Nonmonetary Cause of Lower Prices, Report 5 May

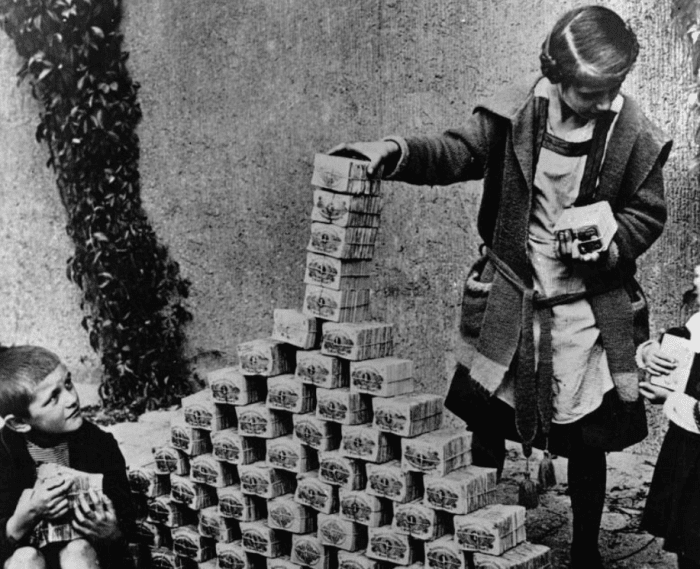

Over the past several weeks, we have debunked the idea that purchasing power—i.e. what a dollar can buy—is intrinsic to the currency itself. We have discussed a large non-monetary force that drives up prices. Governments at every level force producers to add useless ingredients, via regulation, taxation, labor law, environmentalism, etc. These are ingredients that the consumer does not value, and often does not even know are included in the production process. However, these useless ingredients can get quite expensive, especially in industries that are heavily regulated such as health care.

What Force Pushes Prices Down?

There is another non-monetary force, and this one is pushing prices down. Producers are constantly finding useless ingredients that they can remove. In the research for his Forbes article on falling wages, Keith discovered that dairy producers found ways to eliminate 90% of the ingredients that go into producing milk between 1965 and 2012. For example, they reduced by two thirds the labor hours that support each cow.

There is a school of industrial production that studies waste and ways that producers can remove it. It is called the Lean Manufacturing movement, also known as the Toyota Production System (TPS), as Toyota originated it. TPS identifies seven types of waste, called muda in Japanese. They are:

- Transport (moving products that are not actually required to perform the processing)

- Inventory (all components, work in process, and finished product not being processed)

- Motion (people or equipment moving or walking more than is required to perform the processing)

- Waiting (waiting for the next production step, interruptions of production during shift change)

- Overproduction (production ahead of demand)

- Over Processing (resulting from poor tool or product design creating activity)

- Defects (the effort involved in inspecting for and fixing defects)

Companies which commit to Lean have processes for continually discovering and eliminating waste, called kaizen in Japanese. We believe that our modern world would not be possible without Lean or other similar approaches. Goods would be far too expensive.

As we keep pointing out, many goods have fallen in price over three and a half decades. Some have fallen massively—computers come to mind. Others such as Levis 501 jeans, have fallen only 21%.

These price drops are despite massive increases in mandatory useless ingredients such as ADA-compliant bathrooms. The net result of added useless ingredients minus subtracted useless ingredients is a lower price. That’s pretty incredible.

Incentives Drive Every Producer and Every Consumer

At least, it seems incredible, until you realize that every producer has a powerful incentive to remove every useless ingredient it can find. Consumers generally choose the lowest priced good. Or even if some goods have higher quality, they want the one of highest quality combined with lowest cost that suits their preferences.

In other words, people may pay more for a Porsche 911 than for a Ford Mustang. But that is because it has higher quality (e.g. handling). They would not pay 911 prices for an ordinary Mustang.

Manufacturers that can produce products that consumers want, at prices consumers want to pay—always less—earn a profit. Manufacturers who can’t, don’t. So any manufacturer which can keep finding and removing useless ingredients—which by definition and by nature are things consumers do not value—will outcompete all other manufacturers. Many times, consumers do not demand a lower price, they demand new features or higher performance. They want manufacturers who substitute desirable ingredients for useless ones.

