Barclays Caught Red Handed Manipulating Gold

It was all over the news last week, both mainstream and gold sites. Barclays was caught manipulating the gold price. They were fined £26M, and forced to pay a client who was damaged by their action. The trader who worked for Barclays, Daniel Plunkett, was also fined and banned from working in the financial sector. Here is a link to an article at the Financial Times.

This story is a big deal to the gold community.

It is commonly held that the gold price should be much higher than it is today. For example, many think the proper gold price is the money supply divided by the gold held by the US government. The monetary base is currently about $4T. The US Treasury owns about 261M ounces of gold. Simple math gives us $15,300 per ounce. If we use a broader measure of the money supply, the gold price should be even higher.

Also, there is the argument from common sense. Since 2008, the Fed has been “printing” trillions of dollars. Its balance sheet ballooned from just over $800B to just under $4.4T today. With all this fresh, new money flooding into the markets, why isn’t the gold price reacting as it should?

There are other theoretical arguments why the gold price should be skyrocketing. Instead, the fact is that it’s been dropping since 2011.

It must be that someone is pushing the gold price down. How else can we explain why the price is $1,300 and falling? They are keeping it thousands, if not tens of thousands of dollars, below the level where it ought to be.

And now, we have the Barclays scandal. It seems to offer the smoking gun, incontrovertible proof that the gold market is indeed manipulated.

Not quite.

Consider this analogy. Suppose a teenager stands accused of setting fire to several homes in his neighborhood. Despite investigations by the town police, sheriff, state police, and the FBI, they cannot find the sort of evidence that would convict him in court. Then, a breakthrough occurs. The kid is caught red-handed stealing candy at the corner store. Can the district attorney bring him to trial for multiple counts of arson now?

No. You can’t get there from here. Arrest him for petty larceny. Make him apologize to Mr. Hooper and do his 10 hours of community service, or whatever punishment is suitable, for candy theft. But as to the arson, you don’t have any more evidence than you did yesterday.

Compared to the arson of suppressing the gold price, Barclay’s client scam is the equivalent of stealing candy. They sold an options contract to a client. This contract obligated them to pay out if the PM gold fix was above $1,558.96 on June 28, 2012. On that day, right before the PM fix process began, the gold price was a few bucks over the threshold. Then it began to drop. Then it rose. Then Mr. Plunkett took steps to push the price below his threshold. He entered an order to sell some gold. After a few more gyrations, the committee agreed to set the fix below the threshold. Barclays did not have to pay its client. After the fix was set, Plunkett bought back the gold he had sold. He took a slight loss on the purchase and sale of the gold, but nothing close to the cost of paying the client. Not incidentally, Mr. Plunkett was paid a big bonus.

What Barclays did may or may not have been illegal at the time they did it. I don’t know, and I am not an expert on UK law. It was certainly interpreted as having been illegal by the UK Financial Conduct Authority.

Certainly, Barclays breached the most fundamental trust that a financial institution must establish with its clients. In a free market, why would anyone do business with a bank that deliberately acts against client’s interests? Today, we don’t have a free market. We have an enormous burden of regulations. There aren’t many choices for bullion banking services. And as we saw with Deutsche Bank resigning from the silver fix, the legal environment is getting worse. Not only are there no new entrants into this market, the existing ones are quitting.

Barclay’s ethical breach and possibly illegal act is a serious matter. However, it is like the kid caught stealing candy, providing no further evidence to convict him of arson. Barclay’s ill-considered sale of gold prior to the fix and purchase afterwards gives us no more proof that the price of gold is thousands of dollars below what it would and should be.

On that front, we are left with specific claims that do not fit the evidence. Broadly, the claims of manipulation fall into two categories. Either the cabal is selling metal out of central bank reserves, or it is selling paper such as futures contracts.

If they are selling metal, that can only apply to gold, as they don’t have any silver metal. So gold is suppressed but silver may be free. If so, how do we explain the fact that the silver price has dropped twice as much as the gold price? In 2011, an ounce of gold would buy about 31 ounces of silver. Today it will buy about 66 ounces. Clearly, whatever force is hitting gold is hitting silver harder.

The other broad allegation is that the cabal is selling futures naked. I have written extensively about this in the past. In essence, there are two major ways this view contradicts the data. First, the sale of a large number of futures will push down the price of a futures contract. Indeed, that is the whole point. If the price of a contract is pushed down, that will cause the condition known as backwardation. Backwardation is when real metal is more expensive than a futures contract. It’s what one would expect, given the allegation that real metal is scarce and getting scarcer, while there is an abundance of bogus paper flooding the market.

I have published data at a time when the manipulators are alleged to have sold 500 tons of gold paper naked. There is nary a blip in the spread between spot and future.

