Monetary Metals Supply and Demand Report: 17 Nov, 2013

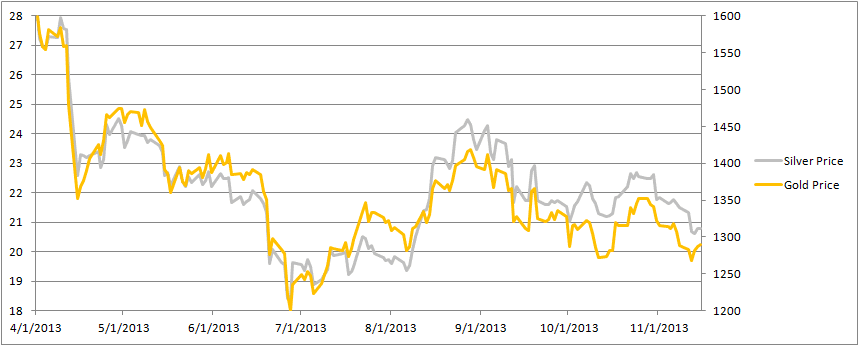

The gold price dropped and recovered, ending basically unchanged. The silver price dropped but didn’t bounce the way gold did, ending down 72 cents.

As always, we want to know: what are the fundamentals? The speculators can run for a while in either direction, but reality will inexorably pull the price back in line sooner or later—to the speculators’ losses.

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Conventional techniques for analyzing supply and demand are inapplicable to gold and silver, because the monetary metals have such high inventories. In normal commodities, inventories divided by annual production can be measured in months. The world just does not keep much inventory in wheat or oil.

With gold and silver, stocks to flows is measured in decades. Every ounce of those massive stockpiles is potential supply. Everyone on the planet is potential demand. At the right price. Looking at incremental changes in mine output or electronic manufacturing is not helpful to predict the future prices of the metals. For an introduction and guide to our concepts and theory, click here.

Here is the graph of the metals’ prices.

The Prices of Gold and Silver

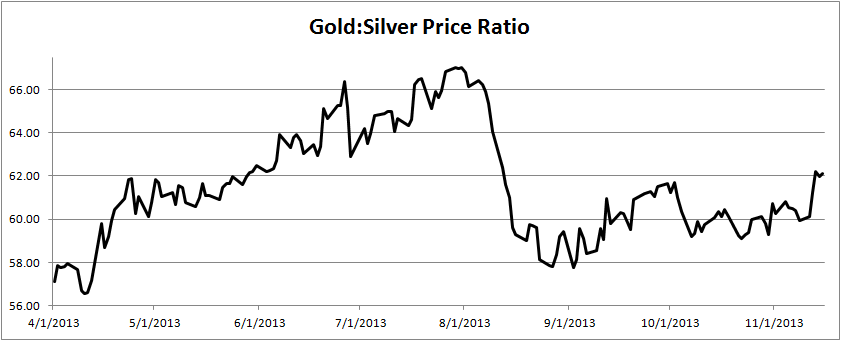

Here is a graph of the ratio of the gold price to the silver price. This shows how many ounces of silver one needs, to buy an ounce of gold. There was a3.6% gain this week. At the end of last week, less than 60 ounces of silver could buy an ounce of gold. Now it’s over 62.

The Ratio of the Gold Price to the Silver Price

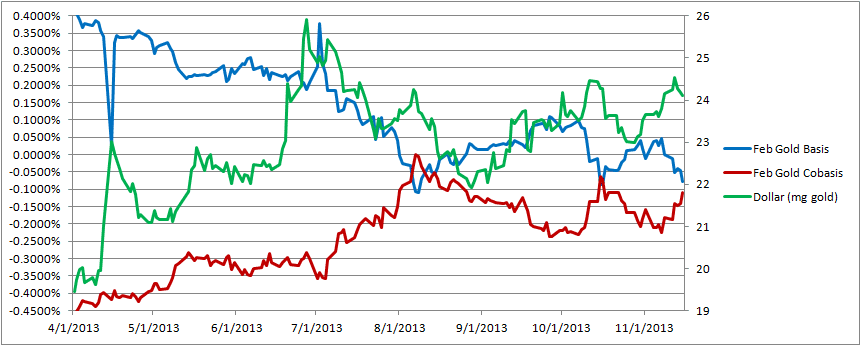

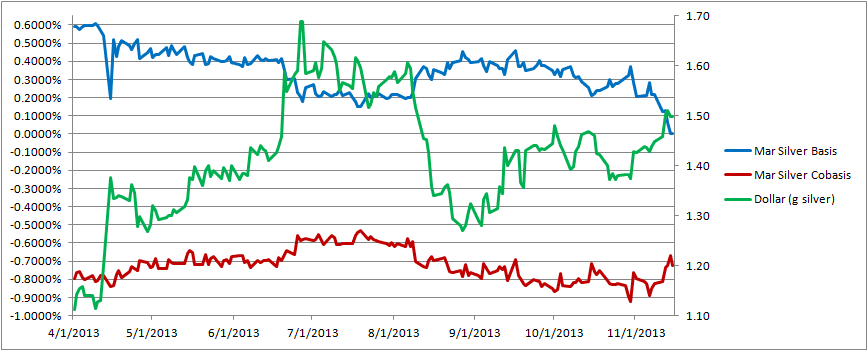

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide terse commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph. NB that we have moved from the December contract to February. Under the pressures of the contract roll, December is becoming too volatile and is being pulled into temporary backwardation.