The automobile industry has a graveyard full of companies like American Motors Corporation, who couldn’t compete. The computer industry also has its failed producers, most famously is IBM, which once made Personal Computers. Though it pioneered the industry, it could not compete with the companies who sprang up in its wake.

It’s safe to say that every good from milk to automobiles to computers is made with an efficiency—that is, a lack of useless ingredients—that would have been unimaginable in the 1980’s or 1990’s. Toyota Production System teaches that removing what it calls waste, and we call useless ingredients, is not a one-time goal. It is a continuous process. First you remove 50% of the cost of production. Then you remove 50%. Etc.

In the same time that a monetarist can say “the Fed is inflating the money supply”, an assembly line worker at Toyota said “if we move this tool caddy a foot to the right, we can save two seconds on every bolt in every Camry.” The net result is that, between 2009 and 2019, the Camry went up in price by 20%. But it went up in horsepower by 28%, up in transmission gears by 60%, up in electronics, and other specifications. We have no idea how much it went up in useless ingredients.

Punching through the Prevailing Paradigm

We have talked a lot about non-monetary drivers of price. For several weeks, we covered the force that drives them up: useless ingredients. We dwelled on it, because nearly everyone accepts Milton Friedman’s profound-sounding bogus idea “inflation is everywhere and always a monetary phenomenon.” They accept this along with the equally bogus idea that inflation means rising prices, and that rising prices are the direct and linear consequence of rising quantity of money. Or the even-more bogus ides that irredeemable currency is money.

To debunk the prevailing paradigm, one must dwell on a topic, at the risk of belaboring it. This week we offer a more perfunctory explanation of one driver for falling prices. Because we are not arguing against mom and apple pie, we think most people will find it easier to understand the cause and effect of removing useless ingredients from products and the consequent reduction in price.

Next week, we will address a creature that all sensible people (sensibility being defined as accepting Friedman and the Quantity Theory of Money) would reject. This dragon is the powerful monetary force that pushes prices down (yes we said “monetary”).

Supply and Demand Fundamentals

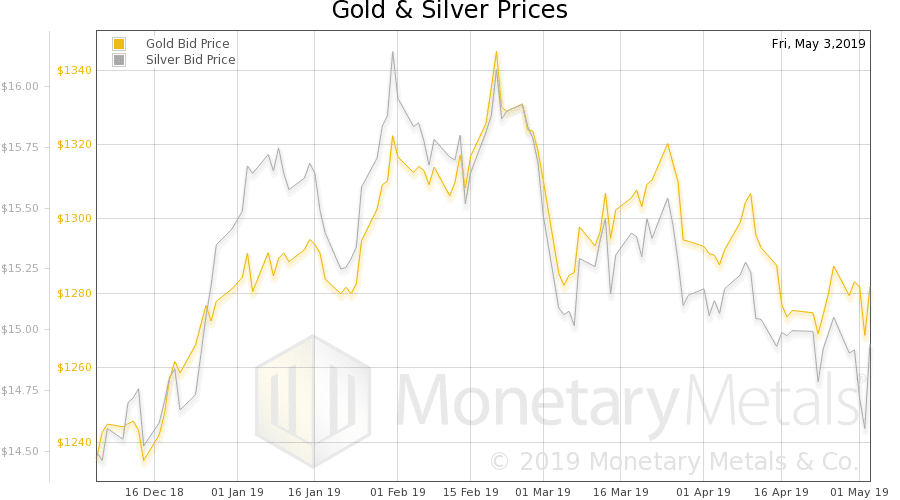

The price of gold was down this week, by $7 and that of silver ¢14.

Last week, we wrote of something brewing in the fundamentals of gold—the fundamental price had fallen by about $150 since March. Well, that trend did not continue this week.

Last week, we mentioned that stock prices were rising faster than stock earnings. Stocks rose more this week, which makes stock holders happy (unlike gold holders). They’re happy because the gain they could get for selling their shares, spends the same as the yield they should be earning in a normal world. It may spend the same, but its source is not.

The source of the gain in rising asset prices is—the wealth of the next speculator, handed over to the seller. To spend. Like a massively multiplayer game version of the Prodigal Son. A gambling game with real money. Well, OK, not real money, but irredeemable currency of uncertain (but currently strong) purchasing power.

