A Signal of Coming Collapse

I proposed seven drivers of financial implosion in my dissertation. My recent writing has focused on two of them. One is the falling rate of interest on the 10-year government bond. As interest falls, the burden of debt rises. Since the falling rate incentivized more and more people to borrow, the number of indebted people, businesses, corporations, and of course governments is large. When the rate gets to zero, the burden of debt becomes theoretically infinite.

In the US, the downward trend is still in a deceptively mild phase (though there was a vicious spike down on Oct 15 to 1.87%). The rate on the 10-year Treasury is 2.3% today. In Germany, it is down to 0.82% and in Japan the metastatic cancer is much closer to causing multiple organ failures, with a yield of just 0.46%.

Two is gold backwardation, which has also been quiescent of late. Although it is worth noting that with these lower gold prices, temporary backwardation has returned. The December gold cobasis is over +0.2%).

I haven’t written much about a third indicator yet. What proportion of government bond issuance does the central bank have to buy? I theorized that when the central bank is buying all of the bonds issued by the government, that this is another sign of imminent collapse. I phrased it, as with the other indicators, as a value that is falling. Collapse happens when it hits zero, if not earlier. Here is what I wrote:

“the average amount of new Treasury bond issuance minus new central bank Treasury bonds falling towards zero (i.e. the central bank is buying a greater and greater proportion of Treasury bonds issued).”

Bloomberg recently published an article about the Bank of Japan’s announcement of a new bond-buying program. Bloomberg presents two facts. One, the Bank plans to buy ¥8 to ¥12 trillion per month. Two, the government is selling ¥10 trillion per month in new bonds. This is an astonishing development.

The Bank of Japan will buy 100 percent of the new government bond issuance.

