Last week, we wrote that regulations, taxes, environmental compliance, and fear of lawsuits forces companies to put useless ingredients into their products. We said:

“For example, milk comes from the ingredients of: land, cows, ranch labor, dairy labor, dairy capital equipment, distribution labor, distribution capital, and consumable containers.”

There are eight necessary ingredients, without which milk cannot be produced.

But, today, the welfare, regulatory, and litigation state forces dairy producers to add numerous other ingredients such as paying for food stamps for unemployable people in the inner cities hundreds of miles away from the dairy farm, tracking tags, giant wheelchair accessible bathrooms, etc. We called these useless ingredients.

Everyone uses the word inflation, when prices go up. Milton Friedman famously said, “Inflation is always and everywhere a monetary phenomenon,” but we have just disproved the second half of his sentence, which is:

“…in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

Au Contraire, Monsieur Friedman. Rising prices can be produced by forcing producers to add more useless ingredients!

They’re doing it to every industry. Not the Federal Reserve. It has nothing to do with the quantity of dollars. Yet everyone thinks the problem of rising prices is intrinsic to the dollar itself. If you participate in the gold or sound money communities online, you have seen many pictures of the eroding dollar, the shrinking number of goods in a shopping cart, nostalgic gas station signs advertising ¢20 a gallon, etc.

As an aside, inflation is a weak argument for the gold standard. We had quite a high rate in the 1970’s, but that was not (nearly) bad enough to make many people seriously propose to return to gold. Today’s much-tamer rate barely musters lip service even from the usual suspects. Wage earners care only that their wages go up as fast as prices—and when they don’t, they are mostly angry at their employers. Pensioners on fixed income care only about their annual cost of living adjustment (COLA), and if it doesn’t keep up, they get mad at the politicians who set it. The welfare classes care only that their EBT cards still work. And the one percenters are happy, because asset prices are rising much faster than consumer prices.

Has the price of a new Honda Accord has gone up a lot? In 2019, the base model starts at $23,720 without options. In 2018, it was $23,570. It has gone up by $150, or 0.6%. We have no idea what new useless ingredients have been added to the 2019 model.

In 2009, the car cost $20,905. Thus, the 10-year increase was $2,815, or 13.5%. We don’t know exactly what the 2019 Accord has, that the 2009 did not, though we note that it had a 4-cylinder engine producing 177 horsepower. The 2019 has 192 horsepower, or 8.5% more.

This raises the idea of hedonic adjustments. For example, the 2019 Accord is a better car (and not just with more power) than the model ten years prior. A hedonic model would attempt to analyze all of the improvements, to determine what part of the $2,815 price increase was due to improvements in the car, vs. how much was due to inflation.

An analysis of useless ingredients may seem similar to hedonic adjustment. Both attempt to break the price increase into a monetary and a non-monetary component. In our observation, it is pretty hard for most people to get their heads around hedonic adjustments. Many people openly scoff at it, as mere Fed propaganda.

The concept of useless ingredients may be an even harder sell. The consumer seems to be getting nothing, yet the price is higher. Therefore, he insists, purchasing power is down. We insist that the dollar is purchasing just as much as before, only it’s purchasing stuff that buyers don’t value. And even stuff about which buyers do not know.

The problem with hedonic adjusting is that it’s inherently subjective. How much is 15 more horsepower worth? How much did it cost? It is easy to assume that better algorithms in the engine computer may increase horsepower without increasing costs. This may even be true in many cases.

Adjusting for useless ingredients is more straightforward, at least in theory. Assuming producers can account for costs, we could see how much each added useless ingredient adds to the final price.

In practice, it would get tricky. In our milk example, the dairy producer must buy containers to put the milk in for retail sale. The container producers are also forced to add useless ingredients, and hence their prices are going up also. The dairy producer would need that data, in order to roll it up into their own useless ingredient component.

We would love to see the Useless Ingredient Adjusted Consumer Price Index (UIA-CPI). It would certainly help lay to rest the undead creature known as the Quantity Theory of Money. Which even today plagues students of economics, who see rising prices as Milton Friedman did. Seeing the real culprit, printed in black and white every quarter, would be a good thing for the field of economics.

