Gold Outlook 2024 Brief

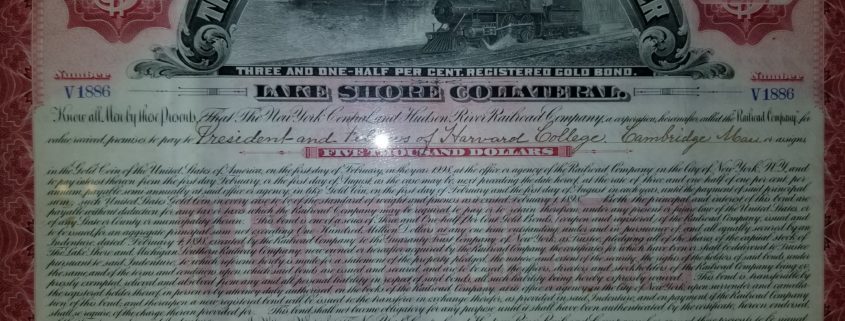

This is a brief preview of our annual Gold Outlook Report. Every year we take an in-depth look at the market dynamics and drivers and finally, give our predictions for gold and silver prices over the coming year. Click here to download a free copy of the full Gold Outlook Report 2024. The talking heads […]