Second, once the futures position is created what happens next? As each futures contract approaches expiration, those who have a position must choose. If you are long—i.e. you bought a future—you can choose to take delivery. You simply need the cash in your account to buy the metal at the contract price. If the contract price is $1,300 then you need $130,000 because each contract is 100 ounces.

If you are short—i.e. you sold a future—then to make delivery you need the metal. The whole premise of the manipulation theory is that they don’t have the metal, that they are “naked” short. In this case, the banks cannot make delivery. They must “roll” their contract position forward. To roll, they must buy the expiring contract and sell the next one out. As I write this, the June gold contract is being rolled right now. Those who want to maintain their positions can move to August, October, or farther.

If banks had massive short positions, they would have to buy large numbers of June contracts. This would push up the price of the June contract. The contract would move further into contango, which is when a future contract is above spot.

What if the banks were merely arbitragers? What if they are buying spot metal and selling futures to earn a small spread? In this case, they have no urgency to close their contracts. They can deliver metal, or they are happy to roll their arbitrate positions if the market pays them an additional profit to do so.

The urgency would be felt by the naked longs, those speculating on the gold price, but who don’t have $130,000 per contract lying around in their accounts. These speculators would have to sell June contracts. This, of course, would cause the opposite change to the price of the June contract. It would fall. This would cause the contract to move into backwardation.

When physicists debate two theories of how the universe works, they always try to think of how to design an experiment to see which theory is right and which is wrong. They love building larger particle colliders and larger telescopes because then they can peer through the lens and say “Ahah! It’s bending to the left!” That means Dr. Smith is wrong and Professor Jones is right.

When market analysts debate two theories, we should take the same approach. The behavior of the expiring contract is our experiment. If the spread between futures and spot bends up—i.e. deeper into contango—it’s because there is buying of the expiring contract with urgency. This means the banks are naked short. If it bends down—into backwardation—there must be selling of the contract with urgency. That means the banks are hedged, and the only urgency is the speculators.

Think about the design of this experiment for a minute. Go through the cases until they make sense. For example, verify there is no other party who would be buying up an expiring future with urgency.

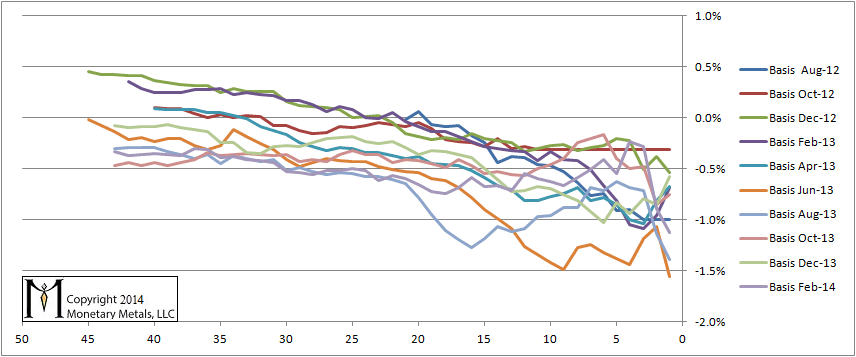

Let’s look at the basis for some contracts. Recall, the basis is basically the spread between the future price and the spot price (future – spot). This oversimplifies it slightly, but we are just interested in seeing the pattern.

Here is a chart showing the basis for contracts in 2012 through 2014, as each heads into expiration. The bottom axis is labeled with the number of trading days prior to the first of the month named in the contract (e.g. for the June contract, 1 means May 31).

Chart of numerous gold bases heading into expiry

There are a certainly a few irregularities in the data set, but they are not important to our experiment. There are some different shapes and sizes here. These contracts do not show parallel lines. However, they all show a falling trend.

The bottom line is that the typical pattern is to bend down, into backwardation.

The sellers of expiring contracts are the ones with the urgency. That is, they are naked longs, without the cash to take delivery.

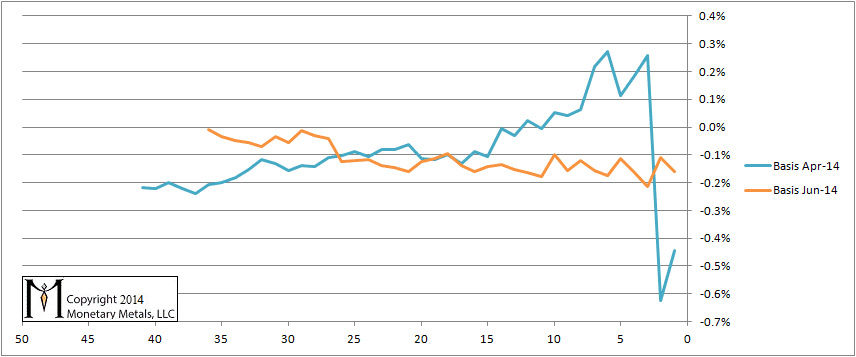

Now, here is the chart of the two most recent gold contracts, April and June 2014.