We are reluctant to call for the Bureau of Labor Statistics to calculate UAI-CPI (even with a catchier name), for one simple reason. The last thing we want is a new regulation that forces producers to report on all useless ingredients, assigning a cost to each. This reporting would itself be yet another useless ingredient added to the production of cars and milk!

Perhaps large companies already gather all the data necessary to calculate the cost of useless ingredients for their products. If so, we would encourage them to publish it.

The only catch is that most people would take exception to our phrase “useless ingredients”. They might reluctantly concede that the cost of compliance is rising. But they would quickly retort that we need all these ingredients. Otherwise, pharmaceutical companies would poison their customers, carmakers would maim, and banks would impoverish them, for profit.

As always when it comes to government intrusion into the market, most people will defend it. Not only defend it, but they often reject concepts and ideas that threaten to shed light on the costs of such intrusion. Sometimes, they want not to know.

We would bet an ounce of fine gold against a soggy dollar bill that advocates for the disabled want you not to know how much cost is added by ADA-compliant bathrooms. Every monger of every regulation prefers to keep the cost hidden, smirking as everyone’s ire is misdirected at the Fed (ironically, just as the Fed is smirking that workers misdirect theirs at employers).

In case there is any doubt, we will add this quote from Bastiat:

“Socialism, like the ancient ideas from which it springs, confuses the distinction between government and society. As a result of this, every time we object to a thing being done by government, the socialists conclude that we object to its being done at all. We disapprove of state education. Then the socialists say that we are opposed to any education… It is as if the socialists were to accuse us of not wanting persons to eat because we do not want the state to raise grain.”

That is precisely our view of employers accommodating employees. Most employers would do what they could (without adding ever more useless ingredients to their products). Most people will bend over backwards to be kind. That’s not what useless ingredients are about. Which is why they have to be forced on businesses by government. No business would choose to serve its customers less and less, while doing useless work that they don’t want.

Anyways, we’ve beaten this topic to death. The purpose, behind the humor and the moral of the story, is that there is a great misconception of monetary economics. To understand useless ingredients is to see the misconception: the value of the dollar is not 1 / prices.

Supply and Demand Fundamentals

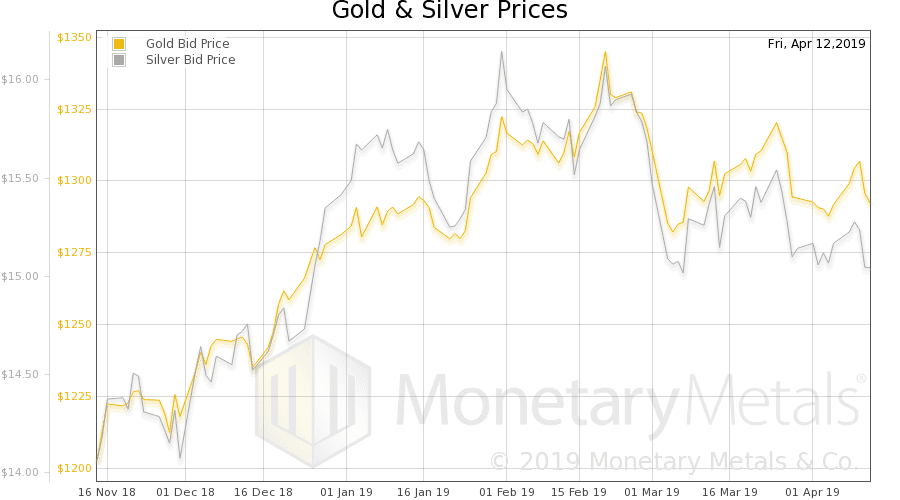

The price of gold inched down, but the price of silver footed down (if we may be permitted a little humor that may not make sense to metric system people).

