinary scarcity seen for most of 2013 is gone. And now the price is $1,325.

Does this mean that the price has to fall further? Not necessarily. But against this big change in the basis, we would certainly not bet on a rising gold price. The balance of risks does not seem prudent for that.

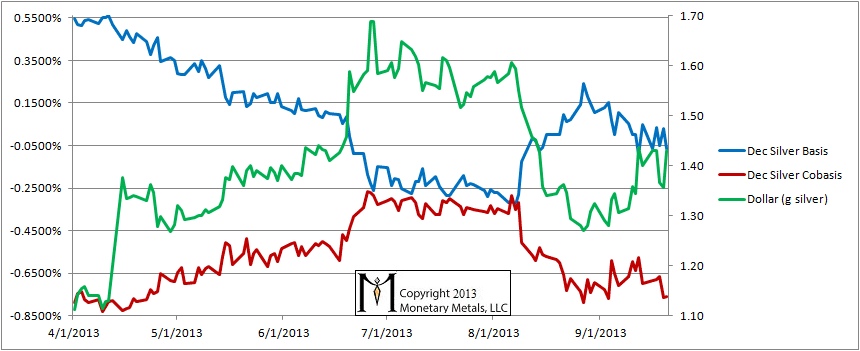

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

We see the same price move as in the gold chart, with the dollar getting sharply weaker, losing about a tenth of a gram of value on Wednesday and Thursday, and gaining it back on Friday.

The cobasis in silver did not show the same dramatic moves as in gold, but it began from a much lower point. And we must emphasize that the silver cobasis also fell in the “Bernanke move”. Like in gold, Wednesday’s silver mania was driven by speculators, buying on margin.

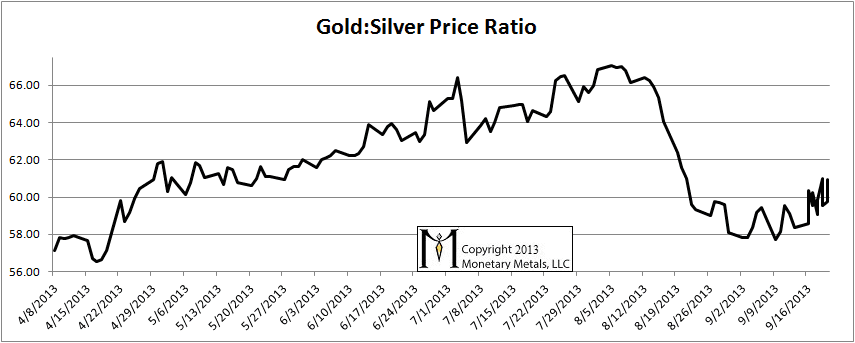

The Ratio of the Gold Price to the Silver Price

Falling prices tend to correlate to a rising ratio.

you repeatedly say that :”With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply.”

Where is your decades silver stocks?

rabo: By ‘stocks’, he means stored physical metals that could come into the market.

Thank you, Keith, for another enlightening analysis! Your website is the only fundamental analysis of gold and silver worth trusting!

Agreed.

While silver’s industrial usage is increasing, it is still only a percentage of what is mined… the flow. Over the decade from 2001 to 2010 silver’s average industrial and photographic usage represented just over 62% of mine supply. Slightly less than 38% was added to stock in the form of jewellery, silverware, coins, medallions and bullion.

Logic insists that there are vast but unquantifiable stocks of silver in the world. The stock continues to rise, just as it has for at least 6,000 years.

Thanks Keith for the very informative site. Am I right that you are saying that the “grain” of the contract roll is a downward pressure on the Oct futures contract? Why is this true, considering that for every long position somebody else holds the short position. Aren’t the shorts just as likely as the longs to want to roll their position to the next month?

Keith may answer otherwise but here is at least one reason for downward price pressure as a Comex futures contract approaches expiration: On first notice day (FND) and thereafter till expiration date, those holding long positions are subject to receiving a delivery notice – i.e. a notice that a short will deliver against the long’s contract (short holders do not receive a notice of intent from someone who is long). The long position holder, unless he will stand for delivery, must pay an actual cash price to maintain that position. Plus he will need to pony up the total cost of the contract upon its exercise. Since most futures contracts are not exercised, long position holders in particular exit their positions to avoid the delivery charge. Although there is an equal number of short and long contracts at all times, the short-term impetus during contract expiration is initiated by long holders. Thus, downside price pressure, albeit relatively small, dominates.

Keith,

Ditto on James comments. The commentary that Keith provides is trustworthy. I look forward to all the posts from Keith and quite often review many of the older information he has provided.

I also would be asking the same question from dcdrumm concerning the contract roll and the longs and shorts alike closing their positions out.

Thanks again Keith.

“Thank you, Keith, for another enlightening analysis! Your website is the only fundamental analysis of gold and silver worth trusting!”

Took the words right out of my mouth. I look forward to your every update, Keith.

Thanks everyone for your comments and your kind words. :)

In response to dcdrumm, the basis theory is an arbitrage theory of the markets. In this theory, the short positions are not mostly speculators betting on a fall in price. In general, the risk of being long and short is asymmetrical. Betting long involves a finite amount of risk and unlimited gain. Betting short involves an unlimited risk and finite gain. This is especially pertinent to gold and silver, under collapsing currencies.

At any rate, the shorts are typically carrying metal. They are content to deliver if called to do so, and are not under urgent pressure to buy October to close. There are also miners selling some production forward, and they won’t be buying either.

The urgency to close the expiring contract is largely on the long side, though speculators who are short feel it also.

If shorts had the same urgency, then what would happen? The bid would be pressed by longs selling to close and at the same time the ask would be lifted by shorts buying to close. As the market makers departed, we would see the bid-ask spread widening.

basis = Future(bid) – Spot(ask)

cobasis = Spot(bid) – Future(ask)

The basis would be falling and the cobasis would be falling also. This has not been the pattern in recent years.

Thanks for teaching me. I have no eonomics background but with your article which I’ve read on

http://www.financialsense.com/contributors/keith-weiner/supply-demand-analysis-gold-silver is

raise my knowledge up and brougth me here. Thank you so much.

So, to investigating those carry-decarry, we have to track and record both spot and future price.

Is this right. I used to record only the history spot price.