Bitcoin Forked, and Gold and Silver Report 6 August 2017

So bitcoin forked. You did not know this.

Well, if you’re saving in gold perhaps not. If you’re betting in the crypto coin casino, you knew it, bet on it, and now we assume happily diving into your greater quantity of dollars after the fork. You don’t have a greater quantity of bitcoins; bitcoin has no yield. Bitcoin simply sells for a greater quantity of dollars now than it did before. But who wants to sell? Bitcoin’s going to a million bucks—at least.

So bitcoin, whatever it is, forked. Whatever forking is.

To understand these two concepts, let’s consider an analogy.

Picture a bank, the old-fashioned kind. Call it Acme (sorry, we watched too much Coyote and Road Runner growing up). A group of disgruntled employees leave. They take a copy of the book of accounts. They set up a new bank across the street, Wile E Bank. To win customers, they say if you had an account at Acme Bank, you now have an account at Wile, with the same balance!

Is this just the sort of evil thing a greedy bankster would do? Do we need regulation to keep them from doing it (is it even illegal currently)? No, it’s actually impossible. The problem is that Wile E Bank doesn’t have the assets. It does not have the bills and bonds and loans payable to Acme. So it would be suicide to take on the liabilities. It would be nothing more than offering free money to people.

Of course, no one would to do that. It would not be a crime, but an act of altruism. Or perhaps an act of “Wile E Coyote, Super Genius.”

Yet, this is what happened with bitcoin. Bitcoin cash set up across the street (so to speak). Anyone who had a bitcoin balance as of the moment of the fork—when the Coyote and his posse set up shop—has the same bitcoin cash balance now.

To understand how this could be possible, we have to drill down into what makes a currency, a currency. Most in the gold and bitcoin communities would agree on one thing. The dollar is a fiat currency. People use it, because the government has various ways to force them (including especially a monopoly in schools).

The bitcoin people will tell you that bitcoin is not a fiat currency. And they are right. It’s true, no government forces anyone to use bitcoin (if anything, it’s the opposite).

This does not give us enough resolution to see the issue clearly, so let’s keep going deeper. The dollar is not only fiat, but also irredeemable. That means the issuer of the currency will not redeem it for a fixed amount of money. And let’s explain that statement, which may seem rather cryptic (OK, pun intended).

At the time America was founded, there was no question that money meant gold and silver. And when you deposited money in the bank, there was no question that you were entitled to get back the same amount. The dollar was merely a way of standardizing the size of the deposit, so that it was consistent from bank to bank and therefore anyone could read any bank’s or any company’s financial statements. It’s better if everyone agrees on how long a foot is, how much weight is in a pound, how much time is in a second. And how much gold is in a dollar.

By a slow process of erosion, in many incremental steps over two centuries, the government severed any link between the dollar and gold. After 1933, the dollar was not redeemable in gold by the American people. After 1971, it was no longer redeemable even by central banks.

You can exchange the dollar for anything else, including gold. But there is no contractual obligation of the issue to redeem for a fixed amount of gold or else be declared bankrupt. And we see that the terms of exchange, including price, are constantly changing. And the change is generally adversely to those who hold dollars.

Bitcoin, like the dollar, is irredeemable. It can be exchanged for most things, including gold. But there is no issuer per se, much less no contractual obligation by any issuer to redeem for an agreed amount of gold.

However, there is another key concept which differentiates the dollar and bitcoin. That concept is backing. The dollar is a liability, backed by an asset. Yes, it’s true that the backing is debt (government and corporate bonds primarily), and this debt is payable in dollars. Which is backed by this debt. It’s circular, and would surely be a criminal activity if done by private, for-profit actors.

However, for every single dollar you or anyone may have, there is a debtor who is working to pay—or at least service—his debts. Every debtor must sell goods or services of some kind in exchange for dollars, to pay the monthly vig. Or else.

Or else what? If he doesn’t pay, that is called default. And in defaulting, he will lose his home, car, business, etc. The threat of taking away someone’s business or home makes them quite highly motivated to sell whatever they have to, to raise enough cash to keep servicing the debt.

This explains why the dollar has retained so much value, why its value is as stable as it is, and why manufacturers are more and more aggressive to sell better and better stuff.

It is commonly accepted to say the dollar is “printed”, but we can see from this line of thinking it is really borrowed. There is a real borrower on the other side of the transaction, and that borrower has powerful motivations to keep paying to service the debt.

Bitcoin has no backing. Bitcoin is created out of thin air, the way people say of the dollar. The quantity of bitcoins created may be strictly limited by Satoshi’s design.

It is possible for bitcoin to fork, because it is not backed by any asset.

The blockchain is an important new technology. It’s a public ledger that can record anything, with each record indelibly stamped with the date and the recording party. This is useful to record assets. It could revolutionize supply chain management, for example making it possible to track food from farm to table.

