Where Then Will Silver Go, Report 12 June, 2016

The price of gold bumped up thirty bucks, and that of silver about one buck. Is this liftoff—when the dollar falls sharply, and the price of each metal in dollar terms skyrockets? Is this the denoument when the gold bug does not get rich, because although his net worth measured in dollar is massively up, the dollar is down in equal measure?

It’s complicated.

But we doubt it. Perhaps a labor report will come out, or news of a government doing something even more insane than irredeemable paper currency (such as giving the power to outright print currency to the legislature) will cause a rush to gold hoarding.

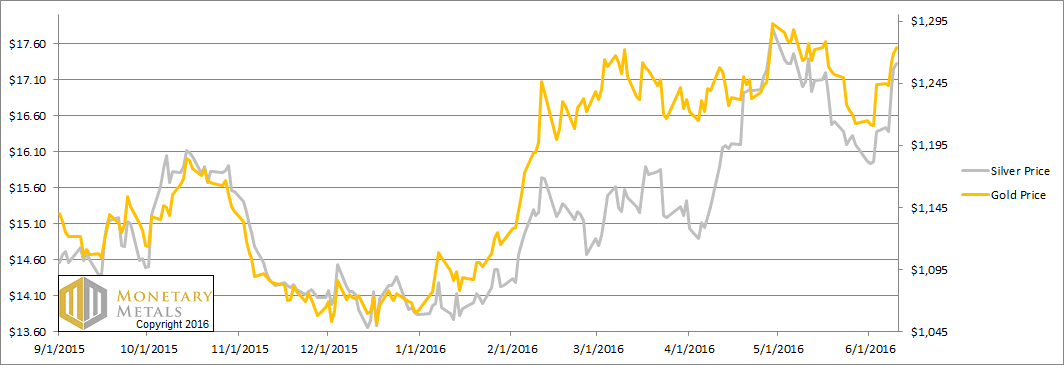

In the meantime, read on for the only true picture of the supply and demand fundamentals. But first, here’s the graph of the metals’ prices.

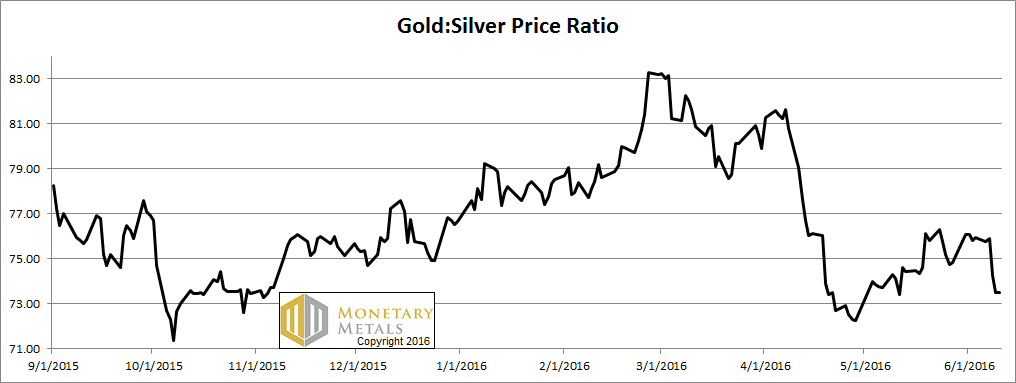

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was down about two and a half points.