Chart of Apr and Jun 2014 gold bases heading into expiry

April shows different behavior. It has a noticeable rising pattern until a few days before the end. There is a good case to be made that a short seller or several short sellers were closing or rolling their positions in February and March of this year. June shows a decline, though more moderate than prior months.

In the weekly Monetary Metals Supply and Demand Report, I have been reporting for some time that the gold price is a bit below its neutral price. The picture of April and June basis behavior is one more piece of evidence to support that.

To clarify, I do not think that the gold price is thousands of dollars below where it should be. I think the gap is about a hundred bucks, in other words a short-term trading phenomenon, not a long-term conspiracy.

Keith,

Your explanations are really clear and you will to teach is definitevely evident , thank you very much. I am still a bit confused about the action on April 2013 , according to some (http://news.sharpspixley.com/article/ross-norman-gold-crushed-by-400-tonnes-or-usd20-billion-of-selling-on-comex/159239/), it would have been 500 t of paper gold dumped , while according to you it is not the case (we should have seen it on the evolution of the basis if so): meaning that there was a sell of physical gold.

Therefore 2 questions:

1- According to you what was the repartition in the sell out , between futures and physical in April 2013 (is it a 50/50 for not having the basis to be modified ?)

2- Is there any possibility that the process of the calculation of the basis is not precise enough and can be “fooled”, how is it calculated on a daily basis (how many calculations of the basis are done throughout the day ?)

Thank you again anyway for all what your are doing to try to vulgarize these concepts , at least the average Joe as I am , is trying to follow what is going on , thanks again

Keith, your logic is impeccable.

Do you have any view on why the Fed. refuses to allow an audit of gold stocks?

Please can you clarify for me. Must the naked short buy back the exact same contract he sold or can he buy any contract for the same period from a willing seller?

For example in the case where the original contract buyer wants to take physical delivery.

Must the short handle physical gold or can he hand over the second contract as fulfillment of his commitment on the original?

Dr, Weiner:

You mention in the above article that the price is $100 below where YOU think it should be from $1,300.

On what basis do you make this analysis. How do you know what the “right” price is when the price is set by millions deciding to buy or not but or sell or not sell their gold at whatever price is currently quoted. Why not say gold can trade at $1,200 or $500?

When you can print all the money you need then the game changes.

When you control the major players in a market AND can print all the money you need the game does not resemble anything like what most people see.

When the price of ‘whatever’ commodity is not the ultimate goal but the price is only one of the controlling factors to your goal then profits and losses have a interesting meaning.

The ‘cabal’ only cares about the price of ‘gold’ because of the market perception.

The PM market is only a very small segment of the financial dealings by the cabal. The perception is a far greater influence to the cabal’s desired goal.

Thanks for the thoughtful comments and questions.

Rueffallais: I did a forensic analysis of Apr 12-15, 2013. The article is in the archives, just scroll back through the site. If you can’t find it, let me know by email or web form.

blowforhome: I generally don’t get into the discussion of motives and the like, but I think they have been resistant to any form of audit. Look at the Ron Paul movement to audit them.

Derek: Futures contracts are fungible. If you are long, you can sell a contract to any buyer. If you are short, you can buy a contract from any seller. The exchange matches up buyers and sellers, and they have an algorithm that decides when to add new contracts or retire existing ones.

johnchew: I say it on the basis of… the basis. :) OK, all joking aside, there is boilerplate in each weekly report saying “We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding.” Right now, in gold, speculators have sold it down a bit.

@Derek: Many of the existing futures clearing firms: TD Ameritrade/Thinkorswim, Interactive Brokers, Tradestation, etc. available for individual traders will not settle commodities for delivery. What they usually do if you do not roll your open futures position upon expiration, they will liquidate the contract for the cash value of the contract at expiration. So, for example, if you sold June 2014 gold at $1350 and it settles at expiry at $1250, then the broker will liquidate that open short contract and apply the credit to your account the margin requirement plus the $100 per contract profit (which is likely settled in cash every day any way. Each day your account is up or down based upon daily settlement, the account is going to be adjusted in cash.) I believe less than 3% of PM futures are delivered.

Keith, I’ve followed you for awhile, but as of today you’re off my favorites list and I won’t be coming back.

I’m sorry it has to be this way, but we approach unsettled times, times for people to take sides.

