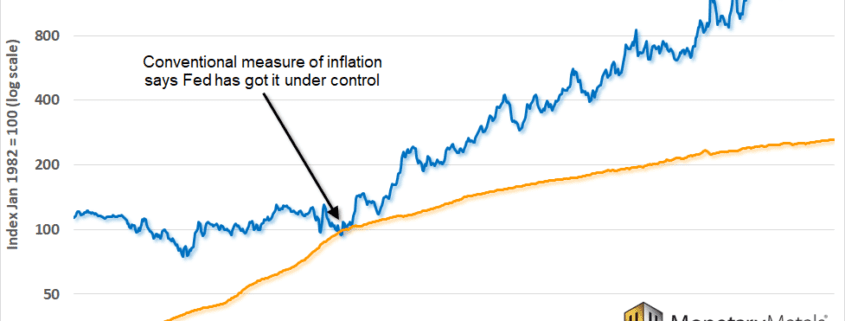

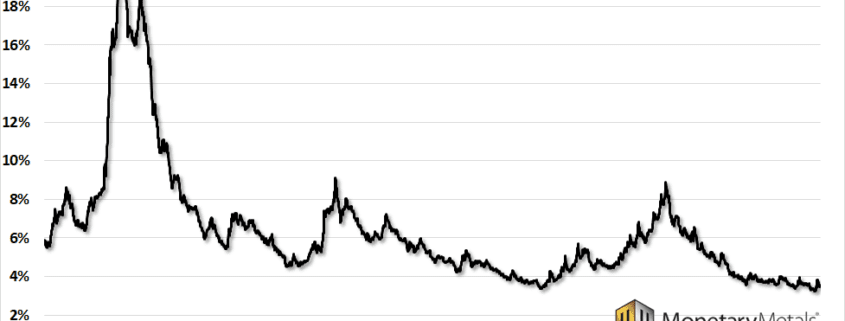

Inflation Is Not Under Control, Report 3 Mar 2018

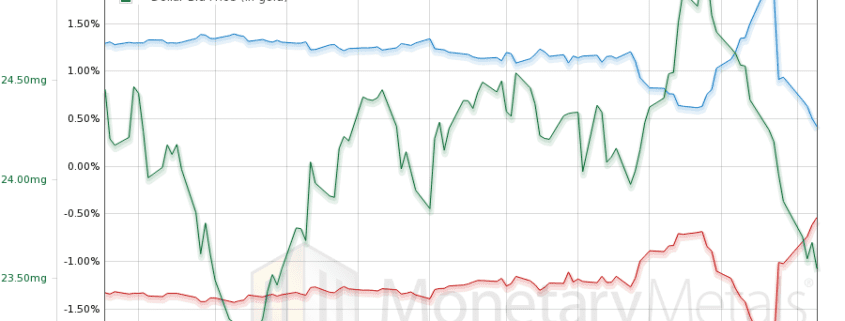

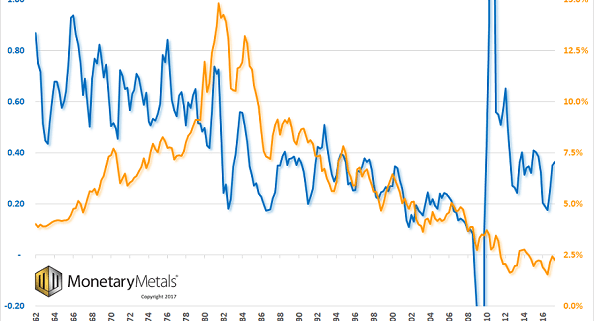

Let’s continue on our topic of capital consumption. It’s an important area of study, as our system of central bank socialism imposes many incentives to consume and destroy capital. As capital is the leverage that increases the productivity of human effort, it is vital that we understand what’s happening. We do not work harder today, […]