And this is the basis—indeed the engine—of our currently-believed-to-be strong economy. The socialists dishonestly coined a term for reducing the burden on productive people and businesses. They called it “trickle down”, to imply fat rich cats drinking and eating, and the masses get only whatever may drip down on them. It is a term derived from the nasty little Marxist view of classes constantly struggling against each other for a larger piece of a fixed pie.

However, the term trickle down is applicable today. The Fed’s falling interest rate regime is a regime of rising asset prices (and Keynes’ evil plan to destroy the capitalist order). Those who own assets—particularly with borrowed capital—get endless capital gains. They get endless platefuls of other people’s capital, forked over to them to buy the same asset at a higher price.

And they spend this capital on everything from cars to planes to filet mignon to aged single malt Scotch. The masses get a trickle. It comes to them in the form of wages, which are under downward pressure due to the same falling interest rate regime.

Let’s paint a picture of this. One rich fat cat gets a heap of borrowed seed corn from another rich fat cat. He feasts on it, hiring chefs and wait staff to serve it to himself and his guests. The hired help are paid some of it, as wages for their labor. Each time a new granary is opened up, the release of the seed corn fuels a smaller boom than the last one.

Everyone is impoverished, first and foremost those who owned the now-consumed seed corn. The rich fat cats smirk that they are very affected by the so called wealth effect, thinking the Fed is bestowing upon them the riches of the poor and the middle class. But the poor never had any riches, and the middle class feels richer for just as the fat cats do. Keynes deceived them, like Sauron deceived Men and Elves with that little bit about the One Ring (with apologies to both diehard fans of JRR Tolkien, as well as non-fans).

It is against this backdrop that we must analyze gold (or anything else). We may be considered iconoclasts by everyone who just wants their asset class to go up so they can get richer. But nevertheless, we must point out the truths that we discover in our research.

And that includes the truth that the gold price is not proportional to the quantity of dollars. It is not driven by interest rates either. Recall that the price of gold went up in the rising rates environment of the 1970’s, and in the falling rates environment of the first decade of the twenty first century. The price of gold does not go up because of increasing useless ingredients mandated in all consumer goods (what most people miscall inflation).

The price of gold goes up, when more people want not to be creditors to the banking system, and/or the Federal Reserve. When they are happy only to own money, and not credit (even highly marketable credit such as the dollar). This rising preference (which cannot be understood in terms of the standard supply and demand model) can drive the price of gold to any number.

Of course if one looks at the price of gold in dollar terms, one misses the main action. One might say that gold will eventually go “no offer”. That is like saying that the road and a tree on the side of it, suddenly veered left and crashed into your car. Sure, it acknowledges the crash, but it reverses cause and effect.

Gold owners will withdraw their bid on the dollar (today is clearly not that day). When they begin to do so in earnest, the price will skyrocket. This will not be due to quantity of dollars, or supply and demand. It will be when the US government, the Federal Reserve, and the banking system have finally destroyed their credit. And when credit ruined, no one is a willing lender.

That trend of falling gold fundamentals over the last month? That was a temporary reversal in the long-term trend of the US government destroying its credit. This week, that long-term trend reemerged. The price of gold did not rise this week—but the fundamentals did (slightly).

Anyways, let’s look at that supply and demand picture of gold. But, first, here is the chart of the prices of gold and silver.

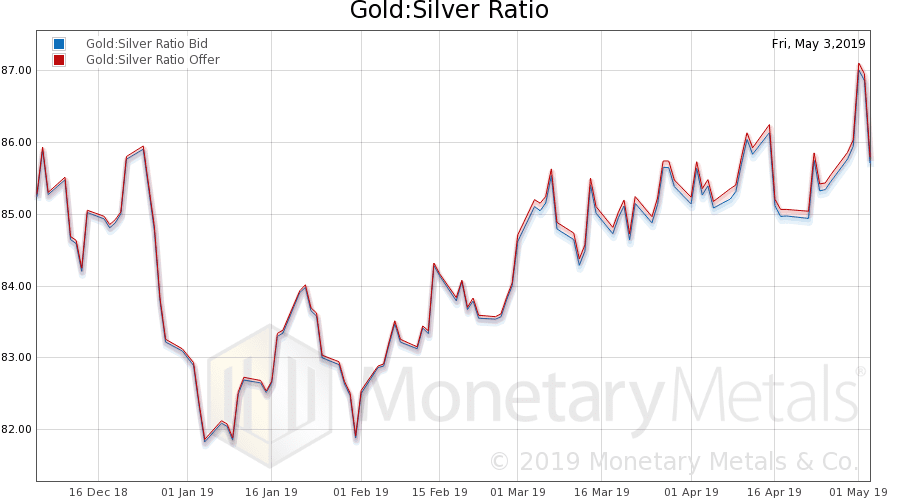

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio rose a bit (after spiking and coming back down).

