Jeff Deist: Why I Joined Monetary Metals

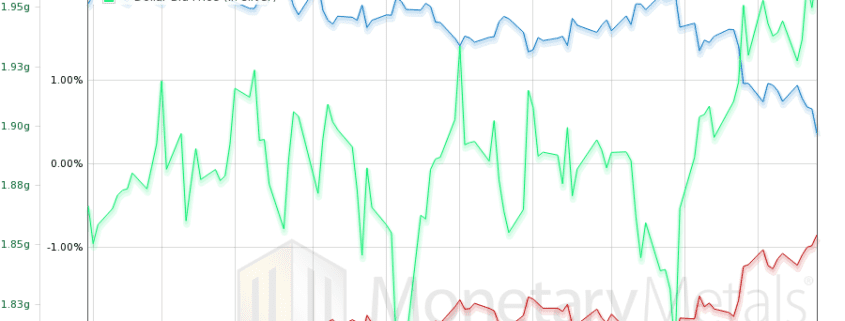

This post was written by Jeff Deist, former President of the Mises Institute. Jeff will be joining Monetary Metals full-time as General Counsel in May. I am exceptionally pleased to join Monetary Metals after ten years at the Mises Institute. Offering yield on gold is both simple and yet novel in today’s modern context. […]