The Ratio of the Gold Price to the Silver Price

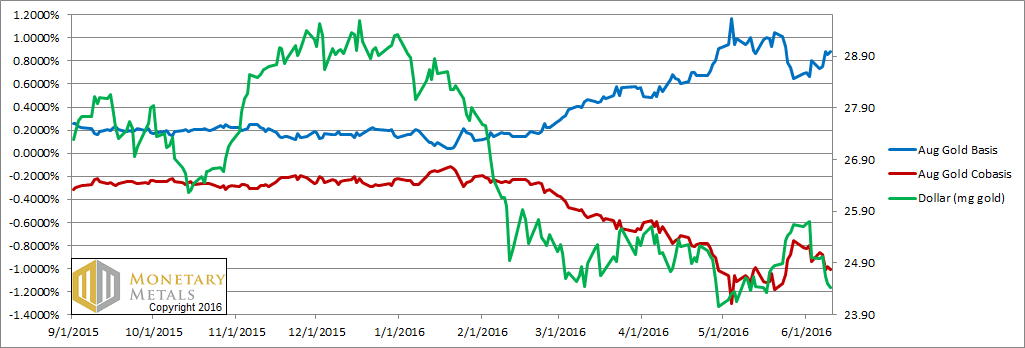

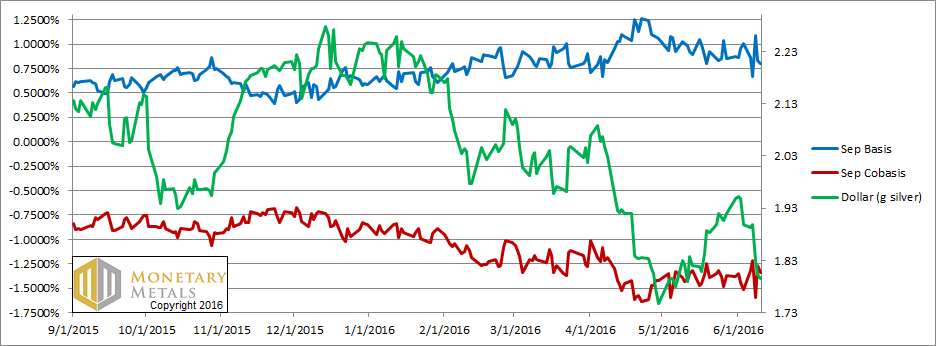

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

The price of the dollar is down (i.e. the price of gold is up). Along with it, the abundance of gold (blue line) is up. More gold is available at the higher price.

But not quite proportionally. Our calculated fundamental price is up $11. It’s now about ninety bucks below the market. We would never recommend to anyone to naked short a monetary metal (see the above for the kind of insanity that could cause a big spike in the price). However, we would not be buyers when gold is selling at such a premium. At least not for a trade—for those who don’t have any, we would always recommend getting some regardless of price.

Note that little changed from last week. The price blipped up, but it was primarily speculators.

Now let’s turn to silver.

The Silver Basis and Cobasis and the Dollar Price

In silver, the price of the dollar is down sharply and silver became slightly more scarce. Note that we have switched from following the July to the September contract, as July has become too volatile.

We regard the cobasis to be bouncing along at the bottom. Yes, it’s higher than it was last week, and yes the price of silver is up sharply, and yes the fundamental price is up from last week. It’s still about two bucks below the market.

Two bucks is a premium of almost 11.5% to its fundamental.

For now, it seems trading momentum favors silver. “And if that fails, where then will you go, silver?” (paraphrasing Saruman addressing Gandalf in Lord of the Rings

© 2016 Monetary Metals

Many thanks for the report Keith.

It will be interesting to see whether the proportionally higher cobasis in silver is sustainable.

“The markets can stay irrational longer than you can stay solvent”, unfortunately the PM’s at these inflated prices is simply the market being irrational. As you mention Keith, it is good to have some for “insurance” purposes, but a person would have to be ignorant to jump in at these prices.

Maybe not. $10 trillion, yes a T not a B, of worldwide debt is trading at negative interest rates. Gold, silver, and platinum may yet be a preferable asset to government negative yielding government paper despite the current run up in prices. In fact, platinum may be a dirt cheap alternative investment.

If people were buying metal, it would make sense.

But traders are buying paper with leverage.

L&L, liquor and leverage, can be dangerous no doubt. The price action today in precious metals is confirmation of your concerns. I’m not accusing the futures traders of being drunk on the job, although maybe so after the market close.

It won’t take much investment interest in platinum to bull the market back to the price of gold. $2 billion would do very nicely, a pittance in a world awash with investment funds. So far I’m wrong, mea culpa. But at a $300 discount to gold, I’m happy with my position, and relaxed about market fluctuations. If it costs too much to roll, I don’t mind taking delivery. We are living in a financial never-never land, an investment in precious metals makes more sense than bonds, and maybe equities too, from a preservation of capital standpoint.

It is not impossible that “speculators” are correct, and the fundamental price will stair-step upwards to meet the higher market price.

Remember, that the widely believed market narrative the last 3 years has been that the Fed would end QE, raise rates and shrink its balance sheet. There are very good reasons why this will be difficult to execute. Very few are positioned for a reversal of these policies where rates are cut, QE is restarted a 4th time and the Fed balance sheet grows.

Consversely, in 2011-2012 many were convinced it would be QE infinity and gold $5,000 was imminent. Many were not positioned for a temporary “relative tightening” to the conditions present back then. The launch of QE by central banks of competing fiat currencies of the euro and yen also wrong-footed many.

Perhaps once, by sheer “accident” the hot-money is on the right side of this trade.

Just to let you know Keith there are other currencies in the World besides the $US when it comes to the point of having real Gold and not trading it.

I’m sure a Venezuelan holding Gold is pretty pleased with himself.