Reflections Over 2023

I am writing this from home. But I spent five of the last six months of the year on the road. Most of that was overseas. In Reflections last year, I wrote about the gruelingness (yes, that’s a word coined as of right now) of it. So I won’t repeat that, but I’ll just say that companies go through stages as they grow. At each stage, activities become hot and issues arise, that were not there in the prior stage. CEO travel is one of those activities, I think.

I greatly enjoy meeting people face to face, and sharing a meal and a beverage of an adult nature. Not to mention seeing old friends in many of the cities I visit for business. Not to mention also the stopping to smell the roses, an important principle that my wife and I try to practice whenever and wherever.

Growing Opportunities

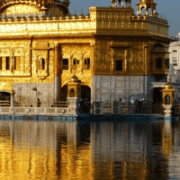

But of course it’s about the opportunities to develop the business. I was interviewed at a gold conference in India. I was on panels in New Orleans and Dubai. The Chairman of the Dubai Multi Commodity Center wrote an article and gave me a shout-out.

I am also enjoying the time at home, for the moment.

2023 was a year of incredible growth of the business. We are making new client account opening records every month, we are doing more and bigger deals to put gold to work. We have grown the team to 32 people. We are now wrapping up a larger capital raise than last year, at a higher valuation.

I am going to offer two observations from numerous discussions, both online and face to face. One, Americans grok gold the least. I think less than 1% have any gold, and those who do generally hold no more than 2 or 3% of their portfolio in gold. In certain regions of the world, most people hold gold and it’s a bigger percentage of their portfolios.

Two, most people (Americans and all around the globe) pay lip service to the idea that, of course, there must be a monetary policy. Those monetary machinations are supposed—somehow—to create gains in the economy by monkeying with the unit of account. Actually, monetary policy bestows capital gains on those who are nimble enough to front-run it, and deals capital losses to others, while eroding the savings of everyone who must hold cash.

Most people will continue to vote for central bankism, irredeemable currency imposed by fiat, and monetary policy gosplanism. There is only a tiny, ragtag movement of people who openly advocate a free market in money.

However, and this is key, people want to escape the ravages of this regime, when it comes to their own portfolios (even in America). When they perceive the risk and uncertainty growing, they become interested in gold. In 2023, they were introduced to the obvious harms of rising interest rates for the first time in a long time, including capital losses and bank failures.

This disparity between what people say they profess and how they handle their own affairs is the key to building a for-profit business to create positive social change. Politics may be bogged down in dysfunction and riddled with perverse incentives. But people are more rational in allocating their own money than they are in assigning their votes.

The Dubai Brain Drain

Much of my time abroad this year was spent in Dubai. It is a fascinating place. It is more first world than any city in the US, let alone the rest of the world. If it offends you to say that American cities are more first world than Europe, and you’re not American, then come spend some time in Scottsdale, Miami, or Las Vegas. Or even Manhattan, San Diego, or Dallas. If it offends you to say that Dubai is nicer, and you’re American, go spend some time in Dubai!

Last summer, big public buildings in Europe like airports were sweltering hot, with either no A/C or the thermostat was turned way up. This picture is at the gate in the Barcelona airport in October. Note the heat and humidity too.

Photo: Keith Weiner

In America, they were air conditioned as normal. In Dubai, outdoor courtyards at hotels have massive air conditioning units ringing the perimeter, blowing lots of cold air. Outdoor air conditioning.

What makes this possible? The short answer is that they don’t punish energy producers and energy consumers the way America does. And America does not do it the way Europe does.

The longer answer is that Dubai has become a brain drain, and a capital drain. People and money are flocking to this jurisdiction, to invest, to work, to build businesses. The massive growth in population and in skyscrapers is obvious. Low (or zero) income tax is a factor. As is the ease of obtaining a visa to live and work there (you cannot become a citizen).

America was once the brain drain. While many people still come to America for its liberal order (“liberal” in the 18th century sense of the word), the current reality is that it is harder and harder to get permission to move to America, harder to get permission to work in America, harder to raise capital for a business, and harder to get regulatory approval to operate a business.