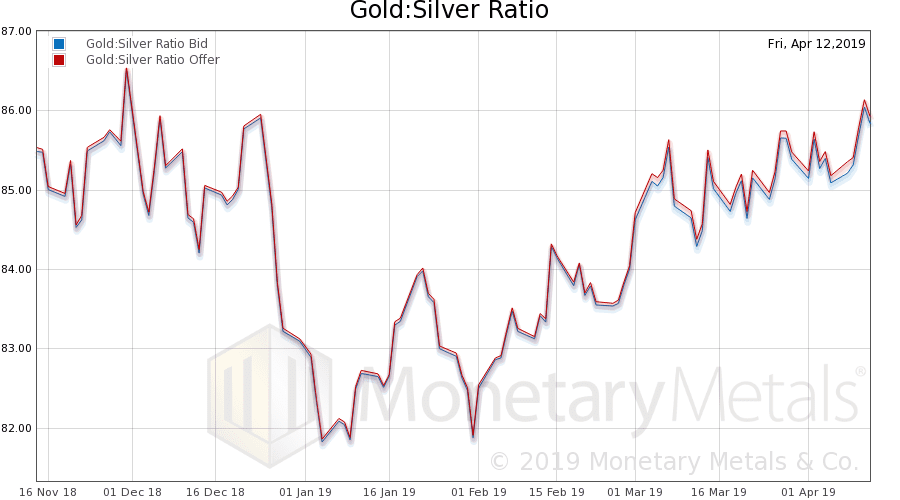

For the gold-silver ratio to be this high, it means one of two things. It could be that speculators are avoiding the monetary metals and metal stackers are depressed. Or that something is going on in the economy, to drive demand for the metals in different directions. One metal is money without counterparty risk. The other is also money but a big part of its demand is from its use in a wide variety of products.

Our president simultaneously told us that the economy is strong, and that the Fed ought to lower rates. If the economy were strong, the demand for silver should be higher. If the Fed lowers rates, then that should rapidly increase the quantity of money and, every speculator knows that should drive prices up.

From the price action, one would say that silver does not seem to be getting either of these messages.

Incidentally, we are doing something to affect the demand for silver—we are paying interest on silver, in silver. We are opening a fresh silver lease deal this week. Contact us, if interested (pun intended).

Anyways, let’s look at the supply and demand picture of silver (and gold too). But, first, here is the chart of the prices of gold and silver.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio went up again this week. It is now near a very long-term high.

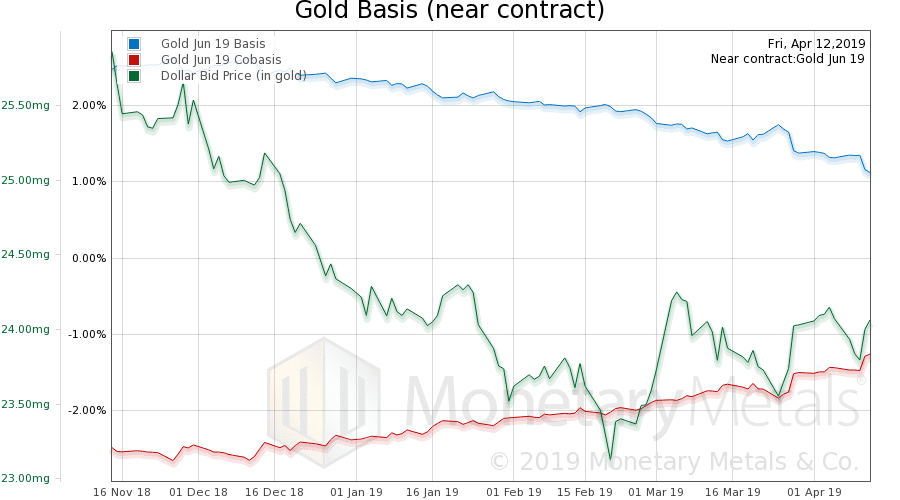

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

The scarcity (i.e. cobasis) as measured by the June contract continues to rise. The gold basis continuous also rose, though less.

The Monetary Metals Gold Fundamental Price is up three bucks, to $1,459.