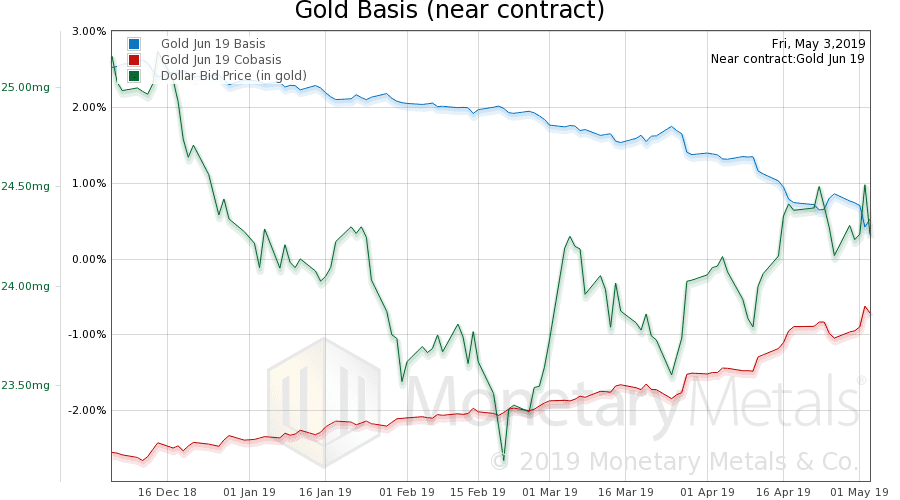

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

The scarcity (i.e. cobasis) rose a bit. Not exactly screaming “bull market”, but not a further decline.

The Monetary Metals Gold Fundamental Price rose four bucks, to $1,377.

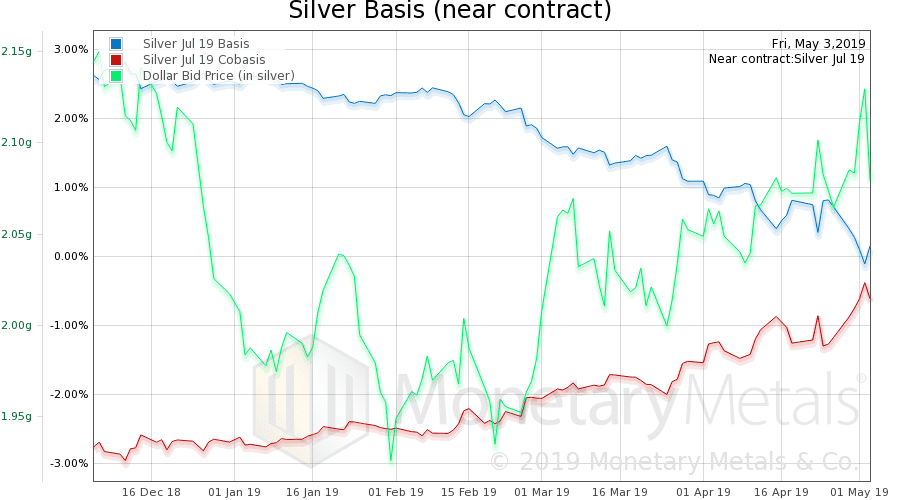

Now let’s look at silver.

The scarcity of silver (i.e. cobasis) rose more than gold’s.

The Monetary Metals Silver Fundamental Price was up 20 cents to $15.85, right back where it was two weeks ago.

© 2019 Monetary Metals

Simply put, the gold price is determined by the demand for gold with respect to the demand for dollars, no ?

What about the demand for gold from holders of other non-Dollar currencies?

Let’s say the Euro enters a currency crisis. We could see a demand for gold and US Dollar both increase from Europeans trying to get their wealth out of Euro-currency. Because gold is less readily available than dollars, it could shoot up like a penny stock in dollar terms. In other words, I don’t see why gold can’t go up in all currencies at the same time.