If America keeps moving in the direction of more controls, more taxes, and more subsidies, then it will continue to decline in all ways including its attractiveness to people, capital, and productive businesses. If Dubai keeps moving in the direction of more openness, more clarity of law, more free trade agreements, and more freedom, it will continue to rise as a center of commerce and haven for wealth.

Nearly 200 years ago, Bastiat wrote about the Seen and the Unseen. He said when there’s a tax or regulation, people focus on the obvious part, what they can see. For example, a minimum wage is seen to raise the wages of unskilled workers. It is unseen that many businesses lay off workers, and some close their doors for good. It is unseen that the former owners are financially ruined or even in debt, that investors lose as well, and even banks write off loans that cannot be paid.

Per Bylund writes about the Unrealized. This phenomenon is not merely that there are unseen consequences (which I don’t refer to as “unintended”, as this presumes intention on the part of the legislators which may or may not be accurate) but also some things that would have been realized are not. For example, businesses are not formed, and products are not brought to market.

And brains may not drain to America, but instead increasingly to Dubai.

The Gold Pivot

Speaking of an unfriendly business climate, this year I had a growing feeling, a premonition. The mainstream view of the gold standard and companies like us who facilitate it will flip. Today, there are regulatory obstacles. But sometime in the not too distant future, abruptly, the mainstream will realize that a yield on gold is essential, like an Internet connection or smartphone. They will feel it’s terribly unfair that we have a leading position worth trillions (or whatever amount of irredeemable currency).

It’s the grasshopper against the ant. At first, the grasshopper is unhelpful if not actively opposed to the ant doing his thing. In the end, the grasshopper appreciates the ant’s successful endeavor—and wants the products of his efforts.

Over Christmas, I spent time with family. My mom asked me if my job is stressful. I asked her, did you ever have a time in school when you studied for a test, took it, and came out feeling good—but the other students were complaining how hard it was? Did you think it was hard?

Stress to an entrepreneur / founder / CEO is like that. The main thing is being prepared.

We are now over 30 employees, with a few open jobs. According to the book Navigating the Growth Curve, we are about to enter Stage 4. In general, each stage transition occurs because of increasing complexity. The book says complexity is a function of headcount. But I personally believe that complexity function is N-factorial. So 33 people is 33 X 32 X 31 X 30… At each stage, the organization and its systems requires a restructuring to manage the complexity. In Stage 1, an autocracy works fine (and is fairly typical of companies doing something new, founded by a subject matter expert). But by 10 people, Stage 2, it breaks down. You can’t have everyone in every meeting, you need to lean on a leadership corps. By 20 people, Stage 3, even that isn’t working any more, and you need a real management team, and you need to let go and delegate.

Stage 4 is all about professionalization and processes. It’s about managing to cadences: planning, budgeting, employee reviews, etc.

At the same time, we are scaling up. Apart from our growing headcount, we have a growing number of clients, a growing amount of gold, and a growing number of bigger deals. This makes it necessary to seek out friction wherever it hides within our processes. And then attack it with extreme prejudice.

Every once in a while, everyone should put down his work tools, do some shoulder circles to relax the muscles, take a step back, and lean against the wall to survey where you’ve been and where you’re going. My Reflections series, written at the end of each year, is my opportunity to do that. You always want to go faster, you always want more. But if you look back and put it in perspective, you see just how far you’ve come.

Then take a deep breath, shrug your shoulders, pick up your tools, and get back to work. There’s stuff to do, and things to build!

Make sure to subscribe to our YouTube Channel to check out all our Media Appearances, Podcast Episodes and more!

Additional Resources for Earning Interest on Gold

If you’d like to learn more about how to earn interest on gold with Monetary Metals, check out the following resources:

In this paper we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF – GLD, and mining stocks against Monetary Metals’ True Gold Leases.

The Case for Gold Yield in Investment Portfolios

Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold pays a yield? This paper answers those questions using data going back to 1972.

Leave a Reply

Want to join the discussion?Feel free to contribute!