One of the biggest obstacles that people have is recognizing manipulation and fraud.

I think your heart is in the right place, but your head is in the sand. Best of luck.

I think the reason people get frustrated with this analysis is in the difference between the futures market and the the spot price. After reading for some time now, I really don’t get it either. Perhaps an explanation of how the spot price is formed out of the futures market would help.

What the average individual investor sees is the spot price moving around, just like a stock price. And what they can clearly see are moments (usually in the middle of the night) when price drops straight down. Reading some of the sources out there, we hear that someone dumped a quarter billion or half a billion dollars worth of gold contracts on the market all at once, which jams the price down.

Whether or not they are successful is another matter, but nobody with a very large amount of money to trade just dumps it all at once for fear of moving the market and getting a bad deal on the purchase or sale. So, the conclusion most people come to is manipulation.

You can see it with your own eyes on the chart. A sudden drop straight down, sometimes with a market halt, usually in the middle of the night and near points of support or resistance on the chart, and the seller clearly doesn’t get the best price for his money. If it looks like a duck and it quacks like a duck…might be a duck.

prattner: The spot price is not formed out of the futures price. They are different markets. The only connection is arbitrage. That is, one can buy spot and sell future, or one can sell spot and buy future.

One of the challenges is to step outside one’s own shoes for a moment. Most, if not all, of the people who read and write gold commentary on the Internet are price takers. That is, you have 10 Eagles you need to sell. Or you got a bonus and you can buy. This is the position of a price taker. The market bids on your gold at X, and you can take it or leave it. The market offers to sell you gold at X+Y, again take it or leave it.

It may seem like a COMEX event can push the price in the wrong direction just before you go to buy or sell. (By the way, the middle of the night in the US is daytime in Europe and/or Asia). But that is only because the markets are connected by the two arbitrages I just outlined.

If someone were to naked-short a mass quantity of paper, it would drive down the price of the futures contract. Then the future would be priced below spot by a large amount.

This simply has not happened.

And, at contract expiry, they would have to roll that massive short position. The behavior of the expiring month would be opposite to what it is, which is what I discus in this article.

Shows how much I know :) But as an official member of the unwashed public, I can tell you that tons of people think that massive, sudden shorting is exactly what’s happening.

And why not? If those sudden, straight down plunges you see painted on the chart so frequently are not shorting, what are they? Bid withdrawal? Regular old long sales?

It is hard to believe that someone holding thousands of long contracts would just say to themselves, You know, selling these contracts little by little can take all day and is SO tedious. If I just enter 2000 and hit sell, I can sneak out of the office early and beat the traffic home. Who gives two shakes if the client loses a couple million? They got so much they won’t even notice. And it ain’t my money!”

Keith, your comments are always insightful and explain very complicated issues in bite size morsels. I agree Barclays is not the smoking gun for large gold manipulation. They are the punk kid who smoked in the back room, maybe left ashes on the floor, but not the arsonist :). But two thoughts why this doesn’t mean there is not an arsonist:

– Your chart showing slight backwardation as contracts expire does not mean there are still not massive naked short sellers who pushed gold down in sharp spikes to rattle the markets, and now must continually roll their contracts forward. It just means there are NET more buyers. The market was rattled lower, but the buyers still showed up after the drops, they don’t want to take delivery, and must sell their expiring contracts causing the slight backwardation, then rebuy. You might ask where is all the buyer’s money coming from? What about that $4B the Fed created? A lot has found its way into speculation on the stock and real estate markets (there’s no opposing force rattling those markets lower so they have risen). Why not the gold market? You might ask why is the balance between buyers and sellers so precise to cause only slight backwardation? I don’t know. Some force would need to be balancing it. But that means it is also highly unstable. You might ask why is the total number of contracts nowhere near high enough to cause this? This brings me to my second point.

– As dolph9 so bluntly hinted at above: Using evidence derived from numbers that may be manipulated as proof there is no manipulation is not valid. If the manipulators are powerful enough, and there are certainly culprits who are, they could have manipulated the numbers not only to produce the effect they want but to show no manipulation. How do we know the official contracts on the books are all there are? Various parties could have officially closed them but maintain the balances on their own internal financial records off the official books. It’s like the tapering the Fed is supposedly doing – which appears to be not as well hidden: They say $45B/mo and falling. But in the last 3 months someone sold +$100B in treasuries. Belgium mysteriously got the money to buy them (cough from the Fed), the treasuries showed up in Belgium’s account outside normal channels, and the Fed balance mysteriously went up the same amount in misc/undefined line items. Fed tapering in the last 3 month appears to have actually been +100B/mo. Maybe this post makes me a conspiracy theorist. I’ll take off my tin foil hat now :).