Reflections Over 2023

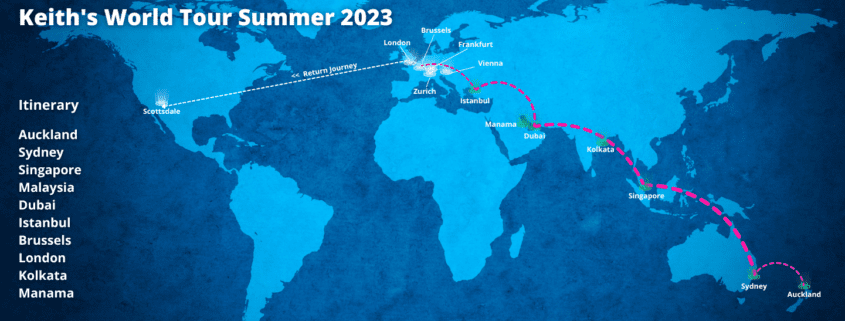

I am writing this from home. But I spent five of the last six months of the year on the road. Most of that was overseas. In Reflections last year, I wrote about the gruelingness (yes, that’s a word coined as of right now) of it. So I won’t repeat that, but I’ll just say that companies […]