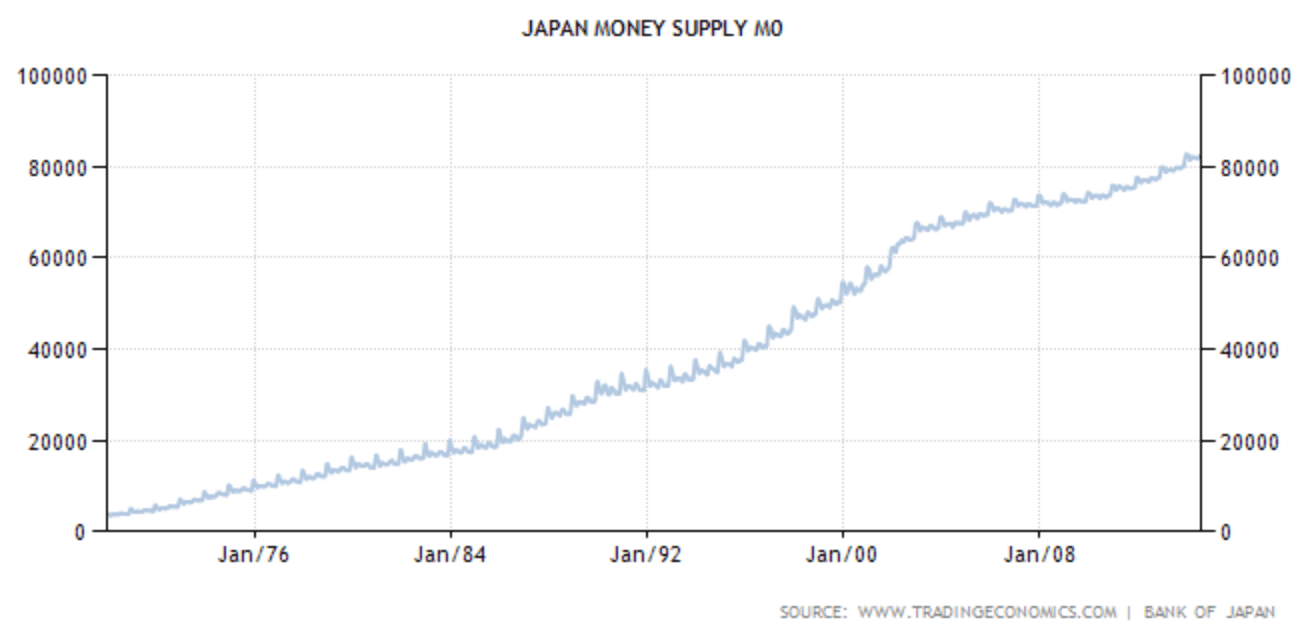

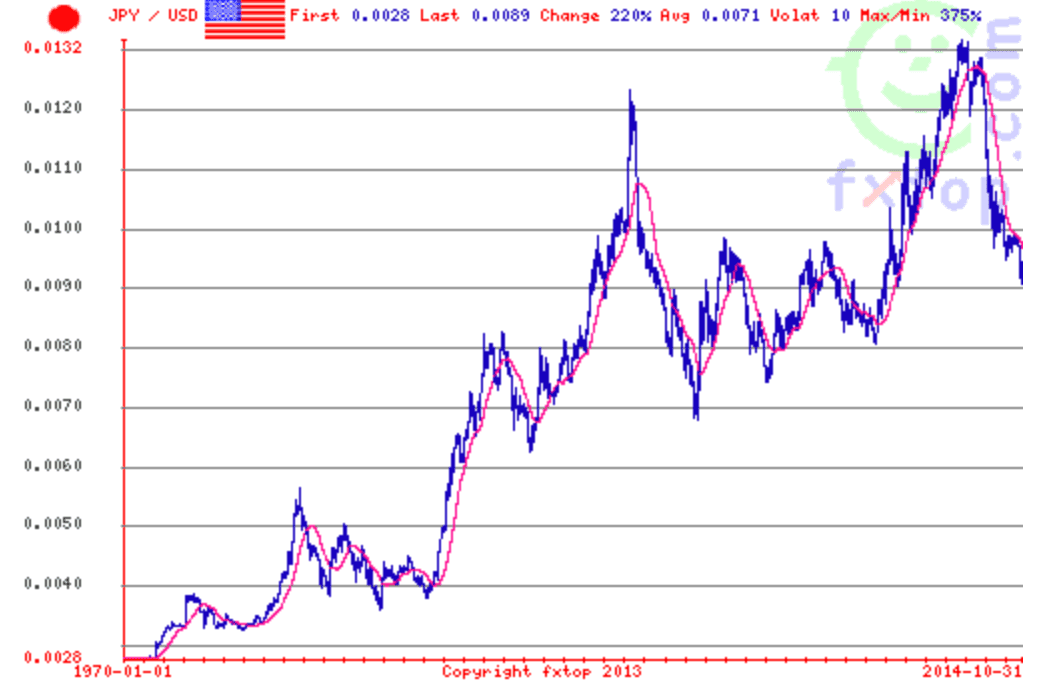

Popular theory holds that a currency’s value falls as the quantity issued rises. In this view, the yen falls as the yen supply increases. While admittedly not scientific, here are graphs of the Japanese yen supply and the price of the yen in dollars from 1970 through present.

The yen has been falling since 2012, but not because of its quantity. It has been falling because the market is questioning its quality. One way to do this is to borrow yen, trade the yen for another currency, and buy an asset in that currency. This carry trade is equivalent to shorting the yen. So long as the yen is falling, and the interest rate on the bond in the other currency is higher than the interest rate paid to borrow the yen, this is a good trade.

What happens as the yen falls faster? Contrary to populist economics, it’s not good for Japanese businesses. However, it is a free transfer of wealth to those engaged in the carry trade. They can repay the borrowed yen at a cheaper and cheaper cost. When the yen goes to zero (which may take a while to play out), their debt is wiped out.

That’s what a currency collapse is. It’s a total wipeout of debt denominated in that currency. Since the currency itself is just a slice of debt, the currency itself loses all value. While on the surface it may seem good for debtors, it’s a horrific catastrophe. No one who understands the human toll, the cost in terms of the lives wrecked (and lost) would look forward to this with anything but dread.

The objective of my writing is to try to prevent it from happening. We need a graceful transition to gold, not an abrupt collapse like 476AD. It may be too late for the hapless Japanese. I hope it’s not too late for the rest of the civilized world.

Great article Keith. On a related point, just noticed that the 1, 2 and 3 month GOFO have dropped to the lowest levels in the past 2 years this morning. Did the cobasis for gold also spike this morning?

Thanks,

Mark

Keith,

I do not understand, is it “imminent” or the collapse will take many more years as written in this article (for yen to go to 0) ?

Thanks.

RD

The question I have is that if the yen collapses will anybody learn from it. You would think so but history shows that the hubris of our leaders knows no bounds.

Perhaps the Japanese will realise at some point that gold is going to protect them from a collapsing yen. They are intelligent people.