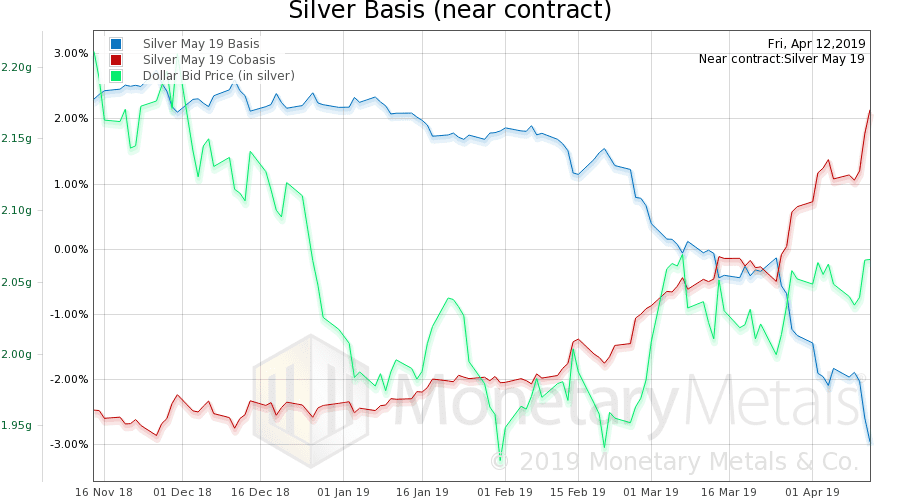

Now let’s look at silver.

The temporary backwardation in the May contract has skyrocketed to over 2%. This means that you could simultaneously sell five big bars of silver, and buy a May silver futures contract to recover your position—and pocket about 4 cents an ounce.

The May contract is below spot. More precisely, the offer price for May is below the bid price on spot. How could this happen? Selling of May, without commensurate selling of spot metal (or other contracts). What would cause unbridled selling of just one contract, the near contract? We will give a hint.

May is about to expire.

Someone needs to sell before First Notice Day, before they could be asked to pay up $75,000 in cash per contract. Lots of someones.

This little idea right here—that we can see the urgent selling of the expiring contract—is the key to understanding why the price-suppression story is bunk. The banks who are short are arbitraged. They have metal (though not necessarily stored in COMEX warehouses) and they have shorted futures contracts to make the basis spread. As they can deliver, they don’t have urgency to close their contracts. If you’re short, you buy to close. And the data shows again and again, that the pressure on the expiring contract is not buying.

It’s selling. It comes from the longs who sell with urgency, as they can’t come up with the cash to buy the metal.

The longs are naked, i.e. speculators. The shorts are not naked, i.e. not carrying a big short futures position to suppress the price.

The Monetary Metals Silver Fundamental Price was down another 9 cents to $16.09.

© 2019 Monetary Metals

:

:

“Hedonic adjustments are subjective.”

…and list prices are only starting points in a negotiation…

In the very early ’90s, US telecom companies added digital service features which included caller-id.

State utility commissions were happy to approve larger than usual rate increases.

For yet an extra fee one can dial “*67” to return to the anonymous mode of yesteryear (no promises should you hope to prank-call the NSA).

To measure that inflation, undo the hedonics and compare anonymous calling in 1984 ;-) to “*67” anonymity in 2004!

Just trying to set facts of the past into equations with facts of the present (or future) is fraught with subjective valuation.

This is why Austrian economics shuns aggregate measures, including such fantasies as “THE money supply.”

It is important to distinguish between price inflation (rising prices), checkable deposits, and monetary base. It is not meaningful to describe the $0.50 increase in the price of milk as “milk price inflation” or even price inflation. Careful definitions of all these terms would remove much of the confusion.

The question of the embedded cost of regulation could be addressed by the use of variance analysis in the context of cost accounting. Another useful technique is Activity-based Costing (ABC).

So, an increase in the price of milk may be due to a mix of factors. Who knows, it could be due to the effect of tariffs on paper imported from Canada.

Effects of an increase in money base are difficult to assign because the pathways indicated through increased demand are not evenly distributed across the economy. Richard Cantillon made this point in his 1755 book, “An Essay on Economic Theory”.

Once again “fundamental” gets stretched way above gold’s bid and what happens? Same thing that happened last April and many other times. Gold breaks down.

No surprise at all. This is turning out to be a wonderful forecasting tool.

Regarding The temporary backwardation in the May contract has skyrocketed to over 2%.

That is money being left on the table! Probably because physical owners don’t think they would get their silver back if they were to sell spot and simultaneously lift COMEX May futures, which at times are 50 or 100 lots on the offer. (spoof offers?)

That backwardaton was about 4 cents an ounce.

If there was fear of loss of metal, the backwardation would infect farther-out contracts.