But something must be emphasized here. A ledger is useful for recording something, but bitcoin is a recording only of itself.

So in this light, it should be clear why a new bank can’t just offer free dollar (or gold) accounts. The old bank has a bunch of assets, say $1.1 million. And a bunch of liabilities, say $1 million. The new bank would declare $1 million in new liabilities but it would have no assets at all.

For 46 years, the dollar has been perfectly irredeemable. However, it is backed by bonds. Bitcoin is not only irredeemable, but also unbacked. That is a big difference—in favor of the dollar.

We have heard bitcoin proponents defend this by saying this is better because there is no risk of loss of the assets. This is akin to saying that being dead is better than being alive, because there is no risk of death.

Being unbacked and irredeemable, bitcoin is just a number in a ledger. Well, now two numbers in two ledgers. Bitcoin and bitcoin cash forked, remember?

We are not here to prognosticate on the bitcoin price. It may or may not be a good speculation today. However, we want to observe one thing. There are small unsound structures, such as a Jenga tower just before someone pulls the last stick. There are big unsound vehicles, such as the RMS Titanic sailing in the iceberg-infested waters of the North Atlantic Ocean. And there are the… pugnacious… systems such as bitcoin. The boldness of bitcoin’s promoters is matched by the unsoundness of bitcoin’s monetary design (as opposed to the technological soundness of the blockchain). This combination will result in devastating losses to whomever is left holding the bag at the end.

Usually, there is no opportunity to call out these things. Or else, one looks at the crowd of believers, and decides discretion is the better part of valor. But this week, bitcoin forked. This is now the time to say that forking is proof that bitcoin as presently constituted is unsound. The crypto emperor is naked.

We want to clarify one thing. We are not saying that anyone involved in bitcoin, is a dishonest person. The principles of monetary economics are not obvious, and we do not fault anyone for participating in the bitcoin market or for thinking that bitcoin is money.

The prices of the metals came down this week, especially silver on Friday, which was -2.7%. Was it manipulation? We doubt it. The manipulators were away from the metals markets this week… something about a fork in another money market which we’ve been told is a bigger threat to the hegemony of the Federal Reserve.

Was is speculators taking profits and getting out of their silver positions? Was it softness in the market for actual metal? Below, is a graph of the silver action on Friday. And also graphs of the true measure of the fundamentals.

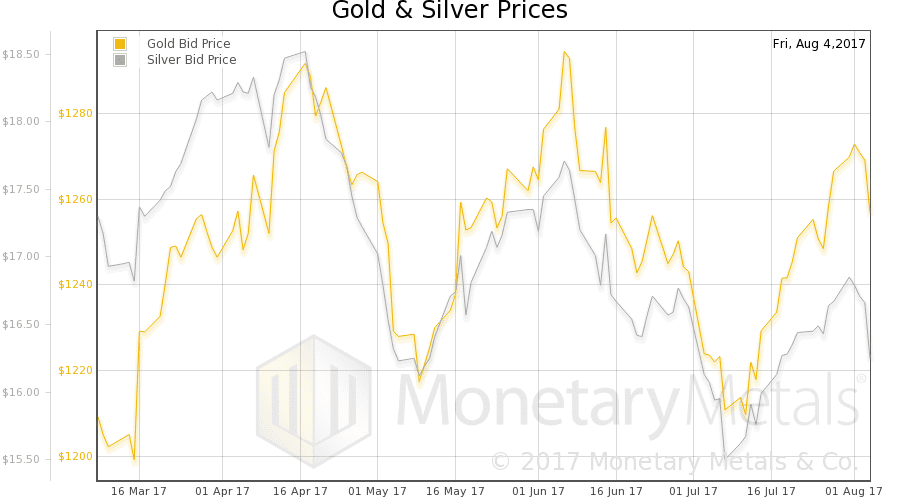

But first, here are the charts of the prices of gold and silver, and the gold-silver ratio.

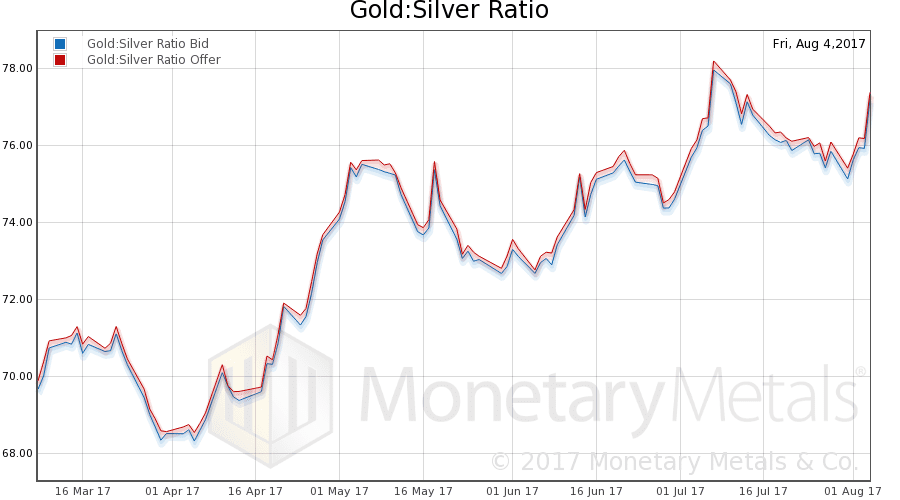

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio moved up this week, especially on Friday. We find it interesting that the ratio did not fall farther.

