The Future of Gold and Money: A Roundtable Discussion

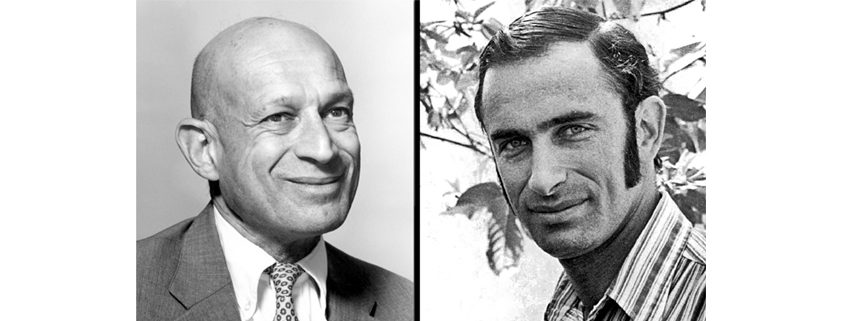

It was quite the cast of interesting characters: one of them began fighting for legal gold ownership back in 1972, one was influenced by Ronald Reagan’s unfulfilled campaign promise to return to the gold standard, and one was a long-time student of objectivism who suddenly had assets to protect. In this entertaining roundtable discussion led […]