The Gold Basis and Cobasis and the Dollar Price

For several weeks, the cobasis has been tracking the price of the dollar. Increases in the dollar price (i.e. decreases in the gold price, measured in dollars) have been accompanied by increases in the cobasis (i.e. increases in scarcity).

This week, the dollar price was flat but the cobasis rose. We shall have to watch and see if this trend continues. Gold became a bit scarcer while its price did not move down. This signals that buyers of physical metal are balanced against sellers of futures. The net result is a (small, so far) rise in scarcity while price didn’t move.

It is interesting to look at this in the context of the gold:silver ratio. For a few months, the ratio had been moving down. Presumably, many traders put on an arbitrage position of long silver / short gold, using futures. This week, the ratio moved up sharply, causing pain to these traders. If they had been unwinding in a major way, then they would be buying gold futures and we would have seen that as a falling cobasis. Either there is not much of a long silver / short gold arbitrage position, or else there has not been much of an unwind yet.

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

Moving to the March silver contract, we see the rise in the cobasis is quite muted for March (the December silver cobasis is now at exactly 0.0000). In this light, the rise in the dollar price (measured in silver, i.e. the fall in the silver price measured in dollars) stands out somewhat. This chart is not necessarily looking bearish for the dollar measured in silver, i.e. bullish for silver priced in dollars.

We reiterate our long-standing advice NEVER NAKED-SHORT THE MONETARY METALS. We are in the terminal decline of paper currencies, though we expect the other currencies to collapse before the dollar. The collapse of the yen or rupee could very well cause the prices of gold and especially silver to crash. Or the market could abruptly change sentiment from the pattern of the last few years.

I am finally getting the hang of thinking in terms of basis and cobasis, but need a bit more help understanding why the collapse of the yen or rupee would cause a crash in PM price. Is it because the subject population would seek shelter in the USD? One would think all available gold and silver would be absorbed first then a run to other fiat currencies. A little help, please. Still adjusting to money vs currency thinking.

It really made it easier to understand when you said “increases in scarcity” then followed it immediately with “(i.e. increases in scarcity).” Thank you.

Oops – I meant “increases in cobasis” followed by “(i.e., increases in scarcity).”

I also wonder why a rupee collapse would trigger a dollar gold price collapse, since it is not a component of the usdx. Unless the usd demand from rupee refugees is greater than their demand for gold (which is probable).

Thanks for your comments.

It’s a good question about rupee collapse and the gold price in USD. One of the major themes I emphasize in my writing is that we live in a world dominated by credit, most of it counterfeit. People (especially big banks, but also hedge funds, pension funds, private equity groups, you name it) borrow to speculate. Why? There’s little to no yield in the traditional investments that have low risk, such as Treasury bonds (I won’t even go into how much is wrong with defining the government bond as “risk free”!) There is even borrowing to lend, i.e. buying bonds on margin. There are bond futures. Etc.

It varies in different parts of the world, but the leverage ratio of major financial players ranges from at least 10:1 to in some cases more than 30:1.

What happens when a major currency begins to collapse? The first issue that comes to mind is that any financial institution which has net exposure to the currency begins to take losses. This puts their balance sheet under stress. One challenge is that they may not have liquid rupees in an account, but illiquid assets denominated in rupees, such as mortgages. Every tick downward of the rupee causes more pain. The mortgages are illiquid in a good market, and in a collapsing rupee environment you can be sure that the bid will collapse if not disappear.

This is not a situation where you bought gold for cash, the price is falling, and you’re having a “calm” discussion with your distraught spouse at the dinner table. This is a situation where you see the losses on the screen, and you get a phone call politely asking for more margin. And perhaps another and another.

You have to liquidate something. You and all the other financial institutions who are in the same boat. You can’t easily liquidate the assets which are the primary source of the pain. You need something which has a bid-ask spread that is not subject to “Bid Dropitis”. Gold and silver…

Of course, the speculators understand this and they front-run the trade.

While this is happening, there are other dynamics playing out. One of them is that affected depositors are watching as well. It takes more to motivate a citizen to move money out of his own currency and banking system than it does a day trader to close a losing position. But at some point, many will take that step. What do you do, if you have significant wealth in rupees, and the rupee is collapsing before your eyes? If you do nothing, you will be wiped out. There are two logical places to go: the USD and gold.

Is it correct to say under this scenario that the final nail in the coffin for the monetary system is a default by the US gov – in other words – interest rates skyrocket – the bond values crash along with the dollar backed by the defaulting bonds? Do you have any timefra for this?

To which you can add that India recently shut down their over-the-counter gold import channels.

Nearly all the “global currency collapse” theories I’ve seen after 2008, identify the USD as the last line of support for irredeemable currency. Of course the “global currency consolidation” theories do essentially the same thing. The resolution of that debate could come in the kind of “interesting times” we seem destined to live through soon. But Menger’s theory about the nature (evolution) of money is borne out in various economic stories week by week. I especially noticed the 10x jump in the 1mo T-Bill spreads that briefly “demonitized” them just hours before the theatrical US Gov’t shutdown was called off. And a week ago Andrew Huszar confessed what Fekete et al have claimed about QE in an article now widely reprinted.

Although my anxiety about any upcoming turmoil remains intact, thanks to these clear theories and sites like Keith’s that track the story as it unfolds, I have much less fear of the unknown than before, when the winds of pure propaganda kept blowing me into one dead end investment after another.