In this graph, we show both bid and offer prices for the gold-silver ratio. If you were to sell gold on the bid and buy silver at the ask, that is the lower bid price. Conversely, if you sold silver on the bid and bought gold at the offer, that is the higher offer price.

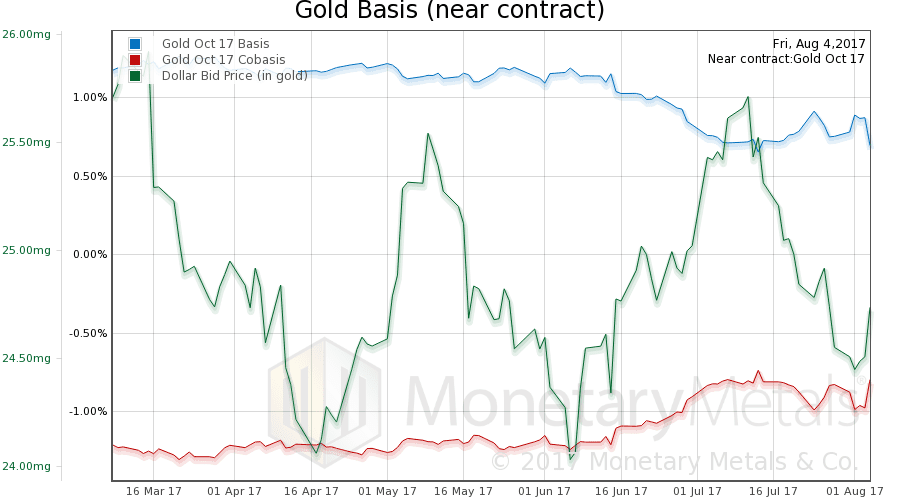

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The dollar rose a bit this week (the mirror image of the falling price of gold). As the dollar rose, the cobasis increased. Gold became a bit scarcer.

Our calculated gold fundamental price fell about $20 (chart here).

Now let’s look at silver.

In silver, the move up in the cobasis is greater. Keep in mind that we are approaching the expiry of the September silver contract, which has been in temporary backwardation for over a month.

The continuous basis in silver moved up, but not so much (chart here).

Our calculated silver fundamental fell a few pennies (chart here).

Here is a graph of the September silver basis overlaid with price for Friday, showing the drop from around $16.70 to below $16.30.

Notice how the event began. At 12:30 (GMT), the price began dropping. But basis is not really responding. This is an even selling of both metal and futures. Slowly at first, the basis moves down, and continues even after the price stabilizes and begins a slow rising trend a little after 14:00. This is the speculators selling getting with the program, and selling. No one wants to hold an asset that’s going down! This is a relatively big move in the basis, around 70bps.

So is the silver selloff over? It’s hard to tell. The fundamentals were firming this week—the fundamental price did not move down much during the move. -$0.09 from Thursday to Friday. On the other hand, speculators may be putting in sell orders over the weekend and may decide to bail out on Monday. Momentum can be self-fulfilling.

© 2017 Monetary Metals

Hi Keith. A few very quick comments. First, I don’t own any Bitcoin. Next, Bitcoin is not “printed out of thin air”. It is “mined” (note the quotes) and gets rarer as “mining” goes on. Ultimately the “mines” run out and that is the end of an increase to Bitcoin. No one can produce more Bitcoin except by working harder. Lastly, Bitcoin is the end of the chain. It isn’t “backed by anything” in the same way gold isn’t backed by anything. It is the ultimate asset. It is elemental.

On the subject of “forking”, you didn’t get it quite right. Bitcoin Cash is not recognized by any “clearing house” that clears Bitcoin transactions. You can use one or the other but not in the same transaction chain. Bitcoin Cash price is also currently is less than 8% the price of Bitcoin. In other words .0797 BTC. You get the same number of coins but nothing close to the same value. They are two very different beasts.

I love your commentary and longer articles. You are a great educator on the many virtues of gold and silver. Keep it coming. :-)

James,

Thanks for your comment.

I acknowledge that the rate of thin-air creation of bitcoin is limited and there is an ultimate cap on the quantity (21M). It is still the creation of a liability without any corresponding asset, and the labor theory of value does not remedy this problem (aside from being false).