Thanks for your comments.

miamonaco: The cobasis for every contract month is up, but not what I would call a spike. Yesterday in Dec, cobasis was +0.24% and today it’s +0.31%.

pherisse: I want to reserve judgement on the timeframe for a bit. I don’t want to underestimate the tricks they have up their sleeves. But on the other hand, this looks pretty serious.

opusnz: I think many will learn the wrong lesson. “Japan increased quantity of money too much. We need to have a better rule, like the Taylor Rule.” No rule can prevent it, it has nothing to do with quantity but with debt and falling interest.

Keith,

I believe I understand your position on gold, not valued in US dollars. You submitted that the supply of gold is constant and that fluctuations in value are due to hoarding and dis-hoarding. [In a nutshell]

I think everyone of us has been saturated with theories of hyperinflation. Under this scenario the price of gold is compared to US dollars would skyrocket to infinity. Mike Maloney and many others subscribe to this theory. Harry Dent on the other hand believes that the price of gold is measured in US dollars will plummet to $750 and then further to $250 as debt default forces deflation.

You have probably studied gold much more than the people mentioned above. I am interested in your thoughts. Do you think that gold is likely to go to either of these (US Dollar) extremes ?

JTR, (and Mr. Weiner),

Thank you for asking this question. It is one that has been on my mind for a long while, and though I have asked it on occasion, I have never yet received an answer. When I first heard Harry Dent’s arguments back in 2010 or early 2011, they immediately struck me as very plausible. These days, gold is performing in ways that are at odds with the gold bugs’ predictions, and more and more you are hearing the word “deflation” bandied about. So, I wonder, is there a possibility that Harry Dent is onto something? Also, I must say, Mr. Weiner, that I can’t reconcile that gold is only valued in relation to the dollar. It just seems to me that gold is in a unique asset class, quite apart from any fiat currency? I’m sure I have missed an important understanding here. Thank you.

JTR: I am saying that people assume that the dollar is money. However, government does not have the power to alter economic law any more than physics. They cannot make a bullet go faster than the speed of light and they cannot make the Fed’s liability into money.

Gold is money. So one should not think of the gold price moving up or down. One should think of the dollar price, as measured in gold. Today, it is around 27mg.

The question I think one should ask is: will the dollar keep going up? My analysis of the basis suggests not too much farther. Dent is, in essence, saying that the dollar will go up to 124mg. I am not that familiar with his arguments, but it sounds like quantity of money analysis. As the quantity decreases (due to debt defaults, I am guessing) then the value of a dollar rises.

That’s the same theory that the gold bugs have used to call for $5,000 or $30,000 gold. The value of a currency is not 1/N where N is the quantity. It just does not work that way.

I would ask Dent one thing. Who in their right mind would choose to hold zero-yield debt instruments of risky borrowers who are defaulting left and right? Would not they choose gold, which has no counterpart risk? I don’t know his view that well, but I think he does not regard gold as money.

Cyn: You are exactly correct. Gold is an asset (money) that has value completely apart from the dollar and dollar prices. Gold was money for thousands of years before the dollar existed, and it will continue to be money after the dollar collapses into the grave where go all irredeemable paper currencies.

Thank you for your response Keith.

(I just discovered how to change my profile to reflect my actual name rather than JTR Industries.)

I agree with you one hundred percent. Federal reserve notes are not money. They are instruments of debt. What was going on in the back of my mind was: When would be a good time to change some of these useless notes in for real money such as gold. Although federal reserve notes are not money, they can at the moment, still be traded for gold. What I am asking (to put this in the correct format) is; Do you have any thoughts about where the dollar is headed (as measured in gold)?

All of the major currencies seem to be based on illusion. I am wondering myself when this illusion will no longer hold power over people. I always think about “the King’s New Clothes” when I am counting currency.

Jack: I share my thoughts every Sunday evening in the Supply and Demand Report published here on this site. :)

Thanks Keith, I am keeping up with the Supply and Demand Reports. You answered my question in the first post. Sorry about that. I will be sure to drink my coffee before jump back in next time.

In any case I think it will be interesting to see how the future plays out. You might be interested the following interview with Jeremy Rifkin:

https://www.singularityweblog.com/jeremy-rifkin-on-the-zero-marginal-cost-society/

He has some very interesting ideas about the role money will play in our future.

How about removing the giant grey inverted commas situated about a third of the way down, paragraph starting “Bloomberg…published etc”. You have had this problem in several other posts on your site, but I hoped that it would have been brought to your attention before now, & remedied.