It is not the same as gold. Gold is the final payment–a physical good delivered into the hands of a human being. Gold is the most marketable good. Bitcoin is a liability on a ledger.

The distinction that bitcoin cash is on a different chain is a technological one. It makes no difference to monetary economists. If the bitcoin ledger is full of money, then so is the bitcoin cash ledger, right?

Hi Keith,

To answer your question, no. It is like saying that one bin is full of tobacco and one full of cotton. They are both filled with commodities that can be used as money so they are both equivalent. They are not.

As to your first assertion, the labor theory of value has no more to do with the value of Bitcoin than it does with the production of gold. They both require inputs of capital and labor but the price is set strictly by market forces. Bitcoin is an asset, not anyone’s liability. You have that reversed. Whose liability could it be? If Overstock.com sends me items and I send Bitcoin in return, there is no further liability on anyone’s part.

The second is arguable. Bitcoin is designed to be the final payment. It has no backing because of that. I can print “Bitcoin Bills”, denominate debt or do anything else but it will all be backed by Bitcoin, the final payment. The vault is electronic rather than physical. We could have a wonderful discussion on the differences between physical and virtual assets but that’s for another day. :-)

Of course, if you hold bitcoin, it is your asset. However, a currency is the liability of its issuer. And bitcoin is no different in principal. However, we see that there is no asset backing this liability.

Bitcoin apologists claim it is backed by electricity consumption in order to create new bitcoins. What is kind strange it is that, by design, “cash costs” can expand by 5 or 10 times in a short time frame such a few months as it seems to be linked in some way with bitcoin exchange rates with fiat/USD.

Thank you Keith. Your articles are well-written and generally insightful. Bitcoin seems like a reminder that perception is reality, until it isn’t. How much lipstick can be put on this pig, and for how long? Of course no one knows.

What we do know is that gold, silver, platinum, and palladium are useful tangible assets, a store of wealth that is portable. These metals are rare in the earth’s crust and expensive to mine. They are not useful to get rich (although large amounts of leverage are available); they are useful for wealth preservation when central banks misbehave. Every sizable portfolio is well advised to put a small percentage of it’s assets into these metals as an anchor to windward, in my opinion. Bitcoin? It is a speculative plaything, nothing more, in my opinion.

Keep up the good work, and best of luck with your ventures.

Oh my, what would happen with a crude but well placed EMP detonated in the central U.S.? I know… puff… 2 out of the country’s 3 electric grids go down (TX has their own separate grid which is better fortified) and with the exception of those who hold physical assets, there’s goes everyone’s (Bitcoin) “money”. So is it true that we only have “money” as long as the blockchain’s computers are whirling away?

Yes, I understand the concept of “assets” and how Bitcoin could be such an asset. I just think it’s a crappy asset. And since i’ve been following BTC since it was priced at a whopping .06 (and recommended by Bob Prechter at the time) I suspect something has changed in the last few years. And that something might have a wee-bit to do with margin, leverage and speculation.

Of course, nobody would dare touch the worthless thing at .06. But now, at $1,000, $2,000, $3,000 and counting, people have suddenly found the courage to invest… and can’t get enough of it, at any price.

Things that make you go humm.

Keep this in mind as well: By far the greatest predictor of market turning points is this — Extreme opinions, widely held. Think gold in 1980 (or 2011) or real estate in 2007, as the best examples recently.

Are we there at such a singularity in BTC? Perhaps not, but neither do we seem very far away, at least in terms of time. Price is another matter, because price can and often does spike to unimaginable levels at the end nears.

What if this new technology was called Bitbits instead of Bit “coin”? How about Bitsticks? Would people still buy them?

I take dollars out of my bank account to buy these bitcoins only later to redeem these bitcoins for more dollars, hoping that I get just as many as I put in. Until I’m paid in bitcoins or until it’s legal to pay my taxes and debts directly in bitcoin I really don’t see the point in rushing out and getting some. If I did it would be to only watch the BTC/USD index everyday. Overstock.com… just more junk.

Hi Keith,

You have excelled your already high standards with this article – thank you.

In my view the bitcoin cap was always a red-herring apart from the ability of being able to split a coin into minute portions, this is proved now by the release of bitcoin cash ( a better product, I am told) that has just doubled the quantity of bitcoin in circulation (clearly the price differential quoted by James must equalise between identical products). The quantity of bitcoin is for practical purposes no more limited than is that of the dollar.

At least the dollar is backed by the full faith and credit of the U.S. government (meaning its ability to borrow), this might not be as solid as gold but considerably better than the sleight of hand of an anonymous whizz kid.

The incredible success of bitcoin illustrates the general level of dissatisfaction with excessive taxation and control and the desire to regain some measure of personal freedom.

I look forward to further articles.